CentML

Founded Year

2022Stage

Acquired | AcquiredTotal Raised

$30.5MValuation

$0000About CentML

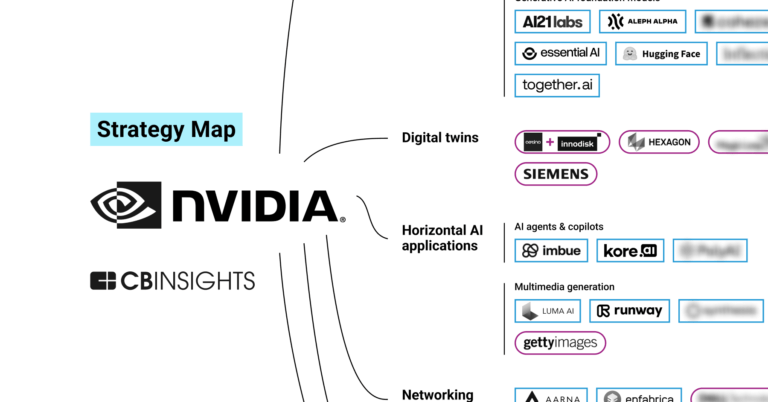

CentML offers an optimization platform for ML training. It focuses on artificial intelligence and machine learning in the technology sector. The company offers an optimization platform for machine-learning training, which allows users to train and deploy own machine-learning models. CentML was founded in 2022 and is based in Toronto, Canada. In June 2025, CentML was acquired by NVIDIA.

Loading...

ESPs containing CentML

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The hardware-aware AI optimization market provides software solutions that optimize AI algorithms and models to run efficiently on available hardware, such as GPUs and CPUs. These solutions also allow enterprises to compress neural networks to run on edge devices or on-prem servers. With optimization tools, businesses can speed up AI deployments, reduce prediction latency, and improve model perfor…

CentML named as Highflier among 10 other companies, including Edge Impulse, Run:ai, and Latent AI.

CentML's Products & Differentiators

CentML Inference Platform

The CentML Inference Platform is a a secure, full stack solution for AI development and deployment. Users can deploy any open-source model on their cloud provider of choice (or on-prem hardware) and affordably scale usage with our performance optimizations.

Loading...

Research containing CentML

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CentML in 4 CB Insights research briefs, most recently on Jul 31, 2025.

Expert Collections containing CentML

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

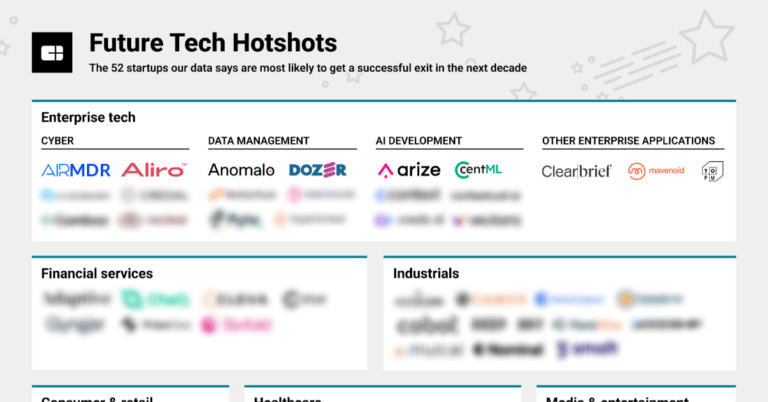

CentML is included in 3 Expert Collections, including Artificial Intelligence (AI).

Artificial Intelligence (AI)

37,256 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Future Tech Hotshots

52 items

The 52 startups our data says are most likely to get a successful exit in the next decade

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Latest CentML News

Oct 31, 2025

Leaders at HardTech Summit optimistic about Canadian mergers but want more support for scaleups. At VentureLab ’s HardTech Summit this week, the spotlight was on how to build Canada’s semiconductor sector amid rising pressure from the United States (US) and shifting geopolitical conditions. These conversations come in the wake of multiple promising Canadian artificial intelligence (AI) chip startups either moving south or getting snapped up by larger American players, including CentML , Hyperlume , Tenstorrent , and Untether AI . “It’s validation by the market that what we’re building is worth a lot, people want it, and they’re willing to pay for it.” Niraj Mathur, Blumind Canadian semiconductor leaders BetaKit spoke with at the summit said this recent activity is positive, and believed that a successful ecosystem features both independent domestic startups and big foreign players with deep Canadian operations. However, they also argued that Canada should do more to support its own chip companies, particularly at later stages, to ensure that the full economic benefits of local innovation, talent, and intellectual property don’t flow south. Toronto-based AI chipmaker Untether recently filed for bankruptcy following an acquihire by US semiconductor firm Advanced Micro Devices (AMD). Ottawa peer Hyperlume also recently sold to US-based Credo mere months after raising a $12.5-million USD seed round to commercialize its tech for AI data centres. Toronto’s CentML, which helps businesses maximize their existing hardware, was acquired by US AI chip giant Nvidia in a deal that could reportedly top $400 million USD. This flurry of Canadian AI chip mergers and acquisitions follows Toronto AI semiconductor developer Tenstorrent’s relocation to the US last year to help it raise more money from American investors and prepare for an eventual public listing. The company closed a nearly $700-million USD Series D at a $2.6-billion valuation shortly afterward. Niraj Mathur, co-founder and CEO of Ottawa AI chip developer Blumind , argued to BetaKit that this recent activity sends a “very positive” signal about growing recognition concerning the importance of semiconductors to the AI stack and the level of Canadian innovation in the space, adding that this has led to increased investment in startups like his own. “It’s validation by the market that what we’re building is worth a lot, people want it, and they’re willing to pay for it,” Mathur said. Kevin Conley, CEO of Kitchener-Waterloo semiconductor startup Applied Brain Research, told BetaKit he is “not worried” about these deals. He said the US views Canada “as a treasure trove of AI talent.” The Silicon Valley-based executive, who has spent his career working in the chip industry and previously held leadership positions at SanDisk, said that it is “really hard” for small semiconductor companies to grow into bigger players. He noted that large chip firms typically grow through mergers and acquisitions. “It’s a really tough business to scale, so you have to have deep pockets, or you have to have an incredible ability to attract customer revenue,” Conley said. Building hard tech startups in Canada comes with some advantages and disadvantages. Conley noted that Canada has “a lot of support” that does not exist in the US, such as government incentives and research programs. Hamid Arabzadeh, chair and CEO of Ottawa chipmaker Ranovus , nonetheless noted on stage that the country is lacking when it comes to later-stage risk capital for hard tech scaleups. His assertion appears to be echoed in data from the Canadian Venture Capital & Private Equity Association (CVCA). Mathur argued that Canada is great at supporting early-stage startups but does a poor job of helping scaleups that typically require bigger bets—more capital and greater risk—to succeed independently. “That’s when our risk-averse nature kicks in,” he said. “Support for those kinds of companies is limited in Canada, and that’s exactly why they become prime acquisition targets.” Even so, Mathur anticipates that US acquirers that maintain operations here will produce more spinoffs down the road. “Support for those kinds of companies is limited in Canada, and that’s exactly why they become prime acquisition targets.” Hyperlume co-founder and former CEO Mohsen Asad predicts that this will hold true over the long run for his company, which he believes will be able to accelerate its vision under the Credo umbrella. Asad, who is now Credo’s senior director of core technologies, told BetaKit that Hyperlume’s Canadian team has remained intact in Canada, and said the company is scaling its presence in the country. Asad argued that deals like this keep and create more cutting-edge tech jobs in Canada, ensuring greater support and nourishing more domestic entrepreneurship over time—something he acknowledged the industry could also use. “It’s not just a single recipe … sometimes it makes sense to go path number one, sometimes path number two,” Asad said. Toronto Global vice-president of investment attraction Daniel Hengeveld also thinks there is a role for foreign direct investment to play in building up Canada’s chip industry. “There is a way to open the door to foreign corporations coming in, investing, and doing great things here,” Hengeveld said on stage. “If we keep that door closed … then we automatically rule ourselves out from being able to compete in the space.” Fellow panellist Chris Smith, corporate vice-president at AMD and head of the firm’s Toronto Markham Design Centre, said Canada’s need to invest in domestic companies and infrastructure should not preclude the country from taking advantage of companies like AMD that are interested in building a strong presence here. AMD has done just that since acquiring Greater Toronto Area (GTA)-based graphics chip developer ATI Technologies in 2006. Smith said AMD now has over 3,000 engineers in the GTA, which marks one of the US semiconductor giant’s largest global research and development centres. The HardTech Summit Expo Hall. As to what Canada could do to grow its semiconductor ecosystem beyond simply supporting more scaleups, Hengeveld argued that the country must pick its lanes since it does not have the capacity to invest in everything across the board. Instead, he wanted the country to focus on strengths like talent. While Smith believed that some entrepreneurs want to move to the US because it is easier to raise money there, he felt Canada remains the place to be for talent and research. He wanted pathways to attract that talent. “As Canadians, we have this humble tendency, which I think, in general, is a great thing. However, we’re talking about a global war for talent and for innovation, and I think in that capacity, we have to be bold,” Smith said. Arabzadeh said on stage that he thinks Canada needs to incentivize local industry leaders with deep experience to leave multinational chip firms and build new companies. He suggested that the government could help by eliminating the capital gains tax for semiconductor companies’ windfalls. He shared this recommendation with the feds, telling them they would not lose any money given the current activity in the space. “We need to think out of the box,” Arabzadeh said. “We have such a small community.” All images courtesy VentureLab

CentML Frequently Asked Questions (FAQ)

When was CentML founded?

CentML was founded in 2022.

Where is CentML's headquarters?

CentML's headquarters is located at 22 Adelaide Street West, Toronto.

What is CentML's latest funding round?

CentML's latest funding round is Acquired.

How much did CentML raise?

CentML raised a total of $30.5M.

Who are the investors of CentML?

Investors of CentML include NVIDIA, NVIDIA Inception Program, Radical Ventures, Gradient Ventures, Deloitte Ventures and 8 more.

Who are CentML's competitors?

Competitors of CentML include Nota AI and 5 more.

What products does CentML offer?

CentML's products include CentML Inference Platform and 2 more.

Loading...

Compare CentML to Competitors

Radium provides enterprise artificial intelligence (AI) cloud solutions, focusing on the lifecycle of artificial intelligence development and deployment. Its offerings include a platform for training, fine-tuning, and deploying AI models, with features that support AI computing. The company's services are aimed at sectors that require AI capabilities, such as research institutions and enterprises interested in generative AI technologies. It was founded in 2019 and is based in Toronto, Canada.

Lambda operates as a company that provides graphics processing unit (GPU) cloud computing services for artificial intelligence (AI) training and inference within the technology sector. Its offerings include on-demand and reserved cloud instances with NVIDIA GPU architectures, as well as private cloud solutions and orchestration tools for managing AI workloads. Lambda serves sectors that require high-performance computing for artificial intelligence, including technology firms, research institutions, and enterprises with AI initiatives. Lambda was formerly known as Lambda Labs. It was founded in 2012 and is based in San Jose, California.

Pienso specializes in generative AI within the artificial intelligence industry. The company offers a no-code solution that enables subject matter experts to train Large Language Models (LLMs) to interpret and utilize their business data without requiring programming skills. Its platform is designed to be interoperable with major LLM providers and can be deployed both in the cloud and on-premises, ensuring data privacy and sovereignty for organizations. Pienso was formerly known as UBQ Labs, Inc. It was founded in 2016 and is based in Arlington, Virginia.

Fractile develops chips for AI model inference, focusing on large language models. The company aims to reduce the time and cost of processing by addressing bottlenecks in existing hardware through the integration of computation and memory. Fractile was formerly known as Neu Edge. It was founded in 2022 and is based in Newbury, United Kingdom.

Letta specializes in developing AI agents within the technology sector. The company offers a platform that enables the creation, deployment, and management of AI agents with memory and reasoning capabilities, supported by a visual interface and APIs. Letta serves the artificial intelligence and machine learning industry. It was founded in 2024 and is based in San Francisco, California.

DataRobot provides artificial intelligence (AI) applications and platforms within the enterprise AI suite and agentic AI platform domains. Its offerings include a suite of AI tools that integrate into business processes, allowing teams to manage AI, along with AI governance, observability, and foundational tools. DataRobot serves sectors including finance, supply chain, energy, financial services, government, healthcare, and manufacturing, and collaborates with NVIDIA and SAP. It was founded in 2012 and is based in Boston, Massachusetts.

Loading...