Human Interest

Founded Year

2015Stage

Series E - II | AliveTotal Raised

$855.72MValuation

$0000Last Raised

$100M | 4 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+17 points in the past 30 days

About Human Interest

Human Interest provides plans for the retirement savings industry, catering to small and medium-sized businesses. The company offers retirement savings plans without transaction fees, allowing businesses to help their employees invest for retirement. Human Interest provides technology solutions to manage the administrative and compliance aspects of retirement plans for its clients. Human Interest was formerly known as Captain401. It was founded in 2015 and is based in San Francisco, California.

Loading...

Human Interest's Product Videos

Human Interest's Products & Differentiators

401(k)

Human Interest 401(k) is a full-service solution for businesses that want all the benefits of a modern 401(k) plan without the burdensome administrative responsibility.

Loading...

Research containing Human Interest

Get data-driven expert analysis from the CB Insights Intelligence Unit.

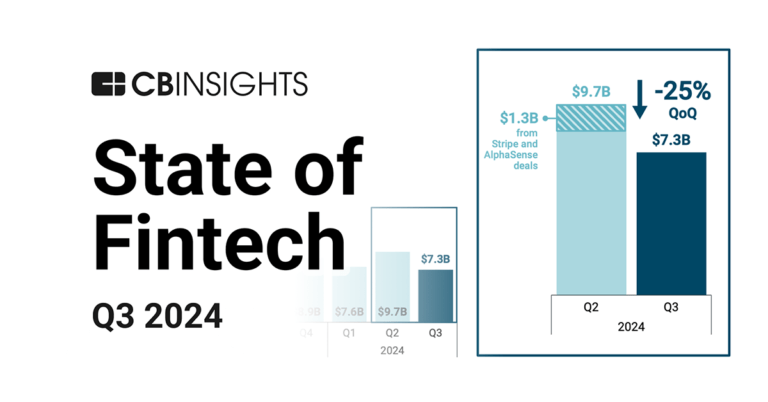

CB Insights Intelligence Analysts have mentioned Human Interest in 3 CB Insights research briefs, most recently on Oct 15, 2024.

Oct 15, 2024 report

State of Fintech Q3’24 ReportExpert Collections containing Human Interest

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Human Interest is included in 7 Expert Collections, including HR Tech.

HR Tech

6,260 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,309 items

Wealth Tech

2,723 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

SMB Fintech

2,003 items

Fintech 100

750 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Financial Wellness

245 items

Track startups and capture company information and workflow.

Latest Human Interest News

Oct 31, 2025

The retirement industry can still make big strides to help participants realize tax-advantaged strategies when taking plan distributions. Reported by Offering workers a strong retirement savings plan is key to helping them save for their future, and allowing participants to make both pre-tax and Roth post-tax deferrals gives them even more of a leg up by providing them a mix of taxed assets. Plans have increasingly enabled participants to save in this way, and thanks to a mandate in the SECURE 2.0 Act of 2022 for catch-up contributions to be made as Roth, those contributions will only grow. In theory, participants should then be able to make withdrawals in alignment with tax strategies, industry experts say that is not always how it shakes out. Plans and providers often require participants to make distributions pro rata, pulling from all investments (including both Roth and pre-tax accounts) equally, which mitigates what could be a massive benefit to savers. Not allowing a participant to choose, for example, a Roth-only distribution “takes away the benefit of having the Roth to begin with,” says Joseph Perry, the national tax leader at CBIZ. “If you’re not able to do that, it disadvantages taxpayers in the way the law was set up to benefit taxpayers.” The Plan Default Workers who are at least 50 years old can save more than the typical limits that apply to workplace retirement plans in the form of “catch-up contributions.” But if an employee earns more than $145,000, SECURE 2.0 included a mandate that, starting in 2026, any catch-up contributions made by those high earners have to be made on a Roth basis. The IRS lets participants take distributions from 401(k)s and similar workplace retirement plans by either designating distributions by contribution type (pre-tax or Roth) or by taking them proportionally from all contributions. Whether or not a participant can self-select distributions by contribution type within a plan depends on whether the plan sponsor allows the option and whether recordkeepers choose to accommodate those requests. Most policy plans default to Roth as the last source distributed to maximize non-taxable earning distribution at retirement, explains Lea Smith, a retirement plan and ERISA specialist at Human Interest. But if a plan design does not allow participants to specify pre-tax Roth to draw from to make distributions, the recordkeeper must stick to what the plan document requires. As a result, some recordkeepers have to pull from all accounts (both Roth and pre-tax) and from all investments equally, and do not have the capability to let participants choose one type of distribution over the other. Limitations for Participants While most providers are in a “really good spot,” operationally, when it comes to managing the new Roth catch-up provisions, the mechanisms for taking money out of the accounts later needs to be discussed more, says Joe Connell, principal at Sikich Financial. “Not being able to pull from a specific account would be a really defeating strategy for [participants] to manage their personal tax situations,” Connell says. “From the recordkeeper standpoint, we’re really not helping participants manage retirement income in a way that is going to be best for them by not giving them the ability to draw Roth-only or pre-tax only.” Smith points out that, “While the new mandate will likely impact the way recordkeepers address contributions, the treatment of distributions, or ‘ordering rules,’ is not new and has been around since Roth first came into effect.” Some Recordkeepers Have Added Provisions Offering participants the chance to choose the source of their distributions is not common practice in plan design, but there are ways for recordkeepers to provide it. Human Interest is among the recordkeepers that allow the participant to direct the ordering of distributions, so that they may elect to have payments made first or last from a Roth account, Smith says. Again, providing this option is at the discretion of the plan sponsor. T. Rowe Price rolled out capabilities to directly address the need in 2023 and has further enhancements in the pipeline, according to Adam Tremper, the company’s head of retirement platforms. He says the existing options allow plan sponsors to set specific distribution options at a plan level, which then allow participants to elect distributions from specified sources (e.g. all Roth or everything but Roth) or specified funds, such as all employer stock or everything but employer stock. The most prevalent use case, he adds, is the flexibility to pick and choose when you do or don’t distribute from Roth sources. “We are also currently developing expanded capabilities that will allow participants full flexibility to select exactly which sources, funds or combination of the two they’d like distributed,” Tremper says. At Fidelity, a spokesperson said that “Fidelity and most other recordkeepers have the capabilities for participants to select pre-tax vs. Roth at the time of distribution. Whether a participant is ultimately able to make those self-directed selections depends on whether the plan sponsor allows for those capabilities in their plan.” Connell says while some recordkeepers are offering flexibility, it’s more often a one-off solution and not available to the tens of millions of participants whose plans are recordkept by the largest providers. But it would make sense for more recordkeepers to make this change. “This would be something that would be an easy way for them to enhance the capabilities of their services,” he adds. “You would think it would pay for itself with the increased amount of assets that don’t have to roll into an individual retirement account to be able to do these customized decisions on whether they think they take their money out pre-tax.” One-off solutions also put more work on the advisers who are trying to be proactive, but may need to pick up the phone and speak to a representative at a recordkeeper, one who sometimes may be unfamiliar with the practice. “I’m worried about how it would work on a grand scale for those who never get to talk to an adviser and get that personal help,” Connell adds. More on this topic:

Human Interest Frequently Asked Questions (FAQ)

When was Human Interest founded?

Human Interest was founded in 2015.

Where is Human Interest's headquarters?

Human Interest's headquarters is located at 655 Montgomery Street, San Francisco.

What is Human Interest's latest funding round?

Human Interest's latest funding round is Series E - II.

How much did Human Interest raise?

Human Interest raised a total of $855.72M.

Who are the investors of Human Interest?

Investors of Human Interest include BlackRock, Baillie Gifford, Marshall Wace Asset Management, TPG, Morgan Stanley Tactical Value and 44 more.

Who are Human Interest's competitors?

Competitors of Human Interest include Wealthsimple, Guideline, FOLIO, Vestwell, Icon Savings Plan and 7 more.

What products does Human Interest offer?

Human Interest's products include 401(k) and 3 more.

Loading...

Compare Human Interest to Competitors

Wacai operates as a fintech company. It develops an online personal financial management platform that provides users with wealth management services and credit solutions. The company was founded in 2009 and is based in Hangzhou, China.

Betterment is a digital investment advisor that provides services in the financial services sector. The company offers services such as investing with diversified portfolios, cash accounts, and retirement savings options. Betterment caters to individual investors looking to grow their wealth through various portfolio options and tax-related features. It was founded in 2010 and is based in New York, New York.

ForUsAll offers a platform that enables employers to provide a modern 401(k) plan. The company offers 401(k) plans for startups and small businesses, with features such as payroll integration, the ability to add cryptocurrency to the plan, and automated administration. It caters to the startup sector, small to medium-sized businesses, and blockchain and web3 companies. The company was founded in 2012 and is based in San Francisco, California.

SigFig is a company that provides digital wealth management solutions within the financial services industry. Their offerings include digital tools for financial institutions, such as banks and wealth management firms, to support account opening, client onboarding, and portfolio management. It was founded in 2006 and is based in San Francisco, California.

Raisin operates as a financial technology company specializing in savings and investment products. The company connects consumers with banks to offer interest rates and provides banks with refinancing options. Raisin serves the financial services industry, facilitating access to savings and investment opportunities across multiple countries. It was founded in 2012 and is based in Berlin, Germany.

Wealthsimple provides various investing products. The company offers services including managed investing, trading, and savings accounts, aimed at individual investors who want to grow their personal wealth through different investment options. It was founded in 2014 and is based in Toronto, Canada.

Loading...