C6 Bank

Investments

2Portfolio Exits

4Partners & Customers

6About C6 Bank

C6 Bank is a mobile-only bank. Its services include checking and savings accounts, debit and credit cards, free toll tags, multi-currency global accounts, investments, and lending products. The company was founded in 2018 and is based in Sao Paulo, Brazil.

Research containing C6 Bank

Get data-driven expert analysis from the CB Insights Intelligence Unit.

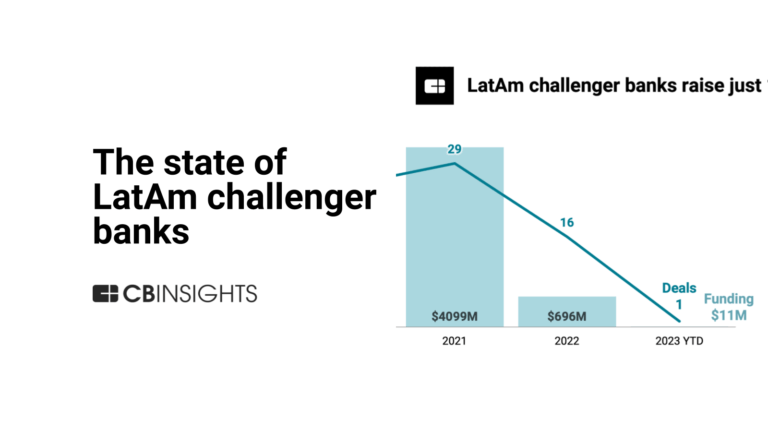

CB Insights Intelligence Analysts have mentioned C6 Bank in 1 CB Insights research brief, most recently on Aug 7, 2023.

Latest C6 Bank News

Nov 18, 2025

Cássia Botelho/Fin | Imagem: print de tela A Confederação Nacional das Instituições Financeiras (Fin) entregou nesta terça-feira (18/11) o “Selo de Prevenção a Fraudes 2025” a 22 instituições, incluindo grandes bancos, neobancos e sistemas cooperativos. A iniciativa, lançada em 2024 pela entidade , reúne bancos, fintechs e instituições de pagamento para reforçar a integridade e a segurança das operações financeiras no Brasil. Participam desta nova etapa representantes de associadas da Fin: Associação Brasileira de Bancos (ABBC), Associação Nacional das Instituições de Crédito, Financiamento e Investimento (Acrefi), Federação Brasileira de Bancos (Febraban) e Zetta, associação que representa instituições financeiras e de pagamento brasileiras, como os maiores bancos digitais do País. No primeiro ciclo da iniciativa, foram certificadas 17 instituições. Dessas, 13 se mantêm na etapa de 2025. Entre elas, os maiores bancos – Banco do Brasil (BB), Bradesco, Caixa Econômica Federal, Itaú Unibanco e Santander -, mas também bancos digitais como Inter, C6 Bank e BS2. Como “estreantes” do selo, estão nove instituições, incluindo nomes como CloudWalk, Efí Bank, Nubank e PicPay. Veja relação completa ao final da matéria. Durante a cerimônia de entrega do selo, Cássia Botelho, diretora-superintendente da Fin, disse que o processo de avaliação das instituições envolveu quase 7 mil horas de análise de procedimentos, cerca de 60 reuniões e uma metodologia que considera oito pilares. “Foi um processo árduo, que promoveu todo o engajamento do setor, uma forma de antecipar toda a problemática do processo de prevenção a fraudes e golpes, de maneira colaborativa”, afirmou ela. Colaboração Em meio ao aumento de golpes e fraudes, Cássia defendeu que o setor financeiro avance de forma coordenada. “A gente vê novas resoluções do Banco Central, várias boas práticas que todos identificamos que podemos implementar mais rapidamente para avançar o processo evolutivo, para essa concessão do selo”, disse. De acordo com ela, no início de 2026, haverá um comitê técnico, com participação aberta às associadas de Febraban, Zetta, Acrefi e ABBC. Ivo Mósca, diretor-executivo da Febraban, reforçou que o combate aos golpes e fraudes é contínuo no setor. “Não esperem dos bancos brasileiros e do sistema financeiro que fiquemos de braços cruzados. Usaremos todos os meios para enfrentar essa realidade. Não nos faltarão criatividade, resiliência, investimentos vultosos e ações concretas para coibir golpes financeiros e fraudes”, disse. “A integridade dos dados e das operações dos nossos clientes é prioridade dos bancos brasileiros.” Leia também Para Eduardo Lopes, presidente da Zetta, o sucesso da inovação e da digitalização dos serviços financeiros “vem com um custo”, que é o maior tempo online das pessoas, abrindo espaço para golpes e fraudes. “Obviamente esse sucesso todo atraiu o lado negativo, que é a criminalidade. Então, os criminosos passaram a explorar também o tempo online e a vulnerabilidade das pessoas, com uso de engenharia social para praticar golpes e fraudes. E a gente não está disposto como sociedade a retroceder nessa agenda”, apontou. Felipe Natale, superintendente jurídico e legislativo da ABBC, destacou a escalada dos golpes e fraudes no setor financeiro em 2025. “Assistimos a uma intensificação significativa das ações de quadrilhas especializadas, com golpes cada vez mais sofisticados, organizados e persistentes. Os fraudadores evoluíram em métodos, velocidade e capacidade de adaptação”, afirmou. Histórico O primeiro ciclo do selo foi realizado em 2024 , sob coordenação da Febraban, resultando na certificação de instituições bancárias que cumpriram requisitos de segurança e conformidade. A governança passou à Fin com o objetivo de ampliar o alcance da iniciativa para outros segmentos, incluindo instituições de pagamento e fintechs. Para obter o selo, as instituições interessadas devem formalizar o pedido junto à Fin. A certificação tem validade de 12 meses. Há possibilidade de renovação após nova avaliação. O selo atesta que a instituição financeira possui processos eficientes de prevenção, detecção e conscientização sobre fraudes. Demonstra alinhamento com as melhores práticas de mercado, atendendo às exigências legais e aos padrões de autorregulação em áreas como: prevenção e mitigação de fraudes e golpes; cooperação e parcerias externas no combate a fraudes; gestão de risco transacional e governança de segurança; conscientização e educação sobre prevenção de fraudes; procedimentos rigorosos para abertura de contas. Veja as “aprovadas”

C6 Bank Investments

2 Investments

C6 Bank has made 2 investments. Their latest investment was in Provi as part of their Corporate Minority on .

C6 Bank Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

Corporate Minority | Provi | Yes | 2 | |||

Other Investors |

Date | ||

|---|---|---|

Round | Corporate Minority | Other Investors |

Company | Provi | |

Amount | ||

New? | Yes | |

Co-Investors | ||

Sources | 2 |

C6 Bank Portfolio Exits

4 Portfolio Exits

C6 Bank has 4 portfolio exits. Their latest portfolio exit was Provi on August 24, 2023.

C6 Bank Acquisitions

3 Acquisitions

C6 Bank acquired 3 companies. Their latest acquisition was Banco FICSA on August 21, 2020.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

8/21/2020 | Acquired | 1 | ||||

10/15/2019 | ||||||

8/23/2019 |

Date | 8/21/2020 | 10/15/2019 | 8/23/2019 |

|---|---|---|---|

Investment Stage | |||

Companies | |||

Valuation | |||

Total Funding | |||

Note | Acquired | ||

Sources | 1 |

C6 Bank Partners & Customers

6 Partners and customers

C6 Bank has 6 strategic partners and customers. C6 Bank recently partnered with Thought Machine on December 12, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

12/9/2022 | Vendor | United Kingdom | Brazil’s C6 Bank taps Thought Machine for core banking technology Brazilian bank for individuals and businesses , C6 Bank , has partnered up with Thought Machine to utilise its core banking technology . | 2 | |

10/26/2022 | Vendor | ||||

1/1/2022 | Vendor | ||||

3/26/2020 | Partner | ||||

Vendor |

Date | 12/9/2022 | 10/26/2022 | 1/1/2022 | 3/26/2020 | |

|---|---|---|---|---|---|

Type | Vendor | Vendor | Vendor | Partner | Vendor |

Business Partner | |||||

Country | United Kingdom | ||||

News Snippet | Brazil’s C6 Bank taps Thought Machine for core banking technology Brazilian bank for individuals and businesses , C6 Bank , has partnered up with Thought Machine to utilise its core banking technology . | ||||

Sources | 2 |

C6 Bank Team

9 Team Members

C6 Bank has 9 team members, including current Chief Executive Officer, Evilian Barreto Goes.

Name | Work History | Title | Status |

|---|---|---|---|

Evilian Barreto Goes | Chief Executive Officer | Current | |

Name | Evilian Barreto Goes | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Chief Executive Officer | ||||

Status | Current |

Compare C6 Bank to Competitors

Banco Original specializes in providing digital banking services for both individual and corporate clients. The bank offers a range of financial products, including online account opening, personalized credit solutions, and specialized services for the agribusiness sector. It caters to large enterprises and the agricultural industry with tailored financial services and support. It was founded in 2001 and is based in Sao Paulo, Brazil.

Sicredi is a financial cooperative that offers a range of banking and financial services across various sectors. The company provides personal, business, and agribusiness banking solutions, including accounts, credit, investments, and insurance, tailored to meet the needs of its members. Sicredi primarily serves individuals, businesses, and the agribusiness sector with its financial products and services. It was founded in 1995 and is based in Porto Alegre, Brazil.

Agibank operates ad a digital bank offering financial services including personal loans, credit cards, and various insurance products. It primarily serves individuals seeking banking and credit solutions. It was founded in 1999 and is based in Sao Paulo, Brazil.

Banco Safra provides banking solutions and investment services within the financial sector. The company offers various financial products including investment portfolios, advisory services, credit and financing options, currency exchange, and insurance. Banco Safra serves individual and corporate clients with an emphasis on managing wealth and investments. It was founded in 1955 and is based in sau paulo, Brazil.

Banco Rendimento is a commercial bank focusing on the Middle-Market sector. The bank offers a range of credit operations, including loans, guarantees, and foreign trade services, as well as currency exchange and international financial services. Its primary clientele consists of companies with significant annual revenues seeking tailored financial solutions. It was founded in 1992 and is based in Sao Paulo, Brazil.

Genial Investimentos operates as a financial services platform in the finance sector. It provides access to quality financial services with a focus on simplicity and efficiency. The company caters to individuals seeking innovation and inclusivity in their financial activities. It was formerly known as Brasil Plural. It was founded in 2009 and is based in Sao Paulo, Brazil.

Loading...