CompScience

Founded Year

2019Stage

Series B | AliveTotal Raised

$46.35MLast Raised

$27.6M | 9 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+56 points in the past 30 days

About CompScience

CompScience is a workers' compensation insurance and safety technology company that focuses on workplace safety analytics. The company provides safety analytics and insurance solutions that aim to identify safety risks and reduce workplace accidents. CompScience serves sectors such as logistics, manufacturing, food manufacturing, auto dealers, heavy retail, grocery retail, construction, and restaurants. It was founded in 2019 and is based in San Francisco, California.

Loading...

CompScience's Product Videos

ESPs containing CompScience

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The workforce safety & risk detection solutions market helps organizations prevent workplace injuries and fatalities through technology-enabled solutions. Companies in this market provide wearable devices, AI-powered computer vision systems, IoT sensors, and software platforms that monitor worker behavior, detect safety hazards, and predict risks in real-time. Key features include biometric monito…

CompScience named as Challenger among 15 other companies, including Hexagon, SafetyCulture, and Protex AI.

CompScience's Products & Differentiators

Intelligent Safety Platform

End to end system for ingesting video, tagging the risks and producing a report.

Loading...

Research containing CompScience

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CompScience in 4 CB Insights research briefs, most recently on Oct 16, 2025.

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Feb 13, 2025

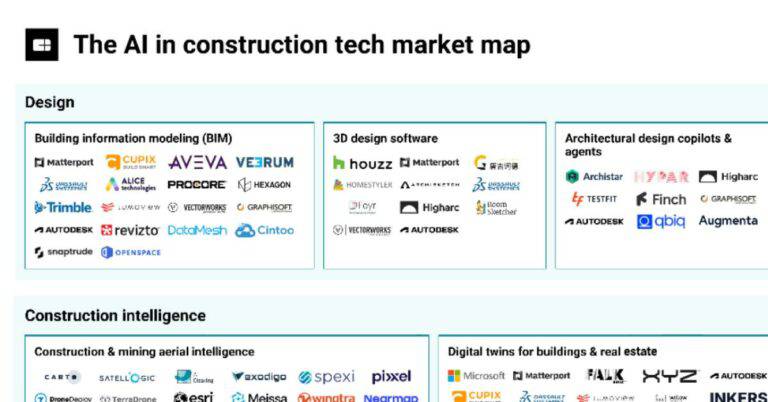

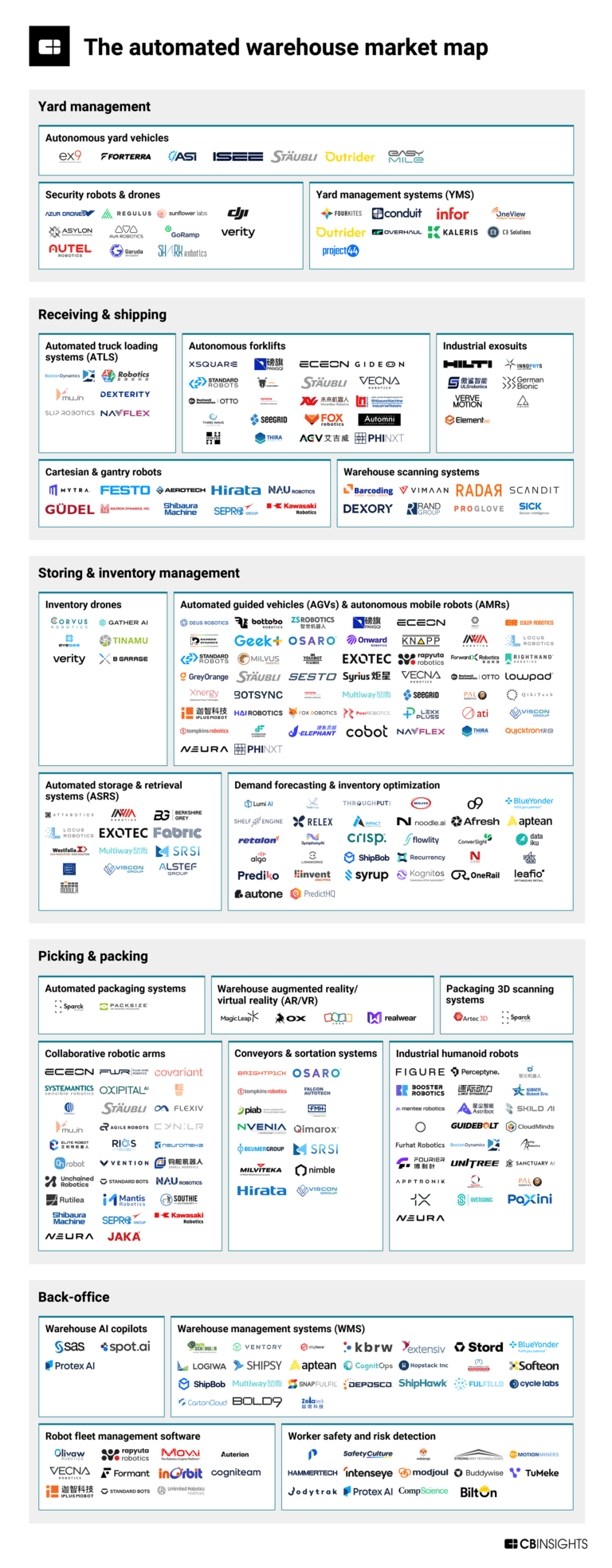

The automated warehouse market mapExpert Collections containing CompScience

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CompScience is included in 9 Expert Collections, including Construction Tech.

Construction Tech

1,530 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Supply Chain & Logistics Tech

5,344 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

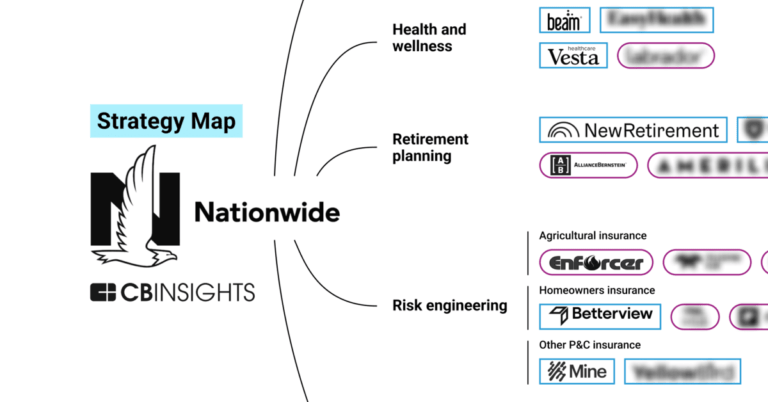

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Advanced Manufacturing

7,017 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Job Site Tech

968 items

Companies in the job site tech space, including technologies to improve industries such as construction, mining, process engineering, forestry, and fieldwork

Latest CompScience News

Oct 19, 2025

CB Insights has released the latest Insurtech 50 list of the world’s most promising or high-potential insurtech startups. The companies that have been selected are said to have a success probability among the international top 3% of private firms, indicated by a median CB Insights’ Mosaic score of 734 out of 1,000 (as of 9/30/2025). This benchmark is considered to be important because broader forces — like AI agent commercialization and extreme weather events — “influence the industry’s tech and underwriting considerations.” The 2025 Insurtech 50 unveiled by CB Insights reportedly includes 27 insurers and intermediaries and 23 tech vendors, which have so far secured a total of $3.6B in funding . 60% of the so-called “winners” are described as being early-stage insurtechs, a 20-percentage point growth from the past year’s list. Nearly three-quarters or around 75% of the selected firms were not in business at the start of the current decade, signaling the potential “opportunity for new entrants to shape the industry’s innovation landscape.” As stated in the report from CB Insights, small and mid-sized businesses fuel growth opportunities for “most insurers and intermediaries.” The companies selected for the list include 13 insurtechs in the commercial category and 6 in the health and benefits category, which are said to be mainly focused on small and mid-sized businesses. Most commercial-focused insurtechs offer coverage for “specific SMB segments, like a16z-backed District Cover, which serves small businesses based in cities.” Proactive risk management is also a key focus areas for some of these firms. For example, CompScience uses computer vision technology to reduce the likelihood of “workplace injuries that could lead to workers’ compensation claims.” Four of the insurtechs in the health and benefits category “are ICHRA (individual coverage health reimbursement arrangement) platforms: Stretch Dollar, Thatch, Venteur, and Zorro.” ICHRA is an alternative to “traditional employer-selected health plans in the US, where employers instead allocate money for their employees to select their preferred qualified plan individually.” These plans are particularly attractive to SMBs . Chris Ellis, Founder and CEO of Thatch, emphasized the benefits for workers as well as employers. Generally, the ICHRA platforms market has seen “favorable market development over the past year, with Mosaic scores (success probabilities) for market leaders steadily increasing.” Many tech vendors build products for insurers seeking to launch various AI agents. AI agents are a widespread focus among tech vendors, which are “loosely mapped across the insurance value chain — distribution, underwriting, operations, and claims.” Examples of AI agent-focused companies include the following: Quandri, which provides AI agents in order to support insurance agency renewals. Sixfold, whose agents include an underwriting referral agent in October of this year. PenguinAi, a platform for payers (and providers) founded “by the former Chief Data Officer of Kaiser Permanente and UnitedHealthcare.” Elysian, a claims TPA with a focus “on AI agent orchestration.” Workflow improvements to support decision-making “are the primary focus for agentic AI deployment among the winners.” In the 12 months following publication, the 2024 Insurtech 50 winners posted accomplishments, including the following: 15 equity funding rounds.

CompScience Frequently Asked Questions (FAQ)

When was CompScience founded?

CompScience was founded in 2019.

Where is CompScience's headquarters?

CompScience's headquarters is located at San Francisco.

What is CompScience's latest funding round?

CompScience's latest funding round is Series B.

How much did CompScience raise?

CompScience raised a total of $46.35M.

Who are the investors of CompScience?

Investors of CompScience include Valor Equity Partners, Alumni Ventures, Four More Capital, Working Capital Fund, Sands Capital and 12 more.

Who are CompScience's competitors?

Competitors of CompScience include Voxel and 4 more.

What products does CompScience offer?

CompScience's products include Intelligent Safety Platform and 1 more.

Loading...

Compare CompScience to Competitors

StrongArm Technologies focuses on enhancing workplace safety and performance through its SafeWork Platform in the safety technology sector. The company offers a suite of products, including ergonomic sensors for injury prevention, microlearning and coaching tools for safety training, and analytics for operational performance optimization. The SafeWork Platform is designed to serve industries prioritizing occupational safety and health. It was founded in 2011 and is based in Denver, Colorado.

Protex AI focuses on AI workplace safety solutions within the industrial safety management sector. The company provides a platform that integrates with existing CCTV systems, using computer vision technology to detect unsafe behaviors and events in various enterprise environments. Protex AI serves sectors including logistics, retail, industrial manufacturing, food and beverage manufacturing, ports, and warehousing. It was founded in 2021 and is based in Dublin, Ireland.

Dori provides an end-to-end platform. The platform helps accelerate the development of deep-learning computer vision applications. It was founded in 2018 and is based in Princeton, New Jersey.

ICW Group Insurance Companies is a national insurance carrier, focusing on the insurance industry. The company offers a range of insurance products for businesses, including workers' compensation, assumed reinsurance, and catastrophe insurance. ICW Group primarily sells to the business sector. It is based in San Diego, California.

Joyn Insurance focuses on underwriting commercial insurance in the small and middle market sectors. The company offers general liability and property insurance, using technology, data, and expertise to deliver a transparent and efficient insurance experience. Joyn Insurance primarily serves sectors such as real estate, manufacturing, services, wholesale, retail, and artisan contractors. It was founded in 2020 and is based in Sacramento, California.

ADVANCE.AI specializes in digital identity verification and risk management within the financial technology sector. The company offers a suite of products and services, including KYC/KYB compliance, anti-money laundering (AML) solutions, fraud prevention, and process automation, all powered by artificial intelligence. ADVANCE.AI primarily serves sectors such as banking, financial services, fintech, e-commerce, and healthcare. It was founded in 2016 and is based in Singapore. ADVANCE.AI operates as a subsidiary of Advance Intelligence Group.

Loading...