4Paradigm

Founded Year

2014Stage

PIPE | IPOTotal Raised

$930MMarket Cap

27.46BStock Price

52.90Revenue

$0000About 4Paradigm

4Paradigm provides AI solutions across various business sectors, including predictive maintenance platforms and AI infrastructure optimization tools. The company serves sectors such as finance, retail, manufacturing, energy, telecommunications, and healthcare. It was founded in 2014 and is based in Haidian, China.

Loading...

4Paradigm's Product Videos

ESPs containing 4Paradigm

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI development platforms market offers solutions that serve as one-stop shops for enterprises that want to develop and launch in-house AI projects. Vendors in this space enable organizations to manage aspects of the AI lifecycle — from data preparation, training, and validation to model deployment and continuous monitoring — through a single platform to facilitate end-to-end model development.…

4Paradigm named as Challenger among 15 other companies, including Dataiku, Domino, and Scale.

4Paradigm's Products & Differentiators

Sage AIOS

Sage AIOS is an enterprise-level AI operating system. As a flexible, secured and open platform, the role of Sage AIOS is analogous to Window’s role for personal computers. It connects the underlying IT infrastructure and various AI applications, and provides enterprises with high concurrency, performance and availability to support the development and launch of AI applications.

Loading...

Research containing 4Paradigm

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned 4Paradigm in 2 CB Insights research briefs, most recently on Oct 3, 2024.

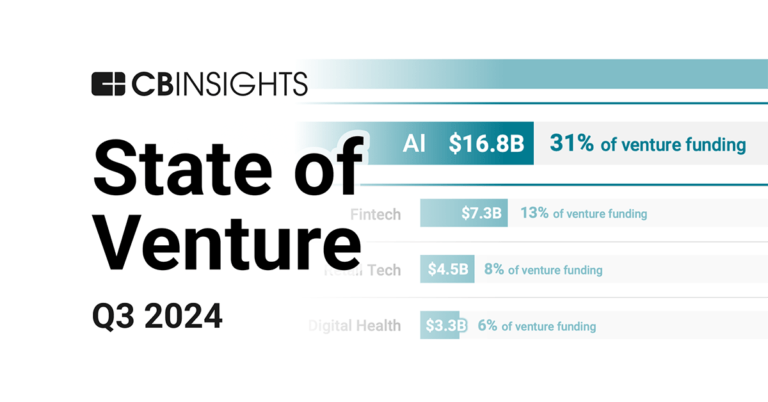

Oct 3, 2024 report

State of Venture Q3’24 Report

Sep 29, 2023

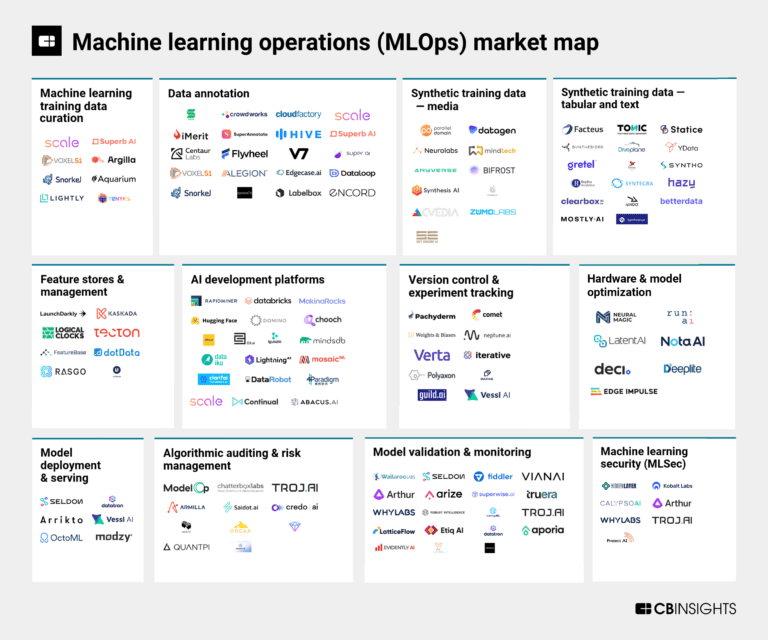

The machine learning operations (MLOps) market mapExpert Collections containing 4Paradigm

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

4Paradigm is included in 5 Expert Collections, including Regtech.

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

AI 100 (All Winners 2018-2025)

200 items

Fintech

14,203 items

Excludes US-based companies

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence (AI)

9,236 items

Latest 4Paradigm News

Nov 13, 2025

作为国内企业级AI领域的先行者,第四范式似乎更是往前走了一步。早在今年上半年,市场便基于过去连续三年良好的亏损缩窄态势,以及今年一季度大幅收缩至-2.12%的营业利润率水平,推断公司即将买入正盈利期。 此次披露的三季度业绩初步证实了这点。 今年前三季度,第四范式实现总收入44.02亿元,同比增长36.8%,远超去年同期增速;毛利润16.21亿元,同比增长20.1%;其中,第三季度公司首度完成了单季度正盈利的跨越。 尽管此次尚未披露具体利润数据,但这并不妨碍市场对第四范式未来前景的认可。 业绩披露的此日,也就是11月13日,第四范式港股股价开盘持续高涨,一度涨超8%,大幅跑赢核心指数。 第四范式是聚焦垂直领域布局的企业级AI行业龙头,主要业务分为先知AI平台、SHIFT智能解决方案和式说AIGS服务三个板块。 今年前9个月,其业绩爆发的核心引擎,便是先知AI平台业务的“二次加速”。 作为公司核心产品线,先知AI平台前三季度收入36.92亿元,同比激增70.1%,远超同期总营收增速,且占总营收比重提升至83.9%,成为绝对的增长支柱。 从单季度表现看,Q1至Q3先知平台收入增速分别为60.5%、79.5%、67.6%,始终保持高位。 这一增长既得益于企业对“可落地、高价值AI应用”需求的井喷,也与平台标准化能力的提升密不可分。IDC数据显示,至今第四范式已连续七年稳坐中国机器学习平台市场份额第一。 如此强劲的增长驱动力背后隐藏着第四范式果断做出的取舍。从具体业务结构来看,第四范式并非实现全线业务飘红。 与先知AI平台业务形成鲜明对比的是,公司主动收缩非核心业务的任务仍在继续。前三季度,其SHIFT智能解决方案收入同比下降12.5%,至6.02亿元;同期其式说AIGS服务收入再度下降70.0%,至1.08亿元。 这一“一升一降”的收入结构变化,并非业务疲软的信号,恰恰相反,它反映了第四范式明确的战略取舍: 将资源高度集中于标准化、可复制的先知AI平台,以追求更高效的规模扩张和更健康的商业模式。 事实上,其第二大业务,SHIFT智能解决方案本就是“先知AI平台”业务在解决方案端的延伸,其开拓和发展以支持「先知AI平台」业务增长为底层目标。 这种战略聚焦的直接成果体现在客户价值的深度挖掘上。截至第三季度末,公司在能源、制造、金融等关键行业的标杆用户数增至103个,虽然数量仅净增5个,但标杆用户的平均营收贡献却达到了惊人的2549万元,同比大幅增长71.4%。 这意味着,第四范式正通过提供更高价值、更深入的解决方案,在现有客户群中实现“深耕”,这为其收入的持续性和稳定性提供了坚实保障。反过来,高质量客户的成功推展也间接印证了其核心平台的产品力与市场潜力。 商业模式领跑,在于第四范式对行业痛点的精准把握与生态布局的前瞻性。 当前,企业级AI正从“概念验证”迈向“规模化落地”,但两大瓶颈始终制约行业发展:一是通用大模型与企业垂直需求的错位,二是国产算力与大模型的适配效率。 第四范式通过“差异化场景聚焦+国产算力生态构建”,成功在这两大领域撕开突破口。 首先,面对百模大战的通用大模型红海,第四范式,并未选择与科技巨头在通用能力上正面交锋,而是聚焦于行业大模型与垂直应用场景。这一“专才”定位,使其能够充分发挥专业性强、实施效率高、综合成本更低的比较优势。 其逻辑很清晰:通用大模型虽能处理文本、图像等通用任务,但在制造工艺优化、金融风控规则推理等垂直场景中,企业更需要“懂行业”的解决方案。为此,公司依托十年积累的行业know-how,构建“生成式AI交互+Agent调用行业垂直模型”的架构,既享受生成式AI降低开发门槛的红利,又通过行业模型的专业性解决企业实际问题。 这种“开箱即用”且直击痛点的“专才”路线,使其在能源、制造等对精度要求高的领域形成高客户粘性——标杆客户平均收入两年翻倍,正是对其场景深耕能力的直接印证。 其次,在另一个关键战场——算力领域,第四范式也有自己的思考和长远布局。 一方面,其今年9月推出的ModelHub XC及底层引擎EngineX,直接瞄准国产算力与国产大模型间存在的“适配痛点”。 据介绍,这个新平台通过统一引擎层支持多架构模型适配,实现“一次适配、多模型即插即用”,目前已适配华为昇腾、寒武纪、天数智芯等主流信创算力。平台半年内,适配认证的模型数量将陆续更新至千数级。 配合“Virtual VRAM”虚拟显存扩展卡(等效10张RTX 4090显存)及云原生调度技术,其本质是将自身打造成国产算力与大模型的“中间件”——企业无需更换硬件,即可高效释放算力价值。这一布局助力自身业务摆脱算力束缚,更使其有望成为未来国产AI生态中不可或缺的基础设施提供商,开辟了全新的增长想象空间。 值得一提的是,其还深入投资多家国产GPU厂商,目前持有商曦望超过9%股份,并通过公司旗下基金战略投资了GPU厂商天数智芯。 除核心平台外,第四范式已在“AI+零售”“AI+储能”“AI+稳定币”等新赛道悄然布局。例如,AI+零售通过AIAgent动态优化定价与促销,提升销售转化率;AI+储能结合智能液冷与AIAgent平台,延长电池寿命并降低运营成本;AI+稳定币则基于AIAgent建模资产价格波动,保障交易安全。这些业务虽未大规模贡献收入,但其技术储备与场景探索,为公司未来3-5年的增长提供了想象空间。 就目前阶段而言,当行业从“拼参数”转向“拼落地”,不可否认,第四范式的“平台化+行业深耕+国产算力生态”组合拳,确实已抢先显露出较难以复制的竞争壁垒;而首次单季盈利的信号,更是预示着其业务规模效应将持续释放。 在企业智能化转型的长周期中,第四范式的长期价值还是很值得持续关注的。 本文来自微信公众号 “港股研究社”(ID:ganggushe) ,作者:港股研究社,36氪经授权发布。

4Paradigm Frequently Asked Questions (FAQ)

When was 4Paradigm founded?

4Paradigm was founded in 2014.

Where is 4Paradigm's headquarters?

4Paradigm's headquarters is located at No.28 Shangdi West Road, Haidian.

What is 4Paradigm's latest funding round?

4Paradigm's latest funding round is PIPE.

How much did 4Paradigm raise?

4Paradigm raised a total of $930M.

Who are the investors of 4Paradigm?

Investors of 4Paradigm include Infini Capital, Tencent, HongShan, China Reform Culture Holdings, Mubadala Capital and 38 more.

Who are 4Paradigm's competitors?

Competitors of 4Paradigm include Dataiku, Domino, Databricks, RealAI, DataRobot and 7 more.

What products does 4Paradigm offer?

4Paradigm's products include Sage AIOS and 4 more.

Who are 4Paradigm's customers?

Customers of 4Paradigm include ICBC, Yum China and CATL.

Loading...

Compare 4Paradigm to Competitors

InData Labs provides data science consulting and software development focused on data science and AI across various sectors. The company offers services including predictive analytics, natural language processing, computer vision, and big data analytics. InData Labs serves industries such as finance, e-commerce, marketing and advertising, manufacturing, and healthcare. It was founded in 2014 and is based in Miami, Florida.

DataRobot provides artificial intelligence (AI) applications and platforms within the enterprise AI suite and agentic AI platform domains. Its offerings include a suite of AI tools that integrate into business processes, allowing teams to manage AI, along with AI governance, observability, and foundational tools. It serves sectors including finance, supply chain, energy, financial services, government, healthcare, and manufacturing, and collaborates with NVIDIA and SAP. It was founded in 2012 and is based in Boston, Massachusetts.

Vianai Systems develops generative artificial intelligence (AI) applications for the financial sector. The company offers a tool called Conversational Finance that uses the Hila platform for financial insights and data analysis through natural language processing. This technology allows finance professionals to ask questions and receive responses. It was founded in 2019 and is based in Palo Alto, California.

BigML is a company that operates in the machine learning sector. They provide a platform for businesses to analyze and predict customer behavior, site conversion rates, healthcare diagnostics, risk profiles, inventory optimization, and other data-driven insights. The company's services allow individuals without expert knowledge in machine learning to upload data and explore its potential. It was founded in 2011 and is based in Corvallis, Oregon.

GAI Insights focuses on providing generative artificial intelligence (AI) solutions within the AI sector. The company offers a range of services including industry-specific research, benchmarking, employee training, and advisory services for implementing large language models in enterprises. It serves the needs of corporate buyers and AI leaders looking to leverage AI for business transformation. It was founded in 2023 and is based in Boston, Massachusetts.

RNV Analytics provides artificial intelligence solutions for the retail sector, focusing on inventory optimization. The company offers a platform that uses AI and machine learning to analyze data from various sales points and customer behaviors, ensuring that products are in the right place at the right time. RNV Analytics serves the retail industry with tools for demand forecasting, stock management, and supply chain planning. It was founded in 2020 and is based in Istanbul, Turkey.

Loading...