Circle

Founded Year

2013Stage

IPO | IPOTotal Raised

$1.127BDate of IPO

6/5/2025Market Cap

23.29BStock Price

104.10About Circle

Circle operates as a financial technology firm focused on enabling businesses to utilize digital currencies and public blockchains within the financial services sector. The company offers a suite of products and services, including the issuance of stablecoins, a blockchain infrastructure for stablecoin finance, and tools for digital currency payments, tokenized funds, and real-time financial transactions. Circle primarily serves financial institutions, businesses, and developers seeking to integrate digital currency solutions into their operations. It was founded in 2013 and is based in New York, New York.

Loading...

ESPs containing Circle

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The stablecoin settlement & payouts market refers to the use of stablecoins, which are cryptocurrencies designed to maintain a stable value, for settling transactions and making payouts. This market offers a fast and cost-effective way to move money across borders and provides access to financial services in emerging markets. Technology vendors in this market offer solutions for digital asset cust…

Circle named as Leader among 13 other companies, including Coinbase, Ripple, and BitGo.

Circle's Products & Differentiators

Circle Account

The Circle Account is a full stack solution that replaces a fractured system for business banking. Securely custody funds, send and receive payments globally and streamline treasury operations all connected through USD Coin (USDC) and integrated with a suite of APIs.

Loading...

Research containing Circle

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Circle in 14 CB Insights research briefs, most recently on Oct 3, 2025.

Oct 3, 2025 report

Dual AI engines: LLMs and optimizers sweep September mega-round funding

Aug 4, 2025

3 markets fueling the shift to agentic commerce

Jul 17, 2025 report

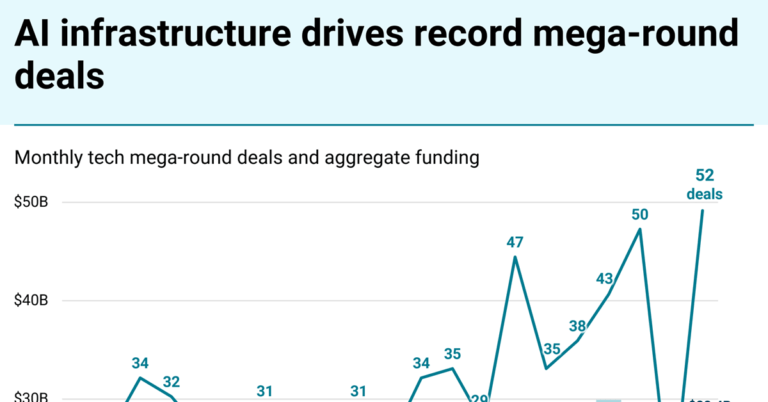

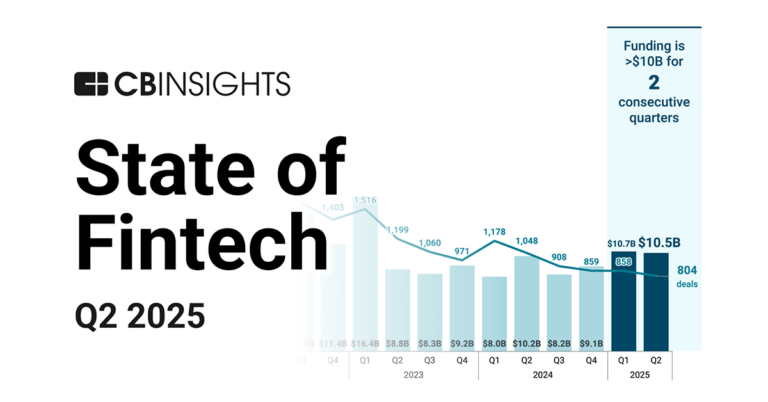

State of Fintech Q2’25 Report

Jul 10, 2025 report

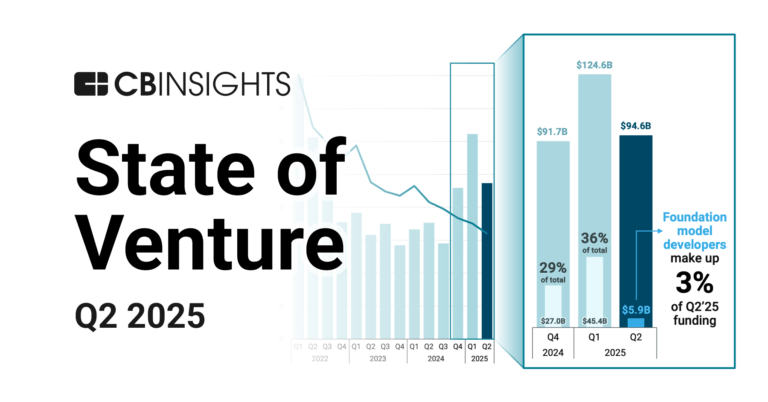

State of Venture Q2’25 Report

May 29, 2025

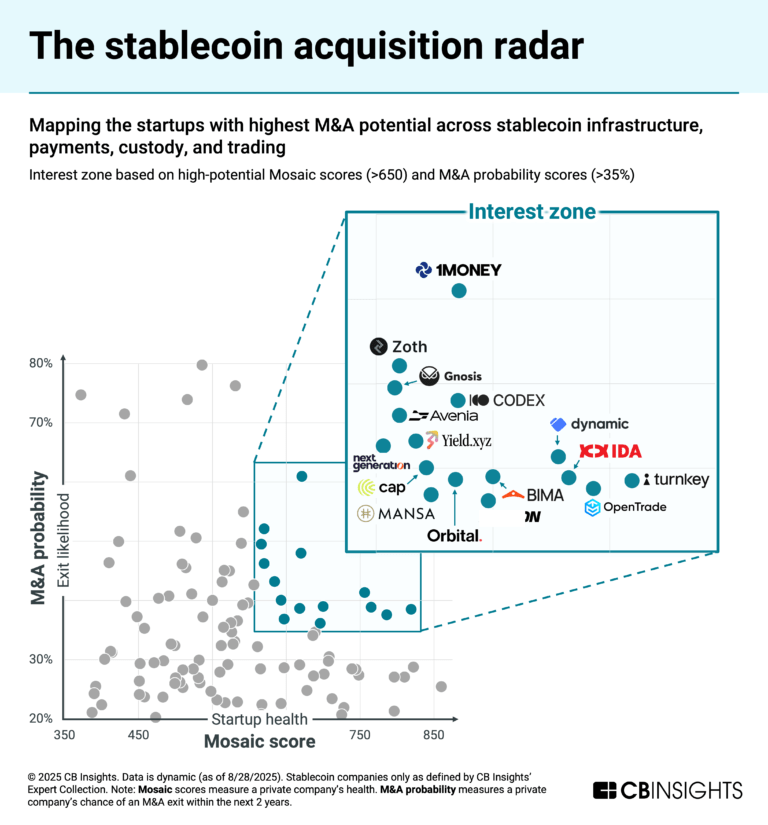

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

Aug 23, 2024

The B2B payments tech market mapExpert Collections containing Circle

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Circle is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Blockchain

14,081 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

286 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Circle Patents

Circle has filed 70 patents.

The 3 most popular patent topics include:

- cryptocurrencies

- blockchains

- alternative currencies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/25/2021 | 4/8/2025 | Parasites of fish, Monopisthocotylea, Geoplanidae, Animal equipment, Dog training and behavior | Grant |

Application Date | 10/25/2021 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Parasites of fish, Monopisthocotylea, Geoplanidae, Animal equipment, Dog training and behavior |

Status | Grant |

Latest Circle News

Nov 11, 2025

The financial infrastructure powering international trade hasn't changed in decades, with popular instruments like letters of credit still having to crawl through correspondent banking networks, eating up days or sometimes even weeks to clear. Amidst this backdrop, a parallel evolution in the form of stablecoins has been gaining steam, moving more capital than Visa and Mastercard combined last year (roughly USD 27.6 trillion). Yet this growth has been confined primarily to the realm of DeFi or centralized exchanges, not in the trad-fi corridors where cross-border payment friction remains most acute. And, while the infrastructure exists for near-instantaneous settlement, connecting it to real-world trade documentation has proven technically and legally complex. That said, recent regulatory developments have begun to change the equation, with the UK's Electronic Trade Documents Act, for instance, giving digital bills of lading the same legal standing as their paper counterparts (akin to frameworks like Singapore's TradeTrust and the UAE's blockchain-based trade finance registry). In fact, experts believe that as and when this transition continues to gain more traction, businesses across the globe will finally be able to embrace electronic processes without fearing jurisdictional disputes. Building rails where documentation meets settlement While existing trade platforms have been digitizing letters of credit and other similar offerings for years, they've lacked native blockchain settlement infrastructure and access to regulated digital currencies that banks can actually use. XDC Ventures' acquisition of Contour Network represents a step in this direction, offering a consortium of banking giants such as HSBC, Standard Chartered, BNP Paribas, and Citi (amongst others) with battle-tested infrastructure for frictionless cross-border trading. Operational since 2019, XDC's Layer-1 framework is EVM-compatible and ready for institutional use cases, so much so that Circle recently deployed its popular USDC stablecoin on the platform, allowing financial institutions to use it for settlements without regulatory uncertainty. Moreover, XDC has also launched its 'Stable-Coin Lab' initiative to help foster pilots with banks and corporates around regulated stablecoin issuance and settlement. On the development, company co-founder, Ritesh Kakkad, opined: "Banks need settlement rails, treasury optimization, and compliance frameworks. We're building all three. We see Contour not only as a trade-finance network but as an enabler of compliant stable-coin use-cases that can deliver new efficiencies and revenue streams for banks and corporates." To put things into context, for a USD 1 million transaction, eliminating traditional foreign exchange fees of 1-3 per cent alone could save users anywhere between USD 10,000 - 30,000, before accounting for reduced processing costs and faster working capital turnover. What institutional infrastructure really requires today From the outside looking in, the broader transformation happening in trade finance isn't just about converting existing assets to electronic ones but about fundamentally rearchitecting how value can move across borders when goods change hands. If the pilot delivers on reducing settlement times from days to hours (while cutting costs by 30-50 per cent), it could very well forge the perfect path for scaling institutional stablecoin adoption beyond crypto markets into the USD 9 trillion annual global trade finance industry. Put even more simply, it could mean the creation of a real bridge between TradFi and Web3, not in some abstract way, but in the way the mechanics of, say, a cargo ship can get paid and manufacturers can manage working capital across continents. In any case, interesting times ahead!

Circle Frequently Asked Questions (FAQ)

When was Circle founded?

Circle was founded in 2013.

Where is Circle's headquarters?

Circle's headquarters is located at 1 World Trade Center, New York.

What is Circle's latest funding round?

Circle's latest funding round is IPO.

How much did Circle raise?

Circle raised a total of $1.127B.

Who are the investors of Circle?

Investors of Circle include Coinbase, 1435 Capital, Marshall Wace Asset Management, Fidelity Investments, Fin Capital and 46 more.

Who are Circle's competitors?

Competitors of Circle include Ripple, Kraken, Zepz, Revolut, Binance and 7 more.

What products does Circle offer?

Circle's products include Circle Account and 3 more.

Who are Circle's customers?

Customers of Circle include FTX and CMS.

Loading...

Compare Circle to Competitors

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

Crypto.com provides services for buying, selling, and trading cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. The company serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

CoinDCX is a cryptocurrency exchange that provides access to virtual digital assets. The company offers a platform for trading cryptocurrencies and complies with regulatory guidelines. CoinDCX also engages in Web3 project investments and educational initiatives related to decentralized technologies. It was founded in 2018 and is based in Mumbai, India.

CoinZoom is a fintech company that provides a cryptocurrency debit card enabling users to spend their crypto and cash, buy, sell, and trade cryptocurrencies. The company serves individuals interested in incorporating cryptocurrency into their financial transactions. It was founded in 2018 and is based in Salt Lake City, Utah.

Blockchain.com specializes in blockchain technology and cryptocurrency-related solutions. The company offers a platform where users can buy, sell, and swap cryptocurrencies like Bitcoin and Ethereum, as well as earn rewards on their cryptocurrency assets. It also provides a cryptocurrency wallet for the self-custody of digital assets and an exchange for trading in fiat currencies. It was founded in 2011 and is based in London, United Kingdom.

BitPay provides cryptocurrency payment processing and digital wallet services within the financial technology (fintech) sector. It offers a platform for individuals and businesses to buy, store, swap, sell, and spend cryptocurrencies and tools for merchants to accept cryptocurrency payments. Its services are available to various sectors, including e-commerce and real estate technology. It was founded in 2011 and is based in Atlanta, Georgia.

Loading...