Clarify Health

Founded Year

2015Stage

Series D | AliveTotal Raised

$389.94MValuation

$0000Last Raised

$150M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-184 points in the past 30 days

About Clarify Health

Clarify Health specializes in healthcare analytics within the healthcare technology sector. Its offerings include analytics and insights that assist healthcare providers, payers, tech and services organizations, and life sciences companies in their operations. The company serves the healthcare industry, including hospitals, health systems, insurance plans, and pharmaceutical companies. It was founded in 2015 and is based in San Francisco, California.

Loading...

ESPs containing Clarify Health

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

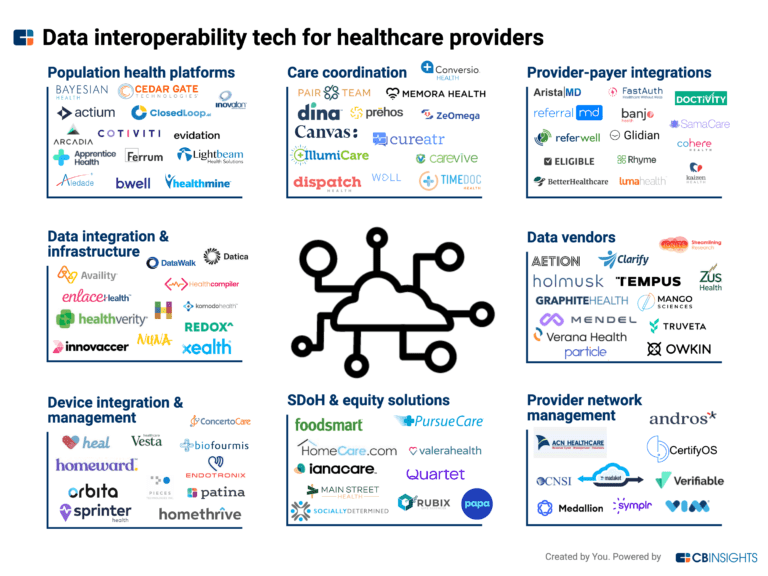

The provider network management software market includes tech companies with solutions for healthcare organizations and insurance companies to efficiently manage and optimize their networks of healthcare providers. These include hospitals, clinics, physicians, and other medical professionals. Organizations can use vendors in this market to streamline various tasks such as contract management, clai…

Clarify Health named as Highflier among 15 other companies, including HealthStream, Kyruus Health, and H1.

Loading...

Research containing Clarify Health

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clarify Health in 4 CB Insights research briefs, most recently on Aug 21, 2024.

Aug 21, 2024

The clinical trials tech market map

Nov 10, 2023

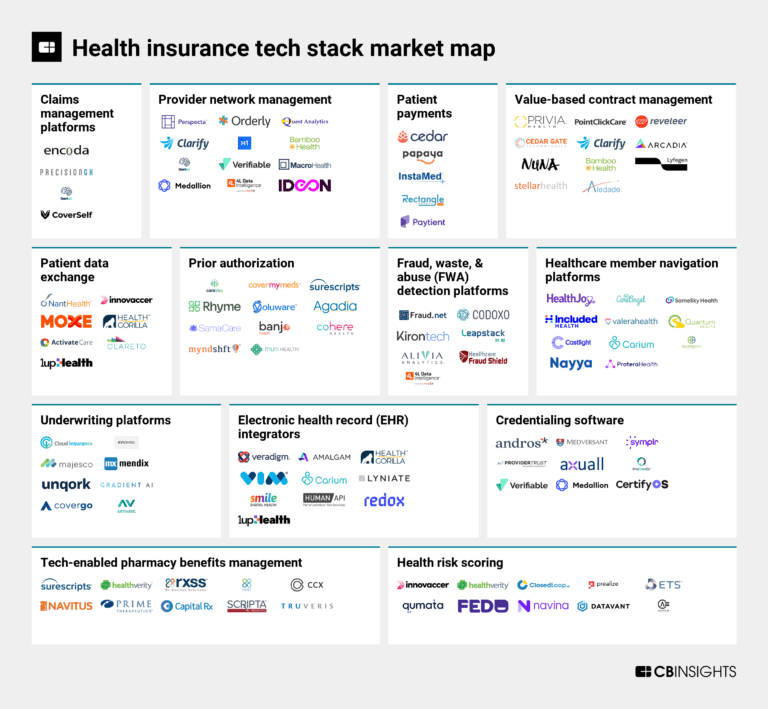

The health insurance tech stack market mapExpert Collections containing Clarify Health

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clarify Health is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Conference Exhibitors

5,501 items

HLTH is a healthcare event bringing together startups and large companies from pharma, health insurance, business intelligence, and more to discuss the shifting landscape of healthcare

Insurtech

3,403 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Value-Based Care & Population Health

1,262 items

The VBC & Population Health collection includes companies that enable and deliver care models that address the health needs for defining populations along the continuum of care, including in the community setting, through participation, engagement, and targeted interventions.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Clarify Health Patents

Clarify Health has filed 22 patents.

The 3 most popular patent topics include:

- machine learning

- financial data vendors

- knowledge representation

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/8/2024 | 4/8/2025 | Grant |

Application Date | 8/8/2024 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | |

Status | Grant |

Latest Clarify Health News

Jul 24, 2025

Asia Pacific is estimated to grow at the fastest rate during the forecast period. By application, the financial segment dominated the market in 2024. By application, the population health segment is estimated to grow at the fastest rate during the forecast period. By end-use, the providers segment held the major share of the market in 2024. By end-use, the payers segment is anticipated to grow significantly during the studied period. Market Overview & Potential What is Healthcare Predictive Analytics? Healthcare predictive analytics employs data analysis techniques to forecast future health outcomes and enhance patient care. By examining both historical and real-time patient data, healthcare providers can identify risks, tailor treatments, and improve resource management. This strategy supports early disease detection, proactive interventions, and better patient results. It leverages statistical modeling, data mining, and machine learning to analyze patient information and predict health trends. This allows for the identification of individuals at risk for specific conditions, anticipation of complications, and personalized treatment planning. Core technologies include data mining, machine learning, statistical modeling, and artificial intelligence. What is the Growth Potential Responsible for The Growth of The Healthcare Predictive Analytics Market? The healthcare predictive analytics market is mainly propelled by the need to cut costs and enhance efficiency in healthcare services. The rising healthcare expenses pose a significant challenge for governments, providers, and patients. Predictive analytics helps optimize resource use, uncover cost-saving opportunities, and streamline operations. Additional key factors include the increasing amount of healthcare data, the expansion of personalized medicine , and the higher prevalence of chronic conditions. The healthcare sector produces vast data from sources such as electronic health records (EHRs), medical devices , and wearable sensors. Predictive analytics is essential in personalized medicine, as it analyzes individual patient information to forecast disease risks, treatment success, and therapy responses. Dive into comprehensive datasets, market sizing, and competitive benchmarks: https://www.towardshealthcare.com/download-databook/5474 What Are the Growing Trends Associated with the Healthcare Predictive Analytics Market? Rising Demand for Advanced Analytics The growing demand for advanced analytics and greater leadership of predictive models and solutions fuels the growth of the market. Technological Advancements Integration of AI and machine learning for advancements and faster data processing for the growth of the market. Population Health Management The growing demand for population health management through an integrated system and solution fuels the growth of the market. Cost Reduction and operational efficiency The cost reduction and demand for efficiency to optimize the processes and resource utilization drive the growth of the market. What Is the Major Challenge in the Healthcare Predictive Analytics Market? The healthcare predictive analytics market encounters several major challenges, such as concerns over data privacy and security, high costs for implementation, and the requirement for skilled staff to handle and analyze the data. Additionally, interoperability issues between various healthcare systems present a significant obstacle, along with the risk of bias in predictive models and an over-dependence on historical data. You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com Regional Analysis: How Did North America Dominate the Healthcare Predictive Analytics Market in 2024? North America led the healthcare predictive analytics market share by 49% in 2024. The growth of the market is driven by the growing demand for the market due to advanced healthcare infrastructure, focus on personalized medicine, and rising adoption of predictive analytics tools by consumers to enhance and improve patient care and reduce costs promotes the growth of the market in the region. The other factors that support the growth of the market in the region are the technological advancements, cost reduction focus, clinical applications, and supportive government initiatives for the promotion of healthcare management drive the growth. The key players like IBM, SAS Institute, Oracle, and CVS Health also play a crucial role in the growth and expansion of the market in the region. What Made Asia Pacific Significantly Grow in The Healthcare Predictive Analytics Market In 2024? Asia Pacific is estimated to grow at the fastest rate during the forecast period. The growth of the market is driven by the growing demand for the market in the region due to the growing application with advancements in the field, which contributes to the growth of the market. The growth is also driven by the government initiatives, rising healthcare expenditure, advancement in technology, growing telemedicine and wearable devices, focus on population health management, integration and adoption of AI and ML for data analysis are some of the drivers that support and contribute to the growth and expansion of the market in the region. Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership Segmental Insights Which Application Segment Dominated the Healthcare Predictive Analytics Market In 2024? The financial segment dominated the market in 2024. The financial application segment is a major driver of growth in the healthcare predictive analytics market, as it helps healthcare organizations optimize revenue cycle management , detect and prevent fraud, and reduce unnecessary costs. By analyzing large volumes of financial and claims data, predictive models enable providers to improve billing accuracy, enhance cash flow, and identify potential risks before they escalate. These benefits improve overall financial performance, increase operational efficiency, and support the wider adoption of predictive analytics solutions in healthcare. The population health segment is estimated to grow at the fastest rate during the forecast period. The population health application segment plays a pivotal role in the healthcare predictive analytics market by enabling proactive, community-wide health management. It leverages large-scale patient and demographic data to identify high-risk populations, forecast disease outbreaks, and inform targeted prevention strategies. These insights facilitate better resource allocation, optimized care coordination, and improved health outcomes across communities. As a result, organizations and public health agencies increasingly adopt population health analytics to reduce disparities, lower costs, and enhance overall population well-being. By end-use How Did The Providers Segment Dominated the Healthcare Predictive Analytics Market In 2024? The providers segment held the major share of the market in 2024. The providers' end-use segment plays a central role in the healthcare predictive analytics market. Hospitals, clinics, and physician groups adopt these tools to forecast patient admissions, optimize staffing, and personalize care pathways. By analyzing patterns in clinical and operational data, providers can identify at-risk patients early, reduce readmissions, and streamline resource allocation. These improvements lead to enhanced care quality, greater operational efficiency, and cost savings, driving widespread adoption of predictive analytics in healthcare organizations. The payers segment is anticipated to grow significantly during the studied period. The payers' end-use segment is a key driver in the healthcare predictive analytics market. Insurance companies and government agencies leverage these tools to identify high-cost patients, detect fraudulent claims, and design value-based payment models. By analyzing claims, utilization patterns, and member demographics, payers can forecast risk, optimize premiums, and incentivize preventive care. These capabilities reduce unnecessary spending, improve patient outcomes, and support strategic decision-making, driving extensive adoption of predictive analytics among healthcare payers. Elevate your healthcare strategy with Towards Healthcare. Enhance efficiency and drive better outcomes schedule a call today: https://www.towardshealthcare.com/schedule-meeting Recent Developments In October 2024, Clarify Health, a healthcare data and analytics company, announced the launch of the first AI-powered predictive analytics solution, Clarify Performance IQ Suite, with improved quality and advanced machine learning. In April 2025, MedeAnalytics, a healthcare enterprise data enrichment platform and analytics software-as-a-service (SaaS) leader, announced the launch of Health Fabric, which is powered by Snowflake AI data cloud. Top Key Players in Healthcare Predictive Analytics Market IBM Healthcare Supply Chain Management Market The healthcare supply chain management market is valued at USD 3.24 billion in 2024, expected to reach USD 3.6 billion in 2025, and projected to grow to USD 9.2 billion by 2034, expanding at a CAGR of 11.05%. AI in Healthcare Revenue Cycle Management Market The AI in healthcare revenue cycle management market stands at USD 20.68 billion in 2024, grows to USD 25.7 billion in 2025, and may hit USD 180.33 billion by 2034, growing rapidly at a CAGR of 24.20%. Digital Healthcare Education Market The digital healthcare education market is valued at USD 53.67 billion in 2024, expected to grow to USD 58.2 billion in 2025, and reach USD 120.67 billion by 2034, showing consistent growth with a CAGR of 8.44%. Advanced Healthcare Solutions Market The advanced healthcare solutions market is witnessing strong momentum from 2025 to 2034, fueled by rising demand for personalized care, evolving patient expectations, and innovations in healthcare technologies. Mixed Reality in Healthcare Market The mixed reality in healthcare market is projected to rise from USD 1.27 billion in 2024 to USD 1.89 billion in 2025, and skyrocket to USD 67.45 billion by 2034, growing at an impressive CAGR of 48.74%. Healthcare Cybersecurity Market The healthcare cybersecurity market starts at USD 20.56 billion in 2024, grows to USD 24.39 billion in 2025, and is projected to reach USD 112.6 billion by 2034, with a strong CAGR of 18.54%. Healthcare Cold Chain Logistics Market The healthcare cold chain logistics market is valued at USD 59.97 billion in 2024, increases to USD 65.14 billion in 2025, and is estimated to reach USD 137.13 billion by 2034, expanding at a CAGR of 8.63%. Big Data Analytics in Healthcare Market The big data analytics in healthcare market grows from USD 40.61 billion in 2024 to USD 47.42 billion in 2025, and is set to reach USD 190.98 billion by 2034, rising at a CAGR of 16.73%. Healthcare Contract Research Organization (CRO) Market The healthcare CRO market is estimated at USD 53.87 billion in 2024, expected to grow to USD 57.66 billion in 2025, and reach USD 106.25 billion by 2034, with a steady CAGR of 7.04%. Healthcare Contact Center as a Service Market The healthcare contact center as a service market is valued at USD 5.86 billion in 2024, forecasted to grow to USD 7.05 billion in 2025, and projected to reach USD 36.24 billion by 2034, growing at a CAGR of 20.34. Segments Covered in The Report By Application Access the full report for in-depth analysis, trends, and strategic growth opportunities: https://www.towardshealthcare.com/price/5474 You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription About Us Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research . Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth. Our Trusted Data Partners

Clarify Health Frequently Asked Questions (FAQ)

When was Clarify Health founded?

Clarify Health was founded in 2015.

Where is Clarify Health's headquarters?

Clarify Health's headquarters is located at 75 Hawthorne Street, San Francisco.

What is Clarify Health's latest funding round?

Clarify Health's latest funding round is Series D.

How much did Clarify Health raise?

Clarify Health raised a total of $389.94M.

Who are the investors of Clarify Health?

Investors of Clarify Health include KKR, Spark Capital, Rivas Capital, Aspenwood Ventures, Sigmas Group and 11 more.

Who are Clarify Health's competitors?

Competitors of Clarify Health include Pentavere, Aetion, hi.health, Lyfegen, Qantev and 7 more.

Loading...

Compare Clarify Health to Competitors

Innovaccer operates within the healthcare sector, providing a healthcare intelligence cloud to integrate and analyze healthcare data. This supports value-based care and population health management. Innovaccer serves a diverse range of entities within the healthcare industry, including healthcare providers, payers, public sector entities, and life sciences organizations. It was founded in 2014 and is based in San Francisco, California.

Cedar Gate Technologies provides value-based care solutions within the healthcare industry. The company offers a platform that integrates data management, analytics, care management, and payment model administration to support value-based care initiatives. Cedar Gate serves payers, providers, and self-funded employers. It was founded in 2014 and is based in Greenwich, Connecticut.

RespondHealth operates within the healthcare technology sector and offers solutions that support clinical discovery, commercialization, and patient care through analytics, decision support, and evidence generation. The company serves healthcare providers, researchers, and pharmaceutical companies with data integration and analysis tools. It was founded in 2013 and is based in Bethesda, Maryland.

Gray Matter Analytics provides analytics solutions for the healthcare industry, with a focus on value-based care. The company offers services and tools that assist payors and providers in monitoring and improving healthcare performance, managing value-based contracts, and utilizing data for insights. Gray Matter Analytics serves the healthcare sector, including providers and payors, by offering analytics that aid in the transition from fee-for-service to value-based care models. It is based in Chicago, Illinois.

Arcadia operates as a healthcare data platform that focuses on healthcare data and analytics. The company provides products including analytics dashboards, care management tools, and population health management solutions. Arcadia serves healthcare providers, payers, and government organizations with a focus on value-based care. It was founded in 2002 and is based in Boston, Massachusetts.

NextGen Healthcare focuses on healthcare technology and data solutions, specifically in electronic health records (EHR), practice management, and revenue cycle management within the healthcare sector. The company provides products aimed at improving clinical quality, productivity, and financial performance for ambulatory practices. NextGen Healthcare's offerings include documentation tools, patient and provider experience tools, and analytics to support value-based care and interoperability. NextGen Healthcare was formerly known as NXGN Management. It was founded in 1974 and is based in Irvine, California.

Loading...