Boosted.ai

Founded Year

2017Stage

Series C - II | AliveTotal Raised

$61.01MLast Raised

$10.71M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-80 points in the past 30 days

About Boosted.ai

Boosted.ai focuses on artificial intelligence (AI) technology for the finance sector, particularly in investment management. The company provides a platform that automates investment research, market monitoring, and financial reporting. It serves various roles in the finance industry, including analysts, portfolio managers, and investment bankers, offering tools for risk assessment and investment strategy development. It was founded in 2017 and is based in Toronto, Canada.

Loading...

ESPs containing Boosted.ai

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI investment intelligence platforms market develops AI-powered solutions that assist investors in research, analysis, and decision-making. These platforms leverage generative AI, copilots, machine learning, and advanced algorithms to analyze financial data, generate investment insights, predict market movements, and provide personalized investment strategies. By automating research processes …

Boosted.ai named as Outperformer among 15 other companies, including Bloomberg, BlackRock, and Morningstar.

Loading...

Research containing Boosted.ai

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Boosted.ai in 5 CB Insights research briefs, most recently on Aug 29, 2025.

Aug 29, 2025 report

Book of Scouting Reports: Generative AI in Financial Services

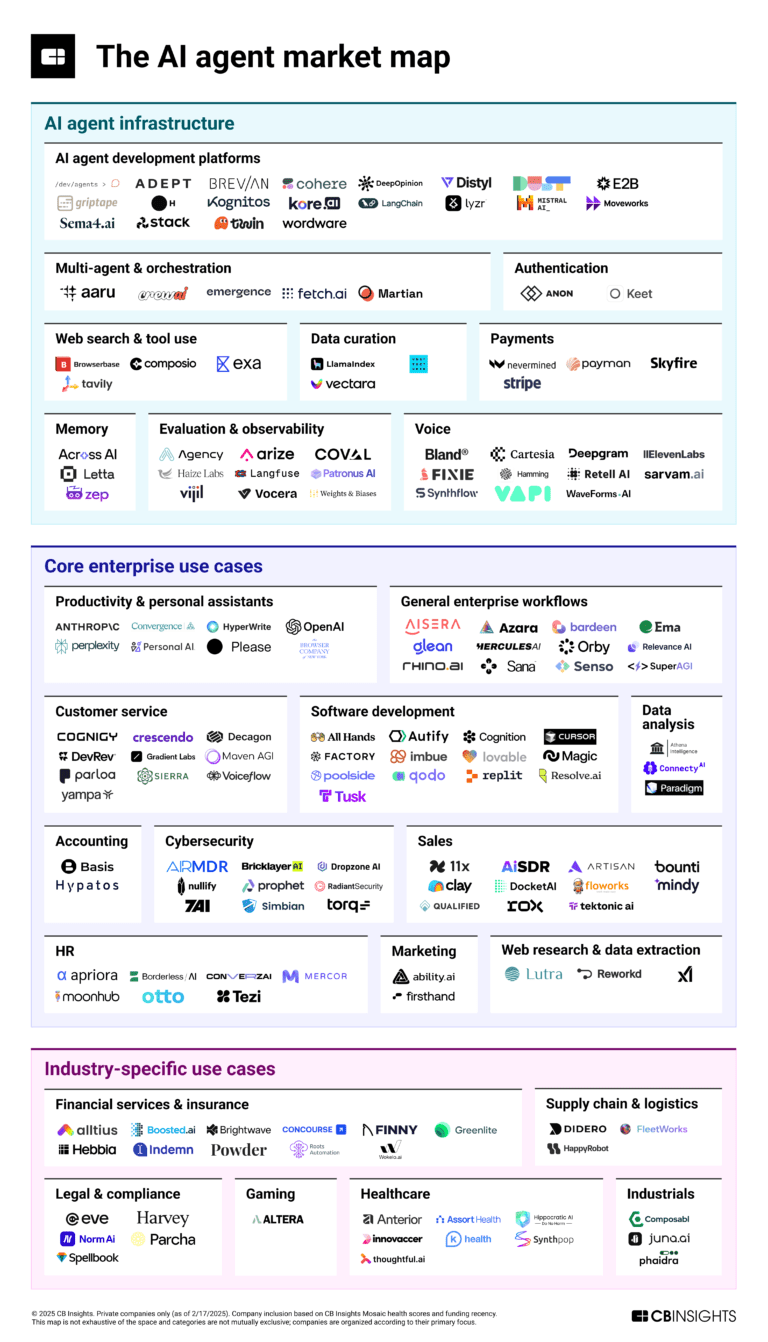

Mar 6, 2025

The AI agent market map: March 2025 edition

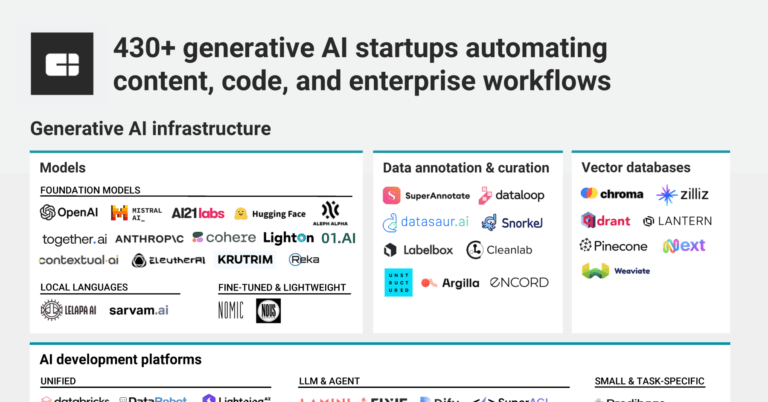

May 24, 2024

The generative AI market map

Oct 6, 2023

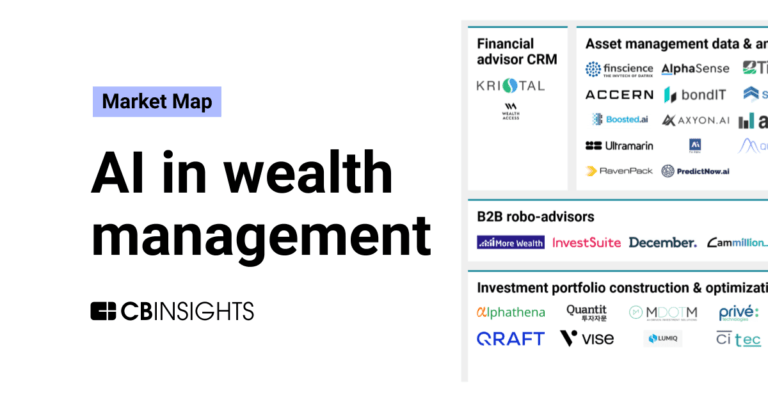

The AI in wealth management market mapExpert Collections containing Boosted.ai

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Boosted.ai is included in 12 Expert Collections, including Wealth Tech.

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,063 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Fintech

14,203 items

Excludes US-based companies

Canadian fintech

345 items

AI 100 (All Winners 2018-2025)

100 items

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Boosted.ai Patents

Boosted.ai has filed 1 patent.

The 3 most popular patent topics include:

- automotive technologies

- battery electric vehicle manufacturers

- car classifications

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/10/2020 | 8/10/2021 | Automotive technologies, Battery electric vehicle manufacturers, Electrical engineering, Electrical generators, Car classifications | Grant |

Application Date | 1/10/2020 |

|---|---|

Grant Date | 8/10/2021 |

Title | |

Related Topics | Automotive technologies, Battery electric vehicle manufacturers, Electrical engineering, Electrical generators, Car classifications |

Status | Grant |

Latest Boosted.ai News

Oct 28, 2025

Boosted.ai, a leading provider of AI-powered investment research tools, has launched voice-enabled conversational agents for financial professionals — a first for the investment management industry. The new capability, powered by ElevenLabs’ advanced text-to-speech and conversational AI technology, allows users to talk to Boosted.ai’s platform in real time, transforming the way analysts and portfolio managers interact with financial data. The integration turns Boosted.ai’s research assistant, Alfa, into a fully conversational, voice-first interface that responds with human-like accuracy and tone. Users can now query complex datasets, request market analysis, or ask for insights on specific securities — simply by speaking, rather than typing. Takeaway Boosted.ai’s voice-driven agents redefine how investment professionals access research, bridging AI analytics with natural conversation for faster, more intuitive decision-making. Why It Matters For Investment Management For investment professionals managing billions in assets, speed and context are critical. Boosted.ai’s integration of ElevenLabs’ voice technology allows users to have fluid, back-and-forth conversations with AI research agents that feel more like discussions with human analysts. The impact is measurable: clients have reported longer and more detailed prompts when speaking naturally, leading to higher-quality outputs and faster insights. Early usage data shows a surge in client engagement, with users generating personalized audio research and saving hours per week. Chief Product Officer Christian Antaloczy explained, “Our customers have consistently asked for more intuitive ways to interact with Alfa. Voice makes the interaction feel more like talking to a real analyst. ElevenLabs allowed us to deliver this next level of service quickly and at high quality.” Takeaway Voice technology transforms passive querying into active dialogue — increasing engagement and unlocking richer, context-driven insights for portfolio managers. How It Works Using ElevenLabs’ conversational voice engine, Boosted.ai’s Alfa can now understand and respond to voice queries in real time. The system supports dynamic, evolving conversations — similar to speaking with an in-house research analyst. For instance, a portfolio manager can ask Alfa to screen companies in the S&P 500 with specific yield and P/E ratios, summarize their earnings transcripts, and analyze exposure to China. Alfa replies instantly with synthesized summaries and follow-up options, guiding the user deeper into relevant data without manual searching or typing. Unlike traditional voice assistants, Alfa anticipates context and prompts further exploration. It continuously surfaces new angles, trends, and data points, converting idle time into actionable insights — effectively serving as a proactive research partner. Takeaway Boosted.ai’s Alfa shifts from reactive Q&A to proactive analysis — transforming how financial professionals research markets, manage risk, and identify alpha opportunities. Setting A New Standard For AI-Driven Research By combining ElevenLabs’ natural voice synthesis with its existing AI analytics engine, Boosted.ai is establishing a new model for human-AI collaboration in finance. The technology gives investment managers the ability to query massive data sets hands-free while maintaining institutional-grade accuracy. Early feedback from users has been enthusiastic. Ralph Aldis of U.S. Global Investors described the experience as “easy, fast, and surprisingly engaging,” noting that speaking to Alfa made research “feel less mechanical and more conversational.” Boosted.ai’s clients — who collectively manage more than $5 trillion in assets — are now leveraging the system to streamline workflows, reduce manual data analysis, and surface actionable insights with unprecedented speed. The company says there’s no accuracy trade-off between text and voice input, thanks to near-perfect transcription and comprehension fidelity. Takeaway Boosted.ai’s move into voice-powered AI establishes a new benchmark for engagement, positioning conversational research as the next frontier in institutional asset management. What’s Next? The launch represents a milestone for the broader AI-in-finance ecosystem. Voice-based agents are likely to become a core interface for asset managers and fintech platforms, offering faster workflows and more human-like interactions. For Boosted.ai, the integration underscores its ambition to transform idle minutes into productive research time and make AI collaboration as natural as conversation. The company’s next focus is expected to include multilingual voice capabilities and integration with client data environments for deeper personalization. Takeaway As AI agents become conversational, the financial research process moves closer to true real-time collaboration between humans and machines — reshaping how insights are generated and acted upon.

Boosted.ai Frequently Asked Questions (FAQ)

When was Boosted.ai founded?

Boosted.ai was founded in 2017.

Where is Boosted.ai's headquarters?

Boosted.ai's headquarters is located at 372 Bay Street, Toronto.

What is Boosted.ai's latest funding round?

Boosted.ai's latest funding round is Series C - II.

How much did Boosted.ai raise?

Boosted.ai raised a total of $61.01M.

Who are the investors of Boosted.ai?

Investors of Boosted.ai include Portage, Spark Capital, Ten Coves Capital, HarbourVest Partners, Royal Bank of Canada and 9 more.

Who are Boosted.ai's competitors?

Competitors of Boosted.ai include Unstructured, Axyon AI, Fintica, Aisot Technologies, causaLens and 7 more.

Loading...

Compare Boosted.ai to Competitors

PredictNow.ai is a company focused on enhancing human decision-making in the financial sector through its Corrective AI technology. The company offers a platform that provides machine learning predictions and optimizations to improve investment strategies and trading operations for hedge funds and financial institutions. PredictNow.ai's solutions are designed to integrate with existing prediction models, enabling firms to make data-driven decisions and optimize their trading performance without replacing established practices. It was founded in 2020 and is based in Niagara On The Lake, Ontario.

CredX.AI operates as an AI-first technology company specializing in financial services and risk analytics. The company offers AI-driven insights and analytics tools to institutional investors. CredX.AI primarily serves the financial sector, delivering solutions that cater to the needs of institutional investors and financial services firms. It was founded in 2017 and is based in Merritt Island, Florida.

RevFX provides artificial intelligence (AI) powered analytics and insights for funds and portfolios within the financial sector. The company offers solutions that track and analyze data to provide insights for go-to-market teams, predicting company engagement and supporting sales and marketing activities. RevFX's products are designed to integrate with existing sales and marketing tools, ensuring security and compliance. RevFX was formerly known as ActHQ. It was founded in 2024 and is based in San Francisco, California.

AlgoDynamix focuses on financial price forecasting analytics within the financial services sector. The company offers price forecasting that provides indications of market movements across various asset classes, without relying on historical data. AlgoDynamix's analytics support investment and trading strategies by delivering insights based on real-time order book data and mathematical analysis. It was founded in 2013 and is based in London, England.

Tano offers artificial intelligence (AI) influencer marketing within the marketing technology sector. It offers a platform that automates influencer marketing campaigns, enabling brands and agencies to partner with a larger number of influencers while reducing operational costs. It primarily serves the marketing and advertising industry, focusing on the efficiency of social media marketing and outreach. It was founded in 2025 and is based in London, United Kingdom.

Axyon AI provides solutions for the investment management industry. It offers asset managers asset rankings and investment strategies across various asset classes, using deep learning and machine learning technologies. Axyon AI serves the financial services sector, including asset managers, hedge funds, and institutional investors. It was founded in 2016 and is based in Modena, Italy.

Loading...