Investments

338Portfolio Exits

94Funds

8Partners & Customers

2About Cisco Investments

Cisco Investments focuses on corporate venture capital within the technology sector, specializing in strategic investments and partnerships with technology startups. The company offers support to startups by providing access to technology expertise, facilitating market innovation, and fostering a diverse, global technology community. Cisco Investments primarily serves sectors such as cloud computing, data center networking, enterprise networking, and security. It was founded in 1993 and is based in San Jose, California.

Expert Collections containing Cisco Investments

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Cisco Investments in 1 Expert Collection, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Research containing Cisco Investments

Get data-driven expert analysis from the CB Insights Intelligence Unit.

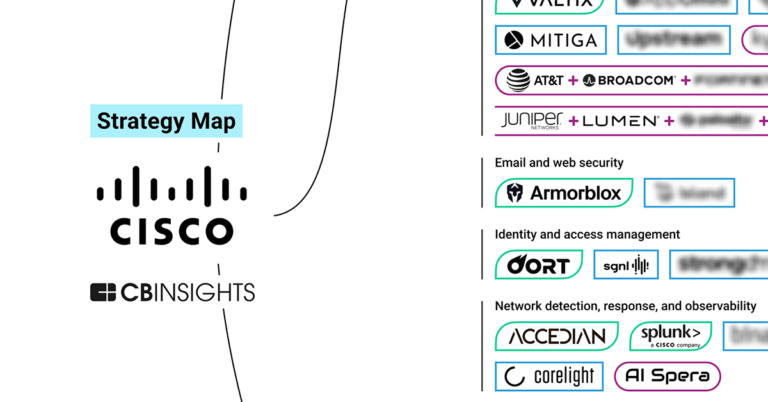

CB Insights Intelligence Analysts have mentioned Cisco Investments in 3 CB Insights research briefs, most recently on Apr 29, 2025.

Apr 29, 2025 report

State of CVC Q1’25 Report

May 29, 2024

483 startup failure post-mortemsLatest Cisco Investments News

Oct 9, 2025

These 10 corporate investors had most exits in the past five years Oct 9, 2025 • Robert Lavine Taking early AI bets and investing outside their comfort zone have allowed some large CVCs to reap rewards despite a turbulent exit market. Although corporations invest in startups for a slew of complex reasons, not all of them financial, they are, like any investor, looking for an eventual exit. When Intel Capital released its 2024 annual review, the first point mentioned wasn’t the strategic value it was bringing to the Intel parent company or the size of recent investments. It was the exits the unit’s portfolio companies had achieved. Over the past few years it has been more difficult for startups to exit through stock market listings and large acquisitions. But some corporate venture units have nonetheless managed a steady stream of exits from the height of the pandemic investment craze, through the pullback, to the current resurgence. Companies like Samsung Ventures and Qualcomm Ventures have done well by going out of their comfort zone and venturing into areas like healthcare, while Salesforce Ventures has seen the enterprise software IPO market dry up and Comcast Ventures has had a surprisingly large number of SPAC exits, although a few of these have subsequently filed for bankruptcy or seen their market capitalisations plummet. 1. GV (114) GV has been a corporate venture powerhouse since the years when it was still known as Google Ventures, playing a large part in parent company Alphabet topping the list of 2024’s most active corporate VC investors . But while some of its most notable exits, like online trading platform RobinHood and networking technology provider Pensando, have been related to GV’s more traditional, online and computing-focused investment areas, it has also had a number of significant exits for startups related to healthcare. GV was one of the first CVC investors outside of the healthcare and pharmaceutical industries to enter the sector as an investor, and now those early investments are bearing fruit. Healthcare navigation service Iora Health was snapped up for over $2bn in 2021 while home care provider CareBridge was acquired for $2.7bn three years later. Those can be added to a string of initial public offerings for various drug development portfolio companies. The largest exit of all? Cancer screening service Grail, which was bought by Illumina for $8bn in 2021 despite regulatory issues over European deal clearance. 2. (joint) Intel Capital (105) Chipmaker Intel has had a lean decade so far, falling behind peers first in mobile devices and then in generative AI, while easing off in its corporate venture investing. It has however recorded a lot of exits for portfolio companies, often in areas that are somewhat distant from its core activities. Up until recently, Intel Capital’s most successful exit over the past five years was electric aircraft developer Joby Aviation, which went public in a reverse merger in 2021, and which has since grown into a $14bn company. Many of its exits have been small or medium sized. The unit has racked up a lot of M&A exits since 2020, but they’ve tended to top out well beneath the billion-dollar mark. Digital banking software provider Technisys is the only billion-dollar M&A exit, acquired for $1.1bn by SoFi in 2022. However, Intel Capital’s most lucrative exit in that time taps into the current zeitgeist for AI and robotics. Driver assistance software producer Horizon Robotics (below) floated in Hong Kong late last year with an implied market cap of $6.7bn and has since seen its share price more than double. Recent investments in robotics companies Figure and Field AI indicate Intel is looking for more in this area. Photo courtesy of Horizon Robotics 2. (joint) Salesforce Ventures (105) Salesforce Ventures was an investor behind many of the big software companies — names like HubSpot. DocuSign and Dropbox — that floated in sizeable listings last decade. That makes the past five years more notable: Salesforce has seen more than 100 exits in the past five years but only two initial public offerings, the last of which was in October 2021. The level of that discrepancy reveals a lot about the dearth of IPOs in recent years, particularly in the enterprise software arena where Salesforce focuses. Even the two that did go public, online trading platform Robinhood and automated forklift manufacturer Cyngn, are from outside the sector. But with the IPO market now opening up again , that could soon change. Some of Salesforce Ventures’ M&A deals have been large however. Google paid $32bn to buy cybersecurity company Wiz in March, almost four years to the day after Salesforce Ventures invested at a $1.7bn valuation, and Okta acquired identity verification software producer Auth0 for $6.5bn in 2021. 4.SoftBank Vision Fund (89) Vision Fund’s appearance on the list is no surprise given that it has far more money than anyone else – some $118bn between two funds – and that it invested far more frequently at its peak, spraying money relatively indiscriminately for a few years. That exit potential was boosted by the fact it often committed the cash at growth stage and later. However, that also means that it has accumulated more visible failures than anyone else. The headline remains WeWork, where SoftBank ended up having to write down over $9bn of its investment, but tutoring service Byju’s, crypto marketplace FTX and packaging producer Zume ended up having their assets acquired for peanuts following bankruptcies, and indoor farm operator Plenty could be set to follow. However, Vision Fund’s big advantage has been its geographical scope, as some of its biggest moneymakers have been in South Korea (Coupang), India (Paytm) and Indonesia (Grab). It scored three more large IPO exits over the past year in the shape of Sweden’s Klarna (below), India-based Swiggy, and US obesity drug developer Metsera, which is set to be bought by Pfizer at double the valuation at which it floated in January. 5. (joint) Samsung Next (52) Samsung has several venture funds and Samsung Next has achieved the largest number of exits, reaping the rewards of an investment strategy that has traditionally leaned into artificial intelligence. Samsung Next was in fact one of the first beneficiaries of the AI craze two years ago when Databricks bought generative AI platform MosaicML for $1.3bn, six times its valuation when the unit invested. That has since been boosted this year by Palo Alto Networks’ $700m purchase of AI cybersecurity software provider Protect AI in May and Nvidia’s acquisition of AI optimisation software CentML for over $400m in July. The last two deals were each for startups under three years old, representing comparatively quick returns on investment, which is part of what has made AI stand out. While it isn’t unusual for startups in buzzy areas to pick up funding quickly, several AI startups have also been acquired for large amounts not long after their formation and early rounds, avoiding the years of growth-stage funding. 5. (joint) Cisco Investments (52) Cisco Investments’ exits over the period can largely be seen as a game of two halves. It had some substantial success early on when three portfolio companies – cloud and app network manager Turbonomic, customer relationship software producer Kustomer and wireless broadband equipment maker Altiostar – were each acquired in 2021 and early 2022 in billion-dollar deals. But if the unit’s earlier exits were predicated on products closer to Cisco’s traditional cloud and networking expertise, its more recent, and larger, successes have come in the wake of the AI rush. The biggest on paper would be Scale AI, acquired by Meta this year for upwards of $14.3bn, though that represented a relatively minor uplift from the valuation at which Cisco Investments backed it a year earlier. Far more lucrative was AI hyperscaler CoreWeave, which has nearly trebled its market cap to $68bn since it went public in March. Cisco Investments’ other notable IPO exit is Credo, which provides the high-speed connectivity technology necessary for companies like CoreWeave, and which has grown into a $25bn company since it went public in 2022. 7. Samsung Ventures (51) The other Samsung subsidiary to make the list, Samsung Ventures has a more diversified portfolio than its sister unit and that is reflected in the exit market. For a long time, its largest exit over this period was SentinelOne, which floated in a $1.3bn IPO back in 2021, while another cybersecurity company, Nozomi Networks, recently agreed to a $1bn acquisition by Mitsubishi Electric. But it isn’t just cybersecurity where Samsung Ventures has hit big. The unit’s largest recent exit was Indian ecommerce marketplace Swiggy, which floated at a $12bn valuation last November, four years after the unit invested at a $3.6bn valuation. Looking further down shows just how much more diverse Samsung Ventures has been compared to many CVC funds at this level. Antibody drug conjugate developer Araris agreed to an acquisition earlier this year that could top $1.1bn while its nine-figure M&A exits cover areas as diverse as semiconductor lithography (Inpria), energy storage (Solid Power) and online video licensing (Jukin Media). 8. Coinbase Ventures (49) Web3 companies have invariably turned up on the lists of the most frequent corporate VC investors over the past few years but Coinbase Ventures is as yet the only CVC unit to rack up a similarly large number of returns. Part of that has to do with Web3 exits being relatively limited so far, while part is related to age: at only seven years old. Coinbase’s venture arm is still one of the elder statesmen in the sector. That also means many of those exits have been smaller, consolidation-based M&A deals. There are no IPOs in the list – Coinbase did invest in stablecoin company Circle prior to its flotation but that was off balance sheet rather than through its venture unit – and relatively few large acquisition exits. But that is changing following the boom in cash for Web3 this year. Two Coinbase Ventures portfolio companies, Hidden Road and Bridge Network, have been the subject of billion-dollar purchases in 2025, and with some of the larger crypto-focused startups now reaching the public markets, we could see the unit higher up in the list in another five years. 9. Comcast Ventures (44) If there’s one factor that makes Comcast Ventures’ exits stick out, it’s the sheer number that went public through special purpose acquisition companies (SPACs) in the reverse merger rush that began in the covid era. That list is headed by online insurer Hippo, which hit the markets at a $5bn valuation back in 2021, and includes cybersecurity software producer ZeroFox, social network Nextdoor, scooter and bicycle rental service Bird and quantum software provider Zapata Computing. That list is more consumer facing than the hard tech-leaning portfolios of many of the other corporate VCs in this list, but it also shows how SPACs came to be distrusted as a route to the public markets. Zapata shut down in late 2024, barely six months after it reached the markets, while Bird had already filed for bankruptcy at the end of 2023. ZeroFox was acquired in 2024 for a quarter of its listing valuation while Nextdoor and Hippo have seen their market caps drop below the billion-dollar mark, with the latter’s CEO later expressing remorse for not going the traditional IPO route with experienced investment banks. 10. Qualcomm Ventures (42) Qualcomm Ventures may have the lowest number of exits on this list, but it has several in the billion-dollar range, largely from companies the average person has never heard of but which supply the technology for online services to run properly. Programmable processor maker Pensando, mobile networking software provider Altiostar and ethernet silicon producer Innovium were all snapped up for between $1bn and $1.65bn in the 2021/2022 period, while cybersecurity software provider SentinelOne floated in an IPO topping $1.3bn around the same time. The unit’s more recent exits, however, lean more towards artificial intelligence. AI developer platform Weights & Biases was acquired for a reported $1.7bn by CoreWeave in March this year, two months after Oosto, a developer of AI-equipped visual recognition software, was bought for $125m (admittedly in a cut-price deal). Its largest exit? Telemedicine startup Doctor on Demand, which merged with Included Health back in 2021 to form a business with a reported $3bn valuation. Sometimes it is the fringe bets that pay off. Robert Lavine

Cisco Investments Investments

338 Investments

Cisco Investments has made 338 investments. Their latest investment was in LangChain as part of their Series B on October 20, 2025.

Cisco Investments Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

10/20/2025 | Series B | LangChain | $125M | Yes | Amplify Partners, Benchmark, CapitalG, Databricks Ventures, Datadog, Frontline Ventures, Institutional Venture Partners, Sapphire Ventures, Sequoia Capital, ServiceNow Ventures, Undisclosed Investors, and Workday Ventures | 7 |

10/1/2025 | Seed VC - II | Fleak | Yes | 3 | ||

10/1/2025 | Seed | Genbio AI | Yes | Undisclosed Investors | ||

8/28/2025 | Unattributed VC | |||||

6/18/2025 | Series B |

Date | 10/20/2025 | 10/1/2025 | 10/1/2025 | 8/28/2025 | 6/18/2025 |

|---|---|---|---|---|---|

Round | Series B | Seed VC - II | Seed | Unattributed VC | Series B |

Company | LangChain | Fleak | Genbio AI | ||

Amount | $125M | ||||

New? | Yes | Yes | Yes | ||

Co-Investors | Amplify Partners, Benchmark, CapitalG, Databricks Ventures, Datadog, Frontline Ventures, Institutional Venture Partners, Sapphire Ventures, Sequoia Capital, ServiceNow Ventures, Undisclosed Investors, and Workday Ventures | Undisclosed Investors | |||

Sources | 7 | 3 |

Cisco Investments Portfolio Exits

94 Portfolio Exits

Cisco Investments has 94 portfolio exits. Their latest portfolio exit was Securiti on October 21, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

10/21/2025 | Acquired | 10 | |||

9/23/2025 | Acquired | 3 | |||

9/18/2025 | Acq - Talent | 4 | |||

Cisco Investments Fund History

8 Fund Histories

Cisco Investments has 8 funds, including Cisco AI Investment Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

6/4/2024 | Cisco AI Investment Fund | $200M | 1 | ||

6/28/2017 | Cisco India Startups Fund | ||||

7/9/2015 | Cisco Internet of Everything UK Fund | ||||

6/23/2014 | Cisco India Innovation Theme | ||||

4/30/2014 | Cisco Internet of Things Fund |

Closing Date | 6/4/2024 | 6/28/2017 | 7/9/2015 | 6/23/2014 | 4/30/2014 |

|---|---|---|---|---|---|

Fund | Cisco AI Investment Fund | Cisco India Startups Fund | Cisco Internet of Everything UK Fund | Cisco India Innovation Theme | Cisco Internet of Things Fund |

Fund Type | |||||

Status | |||||

Amount | $200M | ||||

Sources | 1 |

Cisco Investments Partners & Customers

2 Partners and customers

Cisco Investments has 2 strategic partners and customers. Cisco Investments recently partnered with Fenwick on August 8, 2024.

Cisco Investments Team

1 Team Member

Cisco Investments has 1 team member, including current Founder, Leonard X. Bosack.

Name | Work History | Title | Status |

|---|---|---|---|

Leonard X. Bosack | Founder | Current |

Name | Leonard X. Bosack |

|---|---|

Work History | |

Title | Founder |

Status | Current |

Loading...