Atomwise

Founded Year

2012Stage

Series C | AliveTotal Raised

$220.7MLast Raised

$44.28M | 8 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+186 points in the past 30 days

About Atomwise

Atomwise develops machine learning-based discovery engines and uses artificial intelligence (AI)-based neural networks to help discover new medicines. It predicts drug candidates for pharmaceutical companies, start-ups, and research institutions, and designs drugs using computational drug design. It was formerly known as Chematria. The company was founded in 2012 and is based in San Francisco, California.

Loading...

ESPs containing Atomwise

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

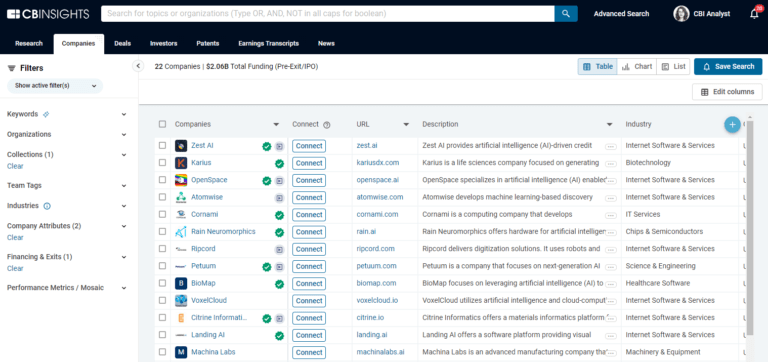

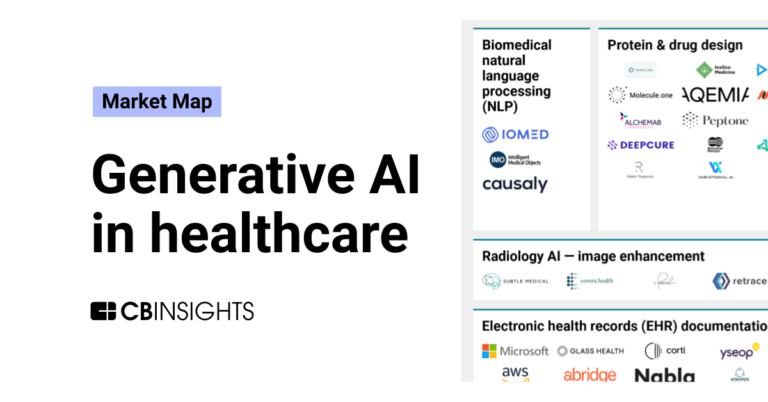

The AI-derived small molecule drugs market leverages AI and machine learning to discover and develop novel small molecule therapeutics. Companies in this market combine physics-based AI algorithms, deep learning models, and generative AI with experimental validation to enable target identification, virtual screening, and lead optimization. Proprietary platforms integrate computational approaches w…

Atomwise named as Highflier among 15 other companies, including Recursion Pharmaceuticals, Insilico Medicine, and Schrodinger.

Loading...

Research containing Atomwise

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Atomwise in 5 CB Insights research briefs, most recently on Jun 27, 2024.

Expert Collections containing Atomwise

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Atomwise is included in 6 Expert Collections, including AI 100 (All Winners 2018-2025).

AI 100 (All Winners 2018-2025)

200 items

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

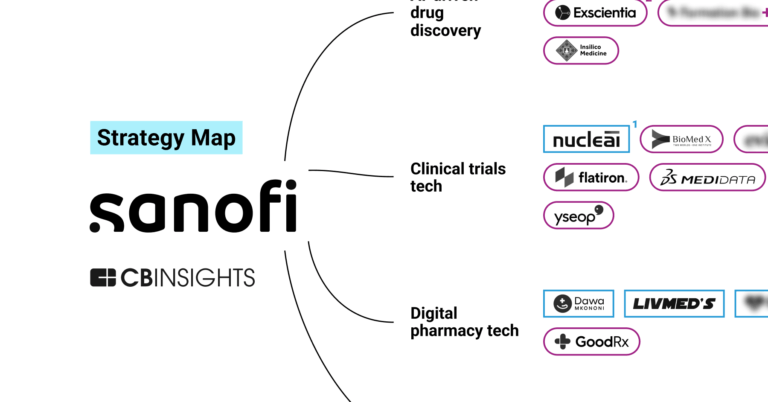

Drug Discovery Tech Market Map

221 items

This CB Insights Tech Market Map highlights 220 drug discovery companies that are addressing 12 distinct technology priorities that pharmaceutical companies face.

Artificial Intelligence (AI)

20,894 items

AI in drug discovery

528 items

Companies using AI to advance therapeutic discovery, categorized into: platforms (primary product is software) and discovery engines (primary product is therapeutics). Additional funnel descriptions reflect how companies are applying AI.

Atomwise Patents

Atomwise has filed 14 patents.

The 3 most popular patent topics include:

- animal virology

- arteriviridae

- artificial intelligence

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/17/2020 | 8/6/2024 | Classification algorithms, Machine learning, Statistical classification, Artificial neural networks, Artificial intelligence | Grant |

Application Date | 1/17/2020 |

|---|---|

Grant Date | 8/6/2024 |

Title | |

Related Topics | Classification algorithms, Machine learning, Statistical classification, Artificial neural networks, Artificial intelligence |

Status | Grant |

Latest Atomwise News

Nov 12, 2025

Artificial Intelligence (AI) in Drug Discovery Market Size, Growth and Forecast 2025-2029 Artificial Intelligence (AI) in Drug Discovery Market Overview: The global Artificial Intelligence (AI) in drug discovery market is projected to grow at a rate of 25-30% over the next five years. Key factors driving this growth include the increasing need to lower drug development costs and timelines, the rising adoption of AI technologies within the healthcare and life sciences sectors, the growing volume of data generated in life sciences, advancements in computing power, and the expanding collaborations between pharmaceutical companies and AI firms. Additionally, the approaching patent cliff, the potential of generative AI models in innovative drug design, and the rising demand for personalized medicine are all contributing to the market’s momentum. However, challenges such as high implementation costs, concerns over data privacy and security, the lack of quality and standardized data, and regulatory and ethical hurdles could pose barriers to continued growth Download Sample Copy: https://meditechinsights.com/artificial-intelligence-in-drug-discovery-market/request-sample/ Competitive Landscape Analysis The global AI in drug discovery market is highly competitive, with several key players making significant contributions to the industry. Some of the major companies in the market include: Atomwise Inc. Artificial Intelligence (AI) in Drug Discovery: Enhancing Efficiency and Reducing Costs AI in drug discovery refers to the use of advanced computational techniques to improve the speed, accuracy, and efficiency of identifying and developing new medications. By leveraging machine learning (ML) and deep learning (DL) technologies, AI can analyze large chemical spaces, predict molecular properties, optimize drug designs, and even repurpose existing drugs for new uses. This integration of AI significantly accelerates the drug development process, lowers costs, and improves the likelihood of successfully bringing new therapies to market. The Growing Demand to Cut Drug Development Costs and Time The increasing need to reduce the cost and time associated with drug development is a primary driver behind the growing adoption of AI in the pharmaceutical industry. Traditional drug discovery is notoriously slow and expensive. It can cost upwards of $2.5 billion to develop a new drug, factoring in the high failure rate. Scientific and technical challenges contribute to a low probability of success, with only about 35% of drug candidates making it past early-stage development and into clinical trials. Even more concerning is that only 9-14% of drugs make it from Phase 1 trials to regulatory approval. The entire process typically takes 12 to 15 years. AI is addressing these challenges by streamlining the drug development process. For example, AI algorithms can analyze massive datasets, predict which compounds might make effective drugs, and optimize the chemical properties of potential candidates. This significantly shortens the time spent on early-stage research, lowering research costs. AI-powered virtual screening is also reducing lead times in drug discovery. As a result, pharmaceutical companies are increasingly relying on AI to drive efficiency, cut costs, and speed up development timelines in a highly competitive market. "The attrition rate during clinical trials is approximately 90%, meaning that only a small fraction of drugs that enter clinical development ultimately receive approval. This high failure rate contributes significantly to the overall costs of drug development." – Associate Director, Leading AI in Drug Discovery Company, United States Download Sample Copy: https://meditechinsights.com/artificial-intelligence-in-drug-discovery-market/request-sample/ Advancements in Computing Power Driving Market Expansion Significant advancements in computing power are fueling the growth of AI in drug discovery. The rise of high-performance computing (HPC), along with powerful graphics processing units (GPUs) and tensor processing units (TPUs), has made it possible for AI algorithms to process enormous datasets, conduct complex simulations, and model biological systems with greater efficiency. These capabilities allow researchers to simulate drug interactions, predict molecular behavior, and identify promising drug candidates faster than traditional methods. As a result, the overall timeline and cost of drug development are being reduced. Machine learning models, supported by advanced computing technologies, can analyze vast genomic, proteomic, and chemical datasets, uncovering novel insights that might be missed by conventional approaches. Additionally, the integration of quantum computing is poised to further revolutionize the field by enabling more accurate simulations of molecular interactions. These innovations are also helping drive the development of personalized medicine, where AI can help tailor treatments to a patient’s unique genetic profile. As computing power continues to improve, AI systems will become even more effective, attracting further investment and accelerating innovation in drug discovery. This ongoing progress is expected to drive market growth and lead to more effective, affordable therapeutics. Growing Trend of Collaborations Between Pharma and AI Companies The AI-driven drug discovery market is experiencing rapid expansion, largely due to the increasing number of collaborations between pharmaceutical companies and AI-focused firms. Traditional drug development is notoriously expensive and time-consuming, prompting pharmaceutical companies to seek more efficient and cost-effective solutions. AI companies bring advanced algorithms, machine learning models, and data analytics tools to the table, enabling the optimization of various stages of drug discovery—from target identification to clinical trials. By partnering with AI firms, pharmaceutical companies can leverage expertise in handling massive datasets, including genomic, proteomic, and clinical data, to make more accurate predictions about a drug's effectiveness, toxicity, and potential side effects. For AI companies, these partnerships provide access to valuable pharmaceutical data, research funding, and real-world opportunities to apply their technologies. Together, these collaborations have resulted in successful outcomes, such as the discovery of new drug candidates, drug repurposing efforts, and optimized clinical trial designs. As a result, strategic partnerships, joint ventures, and licensing agreements between pharma and AI companies are becoming increasingly common, further fueling market growth. This trend is expected to continue as both industries recognize the mutual benefits, driving innovation and accelerating the drug discovery process. The ultimate result will be faster, more effective therapeutics reaching the market. North America: A Key Driver of AI in Drug Discovery Market Growth North America is expected to be a major growth engine for the AI in drug discovery market, driven by several key factors. The region is home to a strong pharmaceutical industry, with leading companies heavily investing in AI to streamline drug development and reduce costs. In addition to a highly developed healthcare infrastructure, North America boasts an abundance of research institutions and significant funding from both government and private sectors, which collectively facilitate the adoption of AI technologies in drug discovery. The region is also a hotbed for AI and biotechnology startups, many of which are collaborating with pharmaceutical giants to create AI-driven solutions. Supportive regulatory frameworks, such as the US FDA's initiatives for AI in healthcare, foster an environment conducive to innovation and faster drug development. The large volume of healthcare data generated in North America, combined with advancements in data analytics and computing power, makes the region an ideal location for AI applications in drug discovery. With these combined factors, North America is expected to drive market growth, attracting investments and pioneering new AI-powered drug discovery techniques. Growth in APAC Driven by Expanding Pharmaceutical Industry and Government Support The Asia-Pacific (APAC) region is also seeing significant growth in AI in drug discovery, fueled by an expanding pharmaceutical industry, increased investments in healthcare infrastructure, and a growing emphasis on precision medicine. Government initiatives promoting AI research and development, coupled with the rising prevalence of chronic diseases, are contributing to greater demand for innovative drug discovery methods. These factors position APAC as a key player in the global market, with the potential for AI-driven solutions to revolutionize the drug discovery landscape. Offering Type Segment Analysis The AI in drug discovery market is divided into two main offering types: Software and Services. The software segment holds the largest market share, driven by the increasing adoption of AI-powered software platforms for tasks such as data analysis, drug design, target identification, and predictive modeling. These AI software solutions enhance the drug discovery process by improving accuracy, accelerating timelines, and reducing costs. On the other hand, the services segment is the fastest-growing area of the market. This growth is primarily fueled by the rising demand for AI-related services, including consulting, integration, and ongoing support. As pharmaceutical companies and research institutions seek customized AI solutions, they require specialized services to implement, manage, and optimize these technologies effectively. Additionally, the complexity of deploying AI software and the need for continual maintenance contribute to the rapid expansion of the services segment. Application Type Segment Analysis The AI in drug discovery market is also categorized by application types, including Oncology, Infectious Diseases, Neurology, Metabolic Diseases, Cardiovascular Diseases, Immunology, and others. Oncology is the largest and most prominent segment. The high prevalence of cancer and the complexity of developing effective treatments drive the widespread adoption of AI in cancer drug discovery. AI helps in identifying novel drug candidates, understanding disease mechanisms, and improving precision medicine approaches. The large volumes of data generated in cancer research also necessitate AI tools to manage and analyze information efficiently. The infectious diseases segment is expected to experience significant growth in the coming years. The global focus on combating infectious diseases, especially following the COVID-19 pandemic, has led to an increased demand for AI-driven solutions. AI's ability to rapidly identify drug targets, predict disease spread, and support vaccine development has made it invaluable in this field. Moreover, the need for fast and cost-effective drug discovery for emerging pathogens continues to drive the growth of the infectious diseases segment. Growth Strategies Adopted by Market Players Companies operating in the AI in drug discovery space are employing both organic and inorganic growth strategies to strengthen their market position. These strategies include collaborations, acquisitions, and new product launches. Some key examples of these strategies include: July 2024: Exscientia launched an AI-powered drug discovery platform in collaboration with Amazon Web Services (AWS). This platform integrates generative AI with robotic lab automation, aiming to accelerate drug development while reducing costs. The solution optimizes drug design, synthesis, and testing to deliver high-quality drug candidates more efficiently. May 2024: Google DeepMind launched AlphaFold 3, an AI model designed to enhance drug discovery by predicting the behavior of all molecules, including human DNA. The new version of AlphaFold aims to cut development time and costs, providing a free online server to assist researchers with complex biological testing. May 2024: Sanofi partnered with Formation Bio and OpenAI to leverage AI technologies for faster drug development. This collaboration combines Sanofi’s extensive data with OpenAI’s AI expertise to streamline the drug development lifecycle. February 2024: Almirall partnered with Microsoft to accelerate dermatology drug discovery using AI and advanced analytics. This three-year partnership focuses on leveraging generative AI and data management to develop innovative treatments and drive Almirall’s digital transformation. September 2023: Merck entered into a strategic collaboration with BenevolentAI and Exscientia to use AI-driven drug discovery in oncology, neurology, and immunology. These partnerships aim to accelerate the development of novel clinical candidates and improve Merck's R&D pipeline. As these examples demonstrate, AI companies and pharmaceutical firms are increasingly joining forces to push the boundaries of drug discovery. The combination of technological innovation, strategic partnerships, and investment in R&D is expected to drive the market’s continued expansion. Browse Full Report: https://meditechinsights.com/artificial-intelligence-in-drug-discovery-market/

Atomwise Frequently Asked Questions (FAQ)

When was Atomwise founded?

Atomwise was founded in 2012.

Where is Atomwise's headquarters?

Atomwise's headquarters is located at 717 Market Street, San Francisco.

What is Atomwise's latest funding round?

Atomwise's latest funding round is Series C.

How much did Atomwise raise?

Atomwise raised a total of $220.7M.

Who are the investors of Atomwise?

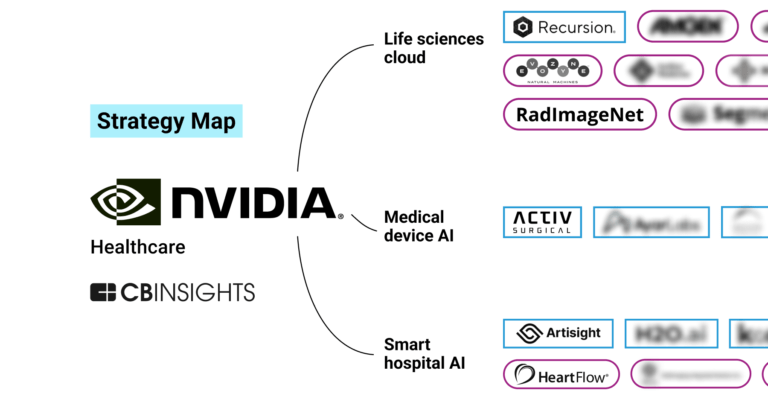

Investors of Atomwise include DCVC, B Capital, Bill & Melinda Gates Foundation, NVIDIA Inception Program, Y Combinator and 16 more.

Who are Atomwise's competitors?

Competitors of Atomwise include SyntheticGestalt, Healx, InSilicoTrials, Brightseed, Isomorphic Laboratories and 7 more.

Loading...

Compare Atomwise to Competitors

Insitro is a data-driven drug discovery and development company that utilizes machine learning and high-throughput biology. The company has a machine learning platform that combines in vitro cellular data with human clinical data to identify insights and interventions in metabolism, oncology, and neuroscience. Insitro's approach uses technology to model disease states and design therapeutic interventions. It was founded in 2018 and is based in South San Francisco, California.

Insilico Medicine focuses on artificial intelligence in drug discovery and development. The company provides artificial intelligence platforms for multi-omics target discovery, deep biology analysis, automated drug design, and predicting outcomes in clinical trials. The technologies are intended to assist in the process of discovering and developing new medications for various diseases. It was founded in 2014 and is based in New Territories, Hong Kong.

SOM Biotech operates as a clinical-stage drug discovery and development company that focuses on the treatment of rare Central Nervous System disorders. The company utilizes an artificial intelligence platform to discover and develop drugs, with emphasis on orphan diseases and repurposing existing drugs for new therapeutic indications. SOM Biotech's lead product has completed Phase 2b trials for Huntington's Disease. It was founded in 2009 and is based in Barcelona, Spain.

Aria Pharmaceuticals operates as a preclinical-stage pharmaceutical company that focuses on the discovery and development of novel, small-molecule therapies in the pharmaceutical industry. The company's main service is the development of new treatments for complex and hard-to-treat diseases using its proprietary symphony platform, which combines biomedical data and artificial intelligence to increase the success rates of drug discovery. Aria Pharmaceuticals primarily serves the healthcare sector, specifically targeting areas where new therapies are most needed. It was founded in 2014 and is based in Palo Alto, California.

Aitia operates as a biotechnology company. It utilizes causal artificial intelligence (AI), multi-omic patient data, and Gemini Digital Twins to study the biological mechanisms of diseases in the oncology and neurodegenerative disease sectors. The company aims to create computational representations of diseases to assist in the development of therapies. It was founded in 2000 and is based in Somerville, Massachusetts.

Healx focused on drug discovery in the healthcare sector. The company specializes in developing treatments for rare diseases by leveraging artificial intelligence and drug development expertise. Healx was formerly known as Healx3. It was founded in 2014 and is based in Cambridge, United Kingdom.

Loading...