Investments

41Portfolio Exits

2Partners & Customers

1About CVS Health Ventures

CVS Health Ventures is a venture capital investment platform focused on health care innovation and digital disruption within the health sector. It partners with startups to support health care developments, utilizing CVS Health's capabilities and connections to assist these companies in scaling. It invests in areas such as care delivery, whole person care, consumer health, and technology. It was founded in 2021 and is based in Woonsocket, Rhode Island.

Research containing CVS Health Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CVS Health Ventures in 4 CB Insights research briefs, most recently on Sep 13, 2024.

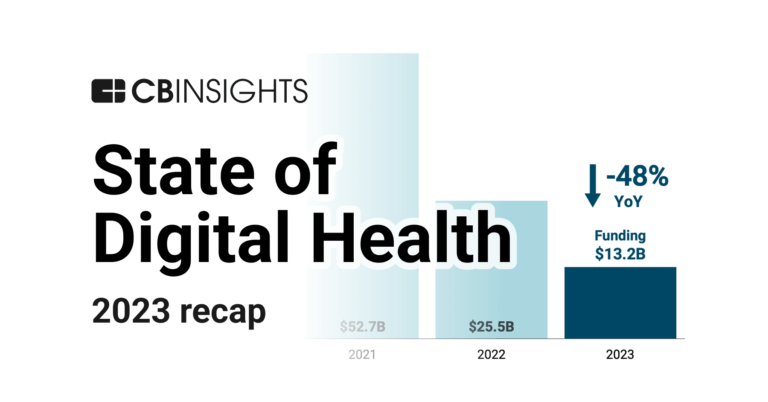

Jan 25, 2024 report

State of Digital Health 2023 ReportLatest CVS Health Ventures News

Oct 20, 2025

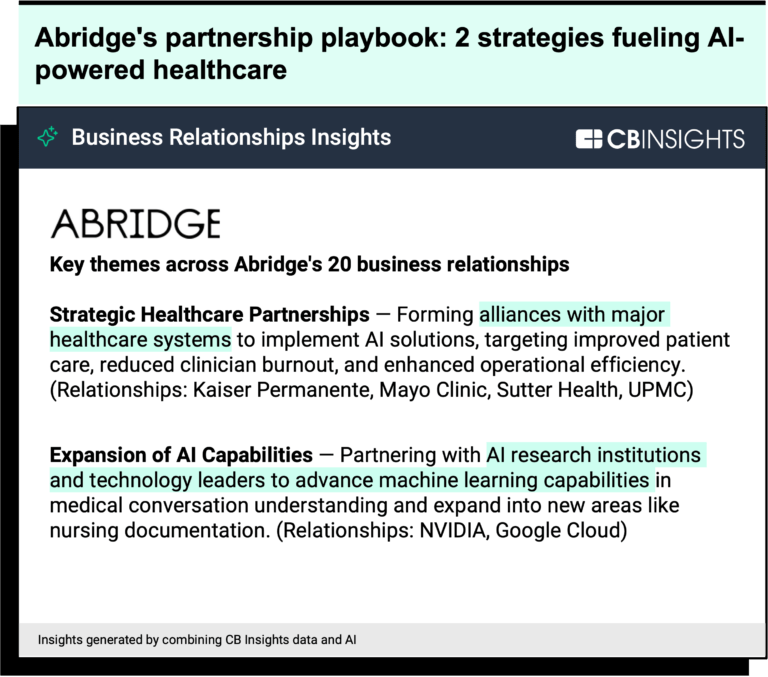

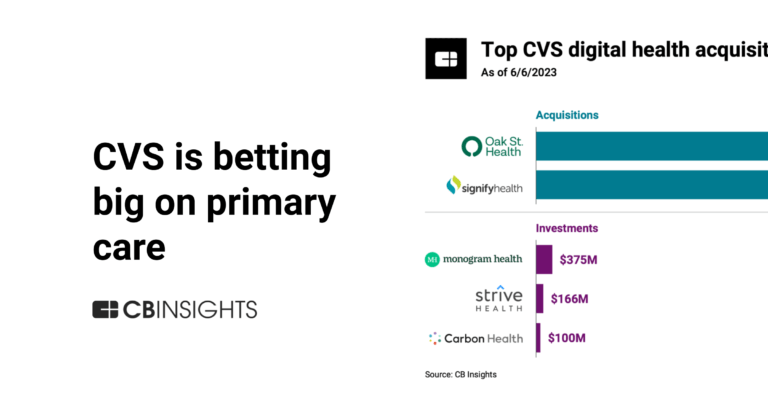

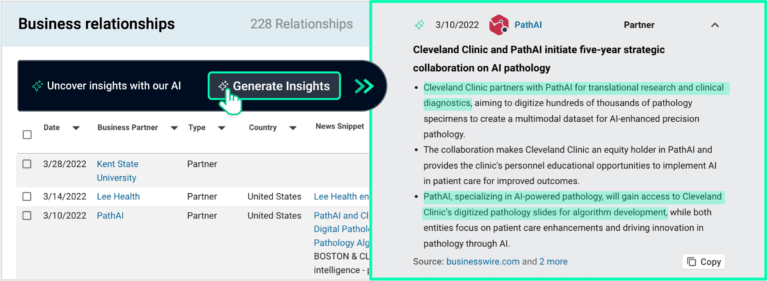

drop to $150 a month — instantly wiping billions off the market caps of Novo Nordisk and Eli Lilly . It was the clearest sign yet that the GLP-1 gold rush is ending. More than 12% of U.S. adults now take a GLP-1 medication, marking one of the fastest-spreading pharmaceutical shifts in modern history. And yet the healthcare infrastructure built to deliver those drugs is already cracking under the weight of demand. The GLP-1 boom may be the first time a trillion-dollar drug class has collided with an outdated care system — equal parts insulin Viagra , and iPhone in how it's reshaping health, culture, and capital. Like insulin, it exposes the fragility of chronic-care management; like Viagra, it reframes a taboo condition through consumer demand; and like the iPhone, it's spawning an entire ecosystem of platforms and providers scrambling to adapt. That's where CVS Health Ventures' latest bet comes in. The company announced it led a $25 million Series A investment in Knownwell , a Boston-based obesity-care platform that treats weight management as a chronic condition — not a subscription business. Knownwell's physician-led model is designed for payers, not just patients , and its expansion signals a deeper shift: the end of the GLP-1 land grab and the start of an outcomes-based phase of obesity care Why it matters now: if list prices compress toward $150, access parity rises and the competitive moat shifts from drug arbitrage to care integration • Telehealth brands (Ro, Hims, Midi) charging $199–$599 monthly risk margin pressure unless they publish outcomes and integrate with payers. • Manufacturers will steer patients through direct channels like LillyDirect and vetted partners. • Payers and employers gain leverage to cover GLP-1s as chronic benefits tied to outcomes instead of cash-pay perks. In that world, Knownwell's payer-aligned, outcomes-tracked model wins on care quality and total-cost management , not on medication markup. From Weight Loss to Longevity: GLP-1s Are Redefining Preventive Medicine The first wave of startups — Ro Hims & Hers Found , and Midi Health — treated obesity as a subscription business, optimizing for growth over outcomes and leaning on compounded semaglutide and tirzepatide during shortages. As supply stabilized, manufacturers began striking direct deals with telehealth platforms to control access and expand affordability. Novo Nordisk now partners with Ro, Hims & Hers, and LifeMD to distribute branded Wegovy through Novo's mail-order pharmacy, often at discounted cash-pay rates (~$499 per month) for patients lacking insurance coverage or prior authorization. Similarly, Eli Lilly launched LillyDirect, a direct-to-consumer channel offering Zepbound vials around $349 per month, frequently integrated through partners like Ro. These arrangements gave consumers cheaper entry points — but they also commoditized telehealth into drug-dispensing storefronts rather than integrated care systems. Now, with FDA scrutiny around compounded GLP-1 drugs intensifying and manufacturers reclaiming distribution, the market is shifting from scripts to systems. Beyond diabetes and obesity, GLP-1s have also emerged as a longevity drug class — with research showing potential benefits across inflammation, cardiovascular risk, liver fat reduction, and kidney protection. A landmark 2023 New England Journal of Medicine trial found that semaglutide significantly reduced the risk of major adverse cardiovascular events among adults with overweight or obesity, even in the absence of diabetes (NEJM, 2023). Early studies have also linked GLP-1s to improved cognition and reduced addictive behaviors, underscoring that these molecules are reshaping not just metabolic care but preventive and whole-body health “As a physician focused on helping patients optimize health on a 30- or 40-year timeline, GLP-1 drugs are among the most powerful tools I have,” said Dr. Dan Henderson, MD, MPH, a primary care physician at Brigham and Women's Hospital and Harvard Medical School whose clinical practice centers on longevity and health span. “Not only do they treat and reverse diabetes and pre-diabetes, but they also have profound effects on inflammation, and they help with many weight-related conditions such as arthritis and sleep apnea — and the list just keeps growing.” Henderson added that even at current market rates, their value remains significant. “Even at $500 a month, they are worth it for tens of millions of people,” he said. “GLP-1s have become the gateway drug for metabolic literacy,” said Dr. Ronald Primas, MD, FACP , a New York–based physician specializing in preventive and longevity medicine and performance optimization. “In the right hands, these therapies reveal how quickly the body—and the brain—can rebound once insulin signaling, inflammation, and energy balance are restored. In my practice, even mildly overweight patients, including executives, celebrities, and other high-performing individuals, have shown dramatic gains: improved insulin sensitivity, normalized blood pressure and lipids, reversal of fatty-liver disease, sharper cognition, elevated mood and focus, improved emotional regulation, and even a reduced desire for alcohol—often within weeks and independent of the weight loss itself.” Primas added that lifestyle integration remains critical. “Optimal nutrition, intelligent training, restorative sleep, and time-restricted feeding can, in many cases, obviate the need for GLP-1 therapy altogether,” he said. “Used in that context, these agents serve as catalysts—not crutches—accelerating the transition to sustainable metabolic health. Much like statins reshaped cardiovascular medicine, I suspect we'll look back on GLP-1s as the beginning of a new era in preventive and cognitive medicine.” As a result, their reach has widened far beyond the diabetic and obese populations to a much broader segment of adults seeking sustainable metabolic and longevity health — including early adopters experimenting with microdosing protocols for appetite control and energy regulation. “Transitioning weight loss and obesity treatments from transactional interactions to true chronic condition management is a must for better health outcomes, not an option,” said Josh Herring, President and CEO of the Longevity Science Foundation . “Program retention is one of the biggest challenges GLP-1 users face today — between side effects, cost, duration, and the mental health aspects of treatment, many patients stop taking the medication within just months. These journeys need to be managed through multidisciplinary care, not siloed telehealth scripts.” That's where Knownwell enters — a model designed not to sell more drugs, but to manage the patients already on them. CVS Health Ventures Is Betting on Infrastructure — Not Injections To understand why CVS Health Ventures is investing here, it helps to see what CVS Health has become. Over the past decade, CVS evolved from a corner-store pharmacy into a vertically integrated healthcare system pharmacy benefit manager (Caremark) provider (MinuteClinic) investor (CVS Ventures) , and, via its $69 billion Aetna acquisition , a national payer ecosystem This transformation — driven by acquisitions and a race to compete with Amazon Walmart , and UnitedHealth Group — gave CVS the infrastructure to manage the entire patient journey: prescription, payment, and prevention. Today, CVS Health Ventures backs early- and growth-stage companies aligned with that mission — whole-person care, consumer-centric models, and technology that makes healthcare more affordable and proactive. In many ways, this is vertical integration 3.0 While Amazon's purchase of One Medical was about controlling access, CVS is using venture capital as a lever to influence care design from within. CVS Health Ventures backs early- and growth-stage companies aligned with its mission to transform care delivery — emphasizing whole-person health, consumer-centric models, and technology that makes care more affordable and proactive. Its portfolio now spans the entire healthcare continuum: Mental health: Workit Health (mobile substance-use recovery), Ellipsis Health (AI-based voice assessments), Nema Health (virtual trauma care). Preventive and chronic care: Thyme Care (value-based oncology), Strive Health (kidney care), Oshi Health (GI health). Aging and home care: WellBe Senior Medical and CareBridge (in-home and community-based care for Medicare Advantage populations). Telehealth and women's health: Maven Clinic (virtual fertility and family care) and Abridge (AI for patient–clinician understanding). Operational tech: AmplifAI (AI-powered workforce optimization) and Carbon Health (primary and urgent care). By backing innovators across these categories, CVS Ventures is building the scaffolding for a healthcare future that treats conditions like obesity not as one-off prescriptions but as longitudinal conditions requiring continuous, multidisciplinary care. The investment in Knownwell — a hybrid model blending primary care, obesity medicine, and metabolic health — fits squarely into that strategy. “We see this as more than an investment,” said Alyssa Reisner , Partner and Executive Director at CVS Health Ventures. “This is an approach that can transform how obesity is treated across the country.” The move positions CVS Health Ventures alongside a new generation of payer-backed venture arms — from Optum Ventures (UnitedHealth Group) to Elevance Health Ventures and Cigna Ventures — each using strategic capital to absorb innovation rather than compete with it. In other words, CVS Ventures isn't chasing venture-style multiples — it's designing the next generation of care infrastructure Knownwell's Business Model: Rewiring Weight Management for Sustainable Scale Knownwell isn't another telehealth startup chasing GLP-1 prescriptions. It was built from the ground up to integrate obesity medicine primary care, and metabolic health — serving as the clinical bridge between traditional health systems and the fast-moving GLP-1 economy Obesity drives more than $260 billion in annual U.S. healthcare costs , yet most treatments still focus narrowly on prescriptions instead of the long-term, systemic nature of the disease. Founded by Brooke Boyarsky Pratt and Dr. Angela Fitch , Knownwell starts from a simple premise: obesity is a chronic disease, not a business model. The company aims to change that — shifting obesity care from a transactional service to a continuous, physician-led discipline. “Knownwell is one of the best players in the metabolic care space,” said Dr. Dan Henderson . “Founded by Dr. Fitch, who is a former president of the Obesity Medicine Association , it is the opposite of the companies that seem to be prescribing to anyone with a credit card. Really solid metabolic care is complicated — and though, as Knownwell seems to prove, it's scalable, it still takes a lot of know-how and systems to do well.” Each patient receives a personalized plan that combines metabolic screening, lab testing, nutritional coaching, and medication management. Clinicians prescribe only FDA-approved GLP-1 drugs (no compounded versions), maintaining clinical and ethical standards in a market crowded with shortcuts. That strategic backer is CVS Health Ventures — the investment arm of CVS Health , which also owns Aetna , one of the nation's largest payers. The partnership gives Knownwell access to capital, distribution, and a deep reimbursement network.As GLP-1 coverage expands, payers are seeking models that deliver measurable outcomes without runaway costs. Knownwell's integrated structure—combining clinical oversight, digital care, and cost accountability—offers a blueprint for sustainable obesity management that could scale through Aetna and other CVS platforms. Knownwell's results are more than patient-satisfaction metrics; they're payer-alignment metrics . The company echoes the early days of Oak Street Health , a high-touch primary-care network later acquired by CVS for $10.6 billion Geoff Price's decision to join Knownwell's board underscores that lineage: both organizations prove that better outcomes and lower costs can coexist. Inside the New Weight Management Divide: Knownwell vs. Ro, Hims & Midi The GLP-1 economy now divides direct-to-consumer platforms (Ro, Hims) — built for customer acquisition and prescription throughput — from emerging care platforms (Knownwell, Midi) built for insurer acceptance and longitudinal management. None of the major consumer platforms publish outcomes data or operate under value-based contracts. Their economics depend on cash-pay volume , not long-term retention. Knownwell, by contrast, is built for a world where GLP-1s are reimbursed like other chronic-disease therapies — with insurance integration FDA-approved prescribing , and clinical outcome tracking as its economic foundation. The comparison underscores a structural divide: consumer-first platforms depend on marketing scale, while Knownwell and Midi build clinically anchored, insurer-integrated systems. As FDA scrutiny tightens and payers push for outcomes, the advantage shifts toward companies designed for reimbursement and continuity , not rapid prescription churn. For CVS Ventures, the takeaway is clear: the next generation of obesity care won't be won by who can fill the most prescriptions but by who can measure outcomes and manage total cost of care. The Market Correction in Obesity Care And Weight Management The GLP-1 market is undergoing a systemic reset — evolving from a direct-to-consumer boom into a payer-driven infrastructure play Regulators are tightening oversight of compounded GLP-1s — limited to specific medical contexts and under stepped-up enforcement. Manufacturers are reasserting control through direct channels ( Zepbound via LillyDirect; Wegovy via Novo partners). Employers and payers want GLP-1 coverage tied to outcomes, not utilization. Clinicians are advocating integrated obesity and metabolic-care models that address root causes , not just prescriptions. Consumers are demanding safer, physician-supervised options as awareness grows around side effects and long-term costs. Strategic capital — from CVS, Optum, and Elevance — is funding the infrastructure to make that viable. It's a rare moment of alignment across stakeholders — from regulators to investors — all pushing toward clinically grounded, economically sustainable care models. “Obesity care is the next frontier of value-based care,” said Geoff Price , co-founder of Oak Street Health and Knownwell's newest board member . “Knownwell is building the model that works for patients, providers, and payers alike.” From Viagra to Ozempic: What History Reveals About the Future of GLP-1 and Longevity Medicine Every pharmaceutical breakthrough follows a curve: hype, saturation, integration, regulation. GLP-1s are entering that third phase — where the business model around the molecule matters as much as the molecule itself. When Viagra redefined sexual health, telehealth startups turned private prescriptions into an e-commerce boom. When statins reshaped cardiology, payers integrated lipid management into routine care. When insulin became mainstream, access and affordability drove a century of policy reform. GLP-1s are repeating that pattern — but at far greater scale. They sit at the intersection of metabolic medicine, employer health costs, and consumer culture . They aren't just reshaping bodies; they're redefining care infrastructure, capital flows, and political narratives. That's why CVS Ventures' bet on Knownwell isn't simply a funding round — it's a play on what comes after the hype cycle. If Viagra made intimacy mainstream and statins made prevention a payer priority, GLP-1s are turning metabolic health into national infrastructure and obesity medicine looks less like wellness and more like primary care. The Next Phase: How CVS and Knownwell Aim to Scale Longevity Care Knownwell plans to expand its hybrid model into new markets and partner with employers and insurers like Aetna on value-based obesity care. It's also pursuing outcomes-based reimbursement tied to sustained metabolic and behavioral metrics, positioning itself as “primary care for metabolic health,” not a weight-loss brand. “There is no longevity panacea,” said Josh Herring of the Longevity Science Foundation . “What will matter most is democratizing access, building integrated systems, and investing in research that treats root causes, not diseases in silos. GLP-1s and cost reductions alone won't solve the crisis—they must be embedded in sustainable models that include nutrition, behavioral change, and care continuity.” Rebuilding the GLP-1 Economy: From Hype to Health Systems The GLP-1 boom began as a consumer story—subscriptions, celebrities, and cash-pay scripts. It will end as a systems story about integration, coverage, and outcomes. CVS Ventures' Knownwell investment marks that inflection point: from selling prescriptions to rebuilding the healthcare infrastructure around them. If the Ozempic economy collapsed under its own hype , this is the reconstruction phase — and CVS is quietly drafting the blueprint for what comes next. The future of weight and longevity care won't belong to whoever prescribes the most Ozempic; it will belong to whoever keeps patients healthiest after they stop taking it. More from the author:

CVS Health Ventures Investments

41 Investments

CVS Health Ventures has made 41 investments. Their latest investment was in knownwell as part of their Series B on October 20, 2025.

CVS Health Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

10/20/2025 | Series B | knownwell | $25M | Yes | Andreessen Horowitz, Flare Capital Partners, Geoff Price, Intermountain Ventures, MassMutual, and Undisclosed Investors | 4 |

9/25/2025 | Series D | Thyme Care | $97M | No | a16z Bio Health, AlleyCorp, Concord Health Partners, Foresite Capital, Frist Cressey Ventures, Humana, Memorial Hermann, Morgan Health, Texas Oncology, and Town Hall Ventures | 5 |

9/23/2025 | Series B | AmplifAI | Yes | 7 | ||

9/9/2025 | Series D | |||||

8/21/2025 | Seed VC |

Date | 10/20/2025 | 9/25/2025 | 9/23/2025 | 9/9/2025 | 8/21/2025 |

|---|---|---|---|---|---|

Round | Series B | Series D | Series B | Series D | Seed VC |

Company | knownwell | Thyme Care | AmplifAI | ||

Amount | $25M | $97M | |||

New? | Yes | No | Yes | ||

Co-Investors | Andreessen Horowitz, Flare Capital Partners, Geoff Price, Intermountain Ventures, MassMutual, and Undisclosed Investors | a16z Bio Health, AlleyCorp, Concord Health Partners, Foresite Capital, Frist Cressey Ventures, Humana, Memorial Hermann, Morgan Health, Texas Oncology, and Town Hall Ventures | |||

Sources | 4 | 5 | 7 |

CVS Health Ventures Portfolio Exits

2 Portfolio Exits

CVS Health Ventures has 2 portfolio exits. Their latest portfolio exit was SpectrumAi on August 18, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/18/2025 | Acquired | 4 | |||

Date | 8/18/2025 | |

|---|---|---|

Exit | Acquired | |

Companies | ||

Valuation | ||

Acquirer | ||

Sources | 4 |

CVS Health Ventures Partners & Customers

1 Partners and customers

CVS Health Ventures has 1 strategic partners and customers. CVS Health Ventures recently partnered with Redesign Health on .

CVS Health Ventures Team

224 Team Members

CVS Health Ventures has 224 team members, including current Founder, Managing Partner, Vijay Jun Patel.

Name | Work History | Title | Status |

|---|---|---|---|

Vijay Jun Patel | H.I.G. Growth Partners, Nike, Daktari Diagnostics, CVS Health, Bain Capital, Oliver Wyman, and Sankaty Advisors | Founder, Managing Partner | Current |

Name | Vijay Jun Patel | ||||

|---|---|---|---|---|---|

Work History | H.I.G. Growth Partners, Nike, Daktari Diagnostics, CVS Health, Bain Capital, Oliver Wyman, and Sankaty Advisors | ||||

Title | Founder, Managing Partner | ||||

Status | Current |

Loading...