Addepar

Founded Year

2009Stage

Series G | AliveTotal Raised

$743.93MValuation

$0000Last Raised

$230M | 6 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+107 points in the past 30 days

About Addepar

Addepar focuses on investment portfolio management within the financial services industry. The company provides a system that consolidates and evaluates data related to the market and clients, aiding investment professionals in decision-making. Addepar's services are relevant to wealth managers, family offices, private banks, and institutions, offering functionalities for trading, rebalancing, scenario modeling, and billing. It was founded in 2009 and is based in New York, New York.

Loading...

Addepar's Product Videos

ESPs containing Addepar

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The investment portfolio construction & optimization market uses data-driven algorithms and analytics to help financial professionals optimize portfolio composition, risk management, and returns. Solutions in this market include robo-advisory platforms, direct indexing tools, and AI-driven portfolio management systems that take into account factors such as asset allocation, risk tolerance, market …

Addepar named as Leader among 14 other companies, including BlackRock, Betterment, and SigFig.

Addepar's Products & Differentiators

Addepar (core platform)

Addepar is a software and data platform purpose-built for professional wealth, investment and asset management firms to deliver outstanding results for their clients. Addepar provides a complete set of portfolio data aggregation, analysis, trading and reporting capabilities built on top of a unique data aggregation model. The platform’s highly scalable and robust APIs integrate with hundreds of Addepar-native and industry-leading products, data providers and service partners to deliver a complete solution for a wide range of firms and use cases.

Loading...

Research containing Addepar

Get data-driven expert analysis from the CB Insights Intelligence Unit.

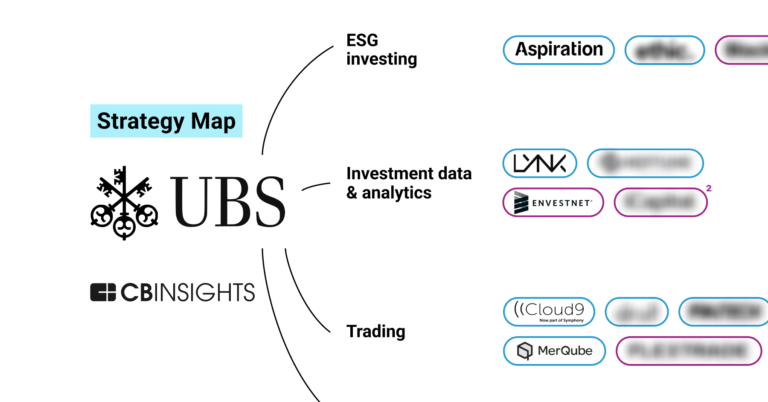

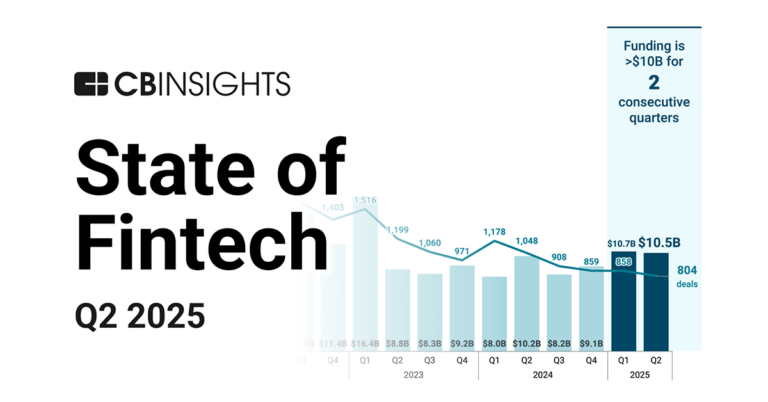

CB Insights Intelligence Analysts have mentioned Addepar in 2 CB Insights research briefs, most recently on Jul 17, 2025.

Jul 17, 2025 report

State of Fintech Q2’25 ReportExpert Collections containing Addepar

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Addepar is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Wealth Tech

2,723 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

825 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Addepar Patents

Addepar has filed 27 patents.

The 3 most popular patent topics include:

- data management

- database management systems

- user interfaces

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/19/2022 | 11/26/2024 | Data management, Data types, Database management systems, Graph data structures, User interfaces | Grant |

Application Date | 7/19/2022 |

|---|---|

Grant Date | 11/26/2024 |

Title | |

Related Topics | Data management, Data types, Database management systems, Graph data structures, User interfaces |

Status | Grant |

Latest Addepar News

Oct 20, 2025

How Family Offices Select Portfolio Software in 2025 Home > Business > How Family Offices Select Portfolio Software in 2025 Reading Time: Share this article In this Article Family offices increasingly face challenges selecting the right portfolio software. Finding a solution to meet unique requirements can be challenging. The stakes are high, and mistakes can lead to operational inefficiencies or missed opportunities. A good selection process considers private market asset support, robust data aggregation, and clear reporting tools. Security features and cost-effectiveness also matter greatly. This guide simplifies the path forward by mapping actionable steps. If you’re curious about building your checklist, stick around for strategies that ease decision-making while minimizing risks. Understanding Key Portfolio Software Features for Family Offices Family offices manage complex portfolios spanning public equities, private markets, real estate, and more. The software you choose must accommodate this diversity. Look for tools offering multi-asset class support to ensure smooth tracking across investments. Seamless integration with external systems is another priority. Reliable data feeds streamline updates from custodians and brokers without manual effort. User experience matters too. Interfaces should be intuitive so team members can access insights without extensive training. And automation reduces repetitive tasks like reconciliation or report generation. A broad market review helps identify gaps in functionality between platforms. For instance, don’t just settle for popular options like Addepar. Instead, evaluating this platform in contrast with Addepar competitors ensures a well-rounded perspective before narrowing choices. Flexibility also makes a difference, as your needs evolve over time, and rigid solutions won’t keep pace with growth or increases in complexity. Ultimately, robust feature alignment lets family offices improve decision-making while optimizing workflows effectively across their investment landscape. Evaluating Private Market Asset Support in Software Options Family offices often hold significant allocations in private markets, such as venture capital, private equity, or real estate. Not all portfolio software handles these asset classes effectively. Ensure the platform can track illiquid investments alongside traditional securities. Private market assets demand detailed tracking for committed capital, distributions, valuations, and unfunded commitments. A capable system simplifies this by automating updates and consolidating data into clear summaries. Custom fields also add flexibility for nuanced entries like partner contributions or performance metrics unique to private funds. This ensures your reports accurately reflect portfolio dynamics without manual adjustments. Lastly, check whether the software provides integrations with specialized platforms or supports uploading third-party valuation models directly into its framework. The Role of Data Aggregation and Integration Capabilities Accurate, up-to-date data is vital for informed decision-making. Family offices should prioritize software that excels in aggregating information from multiple sources. This includes custodians, banks, fund administrators, and private market platforms. Reliable aggregation ensures that performance metrics reflect real-time portfolio conditions without delays or gaps. Manual entry risks inaccuracies, whereas automated imports prevent errors and save time. Integration with existing systems like accounting tools or tax software enhances operational efficiency. Some platforms also support APIs to create custom connections for niche workflows. Cross-platform synchronization simplifies tracking assets held across different jurisdictions or structures. It provides a unified view by consolidating diverse holdings under one interface. Balancing Risk Analytics with Performance Measurement Tools Family offices require tools that measure portfolio performance and identify potential risks. Software should provide clear, actionable analytics to effectively balance returns and risk exposure. Risk management features like stress testing, scenario analysis, and Value at Risk (VaR) modeling help anticipate vulnerabilities during market shifts. These insights allow proactive adjustments before issues escalate. Performance measurement tools must go beyond simple metrics like ROI or IRR. They should provide breakdowns by asset class, strategy, or geography for a deeper understanding of what drives gains or losses across the portfolio. Look for solutions that integrate risk data into dashboards alongside performance summaries. This streamlines monitoring without switching between systems. Customizable benchmarks further enhance precision when tracking investment outcomes against goals. Ensuring Customizable Reporting Matches Unique Needs Family offices often require highly tailored reporting to meet stakeholder demands. Generic, one-size-fits-all reports fail to capture the complexity of diverse portfolios and often don't align with individual preferences. The ideal software offers customizable templates for key reports, such as performance summaries, risk assessments, and cash flow analyses. These should allow adjustments for timeframes, asset classifications, or personalized benchmarks. Dynamic dashboards are equally important. They provide at-a-glance insights with drill-down options for detailed exploration. Flexibility in dashboard design ensures teams focus on metrics that matter most to them. Export options also deserve attention, whether creating polished PDFs for external sharing or integrating data into spreadsheets for deeper analysis. Some platforms support white-labeling capabilities so family offices can present professional-grade visuals under their own branding. Prioritizing Security Measures and Compliance Requirements Handling sensitive financial data means security is a top priority for family offices, and there are ways to protect yourself worth following. The right portfolio software should also offer robust safeguards to protect against breaches or unauthorized access. Look for platforms that include multi-factor authentication (MFA), encryption of data both at rest and in transit, and detailed user access controls. These measures reduce the risk of exposure to cyber threats. Compliance requirements add another layer of complexity. Software must comply with regulations such as GDPR, SOC 2 standards, and other region-specific laws that govern data protection and financial reporting. Audit trails are essential features, as they provide a transparent record of activity within the system, ensuring accountability during internal reviews or external audits. Vendors should also perform regular penetration testing and maintain up-to-date certifications as proof of their commitment to security. Wrapping Up Selecting the right portfolio software is vital for family offices aiming to manage complex investments efficiently. Thoughtful evaluation of features like asset coverage, reporting flexibility, and security ensures solutions align with operational needs. By following a structured approach, decision-makers can confidently choose platforms that support both current demands and future growth. Read More

Addepar Frequently Asked Questions (FAQ)

When was Addepar founded?

Addepar was founded in 2009.

Where is Addepar's headquarters?

Addepar's headquarters is located at 335 Madison Avenue, New York.

What is Addepar's latest funding round?

Addepar's latest funding round is Series G.

How much did Addepar raise?

Addepar raised a total of $743.93M.

Who are the investors of Addepar?

Investors of Addepar include 8VC, Valor Equity Partners, WestCap, EDBI, Vitruvian Partners and 23 more.

Who are Addepar's competitors?

Competitors of Addepar include Apex Fintech Solutions, Eton Solutions, d1g1t, iCapital, FINNY AI and 7 more.

What products does Addepar offer?

Addepar's products include Addepar (core platform) and 4 more.

Who are Addepar's customers?

Customers of Addepar include RBC Wealth Management – U.S..

Loading...

Compare Addepar to Competitors

FINNY AI provides tools for financial advisors to assist in their prospecting efforts within the financial services industry. The company offers services that include identifying potential prospects, prioritizing them based on a compatibility score, and automating outreach processes to support advisor-client connections. Its platform aims to improve the prospecting process, allowing financial advisors to focus on building relationships and developing their businesses. The company was founded in 2023 and is based in New York, New York.

Powder provides artificial intelligence (AI) solutions for the wealth management sector, focusing on document analysis. The company offers AI agents that automate the parsing and analysis of financial documents, which reduces the time required for these tasks and allows wealth management professionals to engage with clients and perform other activities. Powder's AI technology aims to improve client service by increasing productivity, ensuring compliance, and providing data security. It was founded in 2023 and is based in Los Altos, California.

Orion Advisor Technology specializes in providing comprehensive software solutions for financial advisors within the wealth management sector. The company offers a suite of products that facilitate portfolio accounting, client relationship management, and trading, as well as tools for risk assessment, regulatory compliance, and financial planning. Orion Advisor Technology was formerly known as Orion Advisor Services. It was founded in 1999 and is based in Omaha, Nebraska. Orion Advisor Technology operates as a subsidiary of Orion.

d1g1t provides an enterprise wealth management platform in the financial technology sector. The company offers a comprehensive suite of analytics and risk management tools designed to enhance the quality of financial advice and streamline wealth management operations. Its services cater to financial advisory firms, multi-family offices, registered investment advisors (RIAs), broker-dealers, and bank advisor networks, aiming to integrate various aspects of wealth management into a cohesive system. It was founded in 2017 and is based in Toronto, Canada.

Masttro operates as a WealthData company within the financial technology sector. The company offers a platform that aggregates, analyzes, and reports on individuals' and families' total net worth, encompassing both liquid and illiquid investments, liabilities, and passion assets across various currencies and regions. The company primarily serves wealth owners, their beneficiaries, and financial advisors with a focus on providing control, transparency, and peace of mind for informed financial decision-making. It was founded in 2010 and is based in New York, New York.

InvestCloud focuses on transforming the financial industry's approach to digital and operates within the financial technology sector. The company offers a no-code software platform for digital and commerce enablement, providing cloud-native, multi-tenanted solutions that help banks, wealth managers, and asset managers overcome technology debt and meet the needs of their clients. The company primarily serves the financial industry. It was founded in 2010 and is based in West Hollywood, California.

Loading...