Akur8

Founded Year

2019Stage

Series C | AliveTotal Raised

$186.28MLast Raised

$120M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+3 points in the past 30 days

About Akur8

Akur8 provides pricing and reserving platforms for the insurance industry. The company offers a suite of software solutions that utilize machine learning and predictive analytics for actuarial pricing and reserving processes. Akur8's platforms aim to support insurance pricing and reserving for personal and commercial lines insurers, managing general agents, insurers, and health insurers. It was founded in 2019 and is based in Paris, France.

Loading...

Akur8's Product Videos

_(13)_thumbnail.png?w=3840)

_(13)_thumbnail.png?w=3840)

ESPs containing Akur8

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurance pricing software market offers solutions that help insurance companies determine appropriate premium rates for their policies. These platforms leverage advanced algorithms, data analytics, and machine learning to analyze risk factors, claims history, and customer behavior for optimized pricing decisions. Key features include automated risk modeling, regulatory compliance tools, and i…

Akur8 named as Leader among 7 other companies, including Aon, Earnix, and Hyperexponential.

Akur8's Products & Differentiators

Akur8 Risk Module

Akur8's Risk module allows pricing experts to generate, select and adjust risk models to build pure premiums.

Loading...

Research containing Akur8

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Akur8 in 9 CB Insights research briefs, most recently on Oct 16, 2025.

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Mar 12, 2025

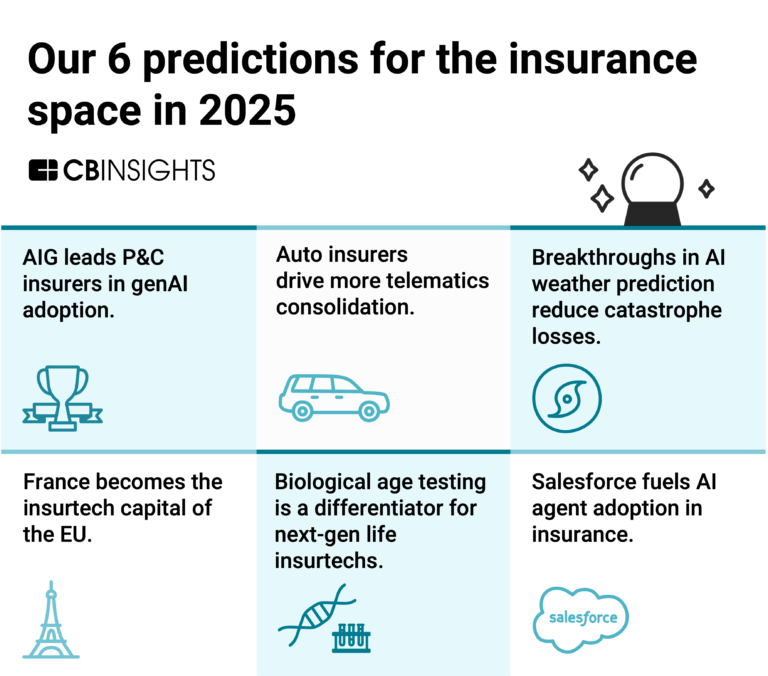

Our 6 predictions for the insurance space in 2025

Feb 13, 2025 report

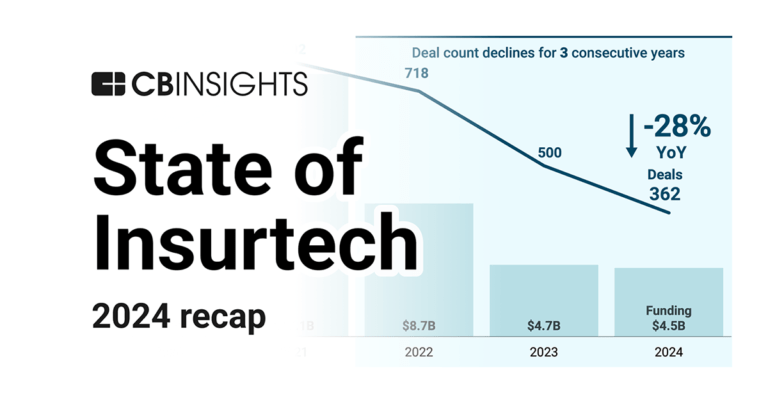

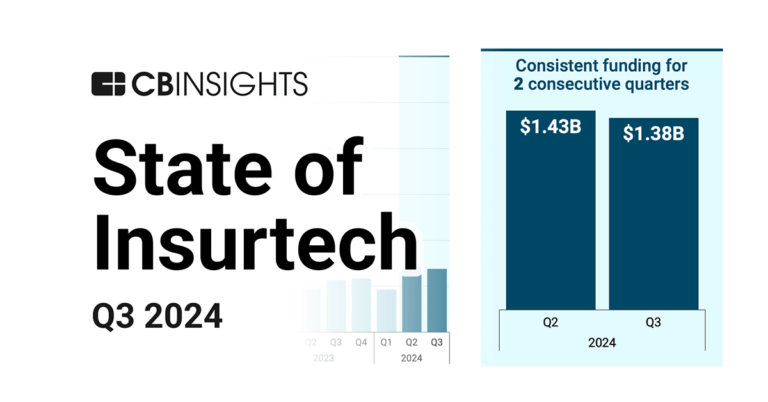

State of Insurtech 2024 Report

Nov 14, 2024 report

State of Insurtech Q3’24 Report

Oct 24, 2024 report

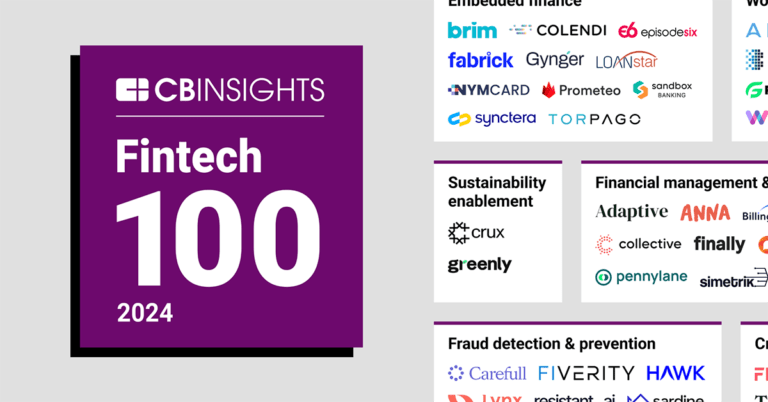

Fintech 100: The most promising fintech startups of 2024

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024Expert Collections containing Akur8

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Akur8 is included in 11 Expert Collections, including Insurtech.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence (AI)

14,208 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

14,203 items

Excludes US-based companies

AI 100 (All Winners 2018-2025)

100 items

Winners of CB Insights' 5th annual AI 100, a list of the 100 most promising private AI companies in the world.

Insurtech 50

200 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Fintech 100

200 items

Akur8 Patents

Akur8 has filed 1 patent.

The 3 most popular patent topics include:

- bioinformatics

- biological databases

- genetics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/30/2020 | Biological databases, Bioinformatics, Genetics, Regression analysis, Geographic information systems | Application |

Application Date | 11/30/2020 |

|---|---|

Grant Date | |

Title | |

Related Topics | Biological databases, Bioinformatics, Genetics, Regression analysis, Geographic information systems |

Status | Application |

Latest Akur8 News

Nov 1, 2025

Allied Market Research published a report, titled, " Underwriting Software Market by Functionality (Underwriting Systems (AUS), Rating Engines, Decision Support Systems), Delpoyment Mode (On-premise and Cloud), and End User (Insurance Companies, Insurance Brokers and Agencies, Reinsurers and MGA (Managing General Agent)) : Global Opportunity Analysis and Industry Forecast, 2024-2032". According to the report, the underwriting software market was valued at $5.7 billion in 2023, and is estimated to reach $15.9 billion by 2032, growing at a CAGR of 12.5% from 2024 to 2032. Get Your Sample Report & TOC Today: https://www.alliedmarketresearch.com/request-sample/A323728 Prime Determinants of Growth However, concerns about data security and privacy issues and resistance to change and legacy systems within some insurance companies are anticipated to hamper the growth of global market. On the contrary, expansion of underwriting software market in emerging economies with growing insurance sectors and increasing digitalization trends and integration of Internet of Things (IoT) devices and telematics data into underwriting software are further likely to create lucrative opportunities for the growth of the global market. Purchase This Comprehensive Report (PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/4gg7Oc6 The Cloud segment dominated the market in 2023 By deployment mode, the cloud segment held the highest market share in 2023 and is projected to maintain its lead position during the forecast period accounting for the underwriting software market revenue and is estimated to maintain its leadership status during the forecast period, owing to its various advantages such as scalability, flexibility, cost-effectiveness, and ease implementation. The automated underwriting system segment dominated the market in 2023 By functionality, the automated underwriting system segment accounted for the largest share in 2023, contributing for more than three-fifths of the underwriting software market revenue, as they offer insurance companies a comprehensive solution for streamlining the underwriting process. These systems utilize advanced algorithms and data analytics to assess risks, make underwriting decisions, and automate repetitive tasks, leading to increased efficiency and accuracy, which is further expected to propel the overall market growth. The insurance companies segment dominated the market in 2023 By end user, the insurance companies segment accounted for the largest share in 2023, owing to their large-scale operations and need for sophisticated risk assessment tools. These companies handle a significant volume of policies and require efficient underwriting processes to manage risks effectively, which is further expected to propel the overall market growth. Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A323728 Asia-Pacific region to maintain its dominance by 2032 By region, the North America segment held the highest market share in terms of revenue in 2022, owing to the region's well-established insurance industry, technological advancements, and high adoption rates of digital solutions. Insurance companies in North America have been early adopters of underwriting software to enhance operational efficiency, improve risk assessment, and deliver better customer experiences, anticipated to propel the growth of the market in this region. However, the Asia-Pacific segment is projected to attain the highest CAGR from 2024 to 2032, owing to economic growth, increasing insurance penetration, and regulatory changes. Insurance companies in Asia-Pacific are recognizing the importance of underwriting software to stay competitive, meet regulatory requirements, and cater to the evolving needs of their customers , which is further expected to contribute to the growth of the market in this region. Leading Market Players: - Insurity LLC. Applied Systems Inc. Ebix Inc Guidewire Software Duck Creek Technologies Accenture Sapiens International FINEOS Verisk Analytics, Inc. OneShield The report provides a detailed analysis of these key players in the Underwriting software market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different countries. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario. Recent Development: In December 2023, Duck Creek Technologies, the intelligent solutions provider defining the future of property and casualty (P&C) and general insurance, announced the release of Duck Creek ClarityTM, an innovative, cloud-native technology solution and the successor to Duck Creek Insights, designed to empower insurers with advanced data management, reporting, and analytics capabilities. In May 2022, Akur8, the next generation insurance pricing solution powered by transparent machine learning, announced that it has partnered with Duck Creek Technologies, a leading provider of SaaS insurance core systems, to offer P&C insurance carriers a fully integrated SaaS platform that will streamline and empower insurers' rate-making process from data to production. In June 2022, Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies , announced a new partnership with leading core system provider, OneShield Software. Under the provisions of this new partnership, critical property intelligence and risk management solutions from the Betterview Platform will be available to insurer clients within the user interface (UI) for the OneShield suite of products, including solutions for policy, billing, and claims. Access Your Customized Sample Report & TOC Now: https://www.alliedmarketresearch.com/request-for-customization/A323728 Key Benefits For Stakeholders This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the underwriting software market analysis from 2024 to 2032 to identify the prevailing underwriting software market opportunities. The market research is offered along with information related to key drivers, restraints, and opportunities. Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network and underwriting software market share. In-depth analysis of the underwriting software market segmentation assists to determine the prevailing underwriting software market opportunity. Major countries in each region are mapped according to their revenue contribution to the global underwriting software market size. Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players. The report includes the analysis of the regional as well as global underwriting software market trends, key players, market segments, application areas, and underwriting software market growth strategies. Underwriting Software Market Key Segments: By Functionality Underwriting Systems (AUS) Rating Engines Decision Support Systems By Delpoyment Mode On-premise Cloud By End User Insurance Companies Insurance Brokers and Agencies Reinsurers MGA (Managing General Agent) By Region North America (U.S., Canada) Europe (France, Germany, Italy, Spain, UK, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific) LAMEA (Latin America, Middle East, Africa) Trending Reports: Small Business Loans Market https://www.alliedmarketresearch.com/small-business-loans-market-A324248 Parametric Insurance Market https://www.alliedmarketresearch.com/parametric-insurance-market-A14966 Secured Personal Loans market https://www.alliedmarketresearch.com/secured-personal-loans-market-A324233 Virtual Cards Market https://www.alliedmarketresearch.com/virtual-cards-market-A17176 Landlord Insurance Market https://www.alliedmarketresearch.com/landlord-insurance-market-A259985 Term Life Insurance Market https://www.alliedmarketresearch.com/term-life-insurance-market-A177239 Biometric Payment Card Market https://www.alliedmarketresearch.com/biometric-payment-card-market-A192413 Pet Insurance Market https://www.alliedmarketresearch.com/pet-insurance-market Wedding Loans Market https://www.alliedmarketresearch.com/wedding-loans-market-A323339 About Us: Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domain. We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry. Contact Us: United States 1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA. Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285 Fax: +1-800-792-5285 help@alliedmarketresearch.com https://medium.com/@kokate.mayuri1991 https://bfsibloghub.blogspot.com/ https://steemit.com/@monikak/posts David Correa Allied Market Research email us here Visit us on social media: LinkedIn Facebook YouTube X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Akur8 Frequently Asked Questions (FAQ)

When was Akur8 founded?

Akur8 was founded in 2019.

Where is Akur8's headquarters?

Akur8's headquarters is located at 26-28 rue de Londres, Paris.

What is Akur8's latest funding round?

Akur8's latest funding round is Series C.

How much did Akur8 raise?

Akur8 raised a total of $186.28M.

Who are the investors of Akur8?

Investors of Akur8 include Guidewire, One Peak Partners, Partners Group, BlackFin Capital Partners, FinTLV and 7 more.

Who are Akur8's competitors?

Competitors of Akur8 include PredictAP, Cytora, ZestyAI, Quantee, Lumnion and 7 more.

What products does Akur8 offer?

Akur8's products include Akur8 Risk Module and 4 more.

Loading...

Compare Akur8 to Competitors

ZestyAI provides AI-powered risk assessment solutions for the property and casualty insurance industry. The company offers peril-specific risk models for natural disasters and environmental hazards, along with property insights to assist in underwriting and pricing decisions. ZestyAI's services are used by the insurance sector for risk management and decision-making. ZestyAI was formerly known as PowerScout. It was founded in 2015 and is based in San Francisco, California.

Earnix provides solutions for the insurance and banking sectors, including an Enterprise Rating Engine, Analytical Underwriting, Dynamic Pricing, Product Personalization, and Customer Engagement Solutions. The company focuses on integrating technologies into existing systems. It was founded in 2001 and is based in Ramat Gan, Israel.

Insurity operates as a provider of cloud-based software solutions for the property and casualty (P&C) insurance industry. The company offers a suite of services including policy administration, claims processing, billing management, and analytics to assist insurers with their operations. Insurity's platform is designed to support the core functions of insurance businesses, allowing them to develop new products and manage policies. It was founded in 1985 and is based in Hartford, Connecticut.

Duck Creek Technologies operates as a solutions provider focused on the property and casualty (P&C) and general insurance industry. The company offers a cloud-based platform that supports insurance systems, enabling operations for the insurance sector. It was founded in 2000 and is based in Boston, Massachusetts.

UnderwriteMe is a technology provider that offers underwriting solutions for the life insurance industry. The company provides products such as decision platforms, underwriting engines, and analytics tools that aim to facilitate the insurance application process and support decision-making. UnderwriteMe serves the life insurance sector by providing technology solutions to insurers and intermediaries. It was founded in 2012 and is based in London, United Kingdom.

BriteCore operates as a cloud-native core insurance platform for property and casualty (P&C) insurers. The company offers services including policy administration, billing and claims management, product configuration, and access to reporting and analytics. BriteCore serves the insurance industry, providing solutions for insurers and managing general agents (MGAs). It was founded in 2009 and is based in Springfield, Missouri.

Loading...