Investments

305Portfolio Exits

14Funds

2About 468 Capital

468 Capital is a venture capital firm that focuses on investing in founder-led technology companies within various sectors. The firm provides early-stage funding and long-term investment support, specializing in identifying and backing startups with the potential to lead their categories. 468 Capital primarily invests in artificial intelligence (AI) & Automation, Infrastructure & Enterprise Software, Energy Transition & Climate, and consumer sectors. It is based in Berlin, Germany.

Research containing 468 Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned 468 Capital in 1 CB Insights research brief, most recently on Aug 7, 2025.

Aug 7, 2025

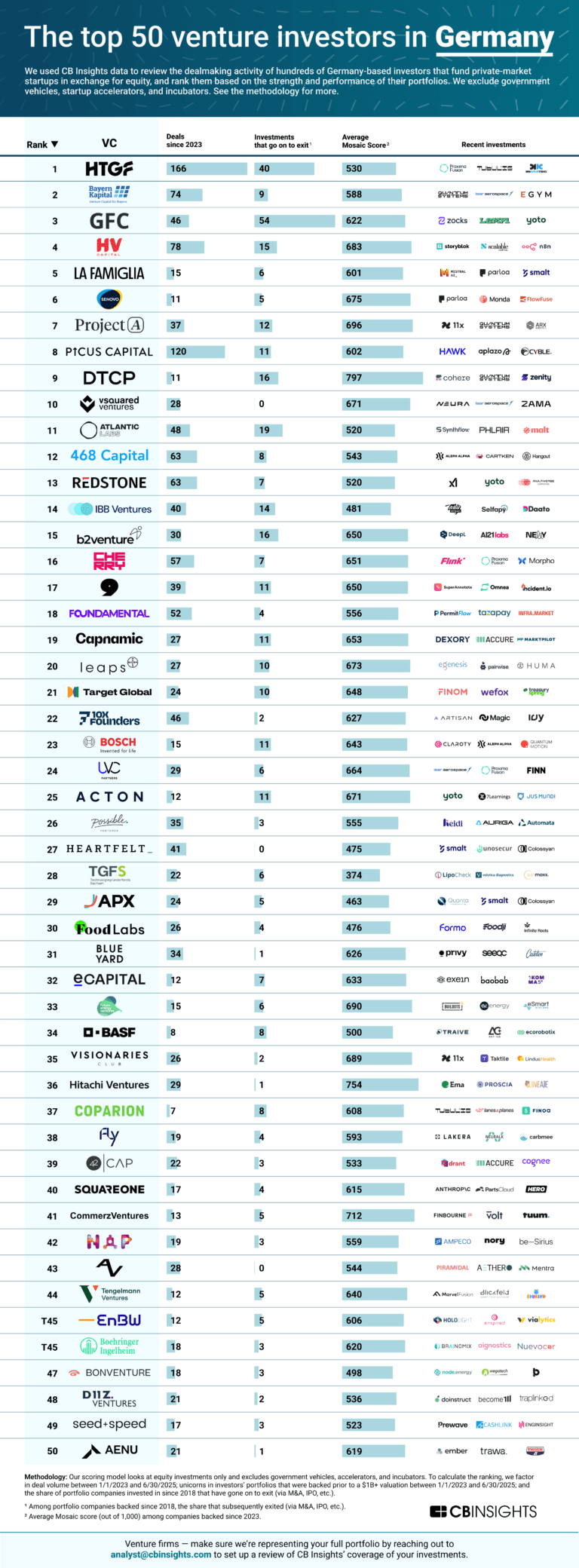

The top 50 venture investors in GermanyLatest 468 Capital News

Nov 12, 2025

Philippine OneLot raises $3.3M in funding co-led by Accion Ventures and 468 Capital OneLot , the Philippines’ financing platform for used car dealers, has raised $3.3 million in seed funding to expand affordable financing and digital tools for independent dealerships. The firm said in a statement on Tuesday that the round was co-led by Accion Ventures and 468 Capital, with new participation from Everywhere Ventures and Seedstars, and continued backing from Crestone Venture Capital, Kaya Founders, and notable angels, including Georg Steiger (BillEase) and Jojo Malolos (Paymongo). The fresh capital will accelerate OneLot’s mission to empower used car entrepreneurs with faster access to credit, AI-driven underwriting, and technology solutions that help them grow their businesses. OneLot is focused on accelerating growth across the used car dealership market in the Philippines. The company will continue expanding its dealer network, extending more credit to existing partners, and broadening its product suite with new software tools and financing solutions that support dealers from sourcing to sales. Together, these initiatives will further strengthen the firm’s position as the trusted partner for used car dealers nationwide. “With this new funding round, we’re doubling down on our mission to become the leading financing platform for used car dealers,” said Harm-Julian Schumacher, Chief Executive Officer and Co-Founder of OneLot. “We’re thrilled to welcome Accion Ventures on board—bringing deep global expertise in fintech and lending that will help us scale smarter and faster, “Together with 468 Capital and the continued support of both new and existing investors, this is a strong vote of confidence in our vision, our momentum, and the opportunity ahead,” he added. It is noted that the Philippines’ rapidly growing $15 billion used car industry is dominated by family-owned dealerships that have shown remarkable resilience as banks and traditional lenders continue to underserve them. Nearly 90 percent of used car dealers in the Philippines remain without reliable bank financing, reflecting a broader credit gap in which only 12 percent of Filipinos have access to formal loans, according to the 2025 World Bank Global Findex report. OneLot, therefore, aims to remove capital barriers, provide access to affordable capital, and enable dealers to buy and sell more cars. The firm combines artificial intelligence (AI)-driven underwriting with on-the-ground vehicle appraisal to issue secured inventory loans within hours. The platform quickly evaluates each vehicle, determines market prices, and makes real-time credit decisions—enabling faster approvals, higher credit limits, and competitive rates while maintaining strong risk controls and high loan profitability. Beyond inventory financing, the firm is building an end-to-end platform that integrates credit, software, and data to empower dealers across the entire value chain. The platform helps dealers source vehicles, manage inventory, and streamline sales, while also offering financial solutions for their retail customers all within a single platform that drives customer satisfaction and long-term retention. The firm is already delivering measurable results. In just one and a half years of operations, the company has issued more than $7 million in loans and now supports over 150 dealers on its platform. “The team is unlocking a massive opportunity in the $15 billion used car market in the Philippines by empowering the family dealerships who drive it, “With their proprietary underwriting models and deep local insight, OneLot is breaking down barriers to credit and building a financial engine for growth,” said Rahil Rangwala, Managing Partner of Accion Ventures. Guilherme Steinbruch, Partner 468, said the firm continues backing OneLot as it builds the end-to-end financing platform for used car dealers. For him, there’s still tremendous room for growth for the firm.

468 Capital Investments

305 Investments

468 Capital has made 305 investments. Their latest investment was in OneLot as part of their Seed VC on November 11, 2025.

468 Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/11/2025 | Seed VC | OneLot | $3.3M | No | Accion Ventures, Crestone Venture Capital, Everywhere Ventures, Georg Steiger, Jojo Malolos, Kaya Founders, and Seedstars | 5 |

10/31/2025 | Seed VC - II | Adam | $4.1M | No | Pioneer, Script Capital, Theo Browne, Tim Glaser, TQ Ventures, Transpose Platform, and Trevor Blackwell | 3 |

10/9/2025 | Seed VC | Vulcan Technologies | $10.9M | Yes | A* Capital, Arash Ferdowsi, Cubit Capital, General Catalyst, Hawktail, Liquid 2 Ventures, Pioneer Fund, Sunshine Lake, SV Angel, Transpose Platform, Trevor Rees-Jones, Twenty Two Ventures, Undisclosed Angel Investors, Undisclosed Investors, Valkyrie Ventures, and Y Combinator | 4 |

9/25/2025 | Series A | |||||

9/8/2025 | Series C - II |

Date | 11/11/2025 | 10/31/2025 | 10/9/2025 | 9/25/2025 | 9/8/2025 |

|---|---|---|---|---|---|

Round | Seed VC | Seed VC - II | Seed VC | Series A | Series C - II |

Company | OneLot | Adam | Vulcan Technologies | ||

Amount | $3.3M | $4.1M | $10.9M | ||

New? | No | No | Yes | ||

Co-Investors | Accion Ventures, Crestone Venture Capital, Everywhere Ventures, Georg Steiger, Jojo Malolos, Kaya Founders, and Seedstars | Pioneer, Script Capital, Theo Browne, Tim Glaser, TQ Ventures, Transpose Platform, and Trevor Blackwell | A* Capital, Arash Ferdowsi, Cubit Capital, General Catalyst, Hawktail, Liquid 2 Ventures, Pioneer Fund, Sunshine Lake, SV Angel, Transpose Platform, Trevor Rees-Jones, Twenty Two Ventures, Undisclosed Angel Investors, Undisclosed Investors, Valkyrie Ventures, and Y Combinator | ||

Sources | 5 | 3 | 4 |

468 Capital Portfolio Exits

14 Portfolio Exits

468 Capital has 14 portfolio exits. Their latest portfolio exit was Rapid Robotics on September 13, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/13/2025 | Acquired | 3 | |||

7/3/2025 | Asset Sale | ABACON CAPITAL | 4 | ||

2/4/2025 | Acquired | 5 | |||

Date | 9/13/2025 | 7/3/2025 | 2/4/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Asset Sale | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | ABACON CAPITAL | ||||

Sources | 3 | 4 | 5 |

468 Capital Fund History

2 Fund Histories

468 Capital has 2 funds, including 468 Capital Fund II.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/31/2022 | 468 Capital Fund II | $400M | 1 | ||

468 Capital |

Closing Date | 1/31/2022 | |

|---|---|---|

Fund | 468 Capital Fund II | 468 Capital |

Fund Type | ||

Status | ||

Amount | $400M | |

Sources | 1 |

468 Capital Team

1 Team Member

468 Capital has 1 team member, including current General Partner, Florian Leibert.

Name | Work History | Title | Status |

|---|---|---|---|

Florian Leibert | General Partner | Current |

Name | Florian Leibert |

|---|---|

Work History | |

Title | General Partner |

Status | Current |

Loading...