Alan

Founded Year

2016Stage

Series F | AliveTotal Raised

$749.27MValuation

$0000Last Raised

$193.17M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-26 points in the past 30 days

About Alan

Alan provides health insurance services and preventive health solutions within the healthcare industry. It offers health insurance plans, a healthcare system navigation tool through Alan Clinic, and mental well-being support with Alan Mind, designed to improve the health and productivity of individuals and corporate employees. It primarily serves diverse sectors, including tech startups, hospitality, the public sector, retail, and industrial businesses. It was founded in 2016 and is based in Paris, France.

Loading...

ESPs containing Alan

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital health insurance providers market refers to insurtech companies that provide private health insurance plans. Companies in this market often focus on providing distinguished value propositions — like telehealth and preventative care services, direct pay capabilities, or member navigation apps. Digital health insurance providers go beyond just the insurance sales process, and some of the…

Alan named as Highflier among 13 other companies, including Collective Health, Oscar, and Acko.

Alan's Products & Differentiators

Alan Insurance

Industry defining health insurance for employees of our customers

Loading...

Research containing Alan

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Alan in 5 CB Insights research briefs, most recently on Nov 3, 2025.

Nov 3, 2025 report

Tech IPO Pipeline 2026: Book of Scouting Reports

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Mar 12, 2025

Our 6 predictions for the insurance space in 2025

Nov 14, 2024 report

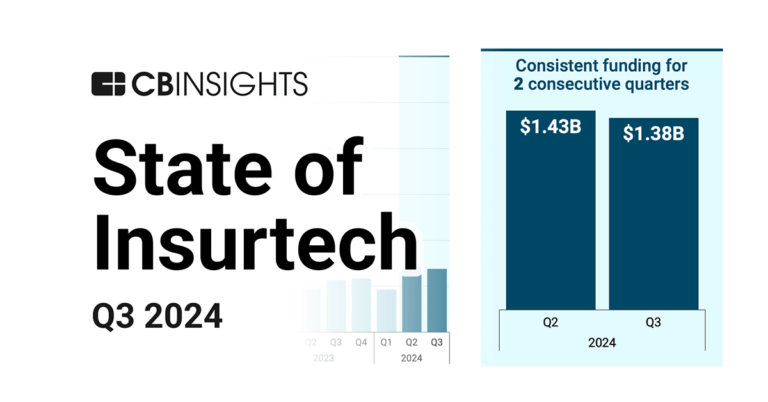

State of Insurtech Q3’24 Report

Oct 17, 2024 report

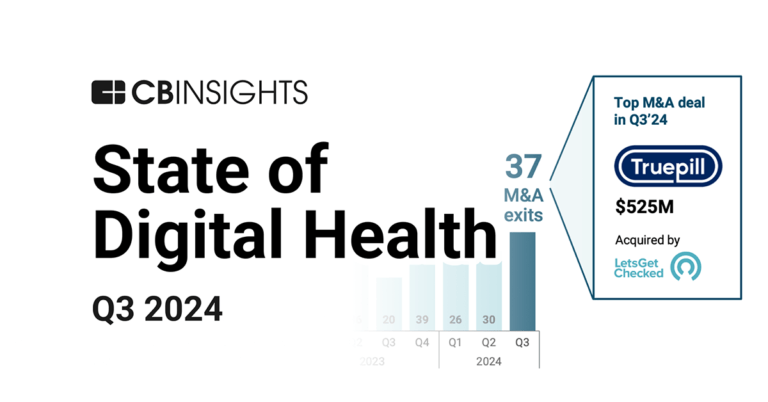

State of Digital Health Q3’24 ReportExpert Collections containing Alan

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Alan is included in 11 Expert Collections, including HR Tech.

HR Tech

6,137 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,309 items

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

3,403 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Future Unicorns 2019

50 items

Alan Patents

Alan has filed 27 patents.

The 3 most popular patent topics include:

- archery

- bows (archery)

- submarine power cables

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/10/2022 | 3/12/2024 | Archery, Bows (archery), Submarine power cables, Hunting equipment, Heraldic charges | Grant |

Application Date | 11/10/2022 |

|---|---|

Grant Date | 3/12/2024 |

Title | |

Related Topics | Archery, Bows (archery), Submarine power cables, Hunting equipment, Heraldic charges |

Status | Grant |

Latest Alan News

Nov 11, 2025

Le client d’aujourd’hui n’est plus celui d’hier. Il compare, commente, zappe parfois en un clic. La fidélité, autrefois acquise par habitude ou proximité, devient une conquête permanente. En 2025, les entreprises ne se battent plus seulement pour vendre, mais pour rester choisies. La vraie question est simple : comment fidéliser sans fatiguer ? 1/ Une fidélité plus fragile, mais plus consciente Selon le Baromètre KPMG–OpinionWay 2025, 68 % des consommateurs français affirment avoir changé au moins une marque de référence au cours des douze derniers mois. Leur motivation ? Pas le prix, mais le sentiment d’être mieux compris ailleurs. Les nouvelles générations de clients, particulièrement les millennials et la génération Z , ne cherchent plus des marques, mais des relations. Ils veulent : des valeurs cohérentes, En clair : la fidélité ne s’achète plus, elle se mérite. 2/ L’IA, entre hyperpersonnalisation et risque de déconnexion Jamais les entreprises n’ont eu autant de données sur leurs clients. Grâce à l’intelligence artificielle, elles peuvent anticiper les besoins, personnaliser les offres, ajuster le ton d’un e-mail ou le moment d’une relance. Mais en 2025, l’enjeu n’est plus de savoir si on utilise l’IA, mais comment. Une étude Salesforce 2025 révèle que 73 % des consommateurs veulent que les marques utilisent l’IA uniquement si cela améliore réellement l’expérience humaine. Autrement dit : la technologie doit amplifier la relation, pas la remplacer. La fidélisation passe désormais par un équilibre subtil entre efficacité digitale et chaleur relationnelle. 3/ L’émotion, le vrai levier de la fidélité Les neurosciences du marketing le confirment : un client fidèle n’est pas celui qui est satisfait, mais celui qui est émotionnellement attaché à la marque. Selon le Harvard Business Review (2024), un consommateur “émotionnellement engagé” dépense deux fois plus et reste fidèle plus longtemps, même face à la concurrence. Or, l’émotion se construit dans les micro-expériences : un message d’après-vente personnalisé, un geste inattendu, Ces attentions créent une mémoire positive : le sentiment d’être vu, reconnu, respecté. 4/ Du parcours client à la relation continue Pendant des années, la fidélisation reposait sur des programmes de points, de réductions ou d’avantages exclusifs. En 2025, cette logique transactionnelle ne suffit plus. Les marques les plus performantes comme Decathlon, Back Market, ou Alan, repensent la fidélisation comme une conversation à long terme. Elles ne se contentent pas d’acheter la fidélité, elles l’entretiennent : en sollicitant les retours clients, en les impliquant dans la co-création de produits, en valorisant leur contribution à la marque. C’est ce que les experts appellent la “customer participation” : faire du client un acteur, pas un spectateur. 5/ Les 4 grands défis de la fidélisation en 2025 1. L’infobésité relationnelle Les consommateurs sont saturés de messages, newsletters et notifications. Chaque marque veut “rester en contact”, au point d’étouffer le lien. Clé de succès : préférer la qualité à la fréquence. Un message sincère et utile vaut mieux qu’un flot d’automatismes. 2. La cohérence de marque La confiance s’effrite dès que le client perçoit un décalage entre le discours et les actes. Une entreprise ne peut plus se dire “éthique” si elle traite mal ses fournisseurs, ou “humaine” avec un service client robotisé. Clé de succès : cultiver la cohérence. Chaque interaction doit incarner la promesse de la marque. 3. L’expérience omnicanale fluide Le client navigue entre boutique, site, réseaux sociaux, service client. S’il doit répéter trois fois la même demande, la confiance s’évapore. Clé de succès : unifier les canaux. Selon Zendesk 2025, 82 % des clients attendent une expérience fluide et connectée entre les points de contact. 4. L’attention à la post-vente La fidélité se joue souvent après l’achat. Un suivi humain, un message de remerciement ou un support réactif transforment un client ponctuel en ambassadeur durable. Clé de succès : considérer la relation post-achat comme le début de la fidélisation, pas sa fin. Exemple : comment une marque de cosmétiques a réinventé sa fidélité En 2024, la marque française Typology a revu entièrement son approche client. Plutôt que de multiplier les promos, elle a misé sur : des diagnostics de peau personnalisés par IA, des conseils gratuits via chat humain, des newsletters éducatives, pas commerciales. Résultat : un taux de réachat en hausse de 32 % en un an. Les clients se sentent accompagnés, pas sollicités. 6/ Fidéliser, c’est aussi prendre soin de la confiance En 2025, la confiance est la nouvelle monnaie du marché. Transparence, authenticité, réactivité : les clients n’exigent pas la perfection, mais la véracité. Une étude Edelman Trust Barometer (2025) indique que 79 % des consommateurs cessent d’acheter à une marque dès qu’ils perçoivent une incohérence éthique ou une communication trompeuse. Cela implique :

Alan Frequently Asked Questions (FAQ)

When was Alan founded?

Alan was founded in 2016.

Where is Alan's headquarters?

Alan's headquarters is located at 117 Quai de Valmy, Paris.

What is Alan's latest funding round?

Alan's latest funding round is Series F.

How much did Alan raise?

Alan raised a total of $749.27M.

Who are the investors of Alan?

Investors of Alan include Temasek, Coatue, Lakestar, Ontario Teachers' Pension Plan, Belfius Bank and 22 more.

Who are Alan's competitors?

Competitors of Alan include NeueHealth, Unmind, Next Insurance, Spectrum.Life, Digit Insurance and 7 more.

What products does Alan offer?

Alan's products include Alan Insurance and 3 more.

Loading...

Compare Alan to Competitors

BIMA operates in the healthcare sector. The company provides services such as telemedicine, specialist care, health screening, personalized health programs, medicine delivery, laboratory testing, and insurance. The company serves individuals seeking health solutions. It was founded in 2010 and is based in Singapore.

NeueHealth operates within the healthcare sector, offering services through owned and affiliated clinics. The company supports independent providers and medical groups with performance-based arrangements and population health tools. NeueHealth serves health consumers, providers, and payors in the healthcare industry. NeueHealth was formerly known as Bright Health Group. It was founded in 2015 and is based in Miami, Florida.

Snapsheet focuses on claims processing technology within the insurance sector, providing a cloud-based platform for claims management. The company's offerings include virtual appraisals, claims management, and digital payment solutions, which aim to address cycle times and efficiency in the handling of auto, property, and commercial insurance claims. Snapsheet's technology is designed to support various stakeholders in the insurance industry, enabling a claims experience. It was founded in 2011 and is based in Chicago, Illinois.

HPOne operates within the healthcare sector, focusing on health insurance and Medicare plans. The company provides sales, marketing, and member outreach services to facilitate the management of Medicare and health insurance members. It was founded in 2006 and is based in Trumbull, Connecticut.

Energie Mutuelle is a healthcare mutual organization that offers health insurance services. The company provides individual and collective health plans, guarantees for dependents, and health services including medical teleconsultation and access to specialized health networks. Energie Mutuelle serves employees and retirees of the electric and gas industries and their dependents. It was founded in 1996 and is based in Paris, France.

AVENIR SANTE MUTUELLE operates as a non-profit organization focused on providing social protection in the health sector. The company offers a range of health and provident insurance solutions, designed to protect individuals and their families against unforeseen life events. These services are primarily targeted towards various segments including young people, families, seniors, independent professionals, active individuals, retirees, communities, and small to medium-sized businesses. It was founded in 1943 and is based in Versailles, France.

Loading...