Acorns

Founded Year

2012Stage

Series F | AliveTotal Raised

$564.02MValuation

$0000Last Raised

$300M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-27 points in the past 30 days

About Acorns

Acorns is a financial technology company that provides savings and investment services within the fintech sector. The company offers products that enable individuals to save and invest their spare change, plan for retirement through individual retirement accounts, and invest for children with custodial accounts. Acorns serves the personal finance and investment sectors, aiming to assist Americans with financial management. It was founded in 2012 and is based in Irvine, California.

Loading...

ESPs containing Acorns

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital financial wellness market consists of fintechs that deliver combinations of financial products, including banking, investing, loans, and P&C insurance, as well as planning tools such as goals-based planning, account aggregation, asset allocation, and budgeting tools. These companies often have B2C and B2B2C distribution models. While digital financial wellness companies may offer compl…

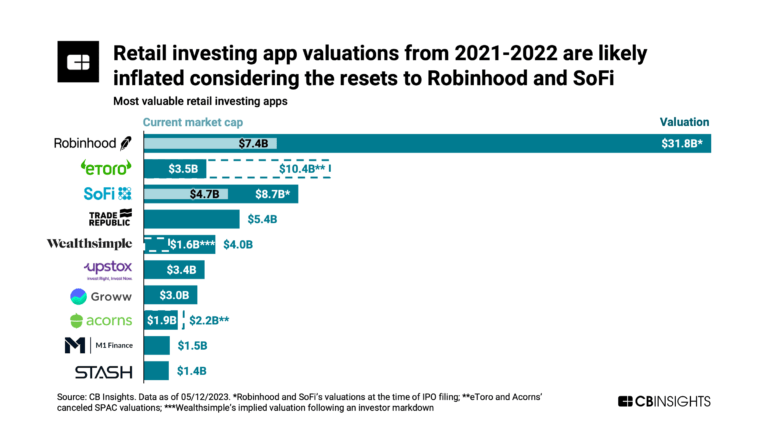

Acorns named as Challenger among 15 other companies, including SoFi, Revolut, and MoneyLion.

Loading...

Research containing Acorns

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Acorns in 3 CB Insights research briefs, most recently on Nov 3, 2025.

Nov 3, 2025 report

Tech IPO Pipeline 2026: Book of Scouting Reports

Aug 30, 2024

The financial planning market mapExpert Collections containing Acorns

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Acorns is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

747 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Tech IPO Pipeline

825 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Acorns Patents

Acorns has filed 27 patents.

The 3 most popular patent topics include:

- financial markets

- investment

- payment systems

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/25/2022 | 9/10/2024 | Payment systems, Transaction processing, Payment service providers, Financial markets, Investment | Grant |

Application Date | 4/25/2022 |

|---|---|

Grant Date | 9/10/2024 |

Title | |

Related Topics | Payment systems, Transaction processing, Payment service providers, Financial markets, Investment |

Status | Grant |

Latest Acorns News

Nov 13, 2025

News provided by Share this article Share toX New data shows that, despite limited faith in traditional systems, optimism and self-reliance are driving a resilient mindset to building wealth. IRVINE, Calif. and NEW YORK, Nov. 13, 2025 /PRNewswire/ -- Acorns , the financial wellness app, today released its 2025 Money Matters Report™, showing how young Americans are navigating financial uncertainty with steady confidence and self-reliance. While many question the stability of traditional safety nets, this generation continues to take action to shape their financial futures. In fact, 72% of 18–35-year-olds believe they will need to rely completely on themselves for retirement, reflecting a lack of faith in institutional stability. "Our data shows that people aren't waiting for the system to save them," said Noah Kerner, CEO and Chairman of Acorns. "They're taking control of their financial futures, and at Acorns, we help build on that self-reliance, giving them the real tools of wealth-making for steady, responsible growth—automatically, in the background of life." Based on data from 5,000 U.S. adults surveyed by Opinium Research, alongside 2,494 Acorns customers, the study highlights how small, consistent actions—not quick wins —fuel a movement toward self-built prosperity. Key findings include: 1. Self-Reliance Defines the New Financial Reality: Young Americans aren't waiting for traditional institutions to fix themselves. They see the problems clearly and are taking control to build their own financial futures. 72% of 18–35-year-olds believe they will need to rely completely on themselves for retirement. This mirrors a lack of faith in institutional stability. 54% think Social Security may be gone by the time they are eligible. 67% do not believe the U.S. will ever fully pay off its national debt. Top concerns: Gen Z cites lack of savings (39%) and Millennials cite debt (35%) as their primary financial concerns. 2. Confidence Drives Financial Action: Even with a challenging economy, young Americans remain confident in achieving key milestones. Two-thirds of 18–35-year-olds believe they will own a home in their lifetime. 65% of 18-35 year olds expect to retire by age 70. 3. Parents are Breaking the Money Taboo, Leading with Education: Financial education is a family priority, with parents seeking tools to equip the next generation for the new era of self-reliance and ensuring their children start their financial journey with optimism and confidence. 95% of parents have discussed money with their kids, though 62% do not feel confident doing so—indicating a high demand for accessible educational tools. 87% of parents of kids 6–13 feel optimistic about their children's financial futures. 38% believe ages 5-8 are ideal to start money lessons, validating the Acorns Early mission of providing an easy way for kids to learn money skills. 4. Acorns Customers Lead the Way in Financial Wellness: The data validates the impact of Acorns as a complete financial wellness system. Access to tools like Round-Ups®, Acorns Later, and Acorns Early helps customers convert optimism to confidence and responsible growth for the whole family. 37% of Acorns customers associate investing with hope, significantly higher than 30% of the general population, showing how daily, automated investing translates to positive sentiment. The belief in homeownership rises sharply to 78% among Acorns customers, compared to two-thirds in the wider pool. The 2025 Money Matters Report™ reinforces Acorns' vision: A financial wellness system for the whole family, creating compound growth at every life stage. The report is being released at Web Summit 2025. For the full report and downloadable data set, visit www.acorns.com/press . About Acorns 2025 Money Matters Report and Customer Survey ACORNS 2025 MONEY MATTERS REPORT METHODOLOGY The research was conducted anonymously by Opinium Research and commissioned by Acorns. This survey was not directed at Acorns customers. Any response collected from a customer was coincidental. The survey was conducted from September 5, 2025 through September 26, 2025, using Opinium Research's nationally representative online research panel. The sample population consisted of 5,000 U.S. consumers ages 18+, comprised of 2,423 males, 2,555 females, 20 nonbinary and 2 preferred not to say. ACORNS 2025 MONEY MATTERS CUSTOMER SURVEY METHODOLOGY This research complements the Acorns 2025 Money Matters Market Survey that was conducted by Opinium in September 2025. This research was conducted by Acorns among 2,494 Acorns customers from September 11 - September 16, 2025. About Acorns Acorns is a financial wellness app that helps everyday people and families save and invest money for the long term. Since 2014, Acorns has grown into a global company with multiple life stage products serving the needs of kids, teens, adults and parents. Named one of TIME's "World's Best Brands of 2024," Acorns has served over 15.5 million people, and helped customers save & invest over $27 billion dollars, much of it from spare change and small amounts. Investment advisory products and services offered by Acorns Advisers, LLC ("Acorns"), an SEC Registered Investment Adviser. Brokerage products and services are provided by Acorns Securities, LLC, an SEC registered broker-dealer, Member FINRA/SIPC. Acorns is not a bank. Banking services issued by Lincoln Savings Bank or nbkc bank, members FDIC. The Acorns Early card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International. For more information, visit www.acorns.com . SOURCE Acorns

Acorns Frequently Asked Questions (FAQ)

When was Acorns founded?

Acorns was founded in 2012.

Where is Acorns's headquarters?

Acorns's headquarters is located at 5300 California Avenue, Irvine.

What is Acorns's latest funding round?

Acorns's latest funding round is Series F.

How much did Acorns raise?

Acorns raised a total of $564.02M.

Who are the investors of Acorns?

Investors of Acorns include Headline, Bain Capital Ventures, Greycroft, BlackRock, TPG and 31 more.

Who are Acorns's competitors?

Competitors of Acorns include Streetbeat, Electus Education, Stash, Varo, ONE and 7 more.

Loading...

Compare Acorns to Competitors

Stash serves as a personal finance app that provides tools for budgeting, stock rewards, and saving for immediate needs and retirement. StashWorks is a workplace benefit that offers education, savings contributions, and rewards for reaching financial goals. Stash was formerly known as Collective Returns. It was founded in 2015 and is based in New York, New York.

Changed is a financial technology company that focuses on helping individuals accelerate their debt repayment and achieve financial freedom. The company offers an application-based platform that rounds up users' spare change from everyday transactions and applies it toward their debt, in addition to providing tools for automated payments, tracking loan balances, and setting financial goals. Changed primarily serves individuals looking to pay off personal loans, student loans, auto loans, credit cards, and mortgages more efficiently. It was founded in 2017 and is based in Chicago, Illinois.

Bundil operates as a crypto investment mobile platform. It allows users to automatically invest spare change from everyday credit or debit card purchases into Bitcoin and other cryptocurrencies. It was founded in 2017 and is based in Dallas, Texas.

Wealthfront specializes in wealth management and robo-advisory services. The company offers automated investing portfolios, cash accounts, and direct stock investing. Wealthfront serves individual investors looking for financial management and investment options. Wealthfront was formerly known as kaChing. It was founded in 2011 and is based in Palo Alto, California.

Cred provides a personalized investment portfolio tool that matches a client's existing worldview and long-term investing needs. It was founded in 2017 and is based in Tel Aviv, Israel.

Betterment is a digital investment advisor that provides services in the financial services sector. The company offers services such as investing with diversified portfolios, cash accounts, and retirement savings options. Betterment caters to individual investors looking to grow their wealth through various portfolio options and tax-related features. It was founded in 2010 and is based in New York, New York.

Loading...