Chime

Founded Year

2012Stage

IPO | IPOTotal Raised

$2.606BDate of IPO

6/12/2025Market Cap

11.53BStock Price

20.39Revenue

$0000About Chime

Chime operates as a financial technology company offering a banking application for users to manage finances. The application includes features like no overdraft fees, early direct deposit, and resources for building credit and financial literacy. Chime serves those who need banking services. Chime was formerly known as 1debit. It was founded in 2012 and is based in San Francisco, California.

Loading...

Chime's Products & Differentiators

SpotMe

Fee free overdraft alternative

Loading...

Research containing Chime

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Chime in 3 CB Insights research briefs, most recently on Jul 17, 2025.

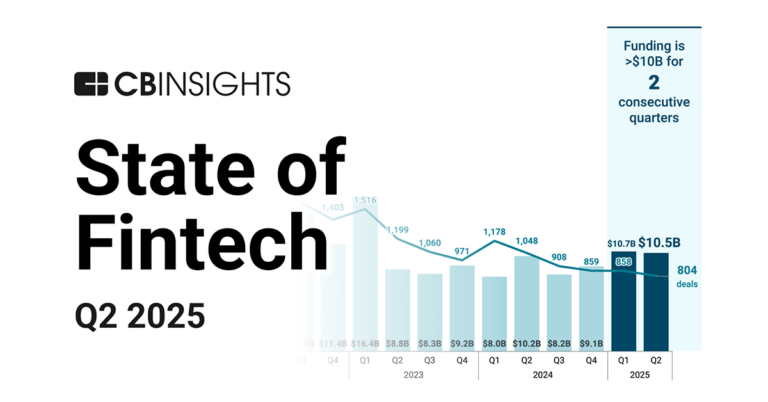

Jul 17, 2025 report

State of Fintech Q2’25 Report

Expert Collections containing Chime

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Chime is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

539 items

Track and capture company information and workflow.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,182 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Chime Patents

Chime has filed 8 patents.

The 3 most popular patent topics include:

- computer security

- machine learning

- remote desktop

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/18/2024 | 4/1/2025 | Machine learning, Units of information, Wireless networking, Artificial intelligence, Remote desktop | Grant |

Application Date | 3/18/2024 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Machine learning, Units of information, Wireless networking, Artificial intelligence, Remote desktop |

Status | Grant |

Latest Chime News

Nov 10, 2025

UKG, a leading global AI platform unifying HR, pay, and workforce management used by 80,000 organizations globally, has made Chime Workplace available in its UKG Marketplace. Chime’s no-cost financial wellness suite will integrate with UKG’s Workforce Operating Platform. Maxwell Group, a senior living provider and a UKG customer, said it has opted for Chime Workplace and discontinued a legacy earned-wage access solution because it offers no-fee earned wage access, often the first step for many employees needing access to their pay anytime, for bills and unexpected expenses. Additional benefits include: Strong employee adoption and engagement to unlock lasting financial progress, workplace retention, and productivity; Actionable data insights that measure program efficacy and workforce financial health, such as savings growth and credit health; and; A model that is built for compliance with regulatory guidelines, providing greater confidence for management. “Supporting the financial well-being of our team is essential to delivering on our guiding principle, People First Always. With Chime, we’re able to enhance our overall benefits with meaningful financial tools that meet our team members where they are, giving them access to their pay now, and greater confidence to achieve their future financial goals,” said Nerissa Nelson , Maxwell Group’s VP of human resources. Financial stress is one of the biggest drains on productivity, with Chime Workplace reporting that employees lose more than six hours each week to money worries. Employers have tried to address this with a range of point solutions, from financial education to earned wage access to emergency savings accounts, but offering them as separate apps often leads to a fragmented experience and low engagement. Chime Workplace solves this by unifying essential financial tools into a single, no-cost app that grows with employees as they move from handling emergencies to building savings and credit. For HR teams, this streamlined approach simplifies program management and drives adoption. Chime is already trusted by millions, with 97% saying it’s helped their financial progress, making it easy for employees to engage with financial wellness benefits. It is embedded directly in the UKG ecosystem. Sponsored Links by DQ Promote

Chime Frequently Asked Questions (FAQ)

When was Chime founded?

Chime was founded in 2012.

Where is Chime's headquarters?

Chime's headquarters is located at 101 California Street, San Francisco.

What is Chime's latest funding round?

Chime's latest funding round is IPO.

How much did Chime raise?

Chime raised a total of $2.606B.

Who are the investors of Chime?

Investors of Chime include 1435 Capital, Crosslink Capital, Menlo Ventures, Dragoneer Investment Group, General Atlantic and 31 more.

Who are Chime's competitors?

Competitors of Chime include SavvyMoney, Jiko, Kredete, Branch, Deserve and 7 more.

What products does Chime offer?

Chime's products include SpotMe and 2 more.

Loading...

Compare Chime to Competitors

KikOff is a personal finance platform that offers a revolving line of credit and a secured credit card. These financial products aim to assist individuals in establishing a payment history and improving their credit scores. KikOff serves individuals interested in building or enhancing their credit profiles. It was founded in 2019 and is based in San Francisco, California.

Varo offers personal banking services. The company provides savings accounts, tools for credit building, and personal finance management features. Varo primarily serves individuals seeking accessible banking solutions. Varo was formerly known as Ascendit Holdings. It was founded in 2015 and is based in San Francisco, California.

Cash App develops a financial services platform. The company offers a range of services, including instant payments, everyday spending savings, simplified banking, stock and bitcoin trading, and tax filing. Its primary customers are individuals seeking a comprehensive solution for their financial needs. It was founded in 2013 and is based in New York, New York.

Arro is a financial technology company that provides credit-building solutions within the financial services industry. The company offers an unsecured credit builder card for individuals with poor or limited credit history to access mainstream credit, which does not involve hard credit checks. Arro provides financial education tools and an AI money coach to help users improve their credit scores and manage their finances. It was founded in 2021 and is based in Los Angeles, California.

EarnIn provides earned wage access and financial management tools. The company offers services including pay access, early paycheck deposits, and financial tools like overdraft alerts and credit score monitoring. EarnIn serves individuals seeking access to their earnings and businesses looking to offer these services to their employees. EarnIn was formerly known as Activehours. It was founded in 2012 and is based in Mountain View, California.

Empower Finance is a financial technology company that provides credit solutions and financial security tools. The company offers cash advances, a line of credit service called Thrive, and savings features. Empower Finance primarily serves individuals seeking financial products and services. It was founded in 2016 and is based in San Francisco, California.

Loading...