CoreWeave

Founded Year

2017Stage

PIPE | IPOTotal Raised

$12.487BMarket Cap

60.14BStock Price

77.36Revenue

$0000About CoreWeave

CoreWeave specializes in graphics processing unit (GPU) cloud computing within the artificial intelligence sector. The company provides a cloud platform for AI workloads that includes GPU and CPU compute services, storage, and networking solutions for AI model training and inference. Its infrastructure focuses on scalability, reliability, and security, serving AI labs, platforms, and enterprises. CoreWeave was formerly known as Atlantic Crypto. It was founded in 2017 and is based in Livingston, New Jersey.

Loading...

Loading...

Research containing CoreWeave

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CoreWeave in 9 CB Insights research briefs, most recently on Apr 3, 2025.

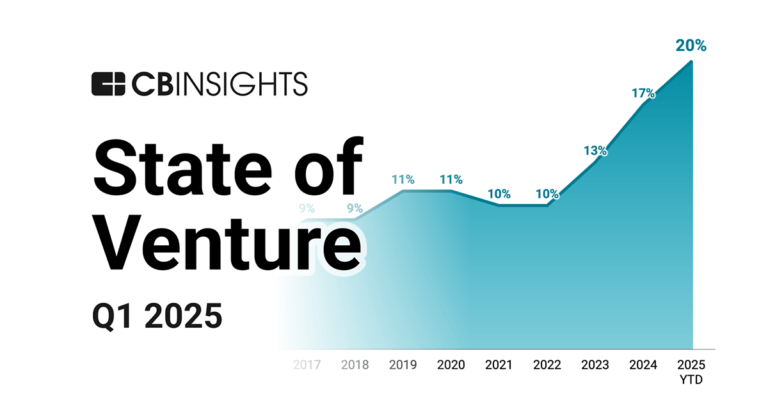

Apr 3, 2025 report

State of Venture Q1’25 Report

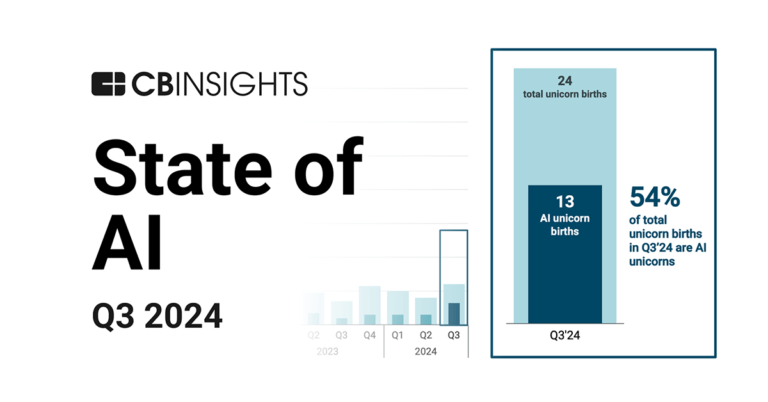

Oct 29, 2024 report

State of AI Q3’24 Report

Jul 30, 2024 report

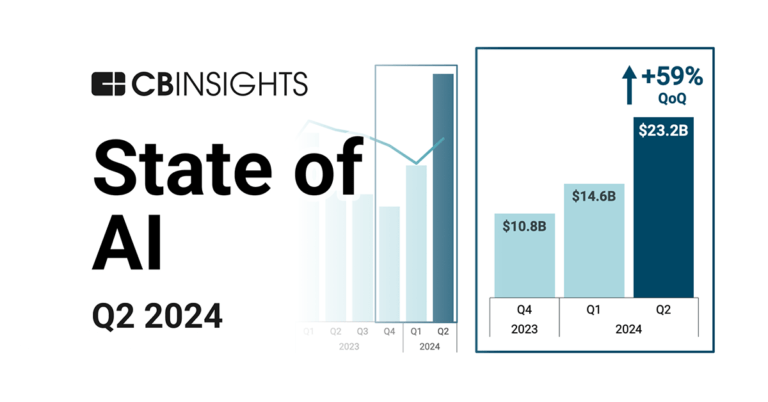

State of AI Q2’24 Report

Jul 3, 2024 report

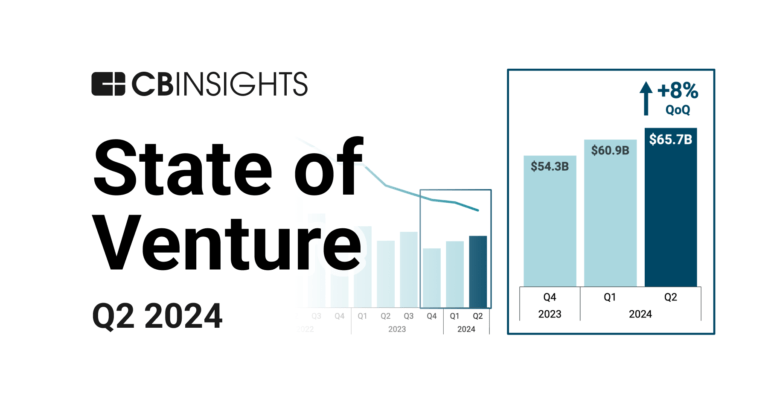

State of Venture Q2’24 Report

Jul 13, 2023 report

State of Venture Q2’23 ReportExpert Collections containing CoreWeave

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

CoreWeave is included in 2 Expert Collections, including Generative AI.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence (AI)

20,894 items

Latest CoreWeave News

Nov 16, 2025

As tech companies gear up to borrow hundreds of billions of dollars to fuel investments in artificial intelligence, lenders and investors are increasingly looking to protect themselves against it all going wrong. Bloomberg AI Debt Explosion Has Traders Searching for Cover: Credit Weekly (Bloomberg) -- As tech companies gear up to borrow hundreds of billions of dollars to fuel investments in artificial intelligence, lenders and investors are increasingly looking to protect themselves against it all going wrong. Banks and money managers are trading more derivatives that offer payouts if individual tech companies, known as hyperscalers, default on their debt. Demand for credit protection has more than doubled the cost of credit derivatives on Oracle Corp.’s bonds since September. Meanwhile, trading volume for credit default swaps tied to the company jumped to about $4.2 billion over the six weeks ended Nov. 7, according to Barclays Plc credit strategist Jigar Patel. That’s up from less than $200 million in the same period last year. “We’re seeing renewed interest from clients in single-name CDS discussions, which had waned in recent years,” said John Servidea, global co-head of investment-grade finance at JPMorgan Chase & Co. “Hyperscalers are highly rated, but they’ve really grown as borrowers and people have more exposure, so naturally there is more client dialogue on hedging.” A representative for Oracle declined to comment. Trading activity is still small compared with the amount of debt that is expected to flood the market, traders said. But the growing demand for hedging is a sign of how tech companies are coming to dominate capital markets as they look to reshape the world economy with artificial intelligence. Investment-grade companies could sell around $1.5 trillion of bonds in the coming years, according to JPMorgan strategists. A series of big bond sales tied to AI have hit the market in recent weeks, including Meta Platforms Inc. selling $30 billion of notes in late October, the biggest corporate issue of the year in the US, and Oracle offering $18 billion in September. Tech companies, utilities, and other borrowers tied to AI are now the biggest part of the investment-grade market, a report last month from JPMorgan shows. They’ve displaced banks, which were long the biggest portion. Junk bonds and other major debt markets will see a wave of borrowing too, as firms build thousands of data centers globally. Some of the biggest buyers of single-name credit default swaps on tech companies now are banks, which have seen their exposure to tech companies surge in recent months, traders said. Another source of demand for the derivatives: equity investors looking for a relatively cheap hedge against the shares dropping. Buying protection on Friday against Oracle defaulting within the next five years cost about 1.03 percentage point, according to data provider ICE Data Services, or around $103,000 a year for every $10 million of bond principal protected. In contrast, buying a put on Oracle’s shares falling almost 20% by the end of next year might cost about $2,196 per 100 shares as of Friday, amounting to about 9.9% of the value of the shares protected. There is good reason for money managers and lenders to at least look at cutting exposure now: An MIT initiative this year released a report indicating that 95% of organizations are getting zero return from generative AI projects. While some of the biggest borrowers now are companies with high cash flow, the technology industry has long been fast changing. Firms that were once big players, such as Digital Equipment Corp., can fade into obsolescence. Bonds that seem safe now may prove to be considerably riskier over time or even default, if profits from data centers fall short of companies’ current expectations, for example. Credit default swaps tied to Meta Platforms Inc. began actively trading for the first time late last month, after its jumbo bond sale. Derivatives tied to CoreWeave have also started trading more actively. Its shares tumbled on Monday after the provider of AI computing power lowered its annual revenue forecast due to a delay in fulfilling a customer contract. In the years before the financial crisis, the high-grade single-name credit derivatives market saw more volume than today, as proprietary traders at banks, hedge funds, bank loan book managers, and others used the products to cut or boost their risk. After the demise of Lehman, trading volume in single-name credit derivatives dropped, and market participants say it’s unlikely it will return to pre-financial levels. There are more hedging instruments now — including corporate bond exchange-traded funds — plus credit markets themselves have become more liquid as more bonds trade electronically. Click here for a podcast with Oaktree about the lack of discipline in the AI rush Sal Naro, chief investment officer of Coherence Credit Strategies, sees the recent increase in single-name CDS trading as temporary. His hedge fund has $700 million in assets under management. “There’s a blip in the CDS market right now because of the data center build out,” said Naro. “Nothing would make me happier than to see the CDS market truly be revived.” But for now, activity is on the rise, traders and strategists at banks said. The overall volume for credit derivatives tied to individual companies has increased by about 6% over the six weeks ended Nov. 7, to about $93 billion, from the same period a year ago, according to Barclays’ Patel, who analyzed the latest trade repository data. “Activity has picked up,” Dominique Toublan, head of US credit strategy at Barclays, said in an interview. “There’s definitely more interest.” Week In Review

CoreWeave Frequently Asked Questions (FAQ)

When was CoreWeave founded?

CoreWeave was founded in 2017.

Where is CoreWeave's headquarters?

CoreWeave's headquarters is located at 290 West Mt Pleasant Avenue, Livingston.

What is CoreWeave's latest funding round?

CoreWeave's latest funding round is PIPE.

How much did CoreWeave raise?

CoreWeave raised a total of $12.487B.

Who are the investors of CoreWeave?

Investors of CoreWeave include Fabrica Ventures, OpenAI, Stack Capital, Bossa Invest, Magnetar Capital and 53 more.

Who are CoreWeave's competitors?

Competitors of CoreWeave include InferX, Crusoe, DataCrunch, Lambda, United Compute and 7 more.

Loading...

Compare CoreWeave to Competitors

RunPod provides cloud-based graphics processing unit (GPU) computing services in the artificial intelligence (AI) sector. The company offers GPU instances, serverless deployment for AI workloads, and infrastructure for training and deploying AI models. RunPod's services include inference, AI model training, and processing compute-heavy tasks. It was founded in 2022 and is based in Moorestown, New Jersey.

Lambda operates as a company that provides graphics processing unit (GPU) cloud computing services for artificial intelligence (AI) training and inference within the technology sector. Its offerings include on-demand and reserved cloud instances with NVIDIA GPU architectures, as well as private cloud solutions and orchestration tools for managing AI workloads. Lambda serves sectors that require high-performance computing for artificial intelligence, including technology firms, research institutions, and enterprises with AI initiatives. Lambda was formerly known as Lambda Labs. It was founded in 2012 and is based in San Jose, California.

Radium provides enterprise artificial intelligence (AI) cloud solutions, focusing on the lifecycle of artificial intelligence development and deployment. Its offerings include a platform for training, fine-tuning, and deploying AI models, with features that support AI computing. The company's services are aimed at sectors that require AI capabilities, such as research institutions and enterprises interested in generative AI technologies. It was founded in 2019 and is based in Toronto, Canada.

Aethir is a decentralized cloud computing infrastructure provider that offers access to GPUs for AI model training, fine-tuning, inference, and cloud gaming. The company primarily serves the artificial intelligence and gaming industries with its distributed cloud solutions. It was founded in 2021 and is based in Singapore, Singapore.

Foundry provides elastic graphics processing unit compute solutions for artificial intelligence (AI) developers across various sectors. It offers access to NVIDIA graphics processing unit (GPU) for AI training, fine-tuning, and inference. Its services cater to Artificial Intelligence (AI) engineers, researchers, and scientists. It was founded in 2022 and is based in Palo Alto, California.

io.net focuses on providing artificial intelligence (AI) solutions. The company offers a platform to harness global graphics processing unit (GPU) resources to provide computing power for AI startups, allowing users to create and deploy clusters for machine learning applications. It primarily serves the AI development and cloud computing industries. io.net was formerly known as Antbit. It was founded in 2022 and is based in New York, New York.

Loading...