BOXX Insurance

Founded Year

2018Stage

Acquired | AcquiredTotal Raised

$25.4MAbout BOXX Insurance

BOXX Insurance specializes in providing integrated cyber insurance and protection services across various sectors. The company offers a suite of products designed to predict, prevent, and insure against cyber threats, with a focus on small businesses and individual home protection. It caters to a range of sectors, including banking, insurers, retailers, e-commerce, mobile operators, and telcos, offering tailored cyber solutions and partnerships. It was founded in 2018 and is based in Toronto, Canada. In July 2025, BOXX Insurance was acquired by Zurich Insurance Group.

Loading...

BOXX Insurance's Product Videos

BOXX Insurance's Products & Differentiators

Cyberboxx Business

Cyberboxx® Business is an all-in-one solution that combines cyber insurance and cybersecurity services to protect small to medium-sized businesses. SMEs get comprehensive coverage, proactive threat prevention, and 24/7 expert support to manage cyber risks.

Loading...

Research containing BOXX Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

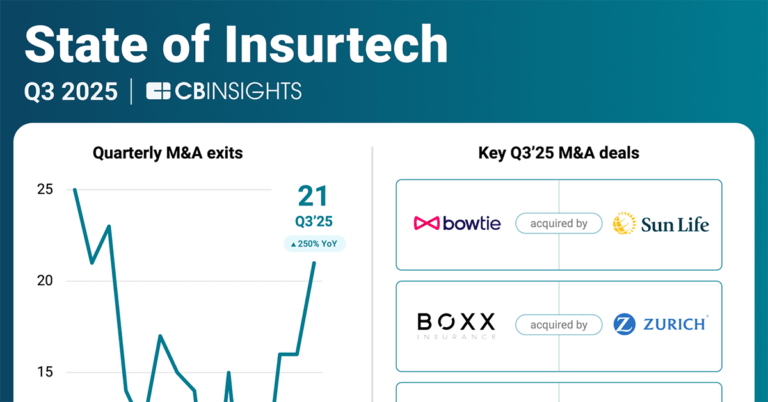

CB Insights Intelligence Analysts have mentioned BOXX Insurance in 1 CB Insights research brief, most recently on Nov 6, 2025.

Nov 6, 2025 report

State of Insurtech Q3’25 ReportExpert Collections containing BOXX Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

BOXX Insurance is included in 5 Expert Collections, including SMB Fintech.

SMB Fintech

1,231 items

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

14,203 items

Excludes US-based companies

Canadian fintech

345 items

Insurtech 50

50 items

Latest BOXX Insurance News

Nov 7, 2025

Investment in MGA Sector Might Have Peaked There’s been a large tranche of capital into the MGA sector over the last few years, but this new report suggests the rate of investment might be slowing; The QualRisk Cyber Insurance Center (QCC) released its 2026 Cyber MGA Periscope, which tracks capital flow, geographic expansion, and consolidation across the global MGA market. “MGAs remain pivotal in the cyber insurance sector, but our 2026 Cyber MGA Periscope reveals a clear trend towards consolidation, typified by Zurich’s acquisition of Canadian MGA BOXX Insurance,” said Daniel Kasper, CEO of QCC. “With ransomware resurgent, competition intensifying between MGAs and legacy carriers, and Asian MGAs on the rise, we anticipate the recent wave of US MGA expansion into Europe will continue into Asia in 2026. In this changing landscape, carriers, investors, and MGA leaders must reevaluate their strategies and regional priorities to maintain a competitive edge.” Key insights from the 2026 MGA Periscope: • Financing continued to soften: Fewer deals and smaller average rounds underscored a more selective funding environment. Publicly disclosed funding in 2025 sits at $49M compared to $87M in 2024. • Consolidation accelerated: Strategic acquisitions and roll-ups increased as sponsors and carriers prioritized scale, diversification, and operating leverage. • Europe in focus: Leading MGAs moved aggressively into Germany and France to capture mid-market and specialty lines. • Preparing for Asia: Market participants are laying groundwork in key hubs, positioning for growth as capacity, distribution, and data infrastructure rapidly develop. • 2025 updates: The MGA Periscope adds enhanced financing and M&A tracking, a refined competitive matrix, and improved graphic visualization. Share this:

BOXX Insurance Frequently Asked Questions (FAQ)

When was BOXX Insurance founded?

BOXX Insurance was founded in 2018.

Where is BOXX Insurance's headquarters?

BOXX Insurance's headquarters is located at 1 Toronto Street, Toronto.

What is BOXX Insurance's latest funding round?

BOXX Insurance's latest funding round is Acquired.

How much did BOXX Insurance raise?

BOXX Insurance raised a total of $25.4M.

Who are the investors of BOXX Insurance?

Investors of BOXX Insurance include Zurich Insurance Group, SixThirty, Cyber Mentor Fund and Lloyd's Lab.

Who are BOXX Insurance's competitors?

Competitors of BOXX Insurance include Coalition and 7 more.

What products does BOXX Insurance offer?

BOXX Insurance's products include Cyberboxx Business and 3 more.

Loading...

Compare BOXX Insurance to Competitors

Coalition serves as a provider of active Insurance in the cybersecurity domain. It offers cyber insurance products, including coverage for ransomware and email compromise, as well as cybersecurity tools and services. It serves a diverse range of sectors by providing insurance and security solutions to manage digital risks. It was founded in 2017 and is based in San Francisco, California.

Cowbell Cyber provides adaptive cyber insurance coverage to small and medium-sized enterprises within the insurance sector. The company offers cyber insurance products that include continuous risk assessment and underwriting, using AI to manage and mitigate cyber risks. Cowbell Cyber serves the insurance industry with a focus on SMEs. It was founded in 2019 and is based in Pleasanton, California.

Resilience operates in the field of cybersecurity risk management and insurance within the financial services and technology sectors. Its offerings include cyber insurance policies, cyber risk quantification, and a risk operations center. Resilience provides solutions that include risk quantification software, cybersecurity expertise, and cyber insurance for middle and large organizations. Resilience was formerly known as Arceo AI. It was founded in 2016 and is based in San Francisco, California.

At-Bay offers insurance and cybersecurity services to mitigate cyber risks. The company provides cyber insurance, tech errors and omissions insurance, and professional liability insurance, along with cybersecurity solutions including a unified security platform, advisory services, exposure management, fraud defense, security training, and incident response. At-Bay was formerly known as CyberJack. It was founded in 2016 and is based in San Francisco, California.

CyberCube provides cyber risk analytics and modeling for the insurance market. The company offers solutions that measure cyber risk and its financial impact, serving businesses and the insurance industry. CyberCube's services are available to various segments within the insurance industry, including brokers, managing general agents (MGAs), insurers, reinsurers, and insurance-linked securities. It was founded in 2015 and is based in San Francisco, California.

Eye Security offers cybersecurity solutions, including threat detection and mitigation across various sectors. The company provides managed extended detection and response (XDR), incident response, security awareness training, and cyber insurance to support business operations. It serves small to medium-sized enterprises in sectors such as logistics, manufacturing, professional services, and healthcare. The company was founded in 2020 and is based in The Hague, Netherlands.

Loading...