Agility Robotics

Founded Year

2015Stage

Unattributed VC | AliveTotal Raised

$589.74MLast Raised

$140K | 2 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+79 points in the past 30 days

About Agility Robotics

Agility Robotics develops humanoid robotics and automation solutions for various industries. The company provides robots designed to automate tasks in manufacturing, distribution, and retail, utilizing AI for control and operation. Agility Robotics serves sectors that require material handling and automation, including warehousing and logistics. It was founded in 2015 and is based in Pittsburgh, Pennsylvania.

Loading...

ESPs containing Agility Robotics

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

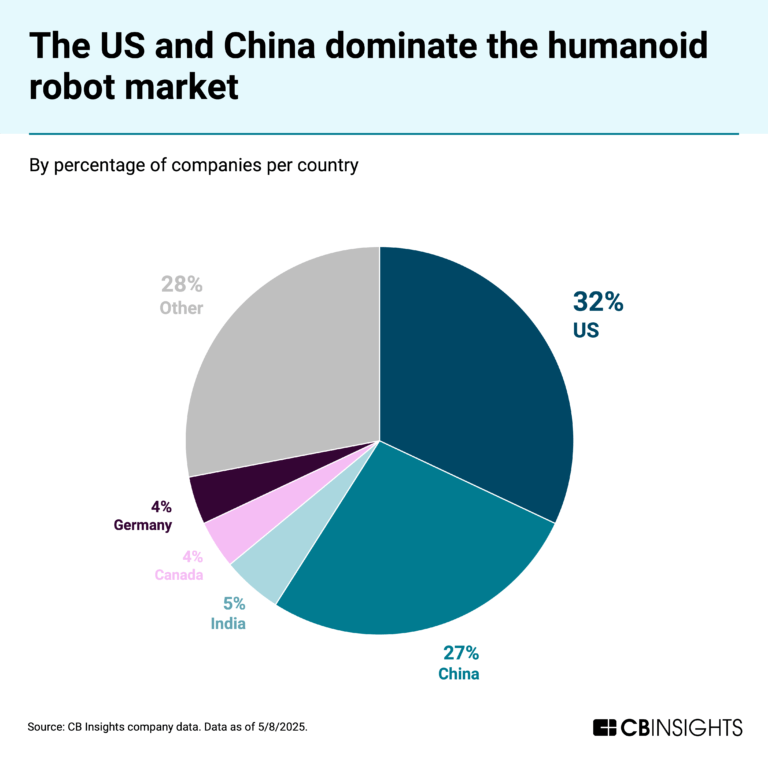

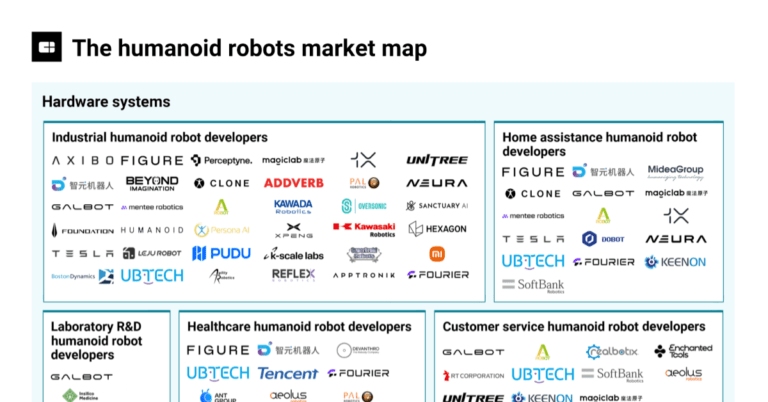

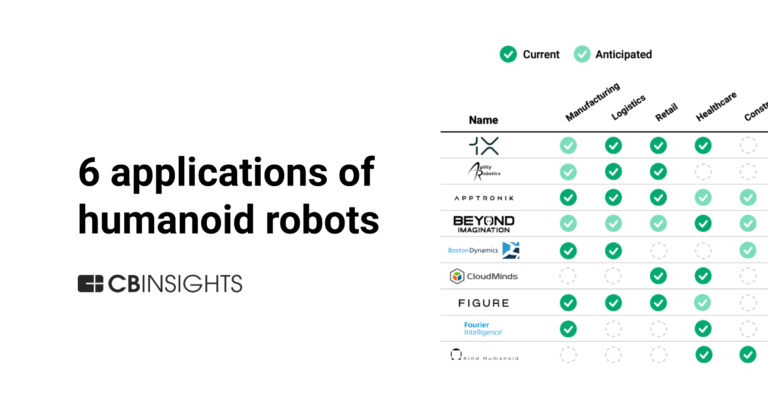

The industrial humanoid robot developers market focuses on the development and deployment of robots with human-like form designed specifically for industrial applications. These robots feature bipedal mobility, articulated limbs, and advanced sensors that enable them to navigate complex environments and perform tasks traditionally done by humans. Industrial humanoid robots enhance automation in in…

Agility Robotics named as Challenger among 15 other companies, including Tesla, Xiaomi, and UBTECH Robotics.

Loading...

Research containing Agility Robotics

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Agility Robotics in 11 CB Insights research briefs, most recently on Aug 27, 2025.

Jun 26, 2025

The humanoid robots market map

Jun 26, 2025 report

Book of Scouting Reports: Humanoid Robots

Feb 13, 2025

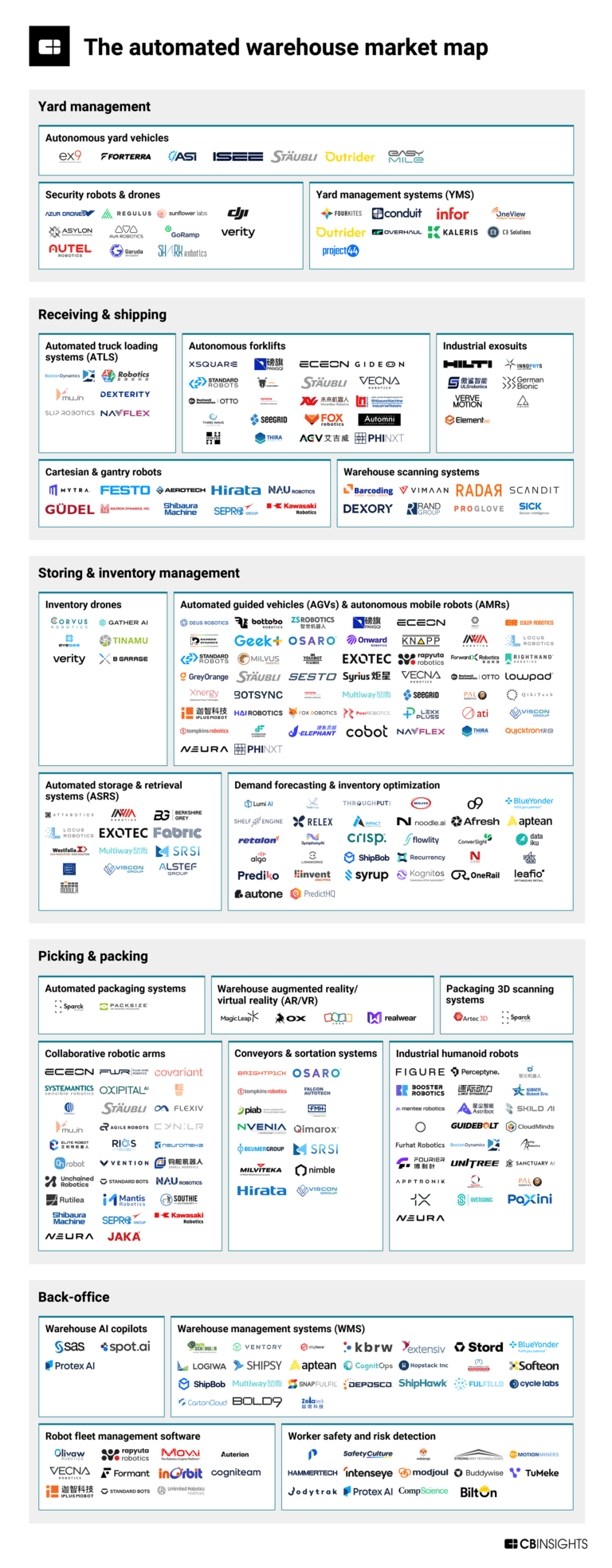

The automated warehouse market map

May 31, 2024

3 applications of generative AI in manufacturing

Mar 26, 2024

6 applications of humanoid robots across industriesExpert Collections containing Agility Robotics

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

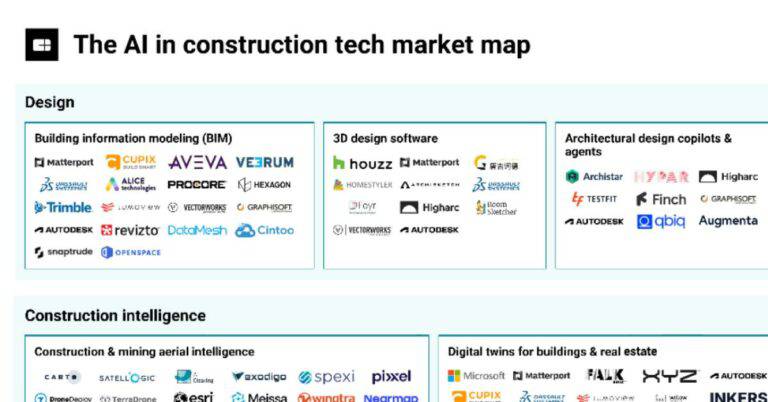

Agility Robotics is included in 9 Expert Collections, including Construction Tech.

Construction Tech

1,530 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Supply Chain & Logistics Tech

6,098 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Robotics

2,753 items

This collection includes startups developing autonomous ground robots, unmanned aerial vehicles, robotic arms, and underwater drones, among other robotic systems. This collection also includes companies developing operating systems and vision modules for robots.

Advanced Manufacturing

7,017 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

AI 100 (All Winners 2018-2025)

200 items

Job Site Tech

968 items

Companies in the job site tech space, including technologies to improve industries such as construction, mining, process engineering, forestry, and fieldwork

Agility Robotics Patents

Agility Robotics has filed 10 patents.

The 3 most popular patent topics include:

- robotics

- actuators

- automotive transmission technologies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/2/2023 | 4/1/2025 | Analog circuits, Bridge circuits, Sensors, Electrical signal connectors, Resistive components | Grant |

Application Date | 8/2/2023 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Analog circuits, Bridge circuits, Sensors, Electrical signal connectors, Resistive components |

Status | Grant |

Latest Agility Robotics News

Nov 7, 2025

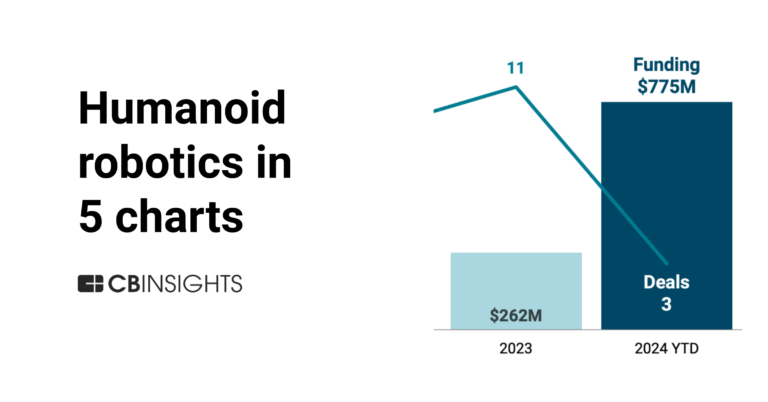

This report provides a comprehensive analysis of the rapidly evolving industrial robotics landscape, highlighting how intelligent, collaborative, and humanoid systems are transforming global manufacturing and automation. It examines the convergence of artificial intelligence, computer vision, digital twins, and advanced actuation that is enabling adaptive, flexible, and connected robotic operations across industries. Industrial Robots move from automation to autonomy Industrial robotics is entering a new phase of transformation as intelligent, mobile, and humanoid systems reshape automation across sectors. Evolving beyond traditional caged robots, next-generation platforms integrate AI, computer vision, digital twins, and advanced actuation to enable adaptive, flexible, and connected operations. Automotive, electronics, and aerospace remain core adopters, while healthcare, construction, and logistics are emerging growth frontiers. Companies such as BMW, Mercedes-Benz, and Tesla are piloting humanoids for assembly and logistics, ABB, FANUC, and KUKA are advancing cobots and modular arms, and startups like Figure AI, Agility Robotics, and Apptronik are redefining human-robot collaboration. The innovation momentum is mirrored in investment activity with deal value rising to $7.3 billion in H1 2025, driven by major venture rounds and late-stage scaling investments in humanoid and mobile robotics. Patent activity peaked in mid-2024, highlighting breakthroughs in dexterity, battery efficiency, and reinforcement learning, while hiring stabilized in 2025 as robotics and AI talent demand diversified across incumbents and startups. Industrial robotics is now moving from hype to real-world deployment. Robots are increasingly embedded within digital manufacturing ecosystems, automating welding, inspection, packaging, and 3D printing while enhancing safety and sustainability. As costs decline and AI capabilities mature, adoption is expanding to SMEs and new domains such as retail, mining, and healthcare. The Innovation Radar: Industrial Robots report explores how this shift from automation to autonomy is redefining industrial productivity, workforce collaboration, and the future of manufacturing intelligence. Industrial robots are evolving beyond traditional automation. Once confined to caged assembly lines, robots are now diversifying into collaborative, mobile, and humanoid systems. Sectors like automotive, electronics, and aerospace lead adoption, while industries such as healthcare, construction, and logistics are emerging growth areas. Advanced technologies are enabling smarter robots. Integration of AI, machine vision, advanced sensors, IoT, and digital twins is pushing robots toward adaptive, flexible, and connected operations. Humanoids and mobile robots are gaining traction, supported by breakthroughs in actuators, battery efficiency, and reinforcement learning. Market signals highlight strong momentum. Total deal value, including venture financing, mergers and acquisitions, equity offerings, private equity, partnerships, and asset transactions, surged to $7.3B in H1 2025, patent activity peaked in mid-2024, and hiring demand across robotics, AI, and engineering roles diversified beyond incumbents to start-ups. Investment focused on humanoid robotics marks a new frontier of capital flows. Adoption grows unevenly across industries. Automotive and electronics remain the largest markets, while small and medium-sized enterprises (SMEs) face barriers of cost and skills. Growth is accelerating in packaging, construction, and retail, with humanoids piloted in automotive factories and exoskeletons deployed in industrial settings. Innovation is shifting from hype to real-world deployment. Robots are increasingly integrated into supply chains and digital manufacturing ecosystems. Practical deployments include humanoids in BMW and Mercedes plants, AI-powered inspection robots in aerospace, and autonomous systems for mining, construction, and healthcare, underscoring that industrial robotics is moving from experimental to operational. Key Highlights Momentum in Intelligent Robotics Deployment: Adoption of next-generation industrial robots is accelerating across automotive, electronics, aerospace, and emerging sectors such as healthcare, construction, and logistics. Collaborative, mobile, and humanoid robots are transforming production, assembly, and inspection with adaptive, AI-enabled precision and real-time human-robot collaboration. Technologies Powering Next-Gen Automation: The report highlights the integration of artificial intelligence, machine vision, reinforcement learning, IoT connectivity, digital twins, and advanced actuators as the foundation for smarter, more energy-efficient, and context-aware robotic systems capable of operating autonomously in dynamic environments. From Automation to Autonomy: Industrial robotics is evolving beyond repetitive, pre-programmed workflows toward self-learning, reconfigurable systems. The report explores how humanoids, exoskeletons, and autonomous mobile robots (AMRs) are redefining workforce collaboration, safety, and operational flexibility across manufacturing and logistics ecosystems. Spotlight on Industry Leaders and Innovators: Profiles and use cases include BMW and Mercedes-Benz deploying humanoid robots in production lines, ABB and KUKA expanding modular cobot portfolios, Tesla and Agility Robotics advancing humanoid mobility, and startups such as Figure AI and Apptronik scaling intelligent humanoids for industrial deployment. Sector-Specific Innovation Trajectories: The report showcases how robotics is enabling smart automation across industries-robotic drilling and inspection in aerospace, 3D-printing and drywall automation in construction, autonomous delivery and warehouse systems in retail and logistics, and surgical and assistive robots in healthcare. Market and Investment Dynamics: Deal value surged to $7.3 billion in H1 2025, signaling investor confidence in humanoid and AI-driven robotics platforms. Patent activity peaked in mid-2024, reflecting innovation in mobility, dexterity, and autonomy, while talent demand stabilized as robotics and AI roles diversified across incumbents and startups. Barriers and Enablers of Scale: Analysis of adoption challenges such as high CapEx, legacy integration, and safety certification, balanced against enablers including AI breakthroughs, government incentives, and reshoring-driven automation initiatives across North America, Europe, and Asia. Strategic Outlook: Industrial robotics is transitioning from hype to deployment maturity, becoming a central enabler of digital manufacturing, supply chain resilience, and sustainable productivity. The Innovation Radar: Industrial Robots report captures this shift toward intelligent, autonomous, and human-centric industrial ecosystems. Technology Analysis Examine the engineering, operational, and human-centric classifications of robots, from articulated and SCARA types to humanoids and autonomous mobile platforms. Learn how breakthroughs in actuators, sensors, and energy systems are redefining payload, dexterity, and endurance across sectors. Innovation Landscape Discover over 80 cutting-edge robotics innovations spanning aerospace, automotive, construction, healthcare, logistics, and retail. From humanoid prototypes like Figure 02 and Optimus to sectoral breakthroughs like AI-powered robotic surgery, autonomous warehouse systems, and 3D-printing robots, see how innovation is moving from hype to deployment. Market Dynamics Gain insights into the 7.3 billion dollars in robotics-related deal value recorded in H1 2025, the peak in patent activity in 2024, and the shifting investment toward humanoid and mobile robotics. Understand key growth drivers such as workforce shortages, reshoring, and AI integration, and the barriers of cost, safety, and skills that still impede mass adoption. Sectoral Applications Learn how industrial robots are revolutionizing production efficiency, quality, and safety across industries including humanoids in automotive assembly, AI-driven inspection robots in aerospace, autonomous exoskeletons in healthcare, and mobile logistics systems in retail and warehousing. Competitive and Innovation Intelligence Track the strategies of global leaders such as ABB, FANUC, KUKA, and Universal Robots alongside emerging disruptors like Figure AI, Agility Robotics, and Boston Dynamics. Understand where the innovation hotspots lie, from high-precision articulated robots to humanoid pilots and AI-native manufacturing systems. Strategic Recommendations Use these insights to develop robotics adoption strategies, identify high-growth application areas, and align your organization with the next wave of automation. The report enables policymakers, investors, and industry leaders to prioritize R&D investments, assess partnership opportunities, and future-proof operations against labor and supply chain disruptions. With industrial robotics now central to the future of manufacturing, logistics, and smart infrastructure, this report offers the intelligence needed to navigate a rapidly evolving innovation landscape and to capture competitive advantage in the era of intelligent automation. Companies Featured ABB AEON Robotics Agility Robotics Aletta Robotics Ally Robotics Ambi Robotics ANYbotics Apptronik Arrival ARMADAS BD Rowa BellaBot BMW Boston Dynamics Cantilever Robotics CarryBot Casbot Charmec Revo Daimler (Mercedes-Benz) Dimitra Robotics Dobot Doosan Robotics DSTL (UK Ministry of Defence) Dynamis Robotics EG7 Robotics Epson America FANUC Figure AI Ford FoxBot Fraunhofer Franka Robotics Geek+ Technology GenesisX Gudel Robots Haipick Robotics HAVOC Robotics IAI Automation Infineon Technologies Intuitive Surgical IRIS Robotics Jabil JAKA Robotics Kawasaki Robotics KNR Systems Koc Holding KUKA LG Electronics Locus Robotics Megarobo Medbot Mitsubishi Electric Necton Analytics NEO Robotics Optimotive Phoenix Robotics Premier Tech Protoclone Sanctuary AI Samsung Electronics Siemens SKYRON SpaceHopper SS Innovations Staubli Stevens AutoStore STMicroelectronics Swift Robotics Techman Robot Tesla Themis Robotics Toyota TURAL-I Unitree Universal Robots Valkyrie VANTAGE Systems Vayu One We Innovate Mobility Yamaha Motor Yaskawa Electric Yuanzheng Robotics Zena RX Zhilang Zyrex For more information about this report visit https://www.researchandmarkets.com/r/tsbzdt About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends. View source version on businesswire.com: https://www.businesswire.com/news/home/20251107524093/en/ Contacts ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Agility Robotics Frequently Asked Questions (FAQ)

When was Agility Robotics founded?

Agility Robotics was founded in 2015.

Where is Agility Robotics's headquarters?

Agility Robotics's headquarters is located at 91 43rd Street, Pittsburgh.

What is Agility Robotics's latest funding round?

Agility Robotics's latest funding round is Unattributed VC.

How much did Agility Robotics raise?

Agility Robotics raised a total of $589.74M.

Who are the investors of Agility Robotics?

Investors of Agility Robotics include Humanoid Global Holdings, NVentures, Canon, Abico Group, WP Global Partners and 19 more.

Who are Agility Robotics's competitors?

Competitors of Agility Robotics include Apptronik, Figure, Asylon, Cobionix, 1X and 7 more.

Loading...

Compare Agility Robotics to Competitors

Figure develops autonomous humanoid robots. The company offers robots that perform tasks autonomously, using AI to learn and execute operations in sectors such as manufacturing, logistics, warehousing, and retail, as well as in home environments. It was founded in 2022 and is based in Sunnyvale, California.

Boston Dynamics focuses on developing mobile robots in the robotics industry. Its offerings include robots for industrial inspection, safety and response operations, and warehouse automation. These robots are equipped with sensors and controls to perform tasks such as data gathering, hazard detection, and cargo handling. It was founded in 1992 and is based in Waltham, Massachusetts.

Perceptyne Robots focuses on the integration of artificial intelligence with robotics within the deeptech and automation sectors. The company provides industrial humanoid robots intended to automate dexterous tasks in various industries, incorporating features like vision guidance, tactile sensing, and teleoperation training. Perceptyne Robots serves sectors that require automation solutions, including manufacturing. It was founded in 2021 and is based in Hyderabad, India.

Sanctuary AI focuses on the development of humanoid robots equipped with artificial intelligence to address labor challenges across various industries. The company specializes in creating robots that can perform tasks requiring dexterity, tactile feedback, and fine manipulation, mimicking human cognitive processes and movements. Sanctuary AI primarily serves sectors that require automation for dull, dirty, or dangerous jobs, such as automotive, manufacturing, and logistics. It was founded in 2018 and is based in Vancouver, British Columbia.

1X is a company that develops humanoid robotics within the technology sector. The company creates general-purpose humanoid robots designed for home use, focusing on safety and intelligent behavior. The company makes that robots are intended to assist humans in domestic environments. It was founded in 2014 and is based in Moss, Norway.

Mentee Robotics specializes in the development of humanoid robots with advanced artificial intelligence capabilities within the robotics and AI technology sectors. Their robots are equipped with full-body motion planning and control, capable of performing complex tasks through dynamic interaction with their environment. The company's products are designed to serve sectors that require automation through sophisticated robotics, such as manufacturing, logistics, and healthcare. It was founded in 2022 and is based in Herzliya, Israel.

Loading...