BuildOps

Founded Year

2018Stage

Series C | AliveTotal Raised

$225.8MValuation

$0000Last Raised

$127M | 8 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+34 points in the past 30 days

About BuildOps

BuildOps is a SaaS platform designed for the commercial specialty contractor industry. The platform includes tools for service, project management, and business operations for trade contractors. Features include invoicing, scheduling, estimates, proposals, payments, workflows, custom forms, and financial reporting. It was founded in 2018 and is based in Santa Monica, California.

Loading...

ESPs containing BuildOps

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The field service management (FSM) software market provides platforms to schedule, dispatch, and manage mobile workforces performing on-site services at customer locations. These solutions include work order management, technician scheduling and routing, mobile apps for field workers, customer communication tools, and inventory management. FSM software serves industries including HVAC, plumbing, t…

BuildOps named as Challenger among 15 other companies, including Microsoft, Oracle, and SAP.

Loading...

Research containing BuildOps

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned BuildOps in 2 CB Insights research briefs, most recently on Aug 27, 2025.

Aug 2, 2023

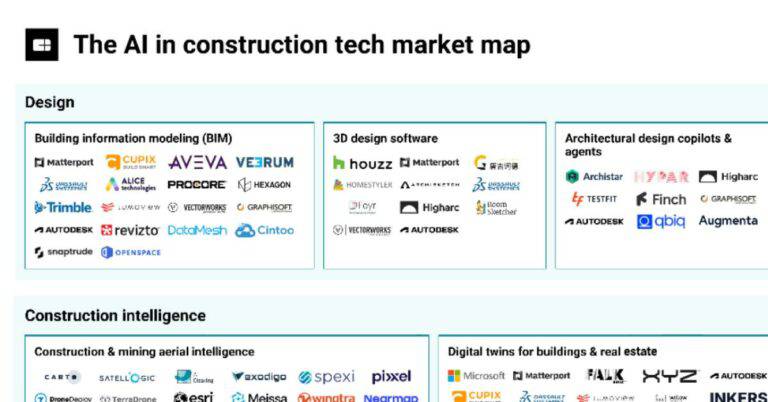

The commercial proptech market mapExpert Collections containing BuildOps

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

BuildOps is included in 7 Expert Collections, including Construction Tech.

Construction Tech

1,530 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Real Estate Tech

2,494 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Unicorns- Billion Dollar Startups

1,309 items

Smart Cities

4,679 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Advanced Manufacturing

3,972 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Latest BuildOps News

Nov 6, 2025

Survey reveals perfect storm driving unprecedented technology adoption: fierce competition, vanishing workforce, and mounting complexity forcing contractors to choose between evolution and extinction LOS ANGELES, CA / ACCESS Newswire / November 6, 2025 / The commercial contracting industry is experiencing a fundamental shift. While contractors remain optimistic about growth opportunities, a perfect storm of challenges is forcing them to make a critical choice: evolve quickly or risk being left behind. According to "The Pivot Point: AI and The Future of Commercial Contracting," a new research report from BuildOps and Kickstand based on a survey of 606 contractors across the U.S. and Canada, the industry has reached an inflection point. Nearly four in five contractors (78%) are already using or testing AI tools on the jobsite-a stunning adoption rate that would have seemed impossible just three years ago. But the other 22% are falling further behind every day. "You can't hire your way out anymore. Yesterday's tools can't build tomorrow," said Alok Chanani, Co-Founder and CEO of BuildOps. "And the firms that are acting on that reality right now-not next year, not when it's convenient-are the ones who will survive." The Perfect Storm The pressure is coming from every direction at once-and from below. America's infrastructure is aging faster than the country can repair it. Bridges, water systems, electrical grids, and HVAC systems that have kept the country running for decades are reaching end-of-life. Commercial contractors aren't just managing routine maintenance anymore-they're the front line keeping critical systems operational while racing to modernize them. On top of that infrastructure crisis, bidding has become brutal-nine in ten contractors report intensifying competition over the past year. Operations have grown more complex as regulatory requirements multiply and economic headwinds intensify. And perhaps most critically, the workforce crisis that's plagued the trades for years is getting worse, not better. Nearly half of all contractors report that more than one in five positions remain unfilled. Skilled labor remains scarce. Burnout is spreading across existing teams. The industry's traditional solution-hire more people-simply isn't working anymore. At the same time, demand is shifting in ways that require new capabilities. HVAC contractors are fielding requests for sophisticated electrification systems. Electricians are being tapped for data center work. Plumbers are installing high-tech efficiency systems. The one-size-fits-all jobsite is disappearing, and the work itself is growing more specialized. This convergence of challenges has created an existential question for contractors: How do you compete, grow, and deliver increasingly complex work when you can't find enough people to do it? The Technology Divide Nearly half are using AI for estimating-turning what used to take hours into minutes. Others are using it for jobsite search, compliance tracking, and administrative work. Among those facing the fiercest bidding competition, more than a third have turned to AI to generate faster, more accurate bids. The technology isn't replacing skilled trades work-it's eliminating the busywork that keeps skilled people from doing their jobs. "Three years ago, 78% AI adoption would have seemed unbelievable," continued Chanani. "Today, it's becoming baseline for staying competitive." But the 22% not yet using AI face a revealing barrier. The primary obstacle isn't cost or security concerns-it's training. Contractors don't lack faith in the technology. They lack knowledge of how to use it. And that training gap is creating two distinct classes of contractors: those learning to work with new tools, and those being left behind. The Outlook Divide The survey reveals something even more striking than the adoption gap: contractors using AI are starting to see a completely different future for the industry. Those using AI are far more likely to believe that Gen Z workers are transforming the trades with tech-savviness. They're more optimistic about the viability of remote or hybrid work for certain contractor roles. They're more confident that firms who can read the trends and act on them will prevail. Non-AI users, meanwhile, see a future that looks a lot more like the past. The technology gap isn't just changing how contractors work-it's changing what they believe is possible. "The firms using AI aren't just working differently-they're thinking differently," said Chanani. "That's the real divide we're seeing." The Stakes The window for action is closing. Four in five contractors believe AI will be essential to remain competitive within just three years. The industry is moving fast, and those on the sidelines are watching the gap widen in real time. Contractors understand the moment they're in. An overwhelming majority believe that firms who can read the trends and act on them will ultimately prevail. Many are tearing up the traditional playbook entirely-overhauling technology infrastructure, launching training programs, recruiting from adjacent industries, and rebuilding workflows from scratch. Despite the pressures, most contractors remain optimistic about their own futures. They believe their roles will endure. But that confidence appears increasingly tied to action, not wishful thinking. "This isn't about AI versus no AI," continued Chanani. "It's about firms that see what's coming and adapt, versus firms that keep doing things the old way expecting different results. The future of the trades won't be decided by who can use AI-but by who does." "Adoption isn't the hard part," Chanani added. "Action is." The research suggests that commercial contracting in 2025 isn't just changing-it's splitting. Into firms that evolve, and firms that don't. Into contractors who embrace new tools, and contractors who wait. Into businesses prepared for tomorrow's challenges, and businesses still fighting with yesterday's capabilities. For those still waiting, the question is simple: Which side will you be on? To download the complete report, visit: https://marketing.buildops.com/hubfs/PDF/BuildOps_ThePivotPoint.pdf About the Study "The Pivot Point: AI and The Future of Commercial Contracting" was conducted by Kickstand exclusively for BuildOps. The survey of 606 commercial contractors across the U.S. and Canada was fielded from August 12-21, 2025, with a 95% confidence level and +/- 4% margin of error. Respondents represented HVAC/mechanical, electrical, plumbing, fire/life safety, low voltage, and specialty trades. About BuildOps BuildOps is mission control for commercial contractors. Purpose-built to support the complexity of commercial service and project work, the BuildOps platform connects every team - from the office to the field - in one unified system of record and action. Trusted by leading HVAC, plumbing, electrical, refrigeration, fire safety, and mechanical contractors, BuildOps combines deep industry insight with powerful, practical technology. It helps contractors quote faster, schedule smarter, manage assets with clarity, and collect payments without the back-and-forth. From AI-powered dispatching to project cost control, BuildOps is where field execution meets executive oversight - giving contractors the control and visibility they need to scale with confidence. To learn more, visit buildops.com Media Contact Justin Mauldin Salient PR achievemore@salientpr.com SOURCE: BuildOps

BuildOps Frequently Asked Questions (FAQ)

When was BuildOps founded?

BuildOps was founded in 2018.

Where is BuildOps's headquarters?

BuildOps's headquarters is located at 2118 Wilshire Boulevard, Santa Monica.

What is BuildOps's latest funding round?

BuildOps's latest funding round is Series C.

How much did BuildOps raise?

BuildOps raised a total of $225.8M.

Who are the investors of BuildOps?

Investors of BuildOps include Fika Ventures, Stepstone Group, Next47, Titanium Ventures, Meritech Capital Partners and 27 more.

Who are BuildOps's competitors?

Competitors of BuildOps include Builder Prime, Joblogic, Raken, FieldPulse, ServiceTitan and 7 more.

Loading...

Compare BuildOps to Competitors

Comstruct provides services in the digitization and automation of materials purchasing for the construction industry. The company offers automated invoice verification, material data collection for project control and documentation, and CO2 emissions reporting for ESG compliance. Comstruct serves the construction sector with solutions focused on purchasing processes and project documentation. It was founded in 2020 and is based in Munich, Germany.

Buildertrend specializes in construction project management software within the technology sector. The company offers a cloud-based platform that provides tools for project planning, financial management, and client communication to streamline the construction process. Buildertrend primarily serves home builders, remodelers, specialty contractors, and commercial contractors. It was founded in 2006 and is based in Omaha, Nebraska.

Bolster is a company that specializes in construction management software within the construction industry. Their platform offers tools for estimating, scheduling, and project management. The software is designed to assist construction businesses in creating estimates, managing projects, and facilitating payments and invoicing. Bolster was formerly known as CostCertified. It was founded in 2016 and is based in Calgary, Alberta.

Foundation Software provides construction accounting software for the construction industry. The company offers products that include job costing, payroll, general ledger, accounts payable, accounts receivable, and certified public accountant (CPA) audit or review tools, aimed at helping contractors manage their business operations. Foundation Software's solutions are designed to address the specific needs of the construction sector, offering tools for financial management, project management, and mobile applications. It was founded in 1985 and is based in Strongsville, Ohio.

Workiz provides field service management software for service professionals in various industries. The company offers tools for scheduling, dispatching, invoicing, payment processing, and customer relationship management. Workiz serves sectors such as HVAC, plumbing, electrical, garage door, locksmith, and home repair services. Workiz was formerly known as Send A Job. It was founded in 2017 and is based in San Diego, California.

CMiC specializes in construction management software within the construction and capital projects industry. The company offers financial and project management software solutions to assist construction firms in managing aspects of financials, projects, resources, and content assets from a unified platform. It was founded in 1974 and is based in Toronto, Canada.

Loading...