Dapper Labs

Founded Year

2018Stage

Incubator/Accelerator | AliveTotal Raised

$676.96MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-59 points in the past 30 days

About Dapper Labs

Dapper Labs provides a blockchain-based collectibles and non-fungible token (NFT) platform. Its platform uses blockchain-enabled applications to bring its customers closer to the brands. It enables users to access new forms of digital engagement and track ownership. The company was founded in 2018 and is based in Vancouver, Canada.

Loading...

ESPs containing Dapper Labs

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The crypto & blockchain loyalty & rewards market uses blockchain technology or a company’s existing infrastructure to deliver blockchain-based loyalty solutions, ranging from helping retailers award cryptocurrency to minting NFTs to verifying loyalty incentives. Additionally, it provides value exchange opportunities through crypto rewards, enabling brands to acquire first-party data and enrich exi…

Dapper Labs named as Leader among 15 other companies, including Bakkt, Lolli, and Permission.io.

Loading...

Research containing Dapper Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

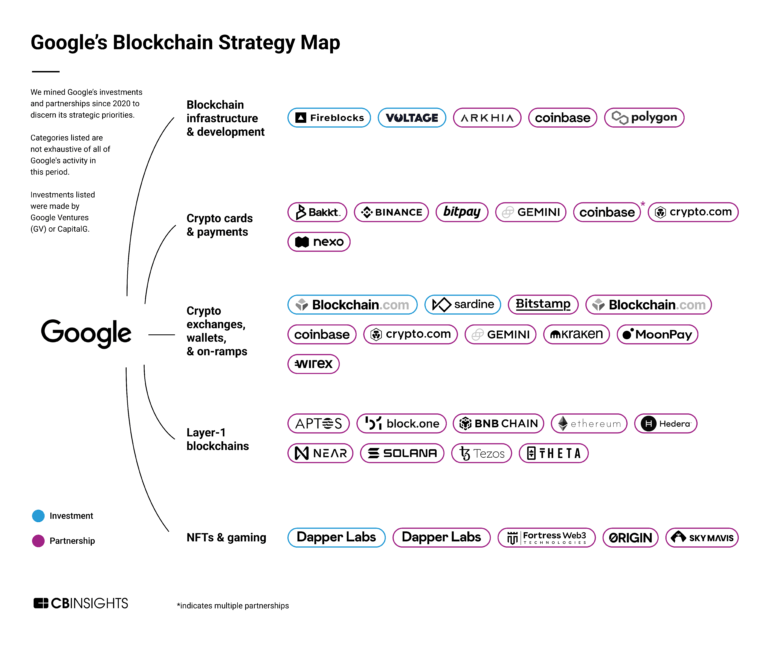

CB Insights Intelligence Analysts have mentioned Dapper Labs in 2 CB Insights research briefs, most recently on Dec 20, 2022.

Expert Collections containing Dapper Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dapper Labs is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Blockchain

13,456 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Luxury Tech

419 items

Tech-enabled companies launching new luxury brands, as well as startups providing tech solutions to the luxury industry, including e-commerce tools, marketing, and more. While these companies may not exclusively target luxury companies, they have notable luxury partners.

Gaming

5,684 items

Gaming companies are defined as those developing technologies for the PC, console, mobile, and/or AR/VR video gaming market.

Influencer & Content Creator Tech

340 items

Companies that serve independent creators who want to monetize their own work, from content creation tools to administrative back-end platforms to financing solutions.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Dapper Labs Patents

Dapper Labs has filed 29 patents.

The 3 most popular patent topics include:

- digital collectible card games

- cryptocurrencies

- 3d imaging

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/31/2022 | 5/14/2024 | Cryptocurrencies, Digital collectible card games, Blockchains, Video on demand services, Video hosting | Grant |

Application Date | 10/31/2022 |

|---|---|

Grant Date | 5/14/2024 |

Title | |

Related Topics | Cryptocurrencies, Digital collectible card games, Blockchains, Video on demand services, Video hosting |

Status | Grant |

Latest Dapper Labs News

Nov 11, 2025

KEY TAKEAWAYS NFTs provide unique digital ownership, exclusivity, and real-world access for fans. DeFi adds financial incentives, tokenized crowdfunding, and liquidity to digital collectibles. Combined, NFTs and DeFi transform fans into active stakeholders, boosting engagement and loyalty. Creators benefit from multiple revenue streams, ongoing royalties, and tighter community bonds. Transparency and automation through smart contracts reduce disputes and enhance trust. Adoption challenges include environmental impact, regulatory uncertainty, technical barriers, and asset volatility. The entertainment industry has long relied on ticket sales, merchandise, streaming, and advertising to connect creators with audiences. While profitable, these models often limit direct interaction between artists, studios, and fans. Today, blockchain technologies, particularly NFTs (Non-Fungible Tokens) and DeFi (Decentralized Finance), are reshaping fan engagement by introducing new mechanisms for ownership, rewards, and community participation. This article explores how NFTs and DeFi are redefining entertainment, highlighting their benefits, challenges, and opportunities for creators and fans alike. Understanding NFTs and DeFi To grasp how blockchain is transforming entertainment, it’s essential to understand its core components: NFTs, which provide unique digital ownership, and DeFi, which enables decentralized financial interactions. NFTs NFTs are unique digital assets secured on a blockchain, representing ownership of art, music, video clips, collectibles, or exclusive experiences. Unlike cryptocurrencies, NFTs are non-fungible, meaning each token is distinct. In entertainment, NFTs are used to: Release limited-edition music, albums, or concert tickets, giving fans exclusivity. Share film and video content, including digital posters, clips, or behind-the-scenes access. Enable gaming assets to be owned, traded, or sold. Tokenize memorabilia and collectibles, creating new revenue streams. DeFi DeFi is a set of financial applications built on blockchains that operate without intermediaries. It includes lending, staking, liquidity pools, and tokenized governance. In entertainment, DeFi enables: Crowdfunding and Revenue Sharing: Fans invest in projects and earn a share of revenue. Fan Tokens and Governance: Fans vote on plotlines, concert setlists, or merchandise. NFT Liquidity: NFTs can be used as collateral or staked to earn rewards, adding financial utility. How NFTs Enhance Fan Engagement NFTs transform the fan experience by providing exclusive access, unique collectibles, and direct interaction with creators. They turn passive audiences into active participants, deepening loyalty and community connection. Some of the ways NFTs enhance engagement are: Creating Exclusivity NFTs provide limited-edition content that only a select number of fans can access, increasing collectible value and loyalty. Musicians can release a single NFT album edition, including VIP concert access or virtual meet-and-greets. Direct Artist-to-Fan Interaction NFTs eliminate intermediaries, allowing creators to engage directly with audiences. Platforms like OpenSea or Rarible track ownership and royalties automatically, fostering a strong community connection. Unlocking Exclusive Experiences NFTs can act as digital keys for: Live-streamed concerts or backstage passes Personalized messages from artists Early access to unreleased content This integration of digital ownership with real-world experiences deepens fan engagement and creates new revenue streams. Monetization Through Secondary Markets Smart contracts enforce royalties on secondary NFT sales, ensuring creators continue earning as their work changes hands. Fans can trade NFTs on marketplaces, participating in a growing collectible ecosystem. How DeFi Adds Financial Incentives DeFi introduces financial mechanisms that go beyond ownership, allowing fans to actively invest, earn rewards, and participate in creative projects. Some of the ways for incentivization are: Tokenized Crowdfunding DeFi enables tokenized fundraising, where fans purchase tokens representing a stake in a project’s revenue. Token holders may also gain governance rights, influencing creative or strategic decisions. This creates a mutually beneficial relationship: fans become stakeholders, and creators secure funding without intermediaries. NFT Financialization DeFi protocols allow NFT holders to borrow against or stake their assets. For example, a fan owning a rare movie NFT can deposit it in a liquidity pool to earn interest or use it as collateral. This adds financial utility to collectibles. Rewarding Fan Loyalty Platforms can implement tokenomics-based rewards, where fans earn tokens for attending events, sharing content, or completing challenges. Tokens may be redeemed for experiences, traded for NFTs, or used in governance, incentivizing continuous engagement. Case Studies in Entertainment Real-world examples illustrate how NFTs and DeFi are reshaping fan engagement across music, sports, film, and gaming. These case studies highlight practical applications, benefits, and lessons for creators and audiences alike. Music: Kings of Leon: In 2021, Kings of Leon released an album as an NFT, offering digital artwork, limited vinyl, and exclusive concert perks. Fans not only owned a digital collectible but also accessed real-world experiences, blending entertainment with investment. Sports: NBA Top Shot: NBA Top Shot lets fans purchase NFTs representing highlight moments. The platform combines scarcity, gamification, and community engagement, giving fans a stake in the digital ecosystem of basketball. Film: Independent Filmmakers: Tokenizing early-access passes, behind-the-scenes content, or limited merchandise allows filmmakers to monetize directly from fans while fostering a sense of ownership in the production’s success. Gaming: Axie Infinity: Games like Axie Infinity leverage NFTs and DeFi through play-to-earn models, where players own characters and in-game assets. Staking or trading these NFTs transforms engagement into active investment, enhancing loyalty and participation. Benefits of Combining NFTs and DeFi Combining NFTs and DeFi unlocks new possibilities for both creators and fans. Together, they offer perks like: Empowering Fans as Stakeholders The combination of NFTs and DeFi transforms fans from passive observers into active stakeholders. Through tokenized ownership, governance rights, and financial incentives, fans become invested in the success of the content and creators they support. Increased Revenue Streams for Creators NFTs generate direct revenue, while DeFi models such as staking and liquidity pools provide secondary financial utilities. Creators benefit not only from initial sales but also from ongoing engagement and trading of their digital assets. Strengthening Community Engagement By integrating blockchain-based ownership and financial participation, creators cultivate tight-knit communities. Fans interact with each other, participate in decisions, and gain access to exclusive content, creating a network effect that enhances long-term engagement. Transparency and Trust Smart contracts and decentralized ledgers ensure that transactions, royalties, and ownership are transparent and verifiable. This reduces friction and builds trust between creators and their audiences. Challenges in Adopting NFTs and DeFi While NFTs and DeFi offer exciting opportunities for fan engagement and creator revenue, their adoption comes with significant hurdles, such as: Environmental Concerns Blockchain networks, especially those using proof-of-work models, consume significant energy. Entertainment companies need to consider eco-friendly alternatives like proof-of-stake or layer-2 solutions to minimize environmental impact. Regulatory Uncertainty NFTs and DeFi are still under scrutiny in many jurisdictions. Issues related to securities laws, taxation, and consumer protection require careful navigation to avoid legal complications. Technical Barriers for Fans Understanding wallets, tokens, and marketplaces can be daunting for new users. Platforms must ensure user-friendly interfaces and provide educational resources to broaden adoption. Market Volatility NFT and DeFi assets can experience high price volatility, impacting fan investments and perceptions. Entertainment companies must manage expectations and clearly communicate the speculative nature of tokenized engagement. Empowering Fans: How NFTs and DeFi Are Redefining Entertainment Engagement NFTs and DeFi are transforming fan engagement in entertainment. By providing digital ownership, financial incentives, and governance opportunities, these technologies empower fans to become stakeholders rather than passive consumers. Creators benefit from new revenue streams, enhanced community engagement, and automated royalty management. Despite challenges like environmental concerns, regulatory uncertainty, and market volatility, the combination of NFTs and DeFi offers a blueprint for a more interactive, inclusive, and financially integrated entertainment ecosystem. The future points toward a model where fans, creators, and platforms are interconnected through verifiable ownership, financial participation, and shared experiences, reshaping the relationship between art, audience, and economy. FAQ What are NFTs and how do they work in entertainment? NFTs are unique digital assets on a blockchain representing ownership of art, music, videos, or experiences. In entertainment, they offer limited-edition content, collectibles, or exclusive access directly to fans. How does DeFi enhance fan engagement? DeFi provides blockchain-based financial tools like staking, lending, and tokenized crowdfunding. Fans can earn rewards, influence decisions, or gain revenue shares while supporting creators. Can NFTs create real-world benefits for fans? Yes. NFTs can unlock backstage passes, early content access, personalized messages, or VIP experiences, linking digital ownership to tangible entertainment perks. What are the financial opportunities for creators using NFTs and DeFi? Creators earn direct revenue from NFT sales, royalties from secondary markets, and financial utilities via DeFi, such as staking or liquidity pools, enabling continuous monetization beyond initial releases. Are there risks for fans investing in NFTs or DeFi entertainment projects? Yes. Risks include market volatility, technical barriers, and regulatory uncertainties. Fans should understand that NFTs and DeFi assets can fluctuate in value and require secure wallets. How do NFTs and DeFi improve transparency and trust? Blockchain and smart contracts ensure verifiable ownership, automatic royalty distribution, and transparent transactions, reducing friction between creators and fans. What are the environmental concerns with NFTs and DeFi? Some blockchain networks consume high energy, especially proof-of-work models. Using eco-friendly alternatives like proof-of-stake or layer-2 solutions can minimize environmental impact.

Dapper Labs Frequently Asked Questions (FAQ)

When was Dapper Labs founded?

Dapper Labs was founded in 2018.

Where is Dapper Labs's headquarters?

Dapper Labs's headquarters is located at 565 Great Northern Way, Vancouver.

What is Dapper Labs's latest funding round?

Dapper Labs's latest funding round is Incubator/Accelerator.

How much did Dapper Labs raise?

Dapper Labs raised a total of $676.96M.

Who are the investors of Dapper Labs?

Investors of Dapper Labs include STING Accelerator, Delta Growth Fund, Third Point Ventures, Andreessen Horowitz, Version One Ventures and 111 more.

Who are Dapper Labs's competitors?

Competitors of Dapper Labs include Gaudiy, Candy Digital, Sorare, DappRadar, Mint Songs and 7 more.

Loading...

Compare Dapper Labs to Competitors

DappRadar is a platform that functions as a decentralized applications (dapps) repository, offering tracking and insights for dapps across multiple blockchains. It includes features such as crypto wallet management, non-fungible token (NFT) portfolio tools, and market analysis for the dapp ecosystem. DappRadar also provides a means for dapp developers to distribute their applications and includes a governance model through its decentralized autonomous organization (DAO). It was founded in 2018 and is based in Klaipeda, Lithuania.

Dibbs specializes in the tokenization of physical collectibles. It operates within the blockchain and NFT sectors. It provides a platform for brands and intellectual property holders to create and manage asset-backed NFTs, offering services such as regulated custody, proprietary 3D imaging, and minting of digital tokens. Dibbs primarily serves sectors that deal with consumer products in sports, music, entertainment, toys, and luxury goods. It was founded in 2020 and is based in El Segundo, California.

Gaudiy focuses on building fan nations and utilizing Web3 technologies. The company offers a fan engagement platform called Gaudiy Fanlink, which employs blockchain to support the entertainment industry. Gaudiy also develops other services such as Gaudiy Financial Labs, which supports financial businesses using generative AI, and C4C Labs, which expands creative and educational enterprises in the Web3 domain. It was founded in 2018 and is based in Tokyo, Japan.

Rally provides a platform focused on alternative asset investment within the financial services sector. The company allows investors to buy and sell shares in collectible assets, enabling these items to be regulated and offered to the public. It serves individuals interested in diversifying their portfolios. It was founded in 2016 and is based in New York, New York.

Royal focuses on the intersection of music and crypto within the blockchain industry. The company offers a platform that enables individuals to own rights in songs using blockchain technology, allowing artists to maintain control over their work and fans to invest in music. Royal primarily serves the music industry, offering solutions that empower artists and engage fans by providing investment opportunities in music. It was founded in 2021 and is based in Austin, Texas.

Alt is focused on facilitating the buying, selling, and valuation of trading cards within the alternative asset investment sector. It offers a marketplace for investment-grade cards, a valuation tool, and services for secure storage and hassle-free selling, primarily serving the collector and investor community. It was founded in 2020 and is based in San Francisco, California.

Loading...