Bridge

Founded Year

2022Stage

Acquired | AcquiredTotal Raised

$58MValuation

$0000Revenue

$0000About Bridge

Bridge specializes in stablecoin orchestration and issuance within the financial technology sector. The company provides APIs that enable developers to convert various forms of currency into stablecoins and to facilitate instant, global transactions with built-in compliance and programmability features. It was founded in 2022 and is based in San Antonio, Texas. In October 2024, Bridge was acquired by Stripe.1B.

Loading...

ESPs containing Bridge

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The yield-bearing stablecoin issuers market includes companies that create and issue stablecoins with built-in yield mechanisms that automatically generate returns for holders without requiring external staking or farming. These issuers embed yield-generation directly into their stablecoin architecture through treasury-backed yields, algorithmic distribution systems, automated DeFi strategy deploy…

Bridge named as Leader among 15 other companies, including Paxos, Ethena, and Maple Finance.

Loading...

Research containing Bridge

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bridge in 5 CB Insights research briefs, most recently on Sep 24, 2025.

Jul 17, 2025 report

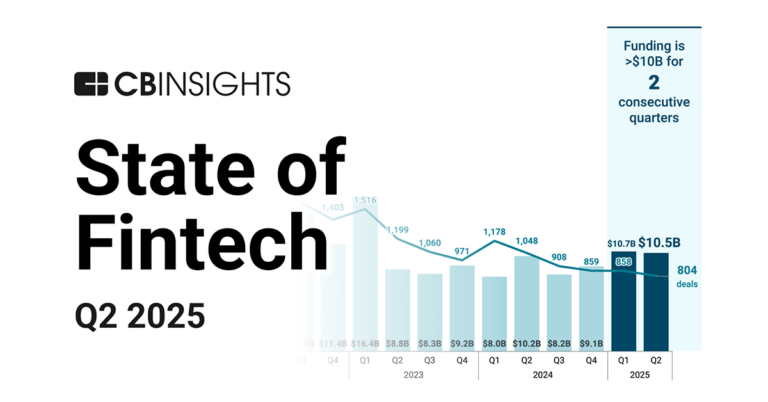

State of Fintech Q2’25 Report

May 29, 2025

The stablecoin market map

Apr 10, 2025 report

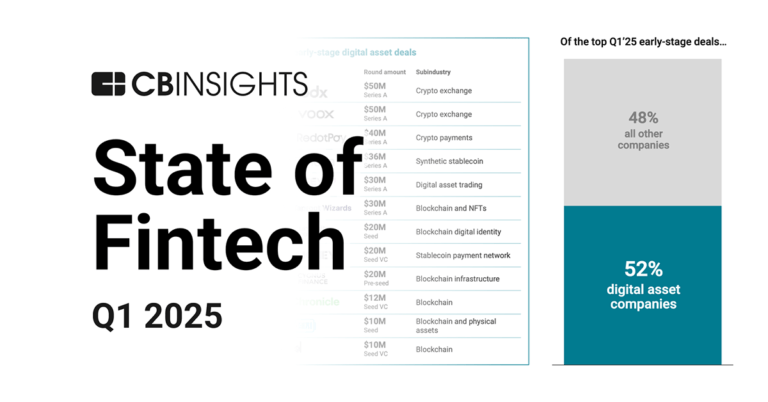

State of Fintech Q1’25 Report

Jan 14, 2025 report

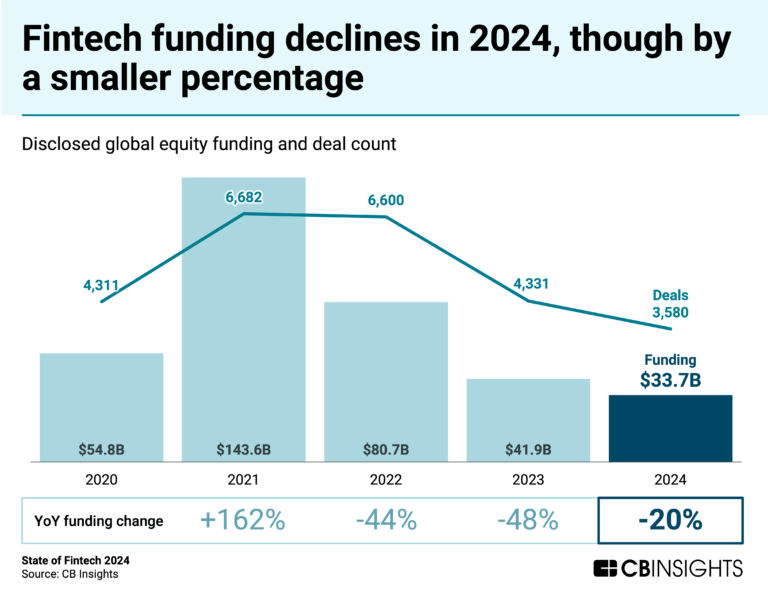

State of Fintech 2024 ReportExpert Collections containing Bridge

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bridge is included in 3 Expert Collections, including Blockchain.

Blockchain

9,320 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Stablecoin

471 items

Latest Bridge News

Nov 14, 2025

Jonathan Gould, comptroller of the currency, speaks during the Federal Reserve Integrated Review of the Capital Framework for Large Banks Conference in Washington, DC, US, on Tuesday, July 22, 2025. Treasury Secretary Scott Bessent offered support for Jerome Powell amid regular attacks from Trump administration officials, saying he sees no reason for the Federal Reserve chair to step down. Al Drago/Bloomberg Key insight: ICBA says Bridge's stablecoin plan violates historic scope of the trust charter. Supporting data: The industry group cites deposit-like business plans and the lack of statutory fiat to expand trust charters through an interpretive letter written by Gould in 2021. Forward look: Crypto trust bids face growing calls from banks, with increasing focus on administrative and legal concerns. A banking trade group wrote to the Office of the Comptroller of the Currency Thursday opposing fintech company Bridge's application for a national trust charter, citing administrative-procedural and statutory issues. Bridge is the stablecoin-focused arm of Stripe. In a letter to the OCC's top chartering officer Stephen Lybarger, the Independent Community Bankers of America asked the agency to reject the application after statements in the applicant's proposed business model proposed "carrying on the business of banking," which ICBA says exceeds the national trust charter's scope without commensurate oversight. "[The charter] was narrowly intended to allow trust banks to facilitate the provision of traditional fiduciary services including personal trust and estate administration, retirement plan services, investment management and advisory activities, and corporate trust administration," Mickey Marshall, ICBA's Vice President and Regulatory Counsel wrote. "By offering stablecoins to consumers, Bridge is attempting to offer a product that is a functional substitute for demand deposits without becoming subject to the laws and regulations that bind other banks, including the Bank Holding Company Act." Bridge, which was acquired for just over a billion dollars by Stripe in February,

Bridge Frequently Asked Questions (FAQ)

When was Bridge founded?

Bridge was founded in 2022.

Where is Bridge's headquarters?

Bridge's headquarters is located at 21750 Hardy Oak Boulevard, San Antonio.

What is Bridge's latest funding round?

Bridge's latest funding round is Acquired.

How much did Bridge raise?

Bridge raised a total of $58M.

Who are the investors of Bridge?

Investors of Bridge include Stripe, Ribbit Capital, Coinbase, SpaceX, Sequoia Capital and 7 more.

Who are Bridge's competitors?

Competitors of Bridge include OwlTing and 4 more.

Loading...

Compare Bridge to Competitors

BVNK provides infrastructure for stablecoin payments within the financial services sector. The company offers a platform that enables businesses to send, receive, convert, and store stablecoins and fiat across various payment rails and blockchains, facilitating money movement. BVNK serves sectors including fintech, marketplaces, trading, gaming, and digital assets. It was founded in 2021 and is based in London, United Kingdom.

Conduit specializes in facilitating international business payments within the financial technology sector. The company offers a platform that enables cross-border transactions using stablecoins or local currencies. Conduit's services cater to various sectors, including fintech companies and businesses managing global cash flow and payroll. It was founded in 2021 and is based in Kalispell, Montana.

MoonPay operates as a Web3 infrastructure company that provides solutions for payments, smart contract development, and digital asset management within the cryptocurrency ecosystem. The company has a platform for individuals and businesses to buy, sell, and trade various cryptocurrencies. MoonPay serves the cryptocurrency exchange and digital asset management sectors, offering services including fiat-to-crypto on-ramps, non-custodial, and wallet support. It was founded in 2018 and is based in Dover, Delaware.

Ramp focuses on providing Web3 financial infrastructure within the cryptocurrency sector. It offers non-custodial services that enable users to buy and sell cryptocurrencies, facilitating the exchange between fiat currency and digital assets. Ramp's infrastructure supports businesses by integrating crypto onboarding tools, ensuring compliance, and providing a seamless user experience for transactions. It was founded in 2018 and is based in London, United Kingdom.

Nilos provides international payments and financial infrastructure for businesses across various sectors. It offers multi-currency accounts, payment solutions, and foreign exchange services for cross-border transactions. It serves import and export merchants, global corporations, and financial technology companies with its financial products. It was founded in 2021 and is based in Tel Aviv, Israel.

Cobre provides a financial management platform. It allows businesses to centralize their treasury operations, optimizing processes such as reconciliation, collections, and payments. The company serves large and medium-sized businesses across various sectors, including e-commerce platforms, technology companies, and real estate administrators. The company was founded in 2019 and is based in Bogota, Colombia.

Loading...