Amazon Web Services

Founded Year

2006Stage

Other Investors | AliveRevenue

$0000About Amazon Web Services

Amazon Web Services provides cloud computing services in sectors including technology, finance, and healthcare. It offers services such as virtual servers and data storage, as well as artificial intelligence (AI) and machine learning capabilities. The company serves startups, enterprises, and public sector organizations using cloud technology. It was founded in 2006 and is based in Seattle, Washington.

Loading...

ESPs containing Amazon Web Services

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI agent marketplaces market provides platforms where users can discover, deploy, and customize pre-built AI agents that automate tasks or workflows. These marketplaces typically offer standalone agents or packaged groups that can be integrated into enterprise systems to handle complex processes in areas like customer service, marketing automation, or data analysis. Some marketplaces also offe…

Amazon Web Services named as Highflier among 12 other companies, including ServiceNow, Salesforce, and Microsoft.

Loading...

Research containing Amazon Web Services

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Amazon Web Services in 24 CB Insights research briefs, most recently on Sep 9, 2025.

Aug 22, 2025

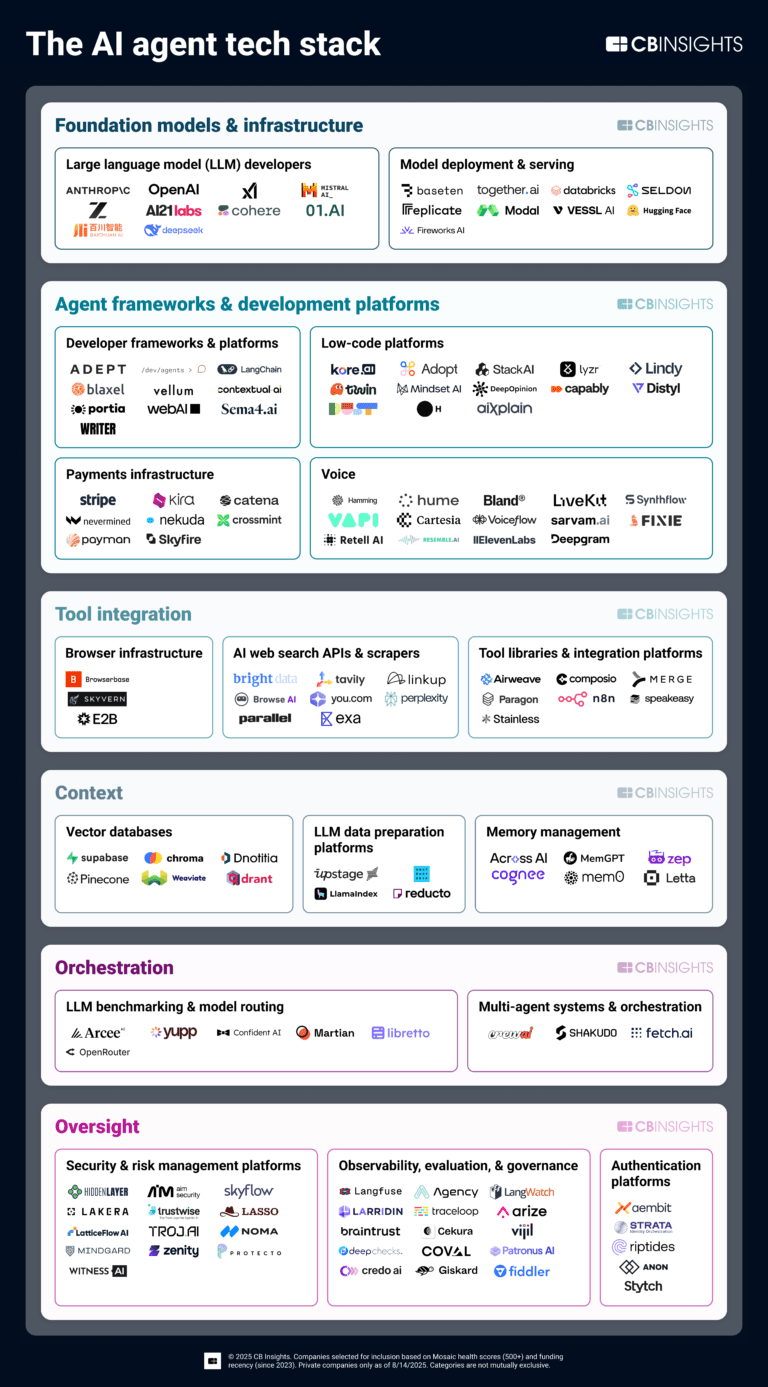

The AI agent tech stack

Aug 14, 2025

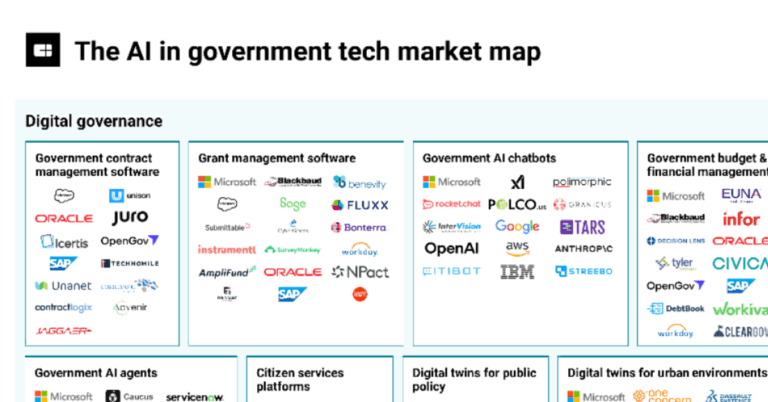

310+ AI companies transforming government

Jul 31, 2025 report

100 real-world applications of genAI across financial services and insuranceExpert Collections containing Amazon Web Services

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Amazon Web Services is included in 12 Expert Collections, including Auto Tech.

Auto Tech

4,189 items

Companies working on automotive technology, which includes vehicle connectivity, autonomous driving technology, and electric vehicle technology. This includes EV manufacturers, autonomous driving developers, and companies supporting the rise of the software-defined vehicles.

Oil & Gas Tech

4,862 items

Companies in the Oil & Gas Tech space, including those focused on improving operations across upstream, midstream, and downstream sectors, as well as those working on sustainable fuels.

Grid and Utility

2,383 items

Companies that are developing and implementing new technologies to optimize the grid and utility sector. This includes, but is not limited to, distributed energy resources, infrastructure security, utility asset management, grid inspection, energy efficiency, grid storage, etc.

Conference Exhibitors

5,302 items

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Latest Amazon Web Services News

Nov 14, 2025

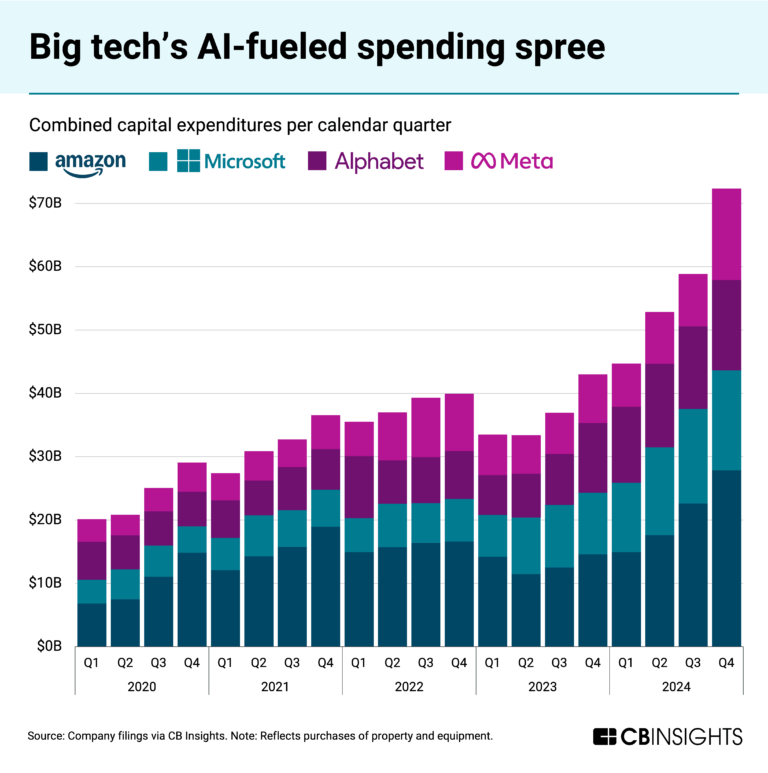

At the heart of this transformation lie data centers, once considered mere server warehouses, now rapidly ascending to the status of fundamental economic infrastructure. Recent analyses and guest opinions across financial circles underscore their pivotal role, likening them to the utilities and transportation networks that powered previous industrial revolutions. This burgeoning importance is triggering a seismic shift in investment patterns, reshaping real estate, technology, and energy markets, and presenting both immense opportunities and complex challenges for investors and public companies. The immediate implications for financial markets are profound. Data centers have transformed into a highly sought-after asset class, attracting massive capital investment and driving robust merger and acquisition (M&A) activity. With global data center demand projected to grow at a compound annual rate of 12-15% until 2030, and total market spending potentially reaching $1 trillion by then, the sector is experiencing unprecedented growth. This surge is fueled by the insatiable demand for cloud computing, e-commerce, and particularly, the explosion of artificial intelligence (AI), which requires immense computational power. This accelerated demand is creating a ripple effect across multiple industries, from semiconductor manufacturing to energy production and infrastructure development, making data centers a central theme for market participants. The Digital Backbone: A Deep Dive into Data Center's Economic Ascent The transformation of data centers into critical economic foundations is a multifaceted phenomenon. These facilities provide the essential infrastructure for storing, processing, and transmitting the vast amounts of data that underpin nearly every sector of the modern economy. From enabling seamless e-commerce transactions and powering sophisticated financial algorithms to facilitating breakthroughs in healthcare and driving the development of AI, data centers are indispensable. Their evolution into hyperscale facilities, designed for massive scalability and efficiency, is a testament to the ever-increasing demands of a digital-first world. The economic benefits generated by data centers are extensive and far-reaching. They are significant drivers of job creation, not only in their direct construction, operation, and maintenance but also in ancillary sectors such as telecommunications, software development, and energy. For instance, estimates suggest that for every direct job in the U.S. data center industry, an additional 7.4 ancillary jobs are created. Furthermore, these projects represent substantial capital investments, often running into billions of dollars, which invigorate local economies and generate considerable tax revenues for state and local governments. Loudoun County, Virginia, a major data center hub, has seen tax revenue from data center equipment purchases surge by 170% between 2021 and 2023, providing significant funding for public services. A pivotal factor accelerating this trend is the unprecedented rise of artificial intelligence. Experts widely agree that AI is supercharging data center demand, creating an unparalleled need for computing power and driving massive investment into specialized infrastructure capable of handling intensive AI workloads. However, this rapid expansion faces a critical bottleneck: power availability. Recent discussions highlight that access to reliable and abundant electricity has become the single biggest constraint on data center expansion, often overshadowing land availability. Data centers are enormous energy consumers, projected to account for up to 7.5% of U.S. electricity consumption by 2030, and nearly 20% in some regions. This scarcity is leading to aggressive pre-leasing, extended construction timelines, and a concerted focus on innovative and sustainable power solutions. Market Movers: Winners and Losers in the Data Center Boom The escalating importance of data centers is creating clear winners and losers across various industries, fundamentally altering investment landscapes. At the forefront of beneficiaries are technology and semiconductor companies, particularly those enabling AI. NVIDIA Corporation NASDAQ: NVDA ), a dominant player in graphics processing units (GPUs) essential for AI workloads, stands out as a primary beneficiary. The demand for powerful chips and specialized architectures for AI data centers is driving an unprecedented surge in server spending, which accounts for a significant portion of total data center investment. The global data center server market alone is projected to nearly quintuple from $204 billion in 2024 to $987 billion by 2030, underscoring the immense opportunity for chipmakers and server manufacturers. Cloud service providers, such as Amazon Web Services (AWS), a subsidiary of Amazon.com Inc. NASDAQ: AMZN Microsoft Azure NASDAQ: MSFT ), and Google Cloud NASDAQ: GOOGL ), are also massive winners. As the primary consumers and developers of hyperscale data centers, their continued expansion directly correlates with the growth of the data center industry. These companies are investing heavily in new facilities and technologies to meet the escalating demand for cloud services and AI infrastructure. Additionally, companies specializing in data center design, construction, and cooling technologies, especially liquid cooling solutions, are poised for significant growth as the industry seeks more efficient and sustainable operational methods. Conversely, the immense power requirements of data centers present a generational investment opportunity for the energy sector, but also significant challenges. Utility companies and power generators that can rapidly expand capacity, especially through renewable sources, nuclear power (like Small Modular Reactors or SMRs), and advanced grid infrastructure, stand to gain substantially. Those unable to meet this demand, or relying on outdated infrastructure, may face pressure. Furthermore, traditional real estate investment trusts (REITs) focused solely on office or retail properties might find themselves lagging behind specialized data center REITs like Equinix Inc. NASDAQ: EQIX ) and Digital Realty Trust Inc. NYSE: DLR ), which are experiencing historically low vacancy rates and surging colocation rents. The capital expenditure inflation and construction delays associated with these complex projects also pose risks for developers and investors. Broader Implications: Reshaping Industries and Policy The rise of data centers as economic foundations extends far beyond immediate financial gains, signaling broader shifts in industry trends, regulatory landscapes, and societal infrastructure. This phenomenon aligns with a broader industry trend of digital transformation, where every sector is increasingly reliant on robust, scalable, and secure digital infrastructure. The sheer scale of data center development is catalyzing significant investments in supporting infrastructure, including advanced telecommunication networks, improved power grids, and transportation links, effectively upgrading entire regions. This mirrors historical precedents where the development of railroads, highways, or utility grids spurred widespread economic development and urbanization. The rapid growth and critical nature of data centers are also attracting increased regulatory and policy attention. Some European governments are now classifying data centers as "strategic digital infrastructure," leading to regulated energy partnerships and incentives for green power solutions. This recognition highlights the national security and economic competitiveness aspects of data center capacity. Policymakers are grappling with balancing economic growth with environmental concerns, particularly regarding the significant energy and water consumption of these facilities. This could lead to stricter regulations on energy efficiency, carbon emissions, and water usage, potentially favoring companies that invest in sustainable technologies. Potential ripple effects on competitors and partners are also significant. For instance, the fierce competition for power and land in established data center hubs could drive development into new, emerging markets, fostering regional economic growth. Companies that fail to adapt to the accelerating demand for AI-ready infrastructure or neglect sustainable practices might find themselves at a competitive disadvantage. However, the collaborative nature of the digital ecosystem also means increased partnerships between cloud providers, energy companies, and local governments to ensure adequate infrastructure. Emerging risks include potential overbuilding in certain markets, the rapid pace of technological advancements leading to infrastructure obsolescence, and geopolitical tensions impacting supply chains for critical components. The Road Ahead: Navigating a Data-Driven Future Looking ahead, the trajectory of data centers as economic foundations points towards continued robust growth, albeit with evolving challenges and opportunities. In the short term, the relentless demand for AI computing power will continue to drive aggressive investment in hyperscale data centers and specialized GPU-dense facilities. This will likely sustain high valuations for data center assets and continued strong performance for semiconductor companies and cloud providers. The focus on overcoming power constraints will lead to innovative solutions, including accelerated development of renewable energy projects, grid modernization, and advanced cooling technologies. Strategic pivots will be crucial, with companies prioritizing locations with abundant, clean energy sources and robust infrastructure. In the long term, the industry is expected to mature, with a greater emphasis on sustainability, efficiency, and resilience. This will open new market opportunities for companies specializing in green data center technologies, energy management systems, and modular data center solutions that can be rapidly deployed. The financing landscape will also continue to evolve; while debt markets and private credit funds are currently heavily involved, questions about potential systemic risks in a downturn will likely lead to diversified financing strategies. Potential scenarios include the emergence of "energy parks" where data centers are co-located with power generation facilities, particularly renewables or small modular reactors, to ensure dedicated and sustainable power supplies. Investors should anticipate continued robust M&A activity as larger players seek to consolidate market share and acquire specialized capabilities. Challenges such as capital expenditure inflation, construction delays, and the increasing complexity of regulatory compliance will remain pertinent. However, the fundamental demand drivers – global digitalization, cloud adoption, and AI proliferation – are unlikely to abate. Companies that demonstrate foresight in securing power, embracing sustainable practices, and innovating in data center architecture will be best positioned for long-term success. Concluding Thoughts: A New Era of Digital Infrastructure Investment The ascent of data centers to the status of critical economic infrastructure marks a pivotal moment in global financial markets. The key takeaway is clear: these facilities are no longer merely support systems but active engines of economic growth and innovation, fundamentally reshaping the landscape for public companies and investors alike. The unprecedented demand, largely fueled by artificial intelligence, has transformed data centers into a highly attractive asset class, driving massive capital inflows into technology, real estate, and energy sectors. Moving forward, the market will be characterized by sustained high investment, intense competition for resources like power and land, and a relentless pursuit of efficiency and sustainability. Investors should closely monitor companies involved in semiconductor manufacturing ( NVIDIA Corporation NASDAQ: NVDA )), cloud computing ( Amazon.com Inc. NASDAQ: AMZN Microsoft Corp. NASDAQ: MSFT Alphabet Inc. NASDAQ: GOOGL )), data center REITs ( Equinix Inc. NASDAQ: EQIX Digital Realty Trust Inc. NYSE: DLR )), and the energy sector's response to this escalating demand. The ability of companies to innovate in power solutions, optimize energy consumption, and navigate evolving regulatory frameworks will be critical determinants of their long-term success. The lasting impact of this trend will be a more digitally integrated and resilient global economy, but also one where the availability of robust, sustainable digital infrastructure is a key differentiator for national and regional competitiveness. What investors should watch for in the coming months are further announcements of hyperscale data center projects, innovations in sustainable power and cooling, and any shifts in regulatory policy that could impact development. The data center boom is not just a passing trend; it is a foundational shift that will continue to redefine economic landscapes for decades to come. This content is intended for informational purposes only and is not financial advice

Amazon Web Services Frequently Asked Questions (FAQ)

When was Amazon Web Services founded?

Amazon Web Services was founded in 2006.

Where is Amazon Web Services's headquarters?

Amazon Web Services's headquarters is located at 410 Terry Avenue North, Seattle.

What is Amazon Web Services's latest funding round?

Amazon Web Services's latest funding round is Other Investors.

Who are the investors of Amazon Web Services?

Investors of Amazon Web Services include IM Ventures, a16z Bio Health, Ignite Start-Up Chile, Sustainable Fintech, Cloud Native Computing Foundation Incubator and 30 more.

Who are Amazon Web Services's competitors?

Competitors of Amazon Web Services include Wasabi, SAS, Linode, Netlify, Backblaze and 7 more.

Loading...

Compare Amazon Web Services to Competitors

Google Cloud operates as a cloud computing service provider offering various solutions, including artificial intelligence (AI) and machine learning, data analytics, and managed databases. The company provides a platform for businesses to leverage AI and machine learning, manage data with analytics, and modernize infrastructure. Google Cloud's services cater to different industries, offering tools for application programming interface (API) management and serverless computing. Google Cloud was formerly known as Google Cloud Platform. It was founded in 2008 and is based in Mountain View, California.

Microsoft Azure operates as a cloud computing platform that provides various services for building, testing, deploying, and managing applications and services through Microsoft-managed data centers. It includes solutions like virtual machine hosting, data storage, software development tools, and services for big data analytics, artificial intelligence, and Internet of Things integration. Microsoft Azure serves sectors that need computing resources and application development tools. It was founded in 2010 and is based in Redmond, Washington.

Alibaba Cloud operates as a provider of cloud computing and data management services in the technology sector. The company offers cloud solutions aimed at supporting the networking and information needs of businesses, financial institutions, and government entities. Alibaba Cloud serves sectors that require cloud infrastructure to support online and mobile commerce. It was founded in 2009 and is based in Hangzhou, China.

Vercel provides tools and services for web development and cloud infrastructure. Its offerings include a platform for building and deploying web applications, utilizing frameworks like Next.js, and tools like Turborepo and an AI SDK for TypeScript. Vercel serves the web development and digital experience sectors, providing solutions for AI applications, e-commerce, marketing, and multi-tenant platforms. Vercel was formerly known as ZEIT. It was founded in 2015 and is based in Covina, California.

SUSE provides enterprise open source solutions within the technology sector. The company offers a range of products, including enterprise Linux servers, cloud-native management tools, edge computing platforms, and artificial intelligence (AI) suites. SUSE serves sectors such as automotive, telecom, banking and financial systems, healthcare, manufacturing, retail, technology and software, federal, pharma, and energy industries. It was founded in 1992 and is based in Foire, Luxembourg.

Oracle Cloud offers infrastructure and platform services, including cloud infrastructure services, platform as a service, and infrastructure as a service, to support various workloads and applications. It provides services for managing databases, integrating AI and machine learning, and conducting big data analytics. It was founded in 1977 and is based in Austin, Texas.

Loading...