AlphaSense

Founded Year

2008Stage

Biz Plan Competition | AliveTotal Raised

$1.397BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-17 points in the past 30 days

About AlphaSense

AlphaSense operates as a platform that provides tools for analyzing and synthesizing insights from business and financial documents. It is utilized by sectors such as investment banking, hedge funds, private equity, asset management, and corporate industries that require market and competitive intelligence. It was founded in 2008 and is based in New York, New York.

Loading...

ESPs containing AlphaSense

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI investment intelligence platforms market develops AI-powered solutions that assist investors in research, analysis, and decision-making. These platforms leverage generative AI, copilots, machine learning, and advanced algorithms to analyze financial data, generate investment insights, predict market movements, and provide personalized investment strategies. By automating research processes …

AlphaSense named as Leader among 15 other companies, including Bloomberg, BlackRock, and Morningstar.

AlphaSense's Products & Differentiators

AlphaSense Core Search (newest release: AlphaSense X)

AlphaSense is the leading market intelligence platform leveraging cutting-edge technology to continuously filter and analyze billions of fragmented pieces of information. We apply the power of AI to an extensive library of high value unstructured and structured data-sets, enabling business professionals to make critical decisions with confidence.

Loading...

Research containing AlphaSense

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AlphaSense in 7 CB Insights research briefs, most recently on Aug 29, 2025.

Aug 29, 2025 report

Book of Scouting Reports: Generative AI in Financial Services

Oct 15, 2024 report

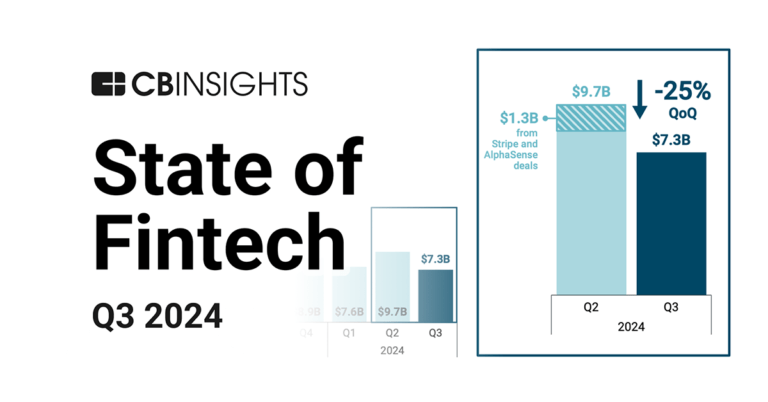

State of Fintech Q3’24 Report

Jul 16, 2024 report

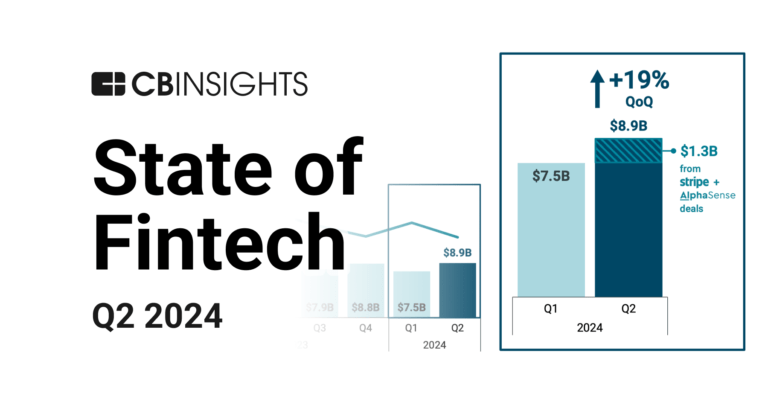

State of Fintech Q2’24 Report

Jul 3, 2024 report

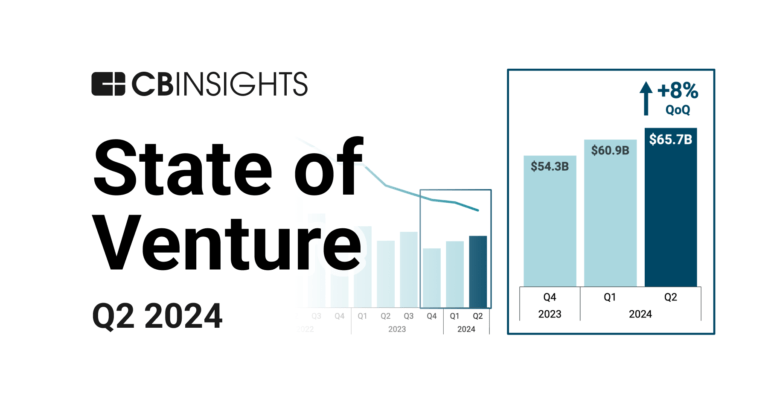

State of Venture Q2’24 Report

Oct 6, 2023

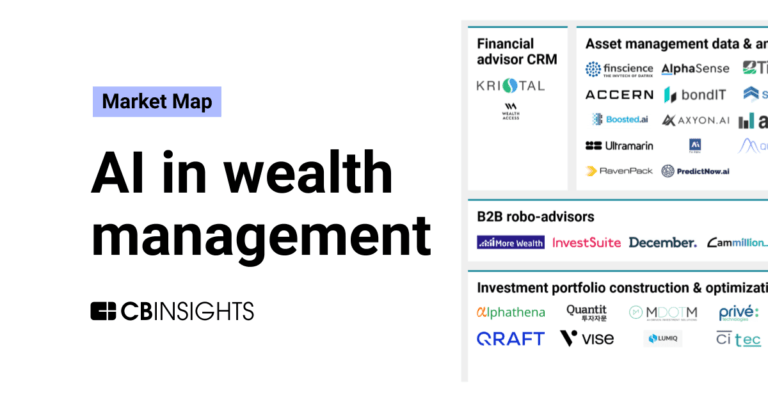

The AI in wealth management market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing AlphaSense

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AlphaSense is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Fintech 100

1,097 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Capital Markets Tech

1,063 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Market Research & Consumer Insights

734 items

This collection is comprised of companies using tech to better identify emerging trends and improve product development. It also includes companies helping brands and retailers conduct market research to learn about target shoppers, like their preferences, habits, and behaviors.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

AlphaSense Patents

AlphaSense has filed 37 patents.

The 3 most popular patent topics include:

- computational linguistics

- natural language processing

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/20/2024 | 3/11/2025 | Natural language processing, Computational linguistics, Data management, Database management systems, Information retrieval genres | Grant |

Application Date | 9/20/2024 |

|---|---|

Grant Date | 3/11/2025 |

Title | |

Related Topics | Natural language processing, Computational linguistics, Data management, Database management systems, Information retrieval genres |

Status | Grant |

Latest AlphaSense News

Nov 11, 2025

Your browser does not support the video tag. AlphaSense is an AI-powered market intelligence platform that is used to inform high-level decision-making. The firm has been involved in AI since its founding in 2011, recognising even then that the technology and its relationship with data would come to play a critical role in how businesses operate. In an exclusive interview with UKTN, AlphaSense’s SVP international and UK country director Daniel Sanchez-Grant discusses how developed the AI sector has become, the problems certain businesses have when wanting to incorporate the technology and what is next for AI. Keep up to date with the latest tech news. Sign up to the free UKTN Daily newsletter. Sign up There are three dimensions to how we are helping customers win on AlphaSense. The first is our content, we have spent the last 10 years building over half a billion different content sets: business proprietary, premium perspectives on every industry of the economy and so content is one part of the dimension. The second is from the very beginning, we had a vision that AI would play a fundamental role in how information is synthesised, understood, summarised. From the very beginning, we brought AI into the core value of what we do, initially starting with natural language and understanding variation in language to now using some of the most innovative generative AI models for very purpose built workflows. Then the final dimension is really workflows. Unlike, perhaps more general purpose AI designed solve a whole multitude of different use cases, AlphaSense exists to help strategy and business professionals cut through the noise and really distil everything that is going on in your market, your competitive landscape, the macro economy, down to the very key insights that you need at any given time you need it. It feels like every month we find new and interesting use cases for AI with different parts of the business What do businesses often get wrong about incorporating AI into their processes? There is so much excitement. The promise of AI right now is this huge productivity driver for companies and so everyone is thinking, what does this mean for us? In some cases they are moving quickly to implement what this might mean. Where people go wrong is adopting AI for AI’s sake, responding to the feeling that they need to instead of actually thinking about what’s the right tool for the specific needs that they have, and how does that fit in with their short and long term goals as a business? So I think mistakes are doing AI because it is cool, versus actually thinking about what business problem are we trying to solve, and how does this help? Which sectors have or will go onto benefit most from AI workflows? There are a few examples. The financial sector is one where we see massive shifts due to AI. AI represents opportunities for optimising their research, doing their due diligence in shorter amounts of time. For example, investment banks can leverage AI to enhance deal execution. They can identify investment opportunities or structure deals more efficiently, just by automating key financial analysis. If you look to sectors like pharmaceuticals or healthcare or consulting or law firms, all of these companies are turning to solutions or turning to AlphaSense for the unique, proprietary insight we bring to parts of their business that they can’t get that information anywhere else. There have been claims that we’re in an unsustainable AI bubble, how confident are you that the technology and sector can continue to grow? It feels like we are just scratching the surface at AlphaSense. It feels like every month we find new and interesting use cases for AI with different parts of the business, where increasingly it feels like we have gone from research professionals being interested in AlphaSense to anyone doing knowledge work and looking to be smart on what’s going on in their sector also getting value. We have got over 500 million documents in AlphaSense that powers our AI, but we have also got increasingly more proprietary content, content that is covering and getting into difficult areas that have been hard to learn about in the past, like private markets, and so where we are continuing to invest in proprietary insights that give you knowledge over parts of your business that have been difficult to find in the past, that continued investment there is also unlocking lots of new and exciting opportunities for us to go and help companies. I think we are very, very early, and I think there is loads more for us to do, and some of the product launches that we have done and the growth that we are seeing is a testament to that opportunity. Topics

AlphaSense Frequently Asked Questions (FAQ)

When was AlphaSense founded?

AlphaSense was founded in 2008.

Where is AlphaSense's headquarters?

AlphaSense's headquarters is located at 24 Union Square East, New York.

What is AlphaSense's latest funding round?

AlphaSense's latest funding round is Biz Plan Competition.

How much did AlphaSense raise?

AlphaSense raised a total of $1.397B.

Who are the investors of AlphaSense?

Investors of AlphaSense include Fast Company’s Next Big Things in Tech, Viking Global Investors, Goldman Sachs, CapitalG, Alkeon Capital Management and 39 more.

Who are AlphaSense's competitors?

Competitors of AlphaSense include Verity, Linq Alpha, Auquan, Grata, Farsight and 7 more.

What products does AlphaSense offer?

AlphaSense's products include AlphaSense Core Search (newest release: AlphaSense X) and 3 more.

Loading...

Compare AlphaSense to Competitors

Generative Alpha operates at the intersection of finance and artificial intelligence. It provides services that convert raw data into usable insights, utilizing predictive models based on private data. The primary clients include sectors that need advanced financial solutions. It was founded in 2023 and is based in San Francisco, California.

YCharts operates as a financial research and proposal platform within the financial services industry. The company provides inclusive data, visualization tools, and analytics for equity, mutual fund, and exchange-traded fund (ETF) data and analysis, enabling investment professionals to improve client engagements and simplify complex financial topics. YCharts primarily serves the financial advisory and asset management sectors. It was founded in 2009 and is based in Chicago, Illinois.

Wokelo provides an investment research platform operating in the financial services sector. The company focuses on research workflows such as due diligence, sector research, and portfolio monitoring, using its proprietary large language model (LLM) based agents for data curation, synthesis, and triangulation. It serves private equity funds, investment banks, consulting firms, and corporates, assisting them in making informed decisions. It was founded in 2022 and is based in Seattle, Washington.

Koyfin is a financial data and analytics platform that focuses on equipping investors with comprehensive market insights and analysis tools across various asset classes. The company offers live market data, advanced graphing, customizable dashboards, and a suite of features to support investment decisions for a range of financial instruments, including stocks, mutual funds, and more. Koyfin primarily serves independent investors, financial advisors, traders, research analysts, students, and enterprise clients with its data-driven solutions. It was founded in 2016 and is based in Miami, Florida.

Hudson Labs is a web-based investment research platform powered by specialized AI. It includes AI-driven fundamental research, systematic forensic analysis, and the Hudson Labs Co-Analyst. The company serves asset managers, insurers, and securities law firms. Hudson Labs was formerly known as Bedrock AI. It was founded in 2019 and is based in Toronto, Canada.

Bloomberg specializes in the distribution of financial data and the provision of news. The company offers a network of data, ideas, and analysis to provide real-time business and market information. Bloomberg serves a range of customers who rely on accurate and timely financial data. Bloomberg was formerly known as Innovative Market Systems. It was founded in 1981 and is based in New York, New York.

Loading...