Bowtie

Founded Year

2018Stage

Corporate Majority | AcquiredTotal Raised

$87.5MRevenue

$0000About Bowtie

Bowtie is a virtual insurer focused on providing medical insurance plans and life insurance products. The company offers coverage under the Voluntary Health Insurance Scheme (VHIS) and other life insurance products. Bowtie's platform allows customers to access insurance protection without the need for intermediaries. It was founded in 2018 and is based in Wan Chai, Hong Kong. In July 2025, Sun Life acquired a majority stake in Bowtie for $70M.

Loading...

Bowtie's Product Videos

ESPs containing Bowtie

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital health insurance providers market refers to insurtech companies that provide private health insurance plans. Companies in this market often focus on providing distinguished value propositions — like telehealth and preventative care services, direct pay capabilities, or member navigation apps. Digital health insurance providers go beyond just the insurance sales process, and some of the…

Bowtie named as Challenger among 13 other companies, including Collective Health, Oscar, and Acko.

Bowtie's Products & Differentiators

Individual Medical Insurance – Voluntary Health Insurance Scheme (VHIS) Series

https://www.bowtie.com.hk/en/insurance/vhis

Loading...

Research containing Bowtie

Get data-driven expert analysis from the CB Insights Intelligence Unit.

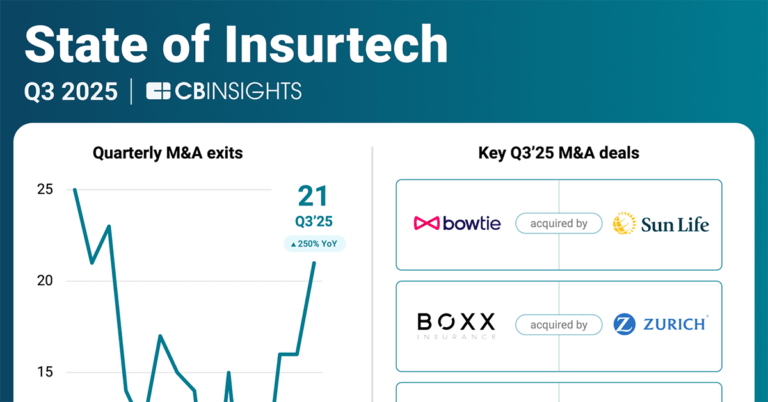

CB Insights Intelligence Analysts have mentioned Bowtie in 3 CB Insights research briefs, most recently on Nov 6, 2025.

Nov 6, 2025 report

State of Insurtech Q3’25 Report

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Nov 7, 2023 report

State of Insurtech Q3’23 ReportExpert Collections containing Bowtie

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bowtie is included in 5 Expert Collections, including Insurtech.

Insurtech

3,403 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

14,203 items

Excludes US-based companies

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Insurtech 50

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Latest Bowtie News

Nov 7, 2025

累計融資總額460億 期間,數碼港企業成功籌集近34億元,累計融資總額達460億元。多家數碼港企業近期完成大規模融資,當中包括客路(Klook)、保泰人壽(Bowtie)、KPay、鯤KUN、HashKey Group、DigiFT、LeapXpert及安擬集團(Animoca Brands)等,這些企業主要集中人工智能(AI)、區塊鏈及數字資產等領域,顯示資本市場對新興科技的高度關注,亦反映數碼港在推動AI和Web3.0等前沿科技發展方向上的成效。 「2025數碼港創業投資論壇」昨於香港數碼港揭幕,論壇上,數碼港與四方精創(Forms HK)簽署合作備忘錄,成立「區塊鏈小鎮@數碼港」(Blockchain Valley@Cyberport),共同推動鏈上金融(on-chain finance)創新發展。同時,數碼港與香港教育大學建立策略夥伴關係,專注教育科技、藝術科技及數碼創新3大核心領域,推動大學研究成果的應用轉化。

Bowtie Frequently Asked Questions (FAQ)

When was Bowtie founded?

Bowtie was founded in 2018.

Where is Bowtie's headquarters?

Bowtie's headquarters is located at 58-64 Queen’s Road East, Wan Chai.

What is Bowtie's latest funding round?

Bowtie's latest funding round is Corporate Majority.

How much did Bowtie raise?

Bowtie raised a total of $87.5M.

Who are the investors of Bowtie?

Investors of Bowtie include Sun Life, Mitsui, Hong Kong X and Wings Capital Ventures.

Who are Bowtie's competitors?

Competitors of Bowtie include Avo Insurance and 3 more.

What products does Bowtie offer?

Bowtie's products include Individual Medical Insurance – Voluntary Health Insurance Scheme (VHIS) Series and 3 more.

Loading...

Compare Bowtie to Competitors

FWD Insurance specializes in providing a range of life, critical illness, and medical insurance products within the insurance sector. The company offers plans that include life insurance, critical illness coverage, and medical insurance, designed to protect individuals and their loved ones. FWD Insurance also provides savings and investment products, accident and disability protection, and a digital platform for online policy management and claims processing. It was founded in 2013 and is based in Hong Kong, Hong Kong.

ZA Bank is a digital banking institution. It offers services such as instant account opening, interest earning, cashback rewards, and interest rate coupons. It primarily serves the digital banking sector. It was founded in 2017 and is based in Hong Kong.

OneDegree provides digital insurance services within the insurance industry. The company offers a variety of insurance products including pet insurance, home insurance, fire insurance, and critical illness coverage. OneDegree also includes supplementary services such as home appliances warranty insurance and cyber insurance for digital assets. It was founded in 2016 and is based in Kwun Tong, Hong Kong.

National Health Service focuses on providing public healthcare services across various medical domains. The company offers services including access to medical information, treatment guidance, and tools for health management, as well as connections to general physician (GPs), pharmacies, hospitals, and dental care. It primarily serves individuals seeking healthcare information and services. It was founded in 1948 and is based in Leeds, United Kingdom.

Kyobo Life Insurance provides life insurance services within the financial sector. The company offers products designed to assist with health challenges, accidents, or retirement. Kyobo Life Insurance was formerly known as Daehan Kyoyuk Insurance. It was founded in 1958 and is based in Seoul, South Korea.

Groupama provides various insurance products and financial services, including auto, home, health, life, and leisure insurance, as well as banking and credit solutions, savings, and retirement plans. The company serves a diverse clientele, including individuals, professionals, businesses, and communities. It was founded in 1991 and is based in Paris, France.

Loading...