Investments

157Portfolio Exits

38About Bezos Expeditions

Bezos Expeditions is a venture capital firm. The firm invests in early-stage ventures, late-stage companies, and seed-stage companies in a wide range of industries. The company was founded in 2005 and is based in Mercer Island, Washington.

Research containing Bezos Expeditions

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bezos Expeditions in 4 CB Insights research briefs, most recently on Oct 14, 2025.

Latest Bezos Expeditions News

Nov 17, 2025

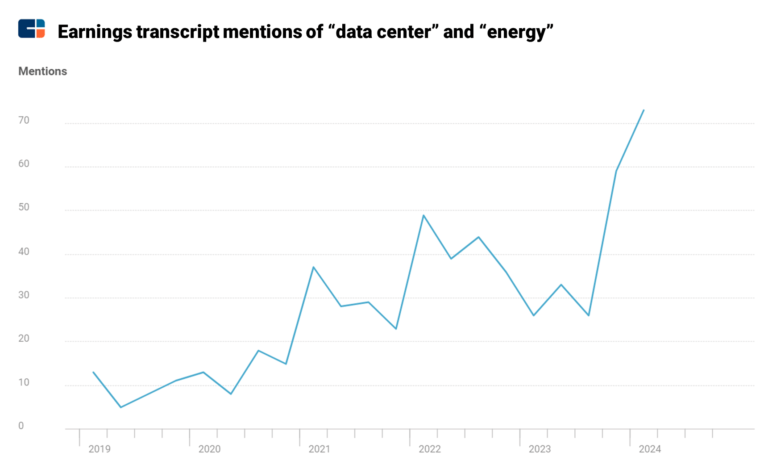

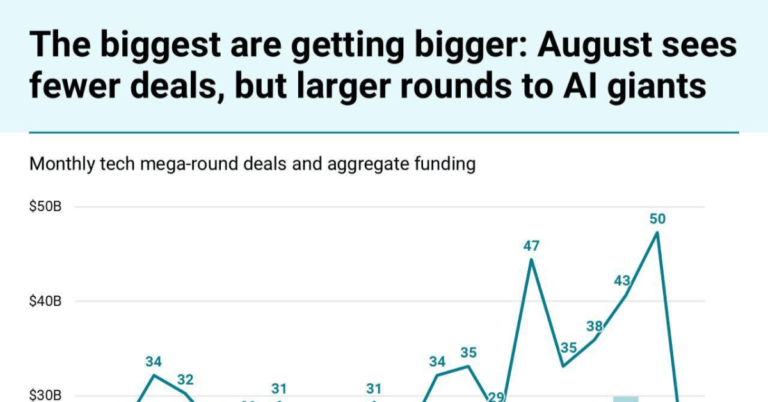

Jeff Bezos is back in the C-suite, and his new company is looking to revolutionize manufacturing. Bezos, Amazon's founder and former CEO, stepped down as CEO of Amazon on July 5, 2021, although he retained his highly influential role as executive chairman of the board. Amazon timeline Founded in 1994 (online bookstore launched in 1995) Originally named Cadabra Current market cap of $2.4 trillion Over 300 million global active customers 2024 full-year revenue of $638 billion +11% 2024 full-year profit of $59.2 billion Bezos has been leading space exploration company Blue Origin, although he is only listed as a founder of the company. However, a new report indicates that Bezos is returning as co-CEO of a new venture called Project Prometheus, which already has billions in funding. Shutterstock Jeff Bezos returns as co-CEO of $6.2 billion AI startup Project Prometheus Former Amazon CEO Jeff Bezos has been secretly building an AI startup called Project Prometheus, according to a New York Times report Or about as secretive as a company that already has $6.2 billion in funding can be. Related: Jeff Bezos sends blunt message on AI bubble According to the report, which cites three people familiar with the matter, it isn't even clear when the company was officially started, but Project Prometheus will focus on AI tech that will help in engineering and manufacturing in different fields, including computers, aerospace, and automobiles. Bezos will be co-CEO along with Vik Bajaj, a physicist and chemist who formerly worked with Google co-founder Sergey Brin at X, Alphabet's Moonshot Factory research hub. Project Prometheus marks the first time Bezos has taken a formal operational role in a company since he left Amazon, according to the Times. The company is entering a crowded field of competitors focused on applying AI technology to physical tasks like robotics, drug design, and scientific discovery. But Project Prometheus has a funding advantage other startups lack. The company has already hired nearly 100 employees, including researchers poached from OpenAI, Google's DeepMind, and Meta. Jeff Bezos calls out "industrial" AI bubble Jeff Bezos' interest in artificial intelligence didn't come out of left field. Earlier this year, Bezos' family office, Bezos Expeditions, invested $72 million in Amsterdam-based AI company Toloka. Related: Jeff Bezos' AI bubble warning backed by big names in banking And last year, Bezos was one of the prominent investors in a $400 million funding round for Physical Intelligence, a robot startup that also counts OpenAI as an investor. Despite his ties to the industry, Bezos isn't blind to the runaway valuations that have become commonplace. "When people get very excited, as they are today about artificial intelligence, for example … every experiment gets funded, every company gets funded, the good ideas and the bad ideas," Bezos said at Italian Tech Week in Turin, Italy, last month. "Investors have a hard time in the middle of this excitement distinguishing between the good ideas and the bad ideas." Bezos said he sees what's happening now as being more akin to an "industrial bubble" similar to biotech in the '90s than the dot-com tech bubble of the early 2000s. While many investors lost a lot of money to that bubble, "we did get a couple of lifesaving drugs," he said. So even if many AI firms with billion-dollar valuations fall by the wayside, in Bezos' mind, the technological advancements will be well worth it, even if some investors are wiped out by the bubble bursting. Despite the tepid quote, Bezos also made it clear that he remained bullish on the sector. But the field is crowded. Wild AI spending and valuations without much ROI By any measure, AI spending has reached astronomical proportions. Amazon, Meta, Alphabet, and Microsoft - the four biggest players - are expected to spend $750 billion on AI-related capital expenditures in the next two years alone. Morgan Stanley analysts expect global spending on datacenters to reach nearly $3 trillion between now and 2028, with $1.4 trillion of that coming from just the big U.S tech companies. "The numbers just don't make sense," according to industry watcher Derek Thompson. "Tech companies are projected to spend about $400 billion this year on infrastructure to train and operate AI models. By nominal dollar sums, that is more than any group of firms has ever spent to do just about anything," he said "The Apollo program allocated about $300 billion in inflation-adjusted dollars to get America to the moon between the early 1960s and the early 1970s. The AI buildout requires companies to collectively fund a new Apollo program, not every 10 years, but every 10 months. Total AI expenditures are projected to exceed $500 billion in 2026 and 2027. Related: Jeff Bezos shares secret that helped Amazon become a giant The Arena Media Brands, LLC THESTREET is a registered trademark of TheStreet, Inc. This story was originally published November 17, 2025 at 2:37 PM.

Bezos Expeditions Investments

157 Investments

Bezos Expeditions has made 157 investments. Their latest investment was in Arrived as part of their Series B on November 07, 2025.

Bezos Expeditions Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

11/7/2025 | Series B | Arrived | $27M | No | Core Innovation Capital, Forerunner Ventures, Neo, and Undisclosed Investors | 3 |

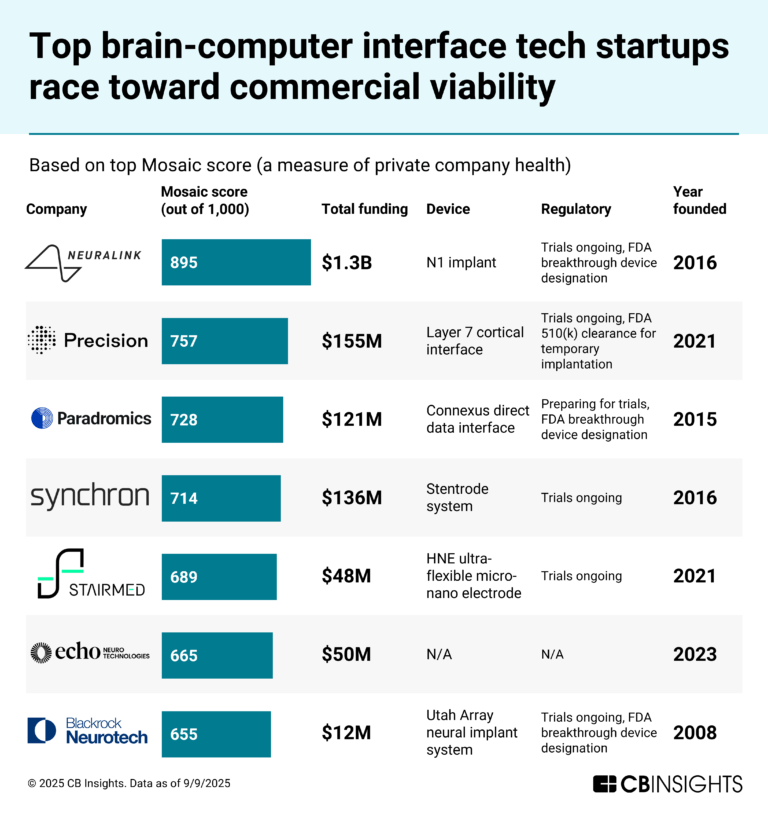

11/6/2025 | Series D | Synchron | $200M | No | ARCH Venture Partners, Double Point Ventures, IQT, K5 Global Technology, Khosla Ventures, METIS Innovative, National Reconstruction Fund Corporation, Neuro Technology Investors, Protocol Labs Venture, Qatar Investment Authority, and T.Rx Capital | 2 |

10/16/2025 | Private Equity | HistoSonics | $250M | Yes | Founders Fund, K5 Global Technology, Thiel Bio, Undisclosed Investors, and Wellington Management | 4 |

8/20/2025 | Series A | |||||

6/12/2025 | Series B |

Date | 11/7/2025 | 11/6/2025 | 10/16/2025 | 8/20/2025 | 6/12/2025 |

|---|---|---|---|---|---|

Round | Series B | Series D | Private Equity | Series A | Series B |

Company | Arrived | Synchron | HistoSonics | ||

Amount | $27M | $200M | $250M | ||

New? | No | No | Yes | ||

Co-Investors | Core Innovation Capital, Forerunner Ventures, Neo, and Undisclosed Investors | ARCH Venture Partners, Double Point Ventures, IQT, K5 Global Technology, Khosla Ventures, METIS Innovative, National Reconstruction Fund Corporation, Neuro Technology Investors, Protocol Labs Venture, Qatar Investment Authority, and T.Rx Capital | Founders Fund, K5 Global Technology, Thiel Bio, Undisclosed Investors, and Wellington Management | ||

Sources | 3 | 2 | 4 |

Bezos Expeditions Portfolio Exits

38 Portfolio Exits

Bezos Expeditions has 38 portfolio exits. Their latest portfolio exit was Spiral on November 18, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

11/18/2025 | Acquired | 3 | |||

6/20/2025 | Acquired | 1 | |||

5/15/2025 | Acquired | 6 | |||

Bezos Expeditions Acquisitions

2 Acquisitions

Bezos Expeditions acquired 2 companies. Their latest acquisition was HistoSonics on August 07, 2025.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

8/7/2025 | Private Equity | $584.57M | Acq - Fin | 6 | ||

10/2/2013 |

Date | 8/7/2025 | 10/2/2013 |

|---|---|---|

Investment Stage | Private Equity | |

Companies | ||

Valuation | ||

Total Funding | $584.57M | |

Note | Acq - Fin | |

Sources | 6 |

Loading...