Anchorage Digital

Founded Year

2017Stage

Series D | AliveTotal Raised

$487MValuation

$0000Last Raised

$350M | 4 yrs agoRevenue

$0000About Anchorage Digital

Anchorage Digital offers a cryptocurrency platform that provides financial services and infrastructure solutions for institutions. It offers services including custody, staking, trading, and governance for digital assets. Anchorage Digital serves sectors such as wealth management, venture capital firms, governments, exchange-traded fund (ETF) issuers, and asset managers. It was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Anchorage Digital

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The stablecoin settlement & payouts market refers to the use of stablecoins, which are cryptocurrencies designed to maintain a stable value, for settling transactions and making payouts. This market offers a fast and cost-effective way to move money across borders and provides access to financial services in emerging markets. Technology vendors in this market offer solutions for digital asset cust…

Anchorage Digital named as Challenger among 13 other companies, including Circle, Coinbase, and Ripple.

Anchorage Digital's Products & Differentiators

Custody

Safekeeping of over 60 digital assets

Loading...

Research containing Anchorage Digital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

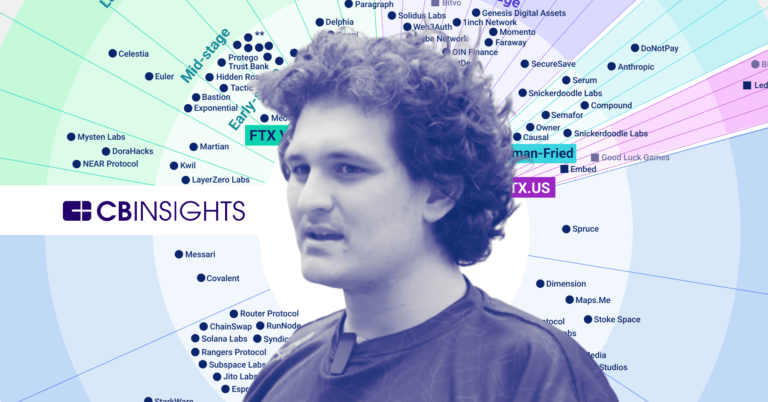

CB Insights Intelligence Analysts have mentioned Anchorage Digital in 2 CB Insights research briefs, most recently on Feb 23, 2023.

Expert Collections containing Anchorage Digital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Anchorage Digital is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Blockchain

9,912 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Capital Markets Tech

1,184 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Anchorage Digital News

Nov 10, 2025

investors — will use Modern Treasury's infrastructure to power its money movement and ledgering. With Modern Treasury, Anchorage Digital can automate money movement via multiple financial providers through a single platform, iterate on its financial infrastructure quickly, and automate payment flows across wires, ACH, and real-time rails. Anchorage Digital provides institutional-grade trading, staking, governance, custody, stablecoin issuance, and settlement for digital assets. With Modern Treasury, Anchorage Digital can automate money movement via multiple financial providers through a single platform, iterate on its financial infrastructure quickly, and automate payment flows across wires, ACH, and real-time rails. “Bridging traditional and digital finance isn't just about compatibility—it's about velocity,” notes Nathan McCauley, Co-Founder and CEO of Anchorage Digital. “With Modern Treasury, we're wiring the banking system directly into the digital asset economy so that institutions can move at crypto speed with bank-grade trust.” Anchorage Digital is leveraging Modern Treasury's Payments for money movement and Ledgers for tracking client balances and transactions. By using Modern Treasury, Anchorage Digital achieves faster interbank payments and automated settlements for fulfilling client redemptions. The platform also provides Anchorage Digital with real-time visibility into liquidity and centralized reconciliation. “Anchorage Digital represents the future of how companies connect their fiat and digital payment strategy for speed and growth,” said Matt Marcus, Co-Founder and CEO of Modern Treasury. “Our platform gives them the flexibility to move money across a variety of banks and payment rails, and expand as they grow, without rebuilding integrations every time." About Modern Treasury Modern Treasury provides trusted infrastructure for money movement. The company helps teams launch and scale payment experiences in days, not months. With best-in-class developer tools and a single API for fiat and stablecoins—plus built-in compliance, ledgering, and reporting—Modern Treasury enables businesses to move money instantly, reliably, and at scale. Backed by leading investors including Benchmark, Altimeter, and Salesforce Ventures, Modern Treasury powers hundreds of companies across industries, helping them build faster payment experiences with real-time visibility into every transaction. Learn more at: https://www.moderntreasury.com/ About Anchorage Digital Anchorage Digital is a global crypto platform that enables institutions to participate in digital assets through trading, staking, custody, governance, settlement, stablecoin issuance, and the industry's leading security infrastructure. Home to Anchorage Digital Bank N.A., the only federally chartered crypto bank in the U.S., Anchorage Digital also serves institutions through Anchorage Digital Singapore, which is licensed by the Monetary Authority of Singapore; Anchorage Digital NY, which holds a BitLicense from the New York Department of Financial Services; and self-custody wallet Porto by Anchorage Digital. The company is funded by leading institutions including Andreessen Horowitz, GIC, Goldman Sachs, KKR, and Visa, with its Series D valuation over $3 billion. Founded in 2017 in San Francisco, California, Anchorage Digital has offices in New York, New York; Porto, Portugal; Singapore; and Sioux Falls, South Dakota. Learn more at anchorage.com , on X @Anchorage , and on LinkedIn

Anchorage Digital Frequently Asked Questions (FAQ)

When was Anchorage Digital founded?

Anchorage Digital was founded in 2017.

Where is Anchorage Digital's headquarters?

Anchorage Digital's headquarters is located at One Embarcadero Street, San Francisco.

What is Anchorage Digital's latest funding round?

Anchorage Digital's latest funding round is Series D.

How much did Anchorage Digital raise?

Anchorage Digital raised a total of $487M.

Who are the investors of Anchorage Digital?

Investors of Anchorage Digital include Andreessen Horowitz, Blockchain Capital, GIC, Elad Gil, Delta Growth Fund and 29 more.

Who are Anchorage Digital's competitors?

Competitors of Anchorage Digital include Digital Securities, Hex Trust, BitGo, Signature Bank, Fireblocks and 7 more.

What products does Anchorage Digital offer?

Anchorage Digital's products include Custody and 2 more.

Who are Anchorage Digital's customers?

Customers of Anchorage Digital include Visa.

Loading...

Compare Anchorage Digital to Competitors

BitGo is a digital asset infrastructure company that provides wallet services, custody, and financial services including wealth management and trading for digital assets. BitGo serves institutional investors, trading firms, investment advisors, exchanges, and developers. It was founded in 2013 and is based in Palo Alto, California.

Fireblocks provides infrastructure for digital asset operations in the financial technology sector. It offers services including custody and management of cryptocurrency operations, wallet solutions, token creation and distribution, and facilitation of blockchain payments. It serves trading firms, financial technologies, financial institutions, and web3 companies. It was founded in 2018 and is based in New York, New York.

Copper operates in digital asset infrastructure, focusing on custody, prime services, and collateral management within the financial technology sector. The company provides digital asset custody, off-exchange settlement solutions, and agency lending services, utilizing Multi-Party Computation technology to facilitate crypto transactions. Copper serves institutional investors, including hedge funds, trading firms, foundations, exchanges, exchange-traded product (ETP) providers, venture capital funds, and miners. It was founded in 2018 and is based in Zug, Switzerland.

Ledger involved in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Ledger's products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. It was founded in 2014 and is based in Paris, France.

Hex Trust offers services including custody, staking, and market services for digital assets. Hex Trust serves protocols, foundations, financial institutions, and the Web3 and Metaverse sectors. It was founded in 2018 and is based in Hong Kong.

Cactus Custody is a financial services provider. It provides services such as mining companies, mining pools, cloud mining platforms, exchanges, funds, and OTC dealers. It also offers digitally enabled, transparent, and efficient institutional custodial services. It was founded in 2019 and is based in Hong Kong.

Loading...