Clay

Founded Year

2017Stage

Series C | AliveTotal Raised

$202MValuation

$0000Last Raised

$100M | 5 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+171 points in the past 30 days

About Clay

Clay provides GTM data solutions, focusing on research and customer relationship management (CRM) enrichment within the sales and marketing technology industry. The company offers tools for lead scoring, email outreach, and integrating data sources to support GTM workflows. Clay serves sales, marketing, and revenue operations teams across various sectors. It was founded in 2017 and is based in New York, New York.

Loading...

ESPs containing Clay

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The sales AI agents & copilots market provides AI-powered assistants and agents to improve efficiency for B2B sales professionals. These platforms help with tasks such as account research, updating customer relationship management (CRM) software, writing personalized emails, and creating sales playbooks. Unlike AI sales development representatives (SDRs), these tools augment human sales teams rath…

Clay named as Highflier among 14 other companies, including Salesforce, HubSpot, and Apollo.

Clay's Products & Differentiators

Custom Signals

Lets users watch any datapoint on the public web or inside SaaS tools—funding, tech-stack shifts, new execs—and trigger instant enrichment and personalized outreach.

Loading...

Research containing Clay

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clay in 3 CB Insights research briefs, most recently on Aug 14, 2025.

Aug 14, 2025 report

Book of Scouting Reports: Enterprise AI Agents

Mar 6, 2025

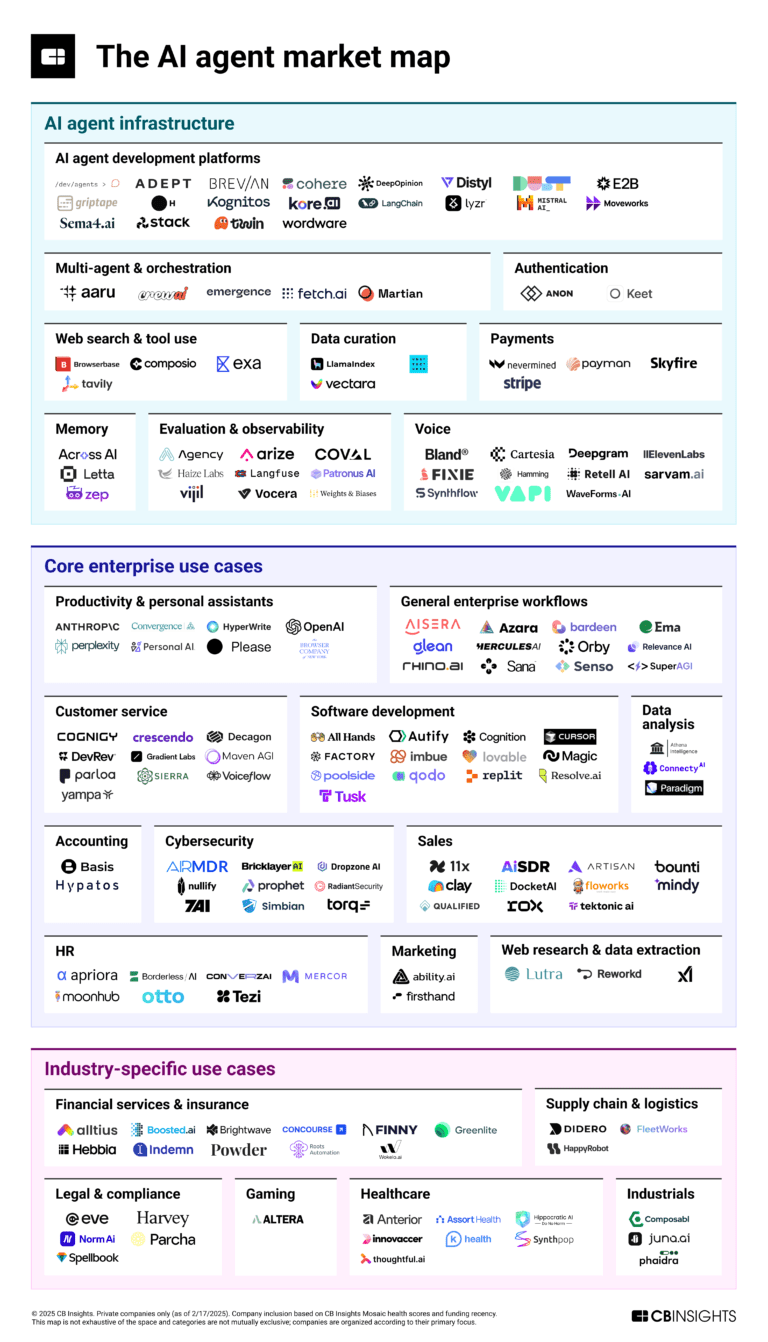

The AI agent market map: March 2025 edition

Aug 7, 2024

The enterprise AI agents & copilots market mapExpert Collections containing Clay

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clay is included in 7 Expert Collections, including Generative AI.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence (AI)

20,894 items

Sales & Customer Service Tech

600 items

Companies offering technology-driven solutions to enable, facilitate, and improve customer service across industries. This includes solutions pre-, during, and post-purchase of goods and services.

AI Agents & Copilots Market Map (August 2024)

322 items

Corresponds to the Enterprise AI Agents & Copilots Market Map: https://app.cbinsights.com/research/enterprise-ai-agents-copilots-market-map/

AI agents (March 2025)

376 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

Unicorns- Billion Dollar Startups

1,309 items

Latest Clay News

Nov 12, 2025

The moment where AI stops being a buzzword and becomes your unfair competitive advantage. SaaStr AI London on December 1-2 is bringing together 2,500 of the sharpest B2B operators, the companies actually scaling with AI (OpenAI, Wiz, Clay, Artisan, Databricks, Intercom), and the tactical playbooks you can deploy the day you get back to the office. This isn’t theory. This isn’t vendor pitches. This is two days of learning exactly how the winners are deploying AI to 3-5x their conversion rates, turn cost centers into profit centers, and build revenue engines that run 24/7. Here are 10 specific reasons why this is the must-attend event to close out 2025: 1. Learn from OpenAI’s Actual GTM Playbook OpenAI went from $0 to $500M ARR faster than almost anyone in software history. Their GTM leadership is sharing the actual playbook – not the sanitized version you read in TechCrunch, but the real decisions, pivots, and strategies that fueled that growth. You can’t get this anywhere else. 2. Stop Wasting Money on AI SDRs That Don’t Work 98% of companies are deploying AI SDRs completely wrong. They’re spamming prospects, destroying sender reputation, and wondering why conversion rates are terrible. The “Deploying AI SDRs… The RIGHT Way” workshop shows you exactly what the 2% who are crushing it are doing differently. This one session could save you $100K+ in wasted AI spend. 3. See How Wiz Hit $12B in 5 Years Using AI Wiz is one of the fastest-growing enterprise companies ever, going from $0 to $12B valuation in five years. Their CMO is breaking down the hypergrowth playbook and how they’ve baked AI into their product and GTM motion. These are the unintuitive decisions that separated them from every other security startup. 4. Intercom’s “All-In” Bet on AI: What Worked and What Didn’t Intercom made one of the boldest product bets in SaaS history by going all-in on Fin, their AI customer service agent. Their CPO Paul Adams is sharing the inside story – the wins, the failures, and what they’d do differently. This is the kind of honest breakdown you never get from a company case study. 5. Turn Your Support Team from Cost Center to Profit Center The “AI to Turn Support Into a Sales Weapon” workshop shows how every support ticket becomes a revenue opportunity. Companies are going from $2M cost centers to $500K profit centers in 8 months using AI. Your support team could be your highest-converting sales channel if you deploy this right. 6. Clay’s Playbook for AI-Powered GTM Clay has become the secret weapon for top GTM teams. Their co-founder is showing exactly how high-performing teams use AI-driven signals to prioritize accounts, personalize outreach at scale, and accelerate pipeline. This is the playbook that’s making traditional sales development obsolete. 7. Hyper-Personalization That Actually Converts Forget “Hi {FirstName}” personalization. The “AI to Hyper-Customize Marketing at Scale” workshop shows you how to create genuinely 1:1 experiences for thousands of prospects simultaneously. Companies doing this are seeing 3-5x improvement in conversion rates because prospects actually believe a human researched them. 8. Real Metrics from Companies Deploying 20+ AI Agents I’m doing a session on how we went from 0 to 20+ AI agents at SaaStr in 18 months, generating $1.5M in revenue while investing $500K+. The exact playbook, the failures we had to learn from, and the ROI calculations that separate hype from reality. Plus case studies from OpenAI (obviously), Wiz, Clay, and 20+ more companies with real results. 9. The AI Orchestration Blueprint for Your Entire Sales Motion Most companies are adding AI to individual parts of their funnel. Winners are thinking end-to-end – lead routing, deal coaching, pipeline forecasting, all connected through AI orchestration. The “AI to Orchestrate Your Entire Sales Motion” workshop shows you how to build this system so every rep performs like your top 10%. 10. Network with 2,500 Operators Actually Doing It This is the biggest reason. You’re not networking with tire-kickers and AI tourists. You’re connecting with 2,500 B2B operators who are deploying AI in production, generating real revenue, and solving the same problems you’re facing right now. The hallway conversations and dinner meetups are worth the ticket price alone. The Bottom Line December 1-2 in London. Two days. 2,500 operators. The companies genuinely crushing it with AI (OpenAI, Fin, Clay, Artisan, Wiz, Databricks, Intercom) sharing their actual playbooks in tactical workshops you can implement immediately. The companies that master AI deployment in Q4 2025 will dominate their markets in 2026. The ones still “exploring” will be playing catch-up with an insurmountable gap. Are you leading or catching up? See you at SaaStr AI London December 1-2! Join 2,500 of the best in B2B and AI to learn what’s actually working – not just the hype. Two days of tactical sessions, real metrics, and the founders and execs who are genuinely scaling with AI. From OpenAI to Fin, from Clay to Artisan, from Wiz to Databricks, and so much more! Related Posts

Clay Frequently Asked Questions (FAQ)

When was Clay founded?

Clay was founded in 2017.

Where is Clay's headquarters?

Clay's headquarters is located at 111 West 19th Street, New York.

What is Clay's latest funding round?

Clay's latest funding round is Series C.

How much did Clay raise?

Clay raised a total of $202M.

Who are the investors of Clay?

Investors of Clay include BoxGroup, First Round Capital, Boldstart Ventures, Meritech Capital Partners, CapitalG and 16 more.

Who are Clay's competitors?

Competitors of Clay include Zyplin and 3 more.

What products does Clay offer?

Clay's products include Custom Signals and 4 more.

Loading...

Compare Clay to Competitors

Cognism provides sales intelligence within the business to business (B2B) sector. The company offers a platform that includes General Data Protection Regulation (GDPR)-compliant data, decision-maker databases, and sales signals to support prospecting. Cognism serves teams in sales, marketing, revenue operations, and recruitment across various industries. It was founded in 2015 and is based in London, United Kingdom.

Jeeva offers sales solutions within the technology services sector. It provides automation tools for lead generation, enrichment, outreach, and sales engagement. Its agents are utilized across industries such as financial services, healthcare, and retail to assist client relationships and enhance operational efficiency. It was formerly known as Involve.Ai. It was founded in 2018 and is based in Santa Monica, California.

Ocean.io specializes in business-to-business (B2B) prospecting data and account-based marketing (ABM) targeting within the technology and data sectors. The company offers a prospecting data platform that uses artificial intelligence to help sales and marketing teams find accounts and contacts and build hyper-targeted company profiles and segments. Ocean.io primarily serves the sales, marketing, and data sectors. It was founded in 2017 and is based in Copenhagen, Denmark.

Upfluence offers a platform for influencer marketing within the eCommerce and social commerce sectors. The platform includes features for influencer discovery, management, and campaign analytics. It provides tools for finding and contacting influencers, managing campaigns, measuring results, and processing payments. It was founded in 2013 and is based in Lyon, France.

Aspire is an influencer marketing software platform that operates in the e-commerce sector. The company offers tools for influencer discovery, campaign management, affiliate tracking, and analytics, aimed at measuring the effectiveness of influencer and affiliate marketing campaigns. Aspire serves e-commerce brands looking to enhance their marketing strategies through word-of-mouth commerce and partnerships. It was founded in 2013 and is based in San Francisco, California.

Referly focuses on lead generation and sales automation within the marketing and sales technology sector. The company provides tools that identify warm leads, automate outreach, and integrate with existing workflows. Referly serves Go-To-Market teams, including marketing, sales, and revenue operations professionals, by offering contact-level signals and network mapping. It was founded in 2024 and is based in Eindhoven, Netherlands.

Loading...