Clara

Founded Year

2020Stage

Series B - IV | AliveTotal Raised

$550MLast Raised

$40M | 7 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+133 points in the past 30 days

About Clara

Clara operates a management platform in the business payments sector. It offers corporate credit cards, bill payment services, cross-border payments, and a software platform for expense management and financial operations. Clara primarily serves large and growing companies across various industries. The company was founded in 2020 and is based in Sao Paulo, Brazil.

Loading...

Clara's Product Videos

Clara's Products & Differentiators

Card

Clara-issued charge card (have premium, business, and virtual offerings)

Loading...

Research containing Clara

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clara in 5 CB Insights research briefs, most recently on Oct 23, 2025.

Oct 23, 2025 report

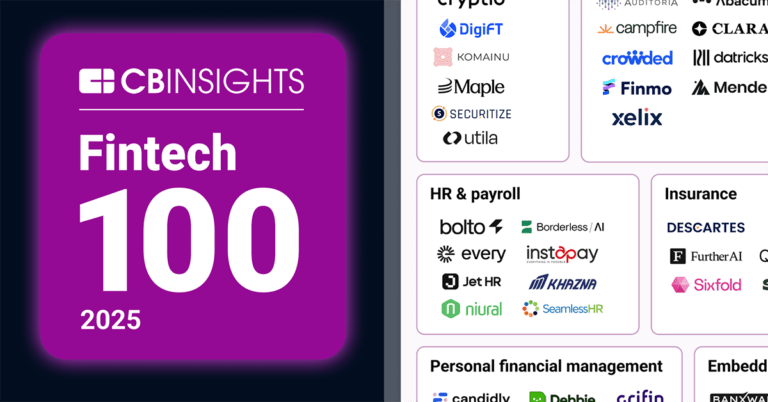

Fintech 100: The most promising fintech startups of 2025

Oct 23, 2025 report

Book of Scouting Reports: 2025’s Fintech 100

Aug 23, 2024

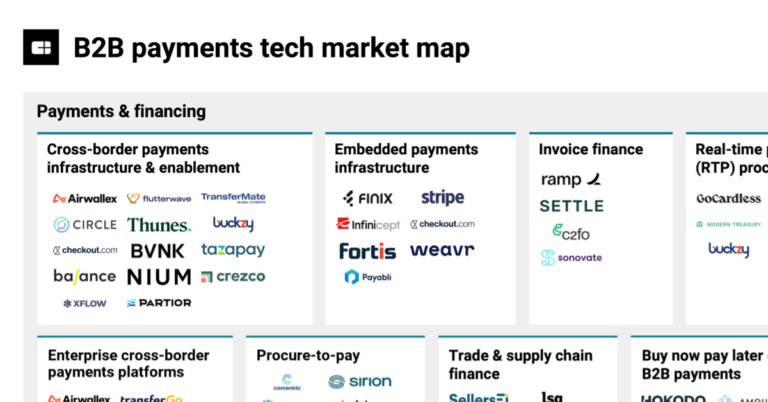

The B2B payments tech market map

Oct 5, 2023 report

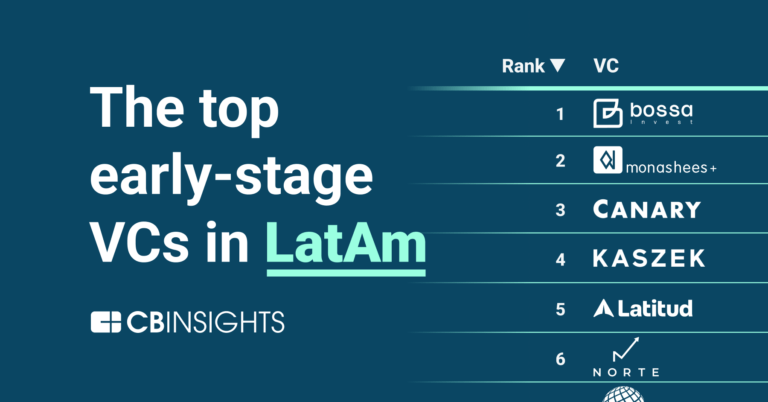

The top 25 early-stage LatAm VCs

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Clara

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clara is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

200 items

Latest Clara News

Nov 5, 2025

startup-crecimiento Shutterstock. Elizabeth Meza Rodríguez Publicado: Actualizado: El Venture Capital (VC) es un impulso para el ecosistema emprendedor, no solo aporta un recurso económico, también acompañamiento estratégico para ayudar a la startups a crecer más rápido y rentable. Son la “levadura del pan”, destaca el libro “Conoce los 10 fondos clave de capital emprendedor en México” , puesto que “se puede hacer pan sin levadura, pero no crecerá”. Lo mismo sucede con ecosistema emprendedor, se puede tener un negocio, pero sin un impulso en capital, la innovación y el desarrollo tecnológico no avanzará. “Para que una empresa pueda crecer necesita, además del talento, resolver un problema y atacar un mercado, de capital. Dependiendo del tipo de empresa es la fuente de capital o financiamiento que se necesita”, precisa Daniela Ruíz Massieu, profesora de emprendimiento y capital emprendedor en el ITAM. El financiamiento de capital emprendedor va dirigido a empresas de alto crecimiento ; startups, que se apalancan en la tecnología para expandirse y generar disrupción en el mercado. Estas empresas crecen muy rápidamente, y para ello necesitan una fuente de financiamiento que esté dispuesta a asumir el riesgo que conlleva una empresa tecnológica”. Ejemplo del impulso del Venture Capital son los unicornios mexicanos como Clip, Kavak, Bitso, Clara, Konfío , entre otras startups que, sin inversión, no hubieran podido crecer tan rápido. Ecosistema de Venture Capital El Venture Capital es catalizador del crecimiento económico y la innovación tecnológica. En el 2014 la inversión en México rondaba los 15.1 millones de dólares y para el 2024 superó los 970 millones de dólares , con más de 170 Venture Capital en el país, de acuerdo con Amexcap. El número de startups financiadas se ha multiplicado; sin embargo, la industria de capital emprendedor en México sigue siendo pequeña en relación con el tamaño de su economía. A penas alrededor del 0.14% del PIB se invierte en Venture Capital, una cifra significativamente menor comparada con países como Brasil (0.19%) Colombia (0.36%) o Estados Unidos (0.97%)”, destaca Daniela Ruíz El capital emprendedor ha pasado varias etapas : desde el boom de levantamiento de grandes inversiones, lo que dio origen a diversos unicornios, hasta la fase de reducción en la asignación de capital, derivado del aumento de las tasas de interés. En este punto los fondos apostaron por darle mayor peso a la rentabilidad que al crecimiento de las startups y haciendo inversiones “más pensadas”. “Actualmente, con la llegada de la Inteligencia Artificial se buscan modelos de negocios escalables y apalancados de la tecnología, a parte de la rentabilidad. Por ellos sectores como fintech y sector salud son más atractivas”. Infográfico EE Recomendaciones para buscar capital emprendedor Daniela Ruíz recomienda a los emprendedores que están buscando inversión realizar un análisis previo para conocer el monto que necesitan , definir en qué lo invertirán y evaluar si realmente el negocio necesita el capital emprender. El capital emprendedor no es para todas las empresas ni para todo tipo de emprendedor. Lo primero que tienes que saber es cuánto necesitas, para que lo vas a usar y si realmente es tu fuente de financiamiento adecuada”. Puntualiza que , si eres una empresa pequeña que quieres crecer orgánicamente y tener una o dos sucursales, el venture capital no es la mejor opción. “A diferencia de un crédito bancario, el fondo comparte el riesgo emprendedor y trabaja para hacer que la empresa crezca y se vuelva atractiva para un futuro comprador”. También le recomienda a los emprendedores ser transparentes con sus números y conocer los Unit Economics, es decir, cuánto ganas por cada producto o servicio y sobre todo. Además, estar dispuesto a tener un socio, ya que el fondo se convierte en un inversionista. Editora El Empresario. Periodista especializada en emprendimiento, pymes, creación de negocios, management y liderazgo. Desde el 2017 coordina El Empresario

Clara Frequently Asked Questions (FAQ)

When was Clara founded?

Clara was founded in 2020.

Where is Clara's headquarters?

Clara's headquarters is located at R. Dr. Renato Paes de Barros. 33, Sao Paulo.

What is Clara's latest funding round?

Clara's latest funding round is Series B - IV.

How much did Clara raise?

Clara raised a total of $550M.

Who are the investors of Clara?

Investors of Clara include General Catalyst, Picus Capital, MONASHEES, DST Global, Coatue and 39 more.

Who are Clara's competitors?

Competitors of Clara include Kamino, ComunidadFeliz, Mendel, Tribal Credit, Tesouro and 7 more.

What products does Clara offer?

Clara's products include Card and 2 more.

Who are Clara's customers?

Customers of Clara include Banco Sabadell, Enseña por México, OnFly and Gulf.

Loading...

Compare Clara to Competitors

ASAAS focuses on financial process automation for businesses. It provides a digital account for billing management, invoicing, receivables anticipation, and supplier payments. It serves freelancers, microentrepreneurs, and large companies. It was founded in 2010 and is based in Joinville, Brazil.

Pluto operates as a spend management and corporate card platform providing financial workflow automation across various industries. The company offers services, including corporate cards with budget controls, employee reimbursements, digital petty cash management, procurement and accounts payable solutions, accounting automation, and invoice management. Pluto primarily serves sectors such as retail and e-commerce, agencies, trucking and fleet, consulting firms, small to medium-sized businesses, and large enterprises. Pluto was formerly known as Pluto Technologies. It was founded in 2021 and is based in Dubai, United Arab Emirates.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Mendel is a technology company that focuses on streamlining and optimizing financial management for large enterprises in the finance and technology sectors. The company offers an integrated solution for intelligent expense management and control, providing real-time reporting, automated workflows, and smart corporate Visa cards. Mendel primarily serves large corporations seeking to digitize their financial processes and increase payment transparency. It was founded in 2021 and is based in Mexico City, Mexico.

Jeeves operates a financial platform providing payment and expense management solutions within the financial services industry. The company offers a suite of tools that streamline global finance operations, including multi-currency accounts, corporate card issuance, cross-border payments, and integrated expense management. Jeeves primarily serves businesses looking to manage their financial operations across multiple countries. It was founded in 2019 and is based in Orlando, Florida.

mica focuses on helping the rental process within the real estate sector. The company offers services such as tenant screening, automated bill payments, rental payment guarantees, and financial tools to facilitate transactions between tenants and landlords. It primarily serves the real estate industry. The company was founded in 2022 and is based in Mexico City, Mexico.

Loading...