Olive

Founded Year

2012Stage

Dead | DeadTotal Raised

$858.8MRevenue

$0000About Olive

Olive provides healthcare revenue cycle management solutions. The company offers services for healthcare providers, including financial clearance, revenue capture, claim management, payment management, denial prevention, and analytics and reporting. Olive serves various sectors within the healthcare industry, such as physician and specialty practices, ambulatory surgery centers, clinical laboratories, and health systems. Olive was formerly known as CrossChx. It was founded in 2012 and is based in Columbus, Ohio. Olive ceased operations in October 2023.

Loading...

Olive's Products & Differentiators

Prior Authorization Suite

Olive’s Prior Authorization Suite ensures you understand the comprehensive eligibility picture for each patient, by combining End-to-End Prior Authorization and Eligibility.

Loading...

Research containing Olive

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Olive in 7 CB Insights research briefs, most recently on May 29, 2024.

May 29, 2024

483 startup failure post-mortems

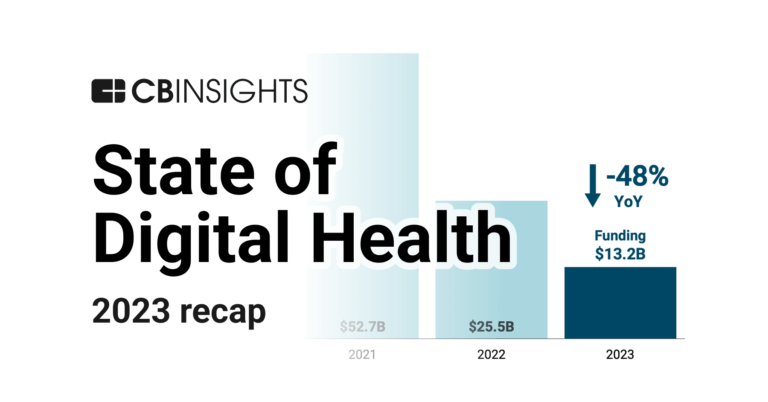

Jan 25, 2024 report

State of Digital Health 2023 Report

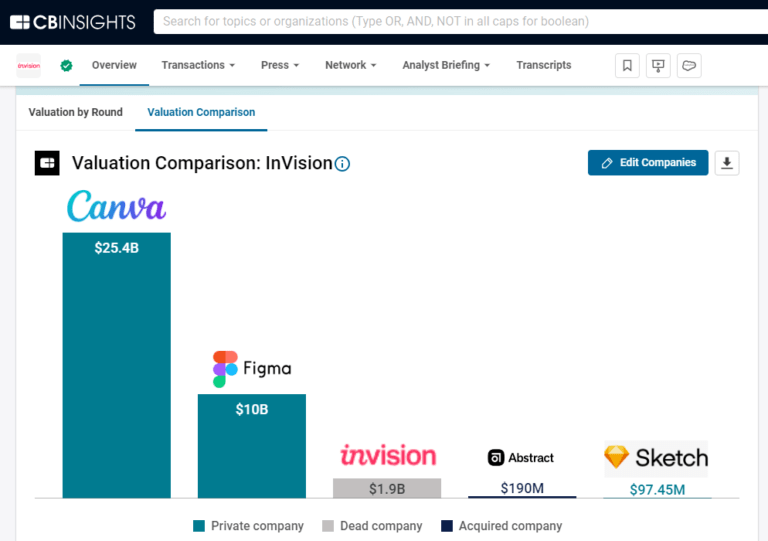

Jan 8, 2024

A $1.9B design unicorn is calling it quits

Nov 21, 2023

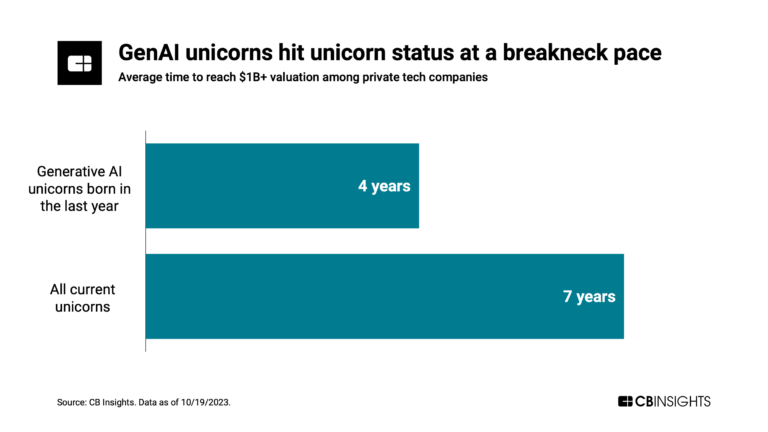

Has the global unicorn club reached its peak?

Sep 22, 2023

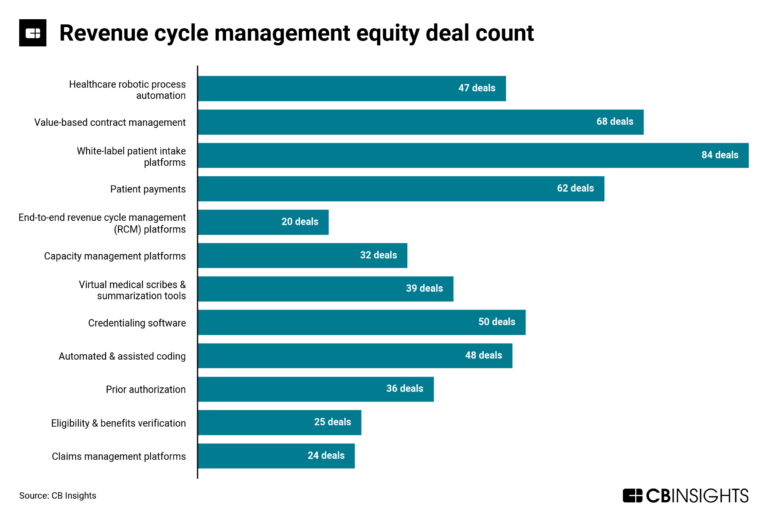

The revenue cycle management market map

Aug 1, 2023

The state of healthcare AI in 5 chartsExpert Collections containing Olive

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Olive is included in 7 Expert Collections, including Robotic Process Automation.

Robotic Process Automation

322 items

RPA refers to the software-enabled automation of data-intensive tasks that are low-skill but highly sensitive operationally, including data entry, transaction processing, and compliance.

Digital Health 50

450 items

The most promising digital health startups transforming the healthcare industry

Conference Exhibitors

5,302 items

Digital Health

12,122 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

AI 100 (All Winners 2018-2025)

100 items

Winners of CB Insights' 5th annual AI 100, a list of the 100 most promising private AI companies in the world.

Value-Based Care & Population Health

193 items

Olive Patents

Olive has filed 53 patents.

The 3 most popular patent topics include:

- social networking services

- cubism

- modern art

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/21/2020 | 4/1/2025 | Videotelephony, Social networking services, Conservation and restoration, Teleconferencing, Machine learning | Grant |

Application Date | 6/21/2020 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Videotelephony, Social networking services, Conservation and restoration, Teleconferencing, Machine learning |

Status | Grant |

Latest Olive News

Nov 11, 2025

At the peak of the AI craze, C3.ai (AI) stock looked unstoppable, with a glossy ticker that represented the future. Today, according to a Reuters report , the company is weighing a sale, with investors adopting more of a show-me approach to once-hot and speculative "pure play" AI stocks. The shift is mostly poetic, though. Thomas Siebel, a Silicon Valley veteran who's been instrumental in shaping the software space, confronts a market that seems to be running out of patience for promises. After slashing guidance and watching shares tank, C3.ai seems to be a cautionary tale of the moment. The business that once thrived on investor imagination finds itself scrambling to prove its real-world utility. In the post-hype AI market, that's perhaps its toughest challenge of all. Bloomberg/Getty Images How C3.ai lost its spark Enterprise AI player C3.ai seems to be learning that perhaps the smartest tech stories can burn out. The business is exploring a sale after founder Thomas Siebel , who's famous for selling off Siebel Systems to Oracle for billions, stepped aside for health reasons. He passed the baton to Stephen Ehikian , a former Salesforce executive, in September. Almost instantly, C3.ai withdrew its full-year guidance and began restructuring its salesforce, pointing to some major turbulence. Related: Quantum computing upstart lands major Pentagon nod Investors didn't wait for clarity, either, as shares crashed by over 54% in 2025 alone , reducing its market cap to approximately $2.15 billion A big part of the debacle had to do with its dismal results. The troubled AI player posted a worrying $116.8 million loss , along with a 19% year-over-year revenue drop Now, reports suggest that its board is weighing "strategic alternatives," from private-equity talks to a full sale. C3.ai's hype outran the product C3.ai built its core business on enterprise AI tools for sectors such as energy, defense, and manufacturing. The problem was that its story continued to evolve much faster than its revenues. Founded as C3 Energy , the company rebranded itself as C3 IoT , and then finally transitioned into becoming C3.ai in 2019. Related: Billionaire investor drops over $80 million on broken brand That "AI pivot," though, effectively turned out to be marketing gold. When ChatGPT hit the scene in late 2022, retail traders continued piling into anything with "AI" attached, and C3.ai's ticker effectively became a magnet By mid-2023, the stock's market value had more than tripled as the frenzy peaked, spearheaded by Nvidia's blowout forecast, sending AI stocks soaring. More Tech Stocks: As Palantir rolls on, rivals are worth a second look Nvidia's next big thing could be flying cars Cathie Wood sells $21.4 million of surging AI stocks However, the exuberance outpaced the earnings. When C3.ai posted a weaker-than-expected sales outlook in June 2023, its shares dropped 13% in a single day, dragging down peers like BigBear.ai SoundHound , and Guardforce AI . Consequently, C3.ai became both a meme stock and a cautionary tale for the market. When the memes met market math The meme-stock era was nothing short of extraordinary, beginning with GameStop and AMC, where Reddit-fueled traders essentially turned Wall Street into a spectator sport. In early 2021, GameStop stock, previously a laggard, skyrocketed from chump-change to , an eye-popping 10,000%-plus surge spearheaded by "diamond hands" memes, along with a collective mission to squeeze short sellers. Fast-forward to , and that same playbook was on display under a shinier banner in AI. Traders rushed into anything that whispered AI. Even BuzzFeed's stock nearly doubled after announcing plans to use OpenAI's technology, despite the mounting losses. C3.ai rode that same wave, and its ticker alone became a rallying cry for retail investors looking to chase the next moonshot. AI's hard reset For every AI stock soaring on the headlines, several others crashed back to earth. The past three years in particular showed that a transformative tech boom - despite the timing, execution, and market fit - still matters. Investors are learning that "AI-powered" doesn't automatically mean profitable, or even sustainable, for that matter. From health care to defense to driverless cars, some of the biggest names in AI have faced reality checks. Some of the hardest AI falls: Argo AI (autonomous driving): Once valued at $7.25 billion , the Ford- and VW-backed startup shut down operations in October 2022 after its management conceded full autonomy was still years away. Ford ended up taking a whopping $2.7 billion hit. Olive AI (health care automation): Raised nearly $1 billion , hitting a superb $4 billion valuation before collapsing in on the back of overexpansion and cash burn. IronNet (cybersecurity): A SPAC-era hopeful, the company went bankrupt in , ultimately listing $35 million in debts after firing all 104 employees. BigBear.ai (data analytics): Rode 2023's AI frenzy, delivered just 2% revenue growth in 2024. Though results improved markedly since then, it remains unprofitable, a reminder that hype alone can't fund innovation. Related: JPMorgan updates stock market outlook for 2026 The Arena Media Brands, LLC THESTREET is a registered trademark of TheStreet, Inc. This story was originally published November 11, 2025 at 9:13 AM.

Olive Frequently Asked Questions (FAQ)

When was Olive founded?

Olive was founded in 2012.

Where is Olive's headquarters?

Olive's headquarters is located at 99 East Main Street, Columbus.

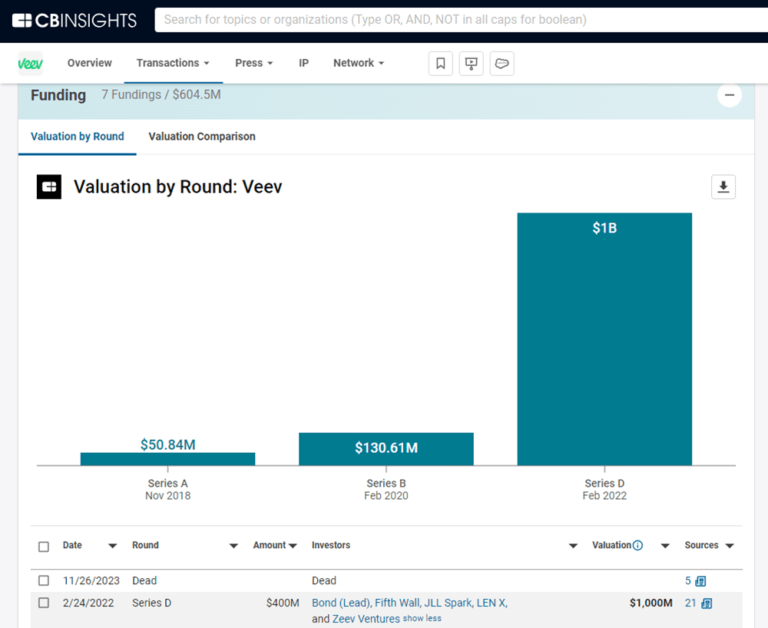

What is Olive's latest funding round?

Olive's latest funding round is Dead.

How much did Olive raise?

Olive raised a total of $858.8M.

Who are the investors of Olive?

Investors of Olive include Tiger Global Management, Vista Equity Partners, Base10 Partners, Drive Capital, General Catalyst and 17 more.

Who are Olive's competitors?

Competitors of Olive include Pieces, Medical Brain, Aideo Technologies, Illumicare, FastAuth and 7 more.

What products does Olive offer?

Olive's products include Prior Authorization Suite and 2 more.

Loading...

Compare Olive to Competitors

Rhyme operates as a technology company focused on automating the prior authorization process within the healthcare sector. The company provides prior authorization services, a solution to eliminate the need for prior authorizations at the point of care, and a shared dashboard for visualization and collaboration between payers and providers. Rhyme primarily serves the healthcare industry, facilitating interactions between payers and providers to improve patient care. Rhyme was formerly known as PriorAuthNow. It was founded in 2016 and is based in New Albany, Ohio.

Notable operates as a company focused on automating healthcare operations through its artificial intelligence (AI) platform. The company offers a suite of services designed to streamline administrative workflows, including registration, scheduling, and care management, by utilizing intelligent agents and customizable automation tools. Notable primarily serves the healthcare industry, providing solutions that aim to improve patient care. It was founded in 2017 and is based in San Mateo, California.

Humata Health specializes in transforming prior authorizations through artificial intelligence and automation within the healthcare sector. The company offers a platform that streamlines the end-to-end prior authorization process for healthcare providers, enhancing efficiency and accuracy. Humata's solutions are designed to serve the healthcare industry, particularly in high-volume service lines such as imaging, cardiology, neurology, orthopedics, sleep studies, and surgery. It was founded in 2023 and is based in Winter Park, Florida.

Epic focuses on developing healthcare software within the health information technology (IT) industry. Its main offerings include coding, testing, and implementing software solutions. Epic's products are utilized by healthcare professionals. Epic was formerly known as Human Services Computing. It was founded in 1979 and is based in Verona, Wisconsin.

AKASA provides generative AI (artificial intelligence) solutions for the healthcare revenue cycle, concentrating on financial processes within the healthcare sector. The company's offerings include automation and optimization of prior authorization, medical coding, claim status updates, and claim attachment processes, powered by generative AI trained on clinical and financial data. It serves hospitals and health systems, with a goal of improving operational efficiency and financial outcomes. AKASA was formerly known as Alpha Health. It was founded in 2018 and is based in San Francisco, California.

Cohere Health serves as a clinical intelligence company that focuses on utilization management and prior authorization in the healthcare sector. The company provides solutions for the prior authorization process, which include intelligent prior authorization, compliance with healthcare regulations, and a platform for health plans to manage their utilization management operations. It was founded in 2019 and is based in Boston, Massachusetts.

Loading...