Attentive

Founded Year

2016Stage

Secondary Market | AliveTotal Raised

$864.52MLast Raised

$1.43M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-110 points in the past 30 days

About Attentive

Attentive is a marketing platform that offers SMS and email marketing services. The company provides tools for customer engagement, including automated marketing journeys, segmentation, and campaign optimization. Attentive serves sectors such as retail, travel, food and beverage, entertainment, and fitness. It was founded in 2016 and is based in Hoboken, New Jersey.

Loading...

Attentive's Product Videos

ESPs containing Attentive

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The direct message marketing market enables businesses to send promotional and transactional messages directly to customers through SMS and messaging apps like WhatsApp. These platforms provide tools for mass texting, automated messaging campaigns, customer segmentation, and real-time analytics. Companies in this market specialize in text message marketing automation, compliance management, and mu…

Attentive named as Leader among 12 other companies, including Twilio, Bluecore, and Klaviyo.

Attentive's Products & Differentiators

SMS

Engage customers across the entire lifecycle with promotional, transactional, and conversational RCS, SMS, and MMS messages

Loading...

Research containing Attentive

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Attentive in 2 CB Insights research briefs, most recently on Nov 3, 2025.

Nov 3, 2025 report

Tech IPO Pipeline 2026: Book of Scouting Reports

Aug 14, 2023

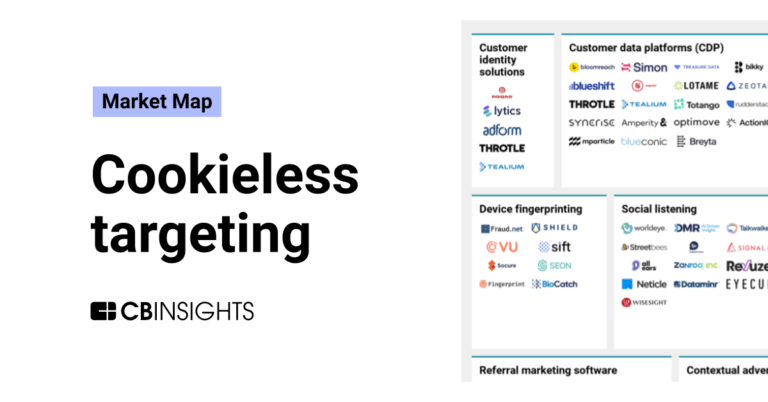

The cookieless targeting market mapExpert Collections containing Attentive

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Attentive is included in 8 Expert Collections, including E-Commerce.

E-Commerce

11,424 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,309 items

Conference Exhibitors

5,302 items

Future Unicorns 2019

50 items

Sales & Customer Service Tech

1,058 items

Companies offering technology-driven solutions for brands and retailers to enable customer service before, during, and after in-store and online shopping.

Targeted Marketing Tech

453 items

This Collection includes companies building technology that enables marketing teams to identify, reach, and engage with consumers seamlessly across channels.

Attentive Patents

Attentive has filed 12 patents.

The 3 most popular patent topics include:

- payment systems

- social networking services

- instant messaging clients

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/18/2024 | 3/11/2025 | Social networking services, Payment systems, Computer security exploits, Mobile operating systems, Instant messaging clients | Grant |

Application Date | 3/18/2024 |

|---|---|

Grant Date | 3/11/2025 |

Title | |

Related Topics | Social networking services, Payment systems, Computer security exploits, Mobile operating systems, Instant messaging clients |

Status | Grant |

Latest Attentive News

Oct 20, 2025

Agentic Commerce: The Inevitable, but Narrow, Future of AI Shopping October 20, 2025 at 8:51 AM EDT By Indy Guha and Dhruv Bansal, VMG Technology Shalf Design-stock.Adobe.com The future of shopping is supposed to look like this: you tell your AI agent — whether powered by ChatGPT or Perplexity — that you need batteries, a new desk chair and maybe a vacation. Minutes later, the items are purchased, the trip is booked, and all you had to do was…nothing. This vision — “agentic commerce” — is being described as the next great revolution in retail. But zoom out. Agentic commerce isn’t just about shopping bots. It’s part of a much larger shift: the front door of the commercial internet is moving. For 20 years, that front door was controlled by Google and Amazon — two trillion-dollar empires built on owning the top of the consumer funnel. Today, the door is creaking open to AI search engines, which want to intercept that intent before it ever reaches a traditional search bar or shopping cart. So AI isn’t just stealing attention — it’s redirecting intent. Answer engines are quickly becoming the first stop on shopping journeys, and the ripple effects are everywhere. TripAdvisor’s search traffic is down ~30% in two years as vacation planning shifts into AI conversations. AllRecipes has lost 15% of traffic as recipe discovery moves into answer engines. Home Depot and Wayfair now see 15%+ of referrals coming directly from language models. This is not a blip. It’s a structural rewiring of discovery and intent. That belief — the inevitability of AI agents controlling high-intent traffic — is why Alphabet, despite owning 90% of search marketing and 39% of digital advertising, trades at just ~7x revenue. Markets are already discounting Google’s grip on the funnel. Advertisement But here’s the harder question: while OpenAI and Perplexity may need this future to materialize, is agentic commerce really inevitable? Two forces suggest otherwise. 1. Follow the Money Why would any retailer or brand willingly become a shipping utility? Allowing AI agents to own the customer relationship would be the ultimate disintermediation. Brands with any market power or customer loyalty will fight tooth and nail to avoid it. We’re already seeing the skirmishes. Walmart and Amazon explicitly block third-party agents from transacting on their sites. For them, surrendering the customer relationship is a non-starter. Similarly, the recent agentic commerce announcement by ChatGPT supports discovery of niche brands and makers via distribution deals for Etsy and smaller Shopify sellers, for whom net new discovery outweighs the cost of not having a customer relationship. 2. Follow the Consumer High vs. Low Consideration (or $ value) Utility vs. Inspiration Low Consideration + Utility, e.g., reordering laundry detergent Low Consideration + Inspiration, e.g., discovering a beautiful set of cocktail glasses High Consideration + Utility, e.g., buying a new monitor High Consideration + Inspiration, e.g., investing in a watch, suit or luxury item. Mapping different types of purchases to a 2×2 matrix Relative to that map, truly autonomous agentic commerce will mostly live in the bottom left quadrant: low-dollar, utility-driven purchases (light teal zone above) like batteries and light bulbs. And arguably it will be consolidated by retailers who compete on category breadth and fulfillment advantage (Amazon, Walmart), not by AI search. What about high-consideration purchases? Consumers might lean on AI search to research options, but the actual transaction migrates to brand- or retailer-owned channels — often enhanced by immersive, experiential retail. And inspiration commerce? That remains firmly in the hands of brands and retailers that own direct emotional connections with customers, with Instagram/TikTok/YouTube being key channels for discovery. Over time, as AI agents truly learn individual taste and build user trust, the agentic frontier will clearly expand (adding the darker teal zone in the graphic). But the only real certainty, both today and for the foreseeable future, is that merchants will have to rethink the bridge (visibility, alignment, shop-ability) from agentic commerce to branded experience. So What’s the Real Future? Agentic commerce is inevitable — but only in a focused slice of consumer spending, a slice already dominated by Walmart, Amazon and other catalog retail giants. And those giants aren’t about to hand over their crown jewels to ChatGPT or Perplexity. Many savvy brands have already reduced exposure to commodity utility categories long before AI agents came knocking. The battleground for everyone else lies elsewhere. For brands in high-consideration or inspiration-driven worlds, the real challenge isn’t whether AI agents disintermediate you. It’s whether your product catalog and merchandising are optimized for the research phase inside answer engines and AI search. That’s where the next fight begins: Generative Engine Optimization (or GEO) and Generative Merchandising. Bridging from Agent to Branded Experience Breaks Manual Merchandising For merchandisers, the job has never been harder. Consumers are showing up from more fragmented paths — search, performance channels, answer engines, social media. They’re also arriving in more diverse shapes — teenagers to retirees, each with different expectations. The culture layer only accelerates this chaos. One summer it’s “Barbiecore” and “tomato girl.” The next, it’s something entirely new. Social virality and influencer-driven demand mean the language of shopping is evolving faster than traditional merchandising systems can keep up. Merchandising has always been the heartbeat of retail — deciding what a shopper sees, when and how. But legacy tools built for static catalogs and predictable profiles can’t handle today’s dynamic journeys. And they’re failing at the very moment customer acquisition has become more expensive than ever. (Merchant-Side) AI Changes the Game Here’s the good news: AI is making real-time merchandising brains possible and is on track to unlock first-party merchant data at a micro-segment level. Foundational models understand not just what customers say — but what they mean. They can parse nuance, context and intent in ways old rules-based systems never could. We’ve spoken with 50+ founders building in this space. What’s clear is that innovators are clustering around three big opportunity zones: GEO and Generative Merchandising, (or Off-Site to On-Site Conversion): Merchants are rapidly trialing AI search visibility tools (Evertune, Octogen, Newgen, Profound, etc.) to understand traffic sources at a query level and identify content gaps. Forward-thinking merchants also are adopting “closed loop” solutions like Fermat, which go beyond visibility and generate shoppable experiences in response to AI search traffic query data. On-Site Customer Discovery: Cimulate, Envive and Constructor are reinventing site search with transformer-powered interfaces that can answer contextual queries like “dress for a beach wedding in San Diego” or “recommend a good high-protein-low-sugar post-workout snack.” In other words, they are helping merchants meet the need as consumers get retrained by AI search to use long form, open ended queries. Post-Purchase Lifecycle Marketing: Auxia, Attentive and Offerfit are extending the merchandising brain into retention, re-engagement and upsell decisions, building holistic buying journeys across marketing channels. Together, these value centers form the scaffolding of the AI-native merchandising stack. And additional consolidation will occur as merchants see value in merging these three “lobes” of an AI merchandising brain. What Will Endure? With dozens of players racing in, what separates the flash-in-the-pan from the enduring platform? We see five factors: Multi-product expansion. The winners won’t stop at search or landing pages — they’ll expand across the entire customer journey. Wedge products. The first product must maximize visibility into journey and intent. Fermat and conversational commerce are good examples. GTM Flexibility. Success requires composable modules that can help the merchant navigate change, replacing incumbents in stages or starting with greenfield. AI + Domain Expertise. Knowing the workflows of merchandisers is as critical as building cutting-edge models that harness the right feedback loops (use case informs training data informs model building informs efficacy) Network Effects. Platforms with broader visibility across retailers will train stronger engines and compound their advantage. The Future of (AI) Merchandising Merchandising is moving from rules-based to AI-native. From static catalogs to dynamic intent maps. From seasonal planning to real-time optimization. And once a merchandising brain exists, it won’t stop at the storefront. It will ripple into supply chains, personalization engines and even how retailers structure their tech stacks. For founders, this is the moment. For retailers, this is the challenge. For both, the opportunity is enormous. Indy Guha is Co-head of VMG Technology , the tech investment arm of VMG Partners. He brings 15+ years of experience scaling and investing in high-growth commerce infrastructure companies. Previously, Guha served as Chief Business Officer at Signifyd, where he led global client facing teams and enterprise products. Before that, he was a Partner at Bain Capital Ventures, investing over $250M in breakout companies like BloomReach, Optimizely, Wrike and Signifyd. Dhruv Bansal is a VP at VMG Technology, where he invests in early-stage startups redefining commerce — from ecommerce infrastructure and marketing tech to supply chain and ops. Over the past five years, he’s helped lead several of VMG’s breakout investments across these categories, partnering closely with founders on strategy, growth, and scaling.

Attentive Frequently Asked Questions (FAQ)

When was Attentive founded?

Attentive was founded in 2016.

Where is Attentive's headquarters?

Attentive's headquarters is located at 221 River Street, Hoboken.

What is Attentive's latest funding round?

Attentive's latest funding round is Secondary Market.

How much did Attentive raise?

Attentive raised a total of $864.52M.

Who are the investors of Attentive?

Investors of Attentive include Karmel Capital, CrossWork, Bossa Invest, Disney Accelerator, Bain Capital Ventures and 25 more.

Who are Attentive's competitors?

Competitors of Attentive include OneText, Konnecto, Bluecore, Regal, Brevo and 7 more.

What products does Attentive offer?

Attentive's products include SMS and 4 more.

Loading...

Compare Attentive to Competitors

Bluecore provides retail marketing technology focused on customer identification and movement within the purchase funnel. It offers a platform for enterprise brands to automate personalized marketing campaigns across various channels, utilizing real-time data and predictive analytics. Bluecore's solutions are tailored for the retail sector, with the goal of improving customer retention and supporting growth for brands. Bluecore was formerly known as TriggerMail. It was founded in 2013 and is based in New York, New York.

Brevo provides customer relationship management and marketing services. The company offers tools for businesses to execute digital marketing campaigns, send transactional messages, and utilize marketing automation features. It primarily serves the marketing industry. Brevo was formerly known as SendinBlue. It was founded in 2012 and is based in Paris, France.

ActiveCampaign focuses on customer experience automation, operating within the marketing automation, email marketing, and Customer Relationship Management (CRM) sectors. The company offers services, including email marketing, marketing automation, e-commerce marketing, and CRM tools designed to help businesses engage meaningfully with their customers. ActiveCampaign primarily serves businesses of all sizes across various sectors, with a particular emphasis on the e-commerce industry. It was founded in 2003 and is based in Chicago, Illinois.

Rokt focuses on electronic commerce technology. The company offers solutions to increase revenue, acquire customers at scale, and form relationships with existing customers. Its solutions include optimizing and monetizing the checkout experience, providing payment providers during checkout, and offering premium post-purchase offers. The company operates in the e-commerce sector. It was founded in 2012 and is based in New York, New York.

Sendlane is a marketing platform that offers email and SMS marketing services. The company provides tools for marketing automation, customer review management, and digital forms. Sendlane's platform is aimed at businesses that want to manage their customer data and marketing efforts through centralized data hubs and multi-channel automation. It was founded in 2013 and is based in Carlsbad, California.

ForMotiv specializes in behavioral analytics within the insurance sector and provides insights into the intent and risk associated with digital applicants. The company offers solutions that analyze behavioral data in real-time to predict user intent and assess risk, which aids in improving conversion rates and reducing fraud. ForMotiv's services are primarily utilized by the insurance industry, enhancing digital experiences and decision-making processes for life, home, auto, and commercial insurance providers. It was founded in 2018 and is based in Philadelphia, Pennsylvania.

Loading...