Checkr

Founded Year

2014Stage

Series E - III | AliveTotal Raised

$740.1MLast Raised

$61.1M | 6 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+30 points in the past 30 days

About Checkr

Checkr specializes in employee background screening and operates within the human resources sector. The company offers a suite of services including criminal background checks, employment and education verification, driving record checks, drug testing, and continuous monitoring. It serves various sectors such as gig and marketplace, staffing, hospitality, retail, manufacturing, healthcare, and technology, providing services to both small and large companies. It was founded in 2014 and is based in San Francisco, California.

Loading...

ESPs containing Checkr

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The recruiting software market helps companies streamline the hiring processes and find the best candidates. These platforms automate tasks across the recruitment process, including job posting, resume screening, assessment analysis, and candidate communication. Some also offer applicant tracking systems, versus plugging into other providers. This market helps companies save time and improve the c…

Checkr named as Leader among 15 other companies, including Workday, Greenhouse, and ADP.

Checkr's Products & Differentiators

Checkr Screenings

Checkr's Screenings and Verifications provide scalable background checks that mitigate risk and increase productivity for your organization. Our advanced background check technology was born out of the demands of gig economy companies, who hire at unprecedented speed and scale. Checkr’s platform enables them to engage millions of people every year while reducing risk to their business.

Loading...

Research containing Checkr

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Checkr in 2 CB Insights research briefs, most recently on Nov 17, 2023.

Expert Collections containing Checkr

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

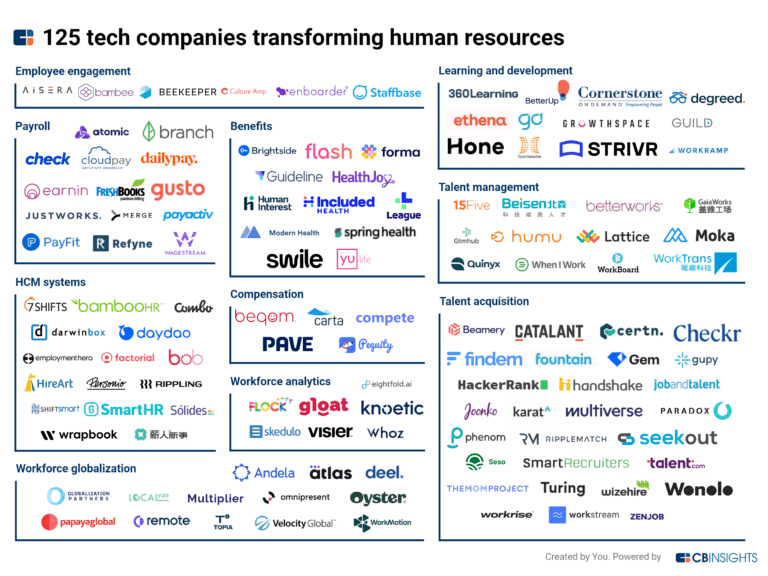

Checkr is included in 9 Expert Collections, including HR Tech.

HR Tech

6,260 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,297 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Tech IPO Pipeline

825 items

Future Unicorns 2019

50 items

Checkr Patents

Checkr has filed 2 patents.

The 3 most popular patent topics include:

- credit

- criminal records

- job scheduling

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/27/2019 | 12/29/2020 | Identity documents, Recruitment, Diagrams, Data management, Identifiers | Grant |

Application Date | 3/27/2019 |

|---|---|

Grant Date | 12/29/2020 |

Title | |

Related Topics | Identity documents, Recruitment, Diagrams, Data management, Identifiers |

Status | Grant |

Latest Checkr News

Oct 27, 2025

Checkr, Chevron decisions push downtown vacancy up again in third quarter The downtown Denver skyline in 2020. (Courtesy Guerilla Capturing) Office vacancy in downtown Denver ticked up again in the third quarter, driven heavily by decisions at a tech firm and an oil and gas giant. At the end of September, total office vacancy in the city center was 37.7%, according to CBRE. That was up 0.6 percentage point from the real estate brokerage’s adjusted second-quarter figure. Total vacancy includes both direct vacancy, in which unused space is marketed by a landlord, and space marketed for sublease by a tenant. Downtown direct vacancy itself was 34.8% last quarter. CBRE’s definition of “downtown” includes the Central Business District and LoDo, as well as LoHi’s Platte Street and a portion of Uptown. It doesn’t include RiNo, Cherry Creek or other spots farther afield. Downtown saw negative net absorption of 171,000 square feet in the second quarter, according to CBRE. That means 171,000 additional square feet — equivalent to seven floors at Republic Plaza — were available at the end of June compared with the end of March. Absorption can be heavily influenced by just one or two large companies. In the second quarter, Xcel’s decision to move to RiNo accounted for the entirety of the negative 270,000 square feet of absorption. In the third quarter, tech firm Checkr and Chevron were the key firms. Checkr, a San Francisco-based background check company, vacated 73,000 square feet in the 18th Street Atrium building at 1621 18th St. in the third quarter, according to CBRE. While the company still has a floor in the building for now — its initial lease was for 92,000 square feet — Checkr will eventually give that up when it moves into a much smaller space at 1125 17th St. The company leased 28,000 square feet there, according to CBRE. Houston-based Chevron, meanwhile, vacated 108,000 square feet in Granite Tower at 1099 18th St. in the third quarter, according to CBRE. Chevron is attempting to sublet the space, which it acquired as part of its 2023 purchase of PDC Energy. In May, Chevron told the state that it intended to lay off 125 employees based out of the office. The biggest downtown lease signing of the third quarter came from another oil and gas giant, EOG Resources, which took 100,000 square feet at 1550 17th St. While great news for the owner of that building, EOG’s deal will ultimately result in more downtown vacancy. That’s because the company is downsizing — the space will eventually replace EOG’s existing 165,000-square-foot lease at 600 17th St. Ken Gooden, a broker at JLL who represents tenants, said he’s hopeful that the numbers won’t get much worse. “I feel like the worst is definitely behind us, but it’s going to be a long recovery,” he said. Gooden said he still doesn’t see a clear catalyst that will transform the nature of downtown or turn the tide on leasing. He noted that the office sector in San Francisco is benefiting from the boom in artificial intelligence companies. “I don’t think there’s any desire for them to come to Denver,” he said. A prepandemic trend of tech companies adding offices here has slowed. But Gooden said his clients that are already located downtown generally aren’t talking about leaving it. One client is “looking very seriously” at 1900 Lawrence, the skyscraper completed in 2024 that needs to secure more tenants before its loan comes due in mid-2027 . For all the focus on downtown as a whole, however, one end of it has much deeper challenges. Total office vacancy is 46% — nearly one in two floors empty — in what CBRE considers Uptown, an area that includes the Wells Fargo Center and blocks to the east. “I don’t have any clients looking there, which is scary,” Gooden said of the east end of downtown. The numbers get better the closer you get to Union Station. Downtown’s nicest office buildings, known as “Class A,” continue to fare better than average. But they too had negative absorption for the quarter, and the stats are still grim, with total vacancy at 31.2%, according to CBRE. Across the broader metropolitan area, total vacancy was 28.2%, according to CBRE, with negative absorption of 264,000 square feet. The downtown Denver skyline in 2020. (Courtesy Guerilla Capturing) Office vacancy in downtown Denver ticked up again in the third quarter, driven heavily by decisions at a tech firm and an oil and gas giant. At the end of September, total office vacancy in the city center was 37.7%, according to CBRE. That was up 0.6 percentage point from the real estate brokerage’s adjusted second-quarter figure. Total vacancy includes both direct vacancy, in which unused space is marketed by a landlord, and space marketed for sublease by a tenant. Downtown direct vacancy itself was 34.8% last quarter. CBRE’s definition of “downtown” includes the Central Business District and LoDo, as well as LoHi’s Platte Street and a portion of Uptown. It doesn’t include RiNo, Cherry Creek or other spots farther afield. Downtown saw negative net absorption of 171,000 square feet in the second quarter, according to CBRE. That means 171,000 additional square feet — equivalent to seven floors at Republic Plaza — were available at the end of June compared with the end of March. Absorption can be heavily influenced by just one or two large companies. In the second quarter, Xcel’s decision to move to RiNo accounted for the entirety of the negative 270,000 square feet of absorption. In the third quarter, tech firm Checkr and Chevron were the key firms. Checkr, a San Francisco-based background check company, vacated 73,000 square feet in the 18th Street Atrium building at 1621 18th St. in the third quarter, according to CBRE. While the company still has a floor in the building for now — its initial lease was for 92,000 square feet — Checkr will eventually give that up when it moves into a much smaller space at 1125 17th St. The company leased 28,000 square feet there, according to CBRE. Houston-based Chevron, meanwhile, vacated 108,000 square feet in Granite Tower at 1099 18th St. in the third quarter, according to CBRE. Chevron is attempting to sublet the space, which it acquired as part of its 2023 purchase of PDC Energy. In May, Chevron told the state that it intended to lay off 125 employees based out of the office. The biggest downtown lease signing of the third quarter came from another oil and gas giant, EOG Resources, which took 100,000 square feet at 1550 17th St. While great news for the owner of that building, EOG’s deal will ultimately result in more downtown vacancy. That’s because the company is downsizing — the space will eventually replace EOG’s existing 165,000-square-foot lease at 600 17th St. Ken Gooden, a broker at JLL who represents tenants, said he’s hopeful that the numbers won’t get much worse. “I feel like the worst is definitely behind us, but it’s going to be a long recovery,” he said. Gooden said he still doesn’t see a clear catalyst that will transform the nature of downtown or turn the tide on leasing. He noted that the office sector in San Francisco is benefiting from the boom in artificial intelligence companies. “I don’t think there’s any desire for them to come to Denver,” he said. A prepandemic trend of tech companies adding offices here has slowed. But Gooden said his clients that are already located downtown generally aren’t talking about leaving it. One client is “looking very seriously” at 1900 Lawrence, the skyscraper completed in 2024 that needs to secure more tenants before its loan comes due in mid-2027 . For all the focus on downtown as a whole, however, one end of it has much deeper challenges. Total office vacancy is 46% — nearly one in two floors empty — in what CBRE considers Uptown, an area that includes the Wells Fargo Center and blocks to the east. “I don’t have any clients looking there, which is scary,” Gooden said of the east end of downtown. The numbers get better the closer you get to Union Station. Downtown’s nicest office buildings, known as “Class A,” continue to fare better than average. But they too had negative absorption for the quarter, and the stats are still grim, with total vacancy at 31.2%, according to CBRE. Across the broader metropolitan area, total vacancy was 28.2%, according to CBRE, with negative absorption of 264,000 square feet. This story is for our paid subscribers only. Please become one of the thousands of BusinessDen members today! Your subscription has expired. Renew now by choosing a subscription below! For more informaiton, head over to your profile.

Checkr Frequently Asked Questions (FAQ)

When was Checkr founded?

Checkr was founded in 2014.

Where is Checkr's headquarters?

Checkr's headquarters is located at One Montgomery Street, San Francisco.

What is Checkr's latest funding round?

Checkr's latest funding round is Series E - III.

How much did Checkr raise?

Checkr raised a total of $740.1M.

Who are the investors of Checkr?

Investors of Checkr include Accel, Battery Ventures, Y Combinator, Institutional Venture Partners, T. Rowe Price and 32 more.

Who are Checkr's competitors?

Competitors of Checkr include Argyle, Persona, Truework, Checkfirst, Sterling and 7 more.

What products does Checkr offer?

Checkr's products include Checkr Screenings and 1 more.

Loading...

Compare Checkr to Competitors

Inflection provides identity management and background screening within the human resources technology sector. It offers products including employment background checks, identity verification, and trust and safety application program interfaces (APIs). With its screening and compliance solutions, Inflection serves the human resources and recruitment industries. It was founded in 2006 and is based in Redwood City, California.

Accurate Background offers a complete set of on-demand employment screening services, including criminal, motor vehicle, and other public records searches, employment history, education and professional license verifications, credit checks, and drug and health screening services.

HireRight is a background screening company. It offers solutions such as on-demand employment background checks, drug testing, employment and education verifications, and more. It serves industries such as insurance, manufacturing, retail, and more. The company was founded in 1995 and is based in Nashville, Tennessee.

Veremark focuses on background screening and reference checking and operates in the human resources and recruitment industry. The company offers services such as managing employment background checks, continuous employee rescreening, and providing a blockchain-secured, fully verified candidate career passport. Veremark primarily serves sectors such as finance technology, technology, human resources (HR), staffing and recruitment, and the gig economy. It was founded in 2018 and is based in London, United Kingdom.

Certn is a company that provides background screening solutions for various industries. The company offers services including identity verification, criminal record checks, and employment verification, aimed at assisting the hiring process. Certn serves sectors that require screening processes, such as property management, healthcare, hospitality, and financial services. It was founded in 2016 and is based in Victoria, Canada.

SELECTiON.COM operates in the pre-employment background screening industry, providing background checks, drug screening, and various other checks necessary for hiring decisions. The company serves sectors that require thorough verification processes such as healthcare, education, financial services, and government. It was founded in 1991 and is based in Cincinnati, Ohio.

Loading...