Berkshire Grey

Founded Year

2013Stage

Take Private | AliveTotal Raised

$266MValuation

$0000Last Raised

$270M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-123 points in the past 30 days

About Berkshire Grey

Berkshire Grey develops artificial intelligence (AI) enabled enterprise robotics aimed at the fulfillment and logistics sectors. The company provides solutions that assist in tasks such as identifying, picking, sorting, packing, and moving goods within a warehouse. Berkshire Grey's technology targets warehouse operations, focusing on the needs of retailers, e-commerce, and logistics enterprises. It was founded in 2013 and is based in Bedford, Massachusetts.

Loading...

ESPs containing Berkshire Grey

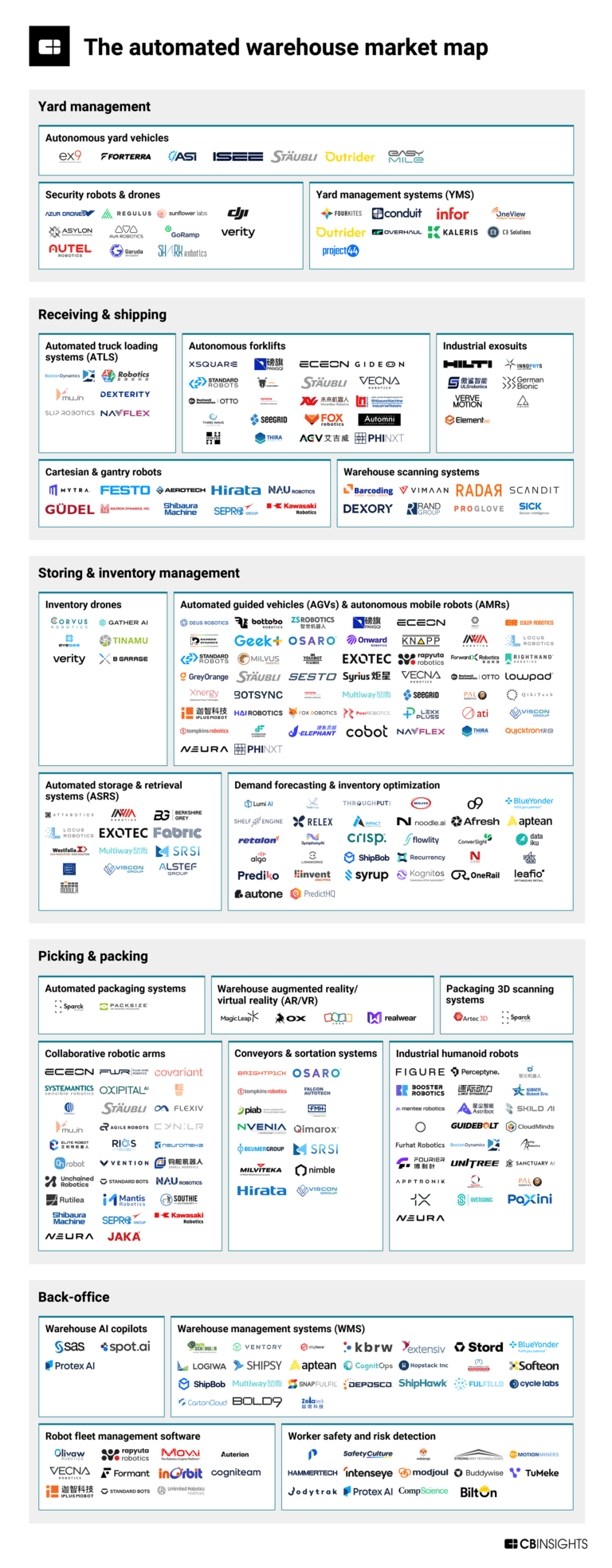

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The automated storage and retrieval systems (ASRS) market helps businesses optimize warehouse operations through computer-controlled systems that automatically store and retrieve goods. These systems use various technologies including robotic shuttles, stacker cranes, vertical lift modules, and autonomous mobile robots to maximize warehouse space utilization and increase fulfillment efficiency. AS…

Berkshire Grey named as Leader among 15 other companies, including Locus Robotics, AutoStore, and Murata Manufacturing.

Loading...

Research containing Berkshire Grey

Get data-driven expert analysis from the CB Insights Intelligence Unit.

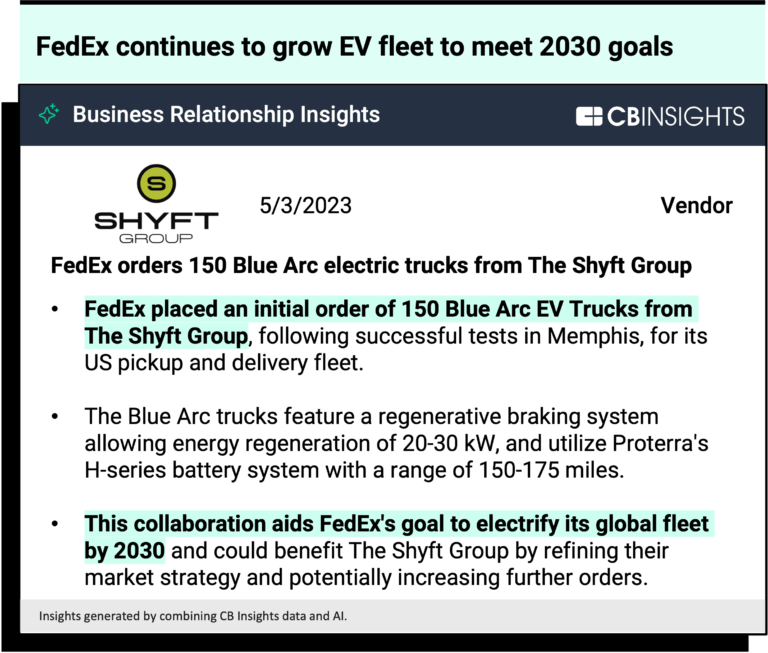

CB Insights Intelligence Analysts have mentioned Berkshire Grey in 4 CB Insights research briefs, most recently on Feb 13, 2025.

Feb 13, 2025

The automated warehouse market map

Sep 28, 2023

The automation in advanced manufacturing market mapExpert Collections containing Berkshire Grey

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Berkshire Grey is included in 5 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

5,420 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Robotics

2,753 items

This collection includes startups developing autonomous ground robots, unmanned aerial vehicles, robotic arms, and underwater drones, among other robotic systems. This collection also includes companies developing operating systems and vision modules for robots.

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Advanced Manufacturing

7,019 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Artificial Intelligence (AI)

20,894 items

Berkshire Grey Patents

Berkshire Grey has filed 290 patents.

The 3 most popular patent topics include:

- robot kinematics

- supply chain management

- barcodes

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/5/2021 | 4/8/2025 | Information retrieval systems, Logistics, Distribution (business), Supply chain management, Natural language processing | Grant |

Application Date | 3/5/2021 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Information retrieval systems, Logistics, Distribution (business), Supply chain management, Natural language processing |

Status | Grant |

Latest Berkshire Grey News

Oct 24, 2025

Get 20% Off All Global Market Reports With Code ONLINE20 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, October 24, 2025 / EINPresswire.com / -- How Large Will The Autonomous Farm-To-Store Delivery Display Market Be By 2025? The market size of autonomous delivery from farm-to-store has seen a sharp increase in the past years. It is projected to expand from $1.57 billion in 2024 to $1.90 billion in 2025, with a compound annual growth rate (CAGR) of 20.7%. The notable growth in the past can be traced back to factors such as an increase in the aging population, escalating urbanization, need for improved crop yields, surging demand for food and scarcity of trained laborers. The market for autonomous farm-to-store delivery display is projected to experience substantial growth in the coming years, expanding to a worth of $3.98 billion in 2029 with a compound annual growth rate (CAGR) of 20.4%. The predicted growth in the forecast duration can be linked to factors like larger farm areas, heightened demand for eco-friendly farming practices, precision agriculture adoption, e-grocery platforms expansion, and the prominence of environmental, social, and governance facets. Key upcoming trends during the forecasting period encompass advancements in robotics technology, assimilation of artificial intelligence (AI) and internet of things (IoT), amalgamation of blockchain and data analytics, the escalating trend of digitization, and burgeoning investments in smart farming technologies. Download a free sample of the autonomous farm-to-store delivery display market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=28535&type=smp What Are The Major Driving Forces Influencing The Autonomous Farm-To-Store Delivery Display Market Landscape? Organic products' demand surge is predicted to fuel the autonomous farm-to-store delivery display market's expansion. Organic products are those cultivated without the use of fabricated chemicals, fertilizers, or genetically modified organisms (GMOs). This surge in organic products' usage is primarily fueled by heightened consumer awareness about the health risks posed by synthetic chemicals. Autonomous farm-to-store delivery displays streamline the food supply chain by guaranteeing prompt and direct distribution of organic products. This method helps maintain product freshness and decreases logistical issues, which boosts overall consumer satisfaction. As an example, organic food sales hit $61.67 billion in 2022, marking a 4.3% rise from 2021, according to Argentina-based organic product certificate provider, LETIS S.A., in May 2024. Hence, the autonomous farm-to-store delivery display market growth is driven by the surge in organic products' demand. The market for autonomous farm-to-store delivery displays is also being driven by the proliferation of e-commerce platforms, fuelled by rising consumer demand for convenience and contactless shopping. E-commerce platforms are digital services or online applications that assist consumers in ordering groceries and other home essentials over the internet. The expansion of such platforms is primarily due to escalating consumer demand for contactless shopping and convenience, as it allows for easy access to fresh groceries without the need to visit physical stores. E-commerce platforms augment autonomous farm-to-store delivery displays by incorporating efficient logistical management and real-time order tracking, thereby making last-mile delivery quicker and more dependable. Moreover, they enhance operational efficiency by optimizing delivery routes and inventory handling, which elevates overall customer satisfaction. For instance, the United States Census Bureau noted a 5.3% (±1.2 percent) increase in e-commerce sales in 2025's second quarter, as compared to the same period in 2024. The rise was more than the general retail sales growth of 3.8% (±0.4 percent). Hence, the rising proliferation of e-commerce platforms propels the autonomous farm-to-store delivery display market's growth. Who Are The Top Players In The Autonomous Farm-To-Store Delivery Display Market? Major players in the Autonomous Farm-To-Store Delivery Display Global Market Report 2025 include: • Ocado Group plc • AutoStore ASA • Zipline International Inc. • Nuro Inc. • Gatik Inc. • Kodiak Robotics Inc. • Berkshire Grey Inc. • Einride AB • Starship Technologies Ltd. • Outrider Inc. What Are The Key Trends Shaping The Autonomous Farm-To-Store Delivery Display Industry? Major players in the autonomous farm-to-store delivery market are turning their attention towards creating highly developed technology products, such as automated vertical farming systems. These products optimize supply chain effectiveness, provide fresh produce, and diminish costs and environmental imprint. Automated vertical farming systems are advanced cultivations utilizing robotics, AI, and managed environments to grow produce vertically, making planting, supervision, and harvesting fully automated to improve efficiency and output. For example, AutoStore, a Norway-based company specializing in automated storage and retrieval systems, and OnePointOne, a US-focused automated vertical farming systems company, introduced Opollo Farm in May 2025. This vertical indoor farming platform, powered by robotics, handles crops in a meticulously controlled setup, thus minimizing space usage, escalating efficiency, and speeding up growth cycles. It provides solutions for labor deficits, water shortages, and supply chain dilemmas, allowing top-quality, locally produced crops to be delivered to retail stores efficiently. This innovative approach facilitates the seamless supply chain of ultra-fresh produce to Whole Foods Market, ensuring a swift transfer from farm to shelf through minimal human interference. Market Share And Forecast By Segment In The Global Autonomous Farm-To-Store Delivery Display Market The autonomous farm-to-store delivery market covered in this report is segmented as 1) By Component: Hardware, Software, Services 2) By Vehicle Type: Ground Vehicles, Aerial Drones, Hybrid Vehicles 3) By Technology: Artificial Intelligence And Machine Learning, Internet Of Things, Global Positioning System And Navigation Systems, Other Technologies 4) By Application: Fruits And Vegetables, Dairy Products, Grains And Cereals, Meat And Poultry, Other Applications 5) By End User: Farmers, Retailers, Distributors, Logistics Providers Subsegments: 1) By Hardware: Delivery Robots And Drones, Sensors And Cameras, Navigation And Control Systems, Communication Devices, Display And Interface Units, Power And Battery Systems 2) By Software: Fleet Management Platforms, Route Optimization Solutions, Inventory And Supply Chain Management, Data Analytics And Insights, Security And Access Control, User Interaction Interfaces 3) By Services: Implementation And Integration, Training And Education, Consulting And Advisory, Support And Maintenance, Managed Services, Data Management And Security View the full autonomous farm-to-store delivery display market report: https://www.thebusinessresearchcompany.com/report/autonomous-farm-to-store-delivery-display-global-market-report Autonomous Farm-To-Store Delivery Display Market Regional Insights In 2024, North America led in the global market of autonomous farm-to-store delivery display and is set to maintain its growth trajectory till 2025. The report encompasses the following regions: Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. Browse Through More Reports Similar to the Global Autonomous Farm-To-Store Delivery Display Market 2025, By The Business Research Company Grocery Delivery Software Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/grocery-delivery-software-global-market-report Automated Parcel Delivery Terminals Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/automated-parcel-delivery-terminals-global-market-report Container Tracking Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/container-tracking-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Berkshire Grey Frequently Asked Questions (FAQ)

When was Berkshire Grey founded?

Berkshire Grey was founded in 2013.

Where is Berkshire Grey's headquarters?

Berkshire Grey's headquarters is located at 140 South Road, Bedford.

What is Berkshire Grey's latest funding round?

Berkshire Grey's latest funding round is Take Private.

How much did Berkshire Grey raise?

Berkshire Grey raised a total of $266M.

Who are the investors of Berkshire Grey?

Investors of Berkshire Grey include SoftBank, FedEx, Revolution Acceleration Acquisition, Khosla Ventures, NEA and 4 more.

Who are Berkshire Grey's competitors?

Competitors of Berkshire Grey include Deus Robotics, Geek+, Nimble, Dexterity, RightHand Robotics and 7 more.

Loading...

Compare Berkshire Grey to Competitors

Oxipital AI offers visual artificial intelligence (AI) solutions within the manufacturing sector. It offers visual AI inspection systems and vision-guided pick-and-place robotic systems designed to enhance manufacturing efficiency and product quality. It primarily serves industries with high-variability manufacturing environments, such as food processing, agriculture, and consumer packaged goods. It was formerly known as Soft Robotics. It was founded in 2012 and is based in Bedford, Massachusetts.

Locus Robotics specializes in artificial intelligence (AI) driven warehouse automation solutions within the robotics industry. The company provides autonomous mobile robots that work collaboratively with humans to enhance productivity and operational efficiency in warehouses. Locus Robotics primarily serves sectors such as third-party logistics, retail and eCommerce, healthcare, and industrial sectors. It was founded in 2014 and is based in Wilmington, Massachusetts.

Bleum Robotics provides software and IT development services across industries including high-tech, financial services, and telecommunications. The company focuses on development centers and provides services such as application development, infrastructure support, maintenance, testing, and modernization of legacy systems. Bleum Robotics serves clients in North America and Europe with a focus on delivering solutions through a delivery model. It was founded in 2001 and is based in Englewood, Colorado.

RightHand Robotics provides robotic piece-picking solutions for order fulfillment in industries like e-commerce and pharmaceuticals. Its offerings include a robotic system for item picking, machine learning, and artificial intelligence, along with fleet management and customer support services. Its technology integrates into existing workflows for order fulfillment. It was founded in 2015 and is based in Charlestown, Massachusetts.

Onward Robotics specializes in warehouse automation and order fulfillment solutions within the logistics and supply chain sectors. The company offers technology that facilitates intelligent coordination between people and robots, aiming to optimize warehouse fulfillment processes. Onward Robotics' main offerings include proprietary software for task assignment and workflow optimization, mobile robots for efficient goods-to-person operations, and systems designed to enhance human-robot collaboration. Onward Robotics was formerly known as IAM Robotics. It was founded in 2012 and is based in Pittsburgh, Pennsylvania.

inVia Robotics provides warehouse automation solutions within the logistics and supply chain industry. The company offers products including autonomous mobile robots, an artificial intelligence (AI) powered warehouse intelligence platform, and a modular goods-to-person system aimed at improving warehouse productivity and operational efficiency. inVia Robotics serves e-commerce distribution centers and supply chain operations, providing a robotics-as-a-service model that integrates with existing infrastructure. It was founded in 2015 and is based in Westlake Village, California.

Loading...