BitSight

Founded Year

2011Stage

Corporate Minority | AliveTotal Raised

$397MValuation

$0000Last Raised

$250M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-37 points in the past 30 days

About BitSight

BitSight operates within the cybersecurity domain and provides products. It offers visibility into cyber risks, threat exposure, and methods to prioritize and mitigate these risks across various digital environments. The company serves sectors that require cybersecurity measures, including financial services, healthcare, and technology. It was founded in 2011 and is based in Boston, Massachusetts.

Loading...

ESPs containing BitSight

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The cyber risk analytics market provides analytical solutions and services to assess and quantify cyber risks specifically for insurance underwriting purposes. These platforms leverage data analytics and modeling techniques to evaluate potential vulnerabilities and financial impacts of cyber incidents for insured organizations. Also known as cyber insurance analytics or cyber risk modeling, these …

BitSight named as Leader among 15 other companies, including Guidewire, Verisk, and SecurityScorecard.

Loading...

Research containing BitSight

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned BitSight in 2 CB Insights research briefs, most recently on Feb 25, 2025.

Feb 25, 2025

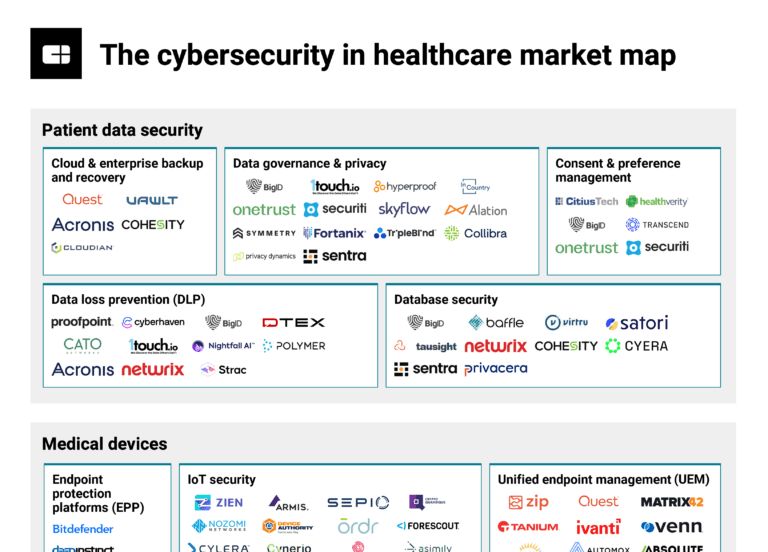

The cybersecurity in healthcare market mapExpert Collections containing BitSight

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

BitSight is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Regtech

1,653 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Grid and Utility

2,988 items

Companies that are developing and implementing new technologies to optimize the grid and utility sector. This includes, but is not limited to, distributed energy resources, infrastructure security, utility asset management, grid inspection, energy efficiency, grid storage, etc.

Tech IPO Pipeline

568 items

Conference Exhibitors

5,302 items

Cybersecurity

11,191 items

These companies protect organizations from digital threats.

BitSight Patents

BitSight has filed 79 patents.

The 3 most popular patent topics include:

- computer security

- computer network security

- domain name system

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/4/2023 | 4/8/2025 | Business continuity, Association football forwards, Association football defenders, Machine learning, Continuous distributions | Grant |

Application Date | 8/4/2023 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Business continuity, Association football forwards, Association football defenders, Machine learning, Continuous distributions |

Status | Grant |

Latest BitSight News

Nov 6, 2025

Financial firms should be performing regular oversight of their vendors to avoid supply chain compromises, according to a new report. Published Nov. 6, 2025 This audio is auto-generated. Please let us know if you have feedback . Dive Brief: Companies that supply financial organizations fare worse on cybersecurity than the organizations they’re supplying, according to a report BitSight published on Thursday. The security gap between financial-services firms and their vendors highlights a major third-party risk facing the financial sector, which generally outperforms other sectors on cybersecurity but is still exposed to the failures of its suppliers. Financial-services firms should perform “rigorous diligence and monitoring” of their suppliers to prevent supply chain attacks, BitSight said. Dive Insight: To assess the gap between financial-services organizations and their vendors, BitSight tested a range of companies from each group on 22 risk vectors, including spam blocking, open ports, mobile application security, endpoint security and patching cadence. On 16 of the risk vectors, suppliers fared worse than their customers, with gaps as big as 15%. Web application security, TLS and HTTP headers were among the areas where suppliers performed the worst compared with their customers. Suppliers performed better than their customers on six risk vectors, including their use of the DMARC and DKIM email security protocols and the DNSSEC protocol for protecting domain-lookup data. BitSight, a cyber risk analysis firm, said that finding “aligns with expectations for larger, more technology-focused organizations.” It isn’t surprising that suppliers have more digital risks than their customers, given that they also have more digital assets, BitSight said. These vendors are also “absorbing the cyber risks associated with the problems” that they’re solving for their customers, the report said. Regardless, BitSight said in its report, “given the regulatory requirements and risk of exposure, it may be troubling for financial sector organizations to learn that their suppliers tend to underperform when it comes to security.” The financial sector is doing better at monitoring the security of its suppliers than other sectors are, according to the report. The average financial firm monitors 36% of its supply chain, compared with a figure of 25% for organizations across all sectors. “Given the growing number of supply chain incidents involving technology providers, perhaps financial sector organizations should be monitoring more of their providers,” BitSight said. “On the other hand, it is possible that financial sector organizations have undertaken a criticality determination and concluded that the vast majority of technology vendors within their supply chain do not need to be continuously monitored.” Financial sector suppliers whose customers don’t monitor their security have roughly three times more critical vulnerabilities in their environments compared with suppliers that are monitored, according to BitSight. One of the most curious statistics in the report involves the performance of suppliers that multiple customers are monitoring. BitSight found “a slight decrease in the security performance of [suppliers] who are monitored by more organizations,” which it said could be because those suppliers are the biggest vendors (and thus have the biggest attack surfaces). “We believe this is a trend worth more analysis, and we will be doing additional research into this area,” BitSight said, “including the impact that direct engagement with organizations has on security posture.”

BitSight Frequently Asked Questions (FAQ)

When was BitSight founded?

BitSight was founded in 2011.

Where is BitSight's headquarters?

BitSight's headquarters is located at 111 Huntington Avenue, Boston.

What is BitSight's latest funding round?

BitSight's latest funding round is Corporate Minority.

How much did BitSight raise?

BitSight raised a total of $397M.

Who are the investors of BitSight?

Investors of BitSight include Moody's, Notable Capital, Flybridge Capital Partners, Menlo Ventures, SingTel Innov8 and 17 more.

Who are BitSight's competitors?

Competitors of BitSight include DeNexus, SixMap, Prevalent, Protos Labs, Apptega and 7 more.

Loading...

Compare BitSight to Competitors

ProcessUnity specializes in cloud-based risk and compliance program automation within various business sectors. The company offers a suite of applications designed to streamline risk management and compliance processes, such as third-party risk management, cybersecurity program management, and policy and procedure management. ProcessUnity's solutions cater to organizations looking to minimize manual tasks and enhance strategic risk mitigation efforts. It was founded in 2003 and is based in Concord, Massachusetts.

SecurityScorecard operates in the cybersecurity industry and specializes in cybersecurity ratings. The company offers a platform for enterprise risk management, third-party risk management, and cyber insurance underwriting, providing a view of cyber risks through continuous monitoring and assessment. It primarily serves the security sector. The company was founded in 2013 and is based in New York, New York.

UpGuard operates in the cybersecurity industry. It provides products related to third-party risk management and attack surface management, aimed at assisting organizations with data protection and security. UpGuard serves sectors, including financial services, technology, and healthcare, offering solutions for vendor risk assessments, security ratings, and compliance with regulatory standards. UpGuard was formerly known as ScriptRock. It was founded in 2012 and is based in Mountain View, California.

SAFE operates in cybersecurity and digital business risk quantification within the cyber risk management sector. The company provides a platform for managing first-party and third-party cyber risks, allowing organizations to quantify, report, and mitigate cyber risks. It serves sectors including financial services, healthcare, technology, and retail. SAFE was formerly known as Lucideus. It was founded in 2012 and is based in Palo Alto, California.

Responsible Cyber focuses on cybersecurity services and products within the cybersecurity industry. The company provides AI-powered products for third-party risk management and governance, risk, and compliance (GRC). Responsible Cyber's solutions aim to improve risk management processes for businesses. It was founded in 2016 and is based in Singapore.

Censinet provides risk management solutions for the healthcare sector, addressing third party cybersecurity and enterprise risk. The company has a platform for managing risks related to vendors, medical devices, and healthcare data. Censinet serves healthcare delivery organizations and their vendors. It was founded in 2017 and is based in Boston, Massachusetts.

Loading...