Cerebral

Founded Year

2019Stage

Series C | AliveTotal Raised

$462MValuation

$0000Last Raised

$300M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+69 points in the past 30 days

About Cerebral

Cerebral focuses on providing online mental health care services within the healthcare sector. The company offers virtual therapy, medication management, and personalized treatment plans for individuals with mental health conditions such as anxiety and depression. It serves clients accessible and coordinated mental healthcare solutions. It was founded in 2019 and is based in Claymont, Delaware.

Loading...

ESPs containing Cerebral

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The D2C prescription behavioral health services market offers mental health and behavioral health services directly to consumers, typically without the need for traditional in-person healthcare provider involvement. These services leverage digital platforms, telemedicine, and personalized approaches to provide convenient, accessible, and evidence-based solutions for individuals seeking treatment f…

Cerebral named as Challenger among 11 other companies, including Teladoc Health, Talkspace, and Hims.

Loading...

Research containing Cerebral

Get data-driven expert analysis from the CB Insights Intelligence Unit.

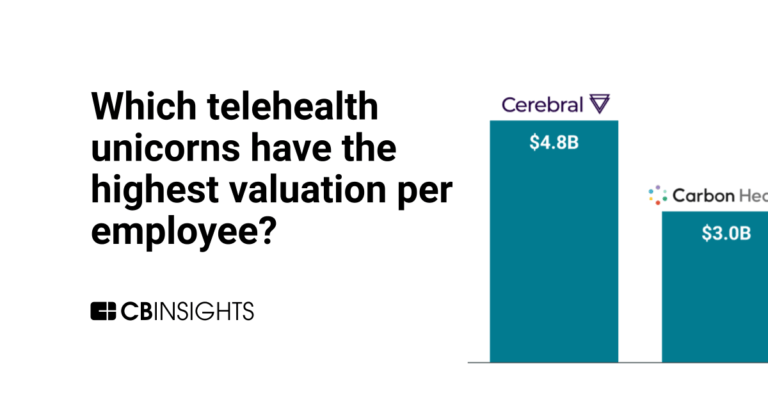

CB Insights Intelligence Analysts have mentioned Cerebral in 2 CB Insights research briefs, most recently on Sep 13, 2023.

Sep 13, 2023

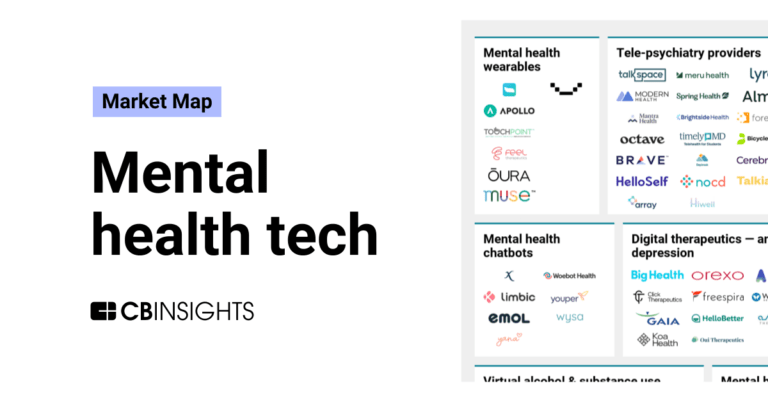

The mental health tech market mapExpert Collections containing Cerebral

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cerebral is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,123 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Mental Health Tech

791 items

This collection includes companies applying technology to problems of emotional, psychological, and social well-being. Examples include companies working in areas such as substance abuse, eating disorders, stress reduction, depression, PTSD, and anxiety.

Cerebral Patents

Cerebral has filed 2 patents.

The 3 most popular patent topics include:

- g protein coupled receptors

- health informatics

- homelessness

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/2/2020 | Olfactory receptors, Psychiatric diagnosis, G protein coupled receptors, Syndromes, Pain scales | Application |

Application Date | 4/2/2020 |

|---|---|

Grant Date | |

Title | |

Related Topics | Olfactory receptors, Psychiatric diagnosis, G protein coupled receptors, Syndromes, Pain scales |

Status | Application |

Latest Cerebral News

Oct 30, 2025

As AI transforms mental health care, data-driven empathy meets technology empowering clinicians, expanding access, and redefining emotional wellness worldwide.” — DataM Intelligence AUSTIN, TX, UNITED STATES, October 30, 2025 / EINPresswire.com / -- According to DataM Intelligence and corroborating sources, the global AI in Mental Health market size was estimated at approximately US$1.95 billion in 2024, with forecasts projecting explosive growth to nearly US$12.69 billion by 2033, representing a compound annual growth rate (CAGR) exceeding 22.8%. This surge is driven by continuous technological innovations, increasing awareness of mental health issues, expanding applications of AI in behavioral health, and augmented adoption of telemedicine platforms incorporating AI tools. The software-as-a-service (SaaS) model dominates the market, fueled by scalable subscription-based offerings that enable widespread access. Regionally, North America leads the market mainly due to high healthcare expenditure, advanced digital infrastructure, and proactive adoption of AI-powered mental health technologies in clinics, hospitals, and consumer applications like apps and chatbots. Asia Pacific is emerging as the fastest-growing region, driven by large population bases, increasing smartphone penetration, acute shortage of mental health professionals, and rising investment in AI healthcare technologies in countries such as China, India, and Japan. Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.datamintelligence.com/download-sample/ai-in-mental-health-market Key Highlights from the Report ➤ The global AI in Mental Health market is forecasted to grow at a CAGR of over 22.8% during 2024 to 2033. ➤ Natural language processing (NLP) technology holds the largest share, enabling AI-driven chatbots and virtual therapists. ➤ Software-as-a-service (SaaS) is the leading deployment model, accounting for more than 65% of market revenue. ➤ Hospitals and clinics constitute primary end-users, adopting AI for diagnostic and therapeutic aids. ➤ North America dominates the market, with substantial growth fueled by the U.S. mental health awareness initiatives. ➤ Asia Pacific exhibits the highest growth rate, driven by expanding healthcare digitalization and unmet mental healthcare needs. Market Segmentation The AI in Mental Health market is segmented primarily by technology, component, and end-user to cater to varied applications and customer requirements. By technology, the market includes natural language processing (NLP), machine learning (ML)/deep learning, and context-aware computing. Among these, NLP is the dominant segment, owing to its capability to power conversational AI tools like chatbots (e.g., Woebot, Wysa) that provide cognitive behavioral therapy (CBT), emotional support, and therapeutic interaction through natural dialogue. Machine learning algorithms contribute to advanced predictive models that analyze behavioral data and clinical records to identify early signs of mental health disorders. Context-aware computing enables real-time emotional state monitoring using data from wearables and smartphones. By component, the market is divided into software and services, with software delivered mainly via SaaS platforms. SaaS solutions facilitate flexible deployment and continuous updates, critical for mental health applications that require personalization and data privacy. Managed services include AI system integration, consulting, and support, assisting healthcare providers in implementing these solutions effectively. By end-user, hospitals and clinics lead the adoption, utilizing AI tools for diagnosis, treatment planning, and patient monitoring. Additionally, individual consumers use AI-powered mental health apps and platforms for self-management of conditions, reducing stigma and improving accessibility. Other end-users include research institutions and employers incorporating AI mental health solutions into wellness programs. Looking For A Detailed Full Report? Get it here:(Year-End Offer - Unlock 30% Savings Before It's Gone!) https://www.datamintelligence.com/buy-now-page?report=ai-in-mental-health-market Regional Insights North America is the leading regional market, accounting for over 40% of the global AI in Mental Health market revenue in 2024. This dominance stems from the high prevalence of mental health conditions, advanced healthcare infrastructure, and significant investments in healthcare AI research and deployment. The U.S. government and institutions actively support initiatives integrating AI into mental health services, including virtual care programs and chatbot applications such as the NHS's Wysa chatbot in the UK and U.S.-based Woebot. The rising costs of traditional mental healthcare create impetus for AI solutions offering cost-effective and scalable alternatives. Europe follows with robust growth, driven by government mental health programs, increasing acceptance of digital health tools, and strong AI research ecosystems in countries like the UK, Germany, and France. Asia Pacific is poised for the fastest growth rate due to expanding healthcare access, increasing awareness, and rapid adoption of digital health technologies. Major AI-driven mental health applications are emerging in China, India, Japan, and South Korea, where the large and underserved populations generate high demand for technology-enabled mental health care. Latin America and the Middle East & Africa regions are gradually adopting AI solutions in mental health, supported by growing government focus and regional healthcare modernization efforts. Market Dynamics Market Drivers The primary drivers of AI in Mental Health market growth include the rising global burden of mental health disorders, inadequate availability of mental health professionals, and the growing need for personalized and accessible care. AI's ability to analyze large datasets swiftly enables early diagnosis and intervention, which is critical in conditions such as depression and suicidal tendencies. Technological advancements make AI tools more capable and user-friendly, attracting adoption by healthcare providers and individual users. The COVID-19 pandemic accelerated digital mental health service demand, further driving AI integration to meet mental health service gaps. Market Restraints Despite growth opportunities, challenges such as data privacy and security concerns remain major restraints. Regulatory uncertainty and the need for robust clinical validation restrict rapid AI deployment in mental health care. Some medical practitioners remain hesitant to adopt AI solutions without clear evidence of efficacy and ethical guidelines for AI usage in psychological therapies. Additionally, high initial investments and integration complexities can slow adoption in certain healthcare settings. Market Opportunities Opportunities lie in expanding AI-powered telepsychiatry and virtual care services, especially in underserved regions. The integration of wearable devices and social media data with AI creates new avenues for real-time mood monitoring and personalized interventions. Innovations in explainable AI offer greater transparency and trust in AI solutions, encouraging wider clinical and consumer acceptance. Strategic collaborations between technology firms, healthcare providers, and government bodies promise accelerated deployment and policy support for AI in mental health. Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/ai-in-mental-health-market Reasons to Buy the Report ✔ Gain comprehensive insights into market size, growth forecast, and competitive landscape. ✔ Understand technological segmentation and deployment models shaping the market. ✔ Access regional market trends and key growth drivers for strategic decision-making. ✔ Identify emerging opportunities and challenges for AI in mental health solutions. ✔ Analyze key players' profiles, strategies, and recent developments in the sector. Frequently Asked Questions (FAQs) ◆ How Big is the AI in Mental Health Market in 2025? ◆ Who are the Key Players in the Global AI in Mental Health Market? ◆ What is the Projected Growth Rate of the AI in Mental Health Market through 2032? ◆ What are the Market Drivers and Restraints in the AI in Mental Health Industry? ◆ Which Region is Estimated to Dominate the AI in Mental Health Market through 2032? Company Insights Key players operating in the AI in Mental Health market include: • Woebot Health • Wysa • Ginger • AiCure • Calmerry • Cognito Therapeutics • Flow Neuroscience • Mental Canvas • Mental Health AI • Moodpath Recent developments: -In October 2025, Woebot Health launched an AI-powered conversational agent clinically validated to support anxiety and depression management. The platform integrates CBT-based responses and received FDA Breakthrough Device designation for digital mental health support. -In September 2025, Cerebral Inc. partnered with Microsoft Azure Health AI to enhance personalized therapy through real-time emotional pattern recognition, improving treatment outcomes for patients. -In August 2025, Talkspace introduced AI-assisted therapy matching that predicts therapist compatibility using natural language analysis from patient assessments, enhancing treatment effectiveness and engagement. Conclusion The AI in Mental Health market is at the forefront of reshaping mental healthcare delivery worldwide. Rapid advancements in AI technologies, growing awareness of mental health issues, and the persistent shortage of mental health professionals are converging to drive unprecedented market growth. From AI-powered chatbots offering round-the-clock counseling to predictive analytics that enable early intervention, these innovations democratize access to mental health services and personalize care like never before. While challenges such as data privacy and regulatory compliance remain, ongoing technological refinement and strategic collaborations promise to overcome these barriers. With North America leading adoption and Asia Pacific emerging as a high-growth region, the market outlook remains robust, promising profound societal and healthcare impacts in the coming decade. Sai Kiran DataM Intelligence 4market Research LLP sai.k@datamintelligence.com Visit us on social media: LinkedIn X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Cerebral Frequently Asked Questions (FAQ)

When was Cerebral founded?

Cerebral was founded in 2019.

Where is Cerebral's headquarters?

Cerebral's headquarters is located at 2093 Philadelphia Pike, Claymont.

What is Cerebral's latest funding round?

Cerebral's latest funding round is Series C.

How much did Cerebral raise?

Cerebral raised a total of $462M.

Who are the investors of Cerebral?

Investors of Cerebral include WestCap, Artis Ventures, Access Industries, SoftBank, Prysm Capital and 11 more.

Who are Cerebral's competitors?

Competitors of Cerebral include Lemonaid Health, Thirty Madison, Joshin, Brightside Health, Anise Health and 7 more.

Loading...

Compare Cerebral to Competitors

Brightside Health focuses on providing mental health care services. It offers online treatment for a range of mental health conditions, including anxiety, depression, insomnia, post-traumatic stress disorder (PTSD), and more, utilizing a combination of licensed psychiatric providers and therapy techniques. Brightside Health was formerly known as Good Measure. The company was founded in 2017 and is based in San Francisco, California.

Lyra Health operates in workforce mental health care within the health benefits industry. The company provides a digital platform that connects employees to mental health providers and tools, utilizing artificial intelligence (AI) for provider matching and offering evidence-based support. Lyra Health serves employers seeking to provide mental health benefits and support employee well-being. It was founded in 2015 and is based in Burlingame, California.

Modern Health serves as a global mental health solution provider in the healthcare industry. It offers services including one-on-one clinical therapy, group therapy sessions, and self-guided mental health resources designed to support the emotional, professional, social, financial, and physical well-being of employees. It primarily serves employers, consultants, health plans, and individuals seeking mental health benefits for their workforce or clients. Modern Health was formerly known as Modern Healthcare. It was founded in 2017 and is based in San Francisco, California.

Slingshot AI utilizes artificial intelligence to work in the mental health care sector. The company develops generative models and AI-assisted services, including AI counseling and crisis text response solutions. Slingshot AI's technology integrates psychological approaches to respect individual autonomy and cultural norms in mental health treatment. It was founded in 2022 and is based in New York, New York.

Lemonaid Health focuses on primary care services within the healthcare sector. The company provides telehealth services and develops a platform that utilizes genetic and non-genetic data. Lemonaid Health was formerly known as Icebreaker Health. It was founded in 2014 and is based in San Francisco, California.

Array Behavioral Care provides virtual psychiatry and therapy services and operates within the healthcare sector. The company offers telepsychiatry solutions across the continuum of care, including hospitals, health systems, community healthcare organizations, and home settings. Its services are designed to expand access to care and improve outcomes for underserved individuals, facilities, and communities. Array Behavioral Care was formerly known as InSight + Regroup. It was founded in 1999 and is based in Mount Laurel, New Jersey.

Loading...