Investments

118Portfolio Exits

14Funds

3Partners & Customers

1About American Family Ventures

American Family Ventures (AFV) operates as a corporate venture capital arm of American Family Insurance. The firm invests in seed or start-up companies through growth-stage companies. It helps to create category-leading companies that can impact their business and the insurance industry. The company was founded in 2010 and is based in New York, New York.

Expert Collections containing American Family Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find American Family Ventures in 2 Expert Collections, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Research containing American Family Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned American Family Ventures in 3 CB Insights research briefs, most recently on Nov 6, 2025.

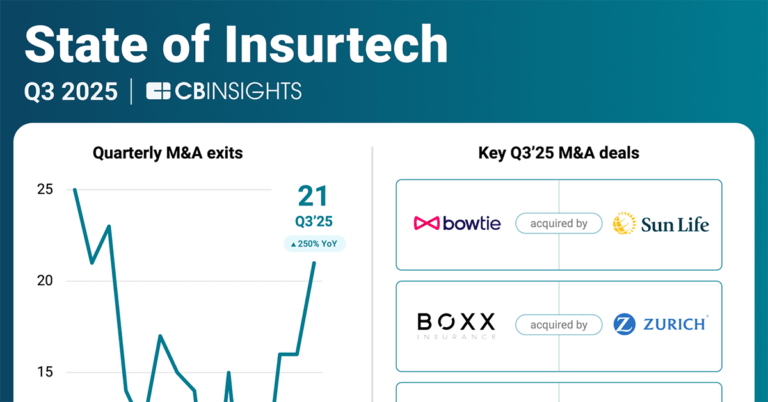

Nov 6, 2025 report

State of Insurtech Q3’25 Report

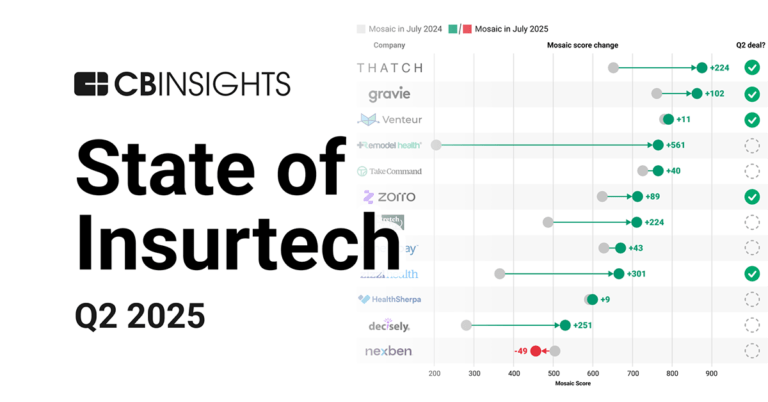

Aug 7, 2025 report

State of Insurtech Q2’25 Report

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024Latest American Family Ventures News

Sep 19, 2025

NASHVILLE, Tenn.–( BUSINESS WIRE )– Elysian , the AI-native third-party administrator (TPA) for commercial insurance, today announced the closing of a $6 million seed round led by Portage, with participation from American Family Ventures and TenOneTen Ventures. The funding will accelerate Elysian's go-to-market efforts, support customer onboarding, and scale the company's delivery operations and technology platform. Built to address the complexity of commercial claims, Elysian was founded by Grace Hanson, former lawyer and seasoned executive who previously served as Chief Claims Officer at Allied World, Homesite Insurance, Hiscox, and Hippo Insurance. Grace brings a rare combination of legal expertise and senior claims leadership to Elysian, shaping a product strategy focused on aligning modern tools with the realities of high-stakes claims environments. “We built Elysian by rethinking claims handling from the ground up – designing a hybrid intelligence system where AI manages the ‘messy middle' and adjusters can focus on the human parts,” said Grace Hanson, Founder and CEO of Elysian. “Our approach is shaped by firsthand industry insight and designed to raise the standard for modern claims services.” The company delivers two core offerings, end-to-end claims handling and Dynamic Claim Review (DCR), supported by proprietary AI technology built to work alongside adjusters, not around them. For active claims, Elysian's system surfaces coverage and liability insights and drafts tailored communications, allowing adjusters to focus on the decisions that matter. DCR brings expert-led analysis to entire claims portfolios, delivering faster, deeper reviews than traditional audits. “Elysian is bringing purpose-built innovation to the core of commercial claims operations. Their platform provides adjusters with the tools to deliver better outcomes, and we're excited to support the team in their next phase of growth,” said Ricky Lai, General Partner at Portage. “Digital TPAs have long been the goal, but delivering this product wasn't possible before modern AI,” said Minnie Ingersoll, Partner at TenOneTen. “Elysian stood out to us by tackling complexity from the outset and building systems that reflect how adjusters work.” “We strongly believe the full category of claims administration will be transformed by modern software, predictive modeling, and generative AI. We are excited to support Elysian as they modernize one of the most challenging and highest value segments of commercial claims.” said Kyle Beatty, Managing Director at American Family Ventures. Elysian's platform is purpose-built to support the types of nuanced, context-rich claims that traditional TPAs and tech-enabled vendors typically sidestep. The company's long-term vision is to deliver better outcomes for carriers and claims professionals by redesigning claims services with modern tools and experienced leadership at its core. About Elysian Elysian is the first AI-native TPA built for superior outcomes in commercial insurance. Elysian combines AI-orchestrated claims processing with elite adjusting talent to handle the most complex commercial claims with unprecedented efficiency and insight. We use multimodal AI-agent orchestration, purpose-built machine learning, statistical optimization and autonomous decisions systems to deliver precise insights to empower adjusters to make the right decisions. For more information, visit www.elysian.is About Portage Portage is a global investment platform focused on fintech and financial services with over US$4B under management, 65+ portfolio companies in 13 countries, and 20+ investment professionals across 4 countries. Our team partners with ambitious companies across all stages, through Portage Ventures and Portage Capital Solutions. We provide flexible capital and deliver a global network of investors, commercial partners, advisors, and value creation experts. Our dedicated value creation team provides portfolio companies with hands-on support in go-to-market, tech & cyber, business acceleration and M&A, and partnerships to accelerate their paths to success. With deep industry knowledge and entrepreneurial experience, Portage is committed to supporting the leaders who are reshaping financial services. Our Partnerships team focuses on long-term commercial collaboration opportunities and has generated 120+ partnerships between corporate financial institutions and portfolio companies. Portage operates in the United States, Canada and Europe. Portage is a platform within Sagard, a global multi-strategy alternative asset management firm with over US$32B under management. For more information, visit www.portageinvest.com About American Family Ventures American Family Ventures is a venture capital firm focused on insurance innovation. Founded in 2013, AFV invests in early-stage startups that are redefining the future of the insurance industry. AFV aims to help create category-leading companies through minority equity positions, active partnership and collaboration, an extensive Insurtech network, and a comprehensive platform of value-add programs. To learn more, visit https://www.amfamventures.com About TenOneTen Ventures TenOneTen is a seed-stage fund built by and for technical founders. Our partners have built and sold companies for $1B+ exits and partner Gil Elbaz created Common Crawl, the foundational dataset that powers today's leading AI models. We have 40+ years combined experience investing in applications of computer vision, NLP, machine learning, and other technologies that solve critical problems in essential industries like logistics, manufacturing, healthcare, and real estate. To learn more, visit https://www.tenoneten.com Contacts Portage Media Contact Bristol Jones bristol.jones@avenuez.com Elysian Media Contact Kim Morton kmorton@first-division.com (c)2025 Business Wire, Inc., All rights reserved.

American Family Ventures Investments

118 Investments

American Family Ventures has made 118 investments. Their latest investment was in Clearcover as part of their Series E - V on October 31, 2025.

American Family Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

10/31/2025 | Series E - V | Clearcover | $25M | No | 1 | |

10/23/2025 | Series A | Bluefields Specialty | $15M | Yes | Crosslink Capital, Equal Ventures, Greenlight Re Innovations, and Undisclosed Investors | 3 |

9/9/2025 | Seed VC | Pathwork | $3.5M | Yes | Costanoa Ventures, Logos Fund, Meridian Ventures, and Undisclosed Angel Investors | 4 |

8/28/2025 | Series A | |||||

7/18/2025 | Seed VC |

Date | 10/31/2025 | 10/23/2025 | 9/9/2025 | 8/28/2025 | 7/18/2025 |

|---|---|---|---|---|---|

Round | Series E - V | Series A | Seed VC | Series A | Seed VC |

Company | Clearcover | Bluefields Specialty | Pathwork | ||

Amount | $25M | $15M | $3.5M | ||

New? | No | Yes | Yes | ||

Co-Investors | Crosslink Capital, Equal Ventures, Greenlight Re Innovations, and Undisclosed Investors | Costanoa Ventures, Logos Fund, Meridian Ventures, and Undisclosed Angel Investors | |||

Sources | 1 | 3 | 4 |

American Family Ventures Portfolio Exits

14 Portfolio Exits

American Family Ventures has 14 portfolio exits. Their latest portfolio exit was Limit on September 24, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/24/2025 | Acquired | The McGowan Companies | 4 | ||

2/6/2025 | Acquired | 2 | |||

12/1/2024 | Acquired | 1 | |||

Date | 9/24/2025 | 2/6/2025 | 12/1/2024 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | The McGowan Companies | ||||

Sources | 4 | 2 | 1 |

American Family Ventures Fund History

3 Fund Histories

American Family Ventures has 3 funds, including AFV Fund III.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

8/18/2020 | AFV Fund III | $213M | 4 | ||

8/2/2019 | Venture Investors Health Fund 6 Limited Partnership | ||||

AFV Fund IV |

Closing Date | 8/18/2020 | 8/2/2019 | |

|---|---|---|---|

Fund | AFV Fund III | Venture Investors Health Fund 6 Limited Partnership | AFV Fund IV |

Fund Type | |||

Status | |||

Amount | $213M | ||

Sources | 4 |

American Family Ventures Partners & Customers

1 Partners and customers

American Family Ventures has 1 strategic partners and customers. American Family Ventures recently partnered with Plug and Play on .

American Family Ventures Team

5 Team Members

American Family Ventures has 5 team members, including current Founder, President, Managing Director, Daniel K. Reed.

Name | Work History | Title | Status |

|---|---|---|---|

Daniel K. Reed | Founder, President, Managing Director | Current | |

Name | Daniel K. Reed | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder, President, Managing Director | ||||

Status | Current |

Compare American Family Ventures to Competitors

Liberty Mutual Strategic Ventures operates as the venture capital arm of Liberty Mutual Insurance, focusing on investments within the insurance technology sector. The company invests in early-stage software, platform, and services companies that aim to reshape the (re)insurance landscape, serving policyholders, agents, brokers, and employees. It was founded in 2016 and is based in Boston, Massachusetts.

Munich Re Ventures operates as the venture capital arm of Munich Re, focused on investments within the insurance industry. The company provides funding and support to companies in sectors such as insurtech, healthtech, cybersecurity & privacy, resilient future, and built world. Munich Re Ventures serves the insurance industry by investing in technologies and business models that address risks and improve risk management. Munich Re Ventures was formerly known as Munich Re/HSB Ventures. It was founded in 2014 and is based in San Francisco, California.

KPMG High Growth Ventures provides business services to startups in various sectors. The company offers outsourced finance and accounting, business design and tax structuring, and guidance on grants and government incentives. KPMG High Growth Ventures serves startups seeking growth solutions. It is based in Sydney, New South Wales.

Insurtech Gateway operates as an insurtech incubator and investor in the insurance technology sector. The company provides early-stage tech founders with underwriting capacity, regulatory compliance, seed capital, and guidance to develop their ideas. Insurtech Gateway serves the insurance industry by facilitating partnerships and investments in insurtech startups. InsurTech Gateway was formerly known as HP Insurtech Gateway. It was founded in 2016 and is based in Sydney, Australia.

FinTLV is a venture capital firm that focuses on insurtech and fintech sectors. The company invests in startups and provides support by utilizing its knowledge of the insurance industry and connections with insurance and reinsurance partners. FinTLV serves the insurtech and fintech industries by offering guidance, facilitating introductions to clients, and aiding in proof of concept projects. It was founded in 2016 and is based in Tel Aviv, Israel.

Bolttech is an international insurtech company that provides services in the areas of protection and insurance. The company connects insurers, distributors, and customers to facilitate the buying and selling of insurance and protection products. Bolttech serves the insurance industry and aims to improve the processes involved in insurance transactions. Bolttech was formerly known as AmTrust Mobile Solutions Singapore. It was founded in 2020 and is based in Singapore.

Loading...