bunq

Founded Year

2012Stage

Series B - III | AliveTotal Raised

$368.05MLast Raised

$31.41M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-59 points in the past 30 days

About bunq

bunq operates as a digital bank that offers various financial services. The company provides a mobile banking app with features for budgeting, saving, investing in stocks and crypto, credit card services, and support for multiple currencies. bunq serves individual consumers and businesses. It was founded in 2012 and is based in Amsterdam, Netherlands.

Loading...

bunq's Product Videos

bunq's Products & Differentiators

bunq account in 5 minutes

Bank account that's ready to use in 5 minutes

Loading...

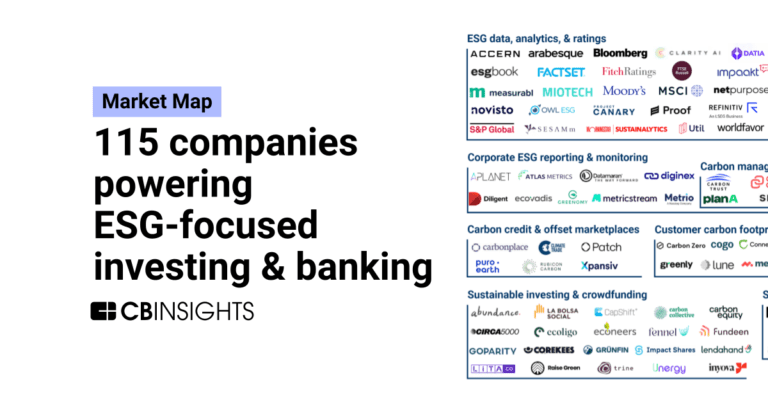

Research containing bunq

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned bunq in 1 CB Insights research brief, most recently on May 24, 2023.

Expert Collections containing bunq

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

bunq is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Fintech

14,203 items

Excludes US-based companies

Digital Banking

1,182 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Fintech 100

100 items

bunq Patents

bunq has filed 3 patents.

The 3 most popular patent topics include:

- banking

- banking technology

- international taxation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/18/2017 | 11/6/2018 | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop | Grant |

Application Date | 5/18/2017 |

|---|---|

Grant Date | 11/6/2018 |

Title | |

Related Topics | Windows Server System, Wireless networking, Cryptographic protocols, Network protocols, Remote desktop |

Status | Grant |

Latest bunq News

Nov 6, 2025

Writer Expected time to read 2 min A slowdown in cost increases across Western Europe, alongside rising prices in parts of Eastern Europe, is creating a more varied picture of affordability for expats and remote workers, according to bunq’s latest findings from the Working Abroad Index 2025. With the global digital nomad community now exceeding 40 million, borderless living has become an established part of modern work life. The annual index tracks the cost of living across 27 European cities, accounting for housing, transport, utilities, groceries, and coworking spaces. In 2025, London recorded the largest coworking price drop in Europe (-28.7%), followed by Helsinki (-27.3%), Paris (-24.5%) and Dublin (-24.4%), signalling a major correction in flexible workspace prices across Western capitals. While these cities remain generally expensive, the drop marks a potential turning point in London’s cost landscape, improving its appeal as a more accessible hub for digital nomads, startups, and international talent. London’s living costs ease as Europe’s shows early signs of stabilisation Digital nomads are beginning to see slower increases in everyday expenses across Western Europe, marking the first signs of price stabilisation. Average living costs across European capitals rose 3.6% year-on-year, the smallest increase since before the pandemic and down from 5% in 2024. In London, overall living costs fell slightly compared to 2024, reaching £2,830 (€3,215 −0.3%). The city also recorded one of the largest drops in utility prices in Western Europe, down 13.9%, while grocery costs fell by 6.7%. Although average rent rose by 2.6%, from £1,985 (€2,255) in 2024 to £2,036 (€2,314) in 2025, this represents a slower rate of increase than in 2024. These changes indicate a possible sign of relative stability in London’s cost landscape, with easing expenses in areas like energy and food helping to balance persistently high rent and transport prices. Helsinki experienced the largest overall decrease in living costs among European capitals, down 2.2% year-on-year, while Dublin saw smaller shifts in overall living costs but recorded some of the most significant drops in utilities (−12%) and transport costs (−9.7%). A narrowing East-West cost divide creates a potential new paradigm Although London remains one of Europe’s most expensive capitals, early signs suggest a narrowing of the East–West cost divide. While London is now showing signs of stabilisation, several Central and Eastern European cities are seeing increases in everyday expenses. Living costs have jumped 12.5% in Sofia, 9.5% in Zagreb, and 8.9% in Budapest. Coinciding with this trend is an even steeper increase in rent costs: 20.9% in Sofia, 11.8% in Zagreb, and 11.2% in Budapest. Despite these increases, the affordability gap remains significant: a central one-bedroom apartment in Sofia (£547/€622) still costs less than a quarter of London’s average (£2,316/€2,632). Emerging mid-tier cities gaining ground Meanwhile, Southern and Baltic cities are consolidating their position as attractive bases for long-stay professionals and remote workers. Athens (£964/€1,095) remains among the most affordable capitals in Europe, recording a slight -0.9% decrease in average living costs since 2024. Vilnius (£1,013/€1,151; +0.3%), Riga (£918/€1,044; +4%), Tallinn (£1,116/€1,268; +6.3%), and Nicosia (£1,037/€1,179; +5.6%) all recorded modest year-on-year increases while remaining below the Western European average. Strong connectivity and quality of life in these mid-size cities can continue to attract long-stay professionals and remote workers. Joe Wilson, Chief Evangelist at bunq: “Living abroad should fit your life, not the other way around. Our research shows where your money goes, so expats can make choices that match their lifestyle: spend smarter, enjoy more, and focus on the experiences that matter.” For more startup news , check out the other articles on the website, and subscribe to the magazine for free. Listen to The Cereal Entrepreneur podcast for more interviews with entrepreneurs and big-hitters in the startup ecosystem. Share This Article

bunq Frequently Asked Questions (FAQ)

When was bunq founded?

bunq was founded in 2012.

Where is bunq's headquarters?

bunq's headquarters is located at Basisweg 32, Amsterdam.

What is bunq's latest funding round?

bunq's latest funding round is Series B - III.

How much did bunq raise?

bunq raised a total of $368.05M.

Who are the investors of bunq?

Investors of bunq include Pollen Street Capital.

Who are bunq's competitors?

Competitors of bunq include Finom, GoDutch, Revolut, Monese, Qonto and 7 more.

What products does bunq offer?

bunq's products include bunq account in 5 minutes and 4 more.

Loading...

Compare bunq to Competitors

Qonto provides banking, financing, bookkeeping, and spend management for businesses. The company offers a business account that includes payment cards, local and international transfers, financing options, and tools for invoicing, expense management, and accounting. Qonto serves self-employed individuals, freelancers, micro-businesses, small and medium enterprises (SMEs), and associations. It was founded in 2016 and is based in Paris, France.

Revolut operates as a financial technology company that provides a digital banking platform. It offers financial services including money management tools, foreign exchange trading, cryptocurrency transactions, and investment services. The company serves individual consumers who want to manage finances. It was founded in 2015 and is based in London, United Kingdom.

Bitwala is a cryptocurrency investment platform operating within the fintech sector. The company offers services including buying, storing, and saving cryptocurrencies, instant euro transfers, biometric crypto storage, and payments with a Visa card. Bitwala serves individuals looking to incorporate cryptocurrency into their financial activities. Bitwala was formerly known as Nuri. It was founded in 2014 and is based in Berlin, Germany.

Allica Bank specializes in financial services for established businesses and focuses on banking solutions within the financial sector. The company offers a range of products including business current accounts, savings accounts, asset finance, commercial mortgages, and growth finance. It caters primarily to small and medium-sized enterprises with a suite of financial products designed to meet their banking needs. Allica Bank was formerly known as Civilised Bank. It was founded in 2019 and is based in London, United Kingdom.

Tide serves as a financial technology company that provides business banking services and financial management tools for small and medium-sized enterprises (SMEs). The company offers services including digital business accounts, invoicing, accounting, savings solutions, loans, and company registration services. Tide primarily serves the SME sector with various products. It was founded in 2015 and is based in London, United Kingdom.

Atom bank is a digital bank that provides financial services such as savings accounts, mortgages, and business loans. The company offers savings products with various interest rates, mortgage solutions, and business financing options, all managed through a mobile app. Atom bank serves individuals and small to medium-sized enterprises seeking banking solutions. It was founded in 2014 and is based in Durham, England.

Loading...