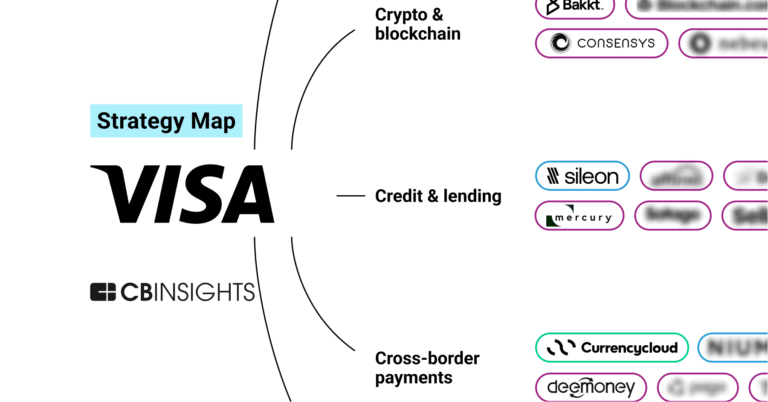

Consensys

Founded Year

2014Stage

Secondary Market | AliveTotal Raised

$732.5MLast Raised

$14M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-36 points in the past 30 days

About Consensys

Consensys focuses on developing products for the decentralized web. The company offers services including self-custodial wallet solutions, tools for building decentralized applications, zkEVM rollup technology for scaling Ethereum, smart contract auditing, and staking services. Consensys serves developers, creators, and users within the web3 ecosystem. It was founded in 2014 and is based in Fort Worth, Texas.

Loading...

Consensys's Product Videos

ESPs containing Consensys

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The enterprise blockchain platforms market provides blockchain infrastructure and development tools for businesses to build distributed applications and networks. These platforms offer permissioned or hybrid blockchain frameworks, smart contract capabilities, consensus mechanisms, and enterprise integration tools. Solutions include both open-source platforms like Hyperledger Fabric and Ethereum En…

Consensys named as Leader among 15 other companies, including IBM, Oracle, and Intel.

Consensys's Products & Differentiators

MetaMask

Mobile Wallet and Browser Extension

Loading...

Research containing Consensys

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Consensys in 8 CB Insights research briefs, most recently on Jul 6, 2023.

Dec 14, 2022

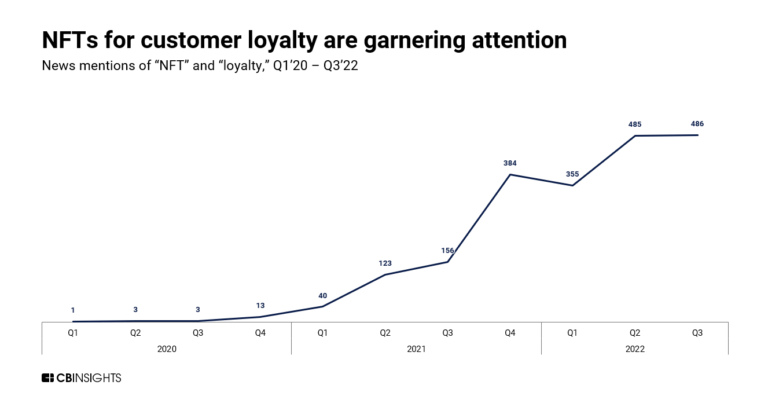

What L’Oréal, Nike, and LVMH are doing in Web3

Nov 19, 2022

State of Enterprise Blockchain 2022Expert Collections containing Consensys

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Consensys is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Blockchain

15,078 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Conference Exhibitors

5,302 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

349 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Consensys Patents

Consensys has filed 5 patents.

The 3 most popular patent topics include:

- cryptocurrencies

- alternative currencies

- blockchains

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/4/2020 | 12/31/2024 | Cryptocurrencies, Cryptography, Anonymity networks, Blockchains, Network protocols | Grant |

Application Date | 12/4/2020 |

|---|---|

Grant Date | 12/31/2024 |

Title | |

Related Topics | Cryptocurrencies, Cryptography, Anonymity networks, Blockchains, Network protocols |

Status | Grant |

Latest Consensys News

Nov 15, 2025

쿠콘, 솔라나 재단과 스테이블코인 기반 글로벌 결제 인프라 구축 '맞손' 국내 결제 인프라 활용한 스테이블코인 PoC 착수…글로벌 페이사 제휴 추진 컴퓨팅 입력 :2025/11/15 10:47 쿠콘이 국내 결제 인프라 운영 노하우를 바탕으로 글로벌 스테이블코인 시장 진출에 박차를 가한다. 쿠콘은 싱가포르에서 솔라나 재단과 스테이블코인 기반 결제 솔루션 개발 및 글로벌 결제 인프라 확장을 위한 전략적 업무협약(MOU)을 체결했다고 15일 밝혔다. 릴리 리우 솔라나 재단 회장(왼쪽), 김종현 쿠콘 대표 (사진=쿠콘) 협약을 통해 양사는 쿠콘이 보유한 ▲국내 200만 개 이상의 오프라인 QR가맹점 ▲10만여 개의 주요 프랜차이즈 ▲전국 4만여 대의 ATM 인프라를 기반으로 솔라나 네트워크를 활용한 스테이블코인 결제서비스 기술검증(PoC)과 더불어 실제 상품 구현에 나선다. PoC 단계에서는 ▲국내 QR 결제망과 ATM 출금망을 활용한 스테이블코인 결제·출금 검증 ▲솔라나 네트워크와 연계된 글로벌 페이사 제휴 모델 검증 ▲국경 간 결제 서비스 구현 가능성 및 운영 노하우 확보 등을 중점적으로 다룰 예정이다. 쿠콘은 이번 협력을 통해 솔라나 재단의 아시아 시장 진출 핵심 파트너로 자리매김하며 글로벌 페이 및 주요 스테이블코인사와의 파트너십 확대를 주도할 계획이다. 솔라나 재단은 전통 금융 기관과의 전략적 제휴를 통해 블록체인 기반 글로벌 결제 인프라 구축에 속도를 내고 있다. 쿠콘은 아시아 시장에서 솔라나 블록체인이 실생활 결제 인프라와 ATM 출금망에 통합될 실질적인 가능성을 검증하는 주요 협력사로 참여한다. 또 국내외 주요 스테이블코인 사업자들과 지급결제 및 유통 분야의 협업을 추진하며 단순 인프라 제공을 넘어 글로벌 스테이블코인 생태계의 중심 허브로 도약할 기반을 마련하고 있다. 더불어 스테이블코인 법제화에 대비해 차세대 지급결제 인프라 구축을 위한 협업도 다각도로 검토 중이다. 관련기사

Consensys Frequently Asked Questions (FAQ)

When was Consensys founded?

Consensys was founded in 2014.

Where is Consensys's headquarters?

Consensys's headquarters is located at 5049 Edwards Ranch Road, Fort Worth.

What is Consensys's latest funding round?

Consensys's latest funding round is Secondary Market.

How much did Consensys raise?

Consensys raised a total of $732.5M.

Who are the investors of Consensys?

Investors of Consensys include Mindrock Capital, Fabrica Ventures, Third Point Ventures, ParaFi Capital, Marshall Wace Asset Management and 43 more.

Who are Consensys's competitors?

Competitors of Consensys include Securitize, Digital Asset, Try Your Best, Tokeny, Phantom and 7 more.

What products does Consensys offer?

Consensys's products include MetaMask and 4 more.

Loading...

Compare Consensys to Competitors

Hyperledger is an open source initiative focused on blockchain technologies within the decentralized systems domain. The organization provides services including the development of ledger technologies, interoperability solutions, decentralized identity systems, and cryptographic protocols. Hyperledger serves sectors that require financial infrastructures, digital identity solutions, and secure systems. It was founded in 2015 and is based in San Francisco, California.

R3 focuses on the digitization of financial services within the enterprise technology sector. It offers a private, permissioned distributed ledger technology (DLT) platform named Corda, designed to enable secure and direct digital collaboration among regulated institutions. R3's solutions cater to various sectors, including banks, central banks, corporations, exchanges, central counterparties, and fintech, providing services such as tokenization of digital assets and currencies, streamlined inter-bank transactions, and modernization of legacy workflows. It was founded in 2014 and is based in New York, New York.

Bitt is a financial software company focused on central bank digital currencies (CBDC) and digital currencies within the financial sector. The company's offerings include a Digital Currency Management System (DCMS) for central banks and financial institutions to deploy CBDCs and stablecoins, along with advisory services for developing and implementing digital currency systems. Bitt serves central banks, financial institutions, and government entities needing digital currency solutions. It was founded in 2013 and is based in Draper, Utah.

Ethereum is a decentralized platform that allows the creation and execution of smart contracts and decentralized applications (dApps) on its blockchain. The platform supports cryptocurrency transactions, digital asset management, and the development of various blockchain-based applications, including those for finance, gaming, and social interaction. Ethereum's infrastructure enables the tokenization of assets and the operation of decentralized finance (DeFi) services, while also addressing user privacy and data security. It was founded in 2014 and is based in Zug, Switzerland.

Bitbond is an asset tokenization platform operating in the financial technology sector. The company offers a smart contract generator, known as Token Tool, which enables users to create and manage the lifecycle of tokens without technical expertise. Bitbond's services also include regulatory-compliant offerings for tokenized financial instruments, digital asset custody solutions, and on-chain payment settlement using stable coins, catering to regulated financial institutions and large issuers. It was founded in 2013 and is based in Berlin, Germany.

BlockInvest focuses on the tokenization of real-world assets within the financial technology sector. The company offers a platform for creating digital securities, enabling the digitization and management of asset sales and investments on the blockchain. It serves financial institutions and market participants looking to optimize alternative asset transactions. It was founded in 2019 and is based in Milano, Italy.

Loading...