Cytora

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$41.43MAbout Cytora

Cytora specializes in the digitization of commercial insurance workflows and operates within the insurance technology sector. It offers a platform that digitizes incoming risks, augments them with additional data, evaluates them against various business rules, and routes them to appropriate systems for underwriting. Its platform is designed to improve premium growth, profitability, and service in the commercial and specialty insurance segments by streamlining core underwriting processes and enabling data-driven decision-making. It was founded in 2014 and is based in London, United Kingdom. In September 2025, Cytora was acquired by Applied.

Loading...

Cytora's Product Videos

_(1)_thumbnail.png?w=3840)

ESPs containing Cytora

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The underwriting data platforms market offers technology solutions for insurance companies to streamline their underwriting processes and improve risk assessment. These platforms provide tools for data analysis, automation, and continuous monitoring to enhance efficiency and accuracy in underwriting. The market includes solutions for health, life, and commercial insurance underwriting, with a focu…

Cytora named as Outperformer among 15 other companies, including Guidewire, Sapiens, and Majesco.

Cytora's Products & Differentiators

Cytora Digital Risk Processing Platform

The Cytora Digital Risk Processing Platform enables commercial insurers to digitise all interactions with brokers, enabling optimised risk workflows and control over the target portfolio. Cytora brings together the data, processes and people enabling insurers to create multi-step risk flows that maximise efficiency and differentiate how risks are processed according to risk appetite, portfolio and automation objectives. From small commercial to middle market to large commercial, Cytora supports different operating models and levels of risk complexity and all submission types from new business to renewals to claims.

Loading...

Research containing Cytora

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Cytora in 4 CB Insights research briefs, most recently on Nov 6, 2025.

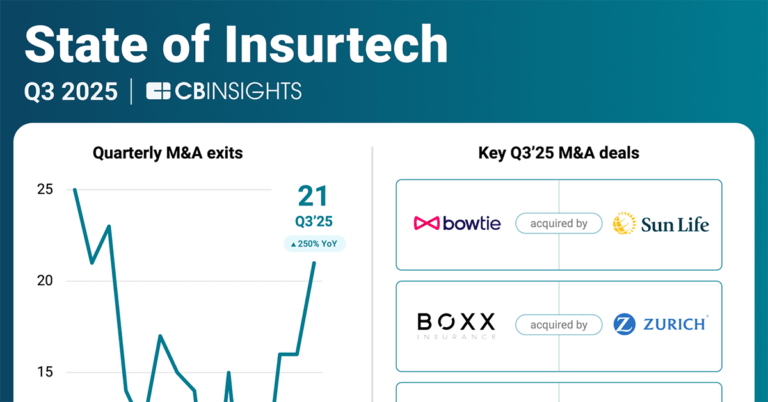

Nov 6, 2025 report

State of Insurtech Q3’25 Report

Oct 11, 2024

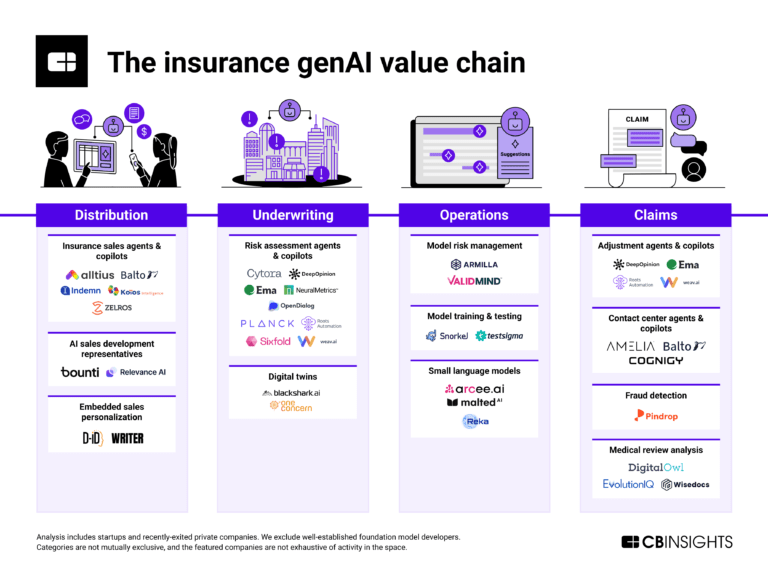

How genAI is reshaping the insurance value chainExpert Collections containing Cytora

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Cytora is included in 6 Expert Collections, including Insurtech.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence (AI)

14,182 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

14,203 items

Excludes US-based companies

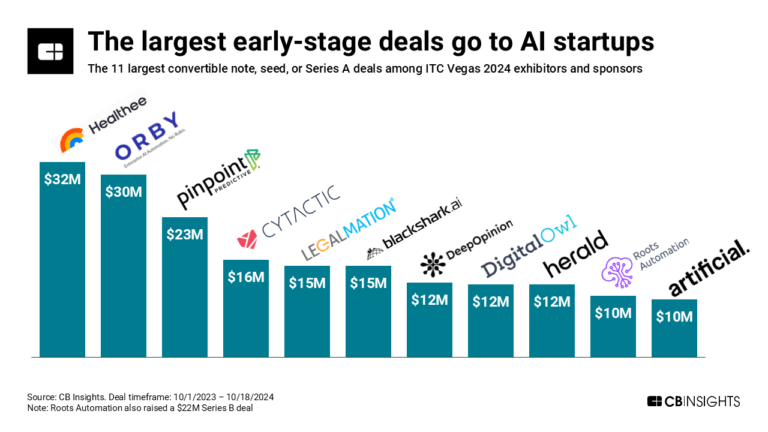

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

AI agents & copilots

1,771 items

Companies developing AI agents, assistants/copilots, and agentic infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy.

ITC Vegas 2025

496 items

Based on sponsor list as of 9.22.2025

Cytora Patents

Cytora has filed 2 patents.

The 3 most popular patent topics include:

- neurological disorders

- rare diseases

- autosomal recessive disorders

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/26/2023 | 10/15/2024 | Stem cells, Transcription factors, Neurological disorders, Rare diseases, Clusters of differentiation | Grant |

Application Date | 9/26/2023 |

|---|---|

Grant Date | 10/15/2024 |

Title | |

Related Topics | Stem cells, Transcription factors, Neurological disorders, Rare diseases, Clusters of differentiation |

Status | Grant |

Latest Cytora News

Nov 13, 2025

Relativity6 CEO and Co-Founder Alan Ringvald joined Cytora’s Making Risk Flow podcast with host Jake Harding to discuss how AI and multi-source data are transforming underwriting. Their conversation covers the growing importance of automation, intelligent data aggregation, and collaboration between human and machine intelligence. Listen to the episode here. The post Relativity6 CEO Alan Ringvald Featured on Cytora’s “Making Risk Flow” Podcast appeared first on Cortado Ventures.

Cytora Frequently Asked Questions (FAQ)

When was Cytora founded?

Cytora was founded in 2014.

Where is Cytora's headquarters?

Cytora's headquarters is located at One London Wall, Barbican, London.

What is Cytora's latest funding round?

Cytora's latest funding round is Acquired.

How much did Cytora raise?

Cytora raised a total of $41.43M.

Who are the investors of Cytora?

Investors of Cytora include Applied, Tech Nation Fintech, Parkwalk Advisors, Cambridge Innovation Capital, EQT Ventures and 18 more.

Who are Cytora's competitors?

Competitors of Cytora include ZestyAI, Instabase, weav.ai, Rossum, Akur8 and 7 more.

What products does Cytora offer?

Cytora's products include Cytora Digital Risk Processing Platform.

Who are Cytora's customers?

Customers of Cytora include Allianz, Chubb, Starr and Beazley.

Loading...

Compare Cytora to Competitors

Kalepa focuses on enhancing underwriting performance in the commercial insurance industry. The company's main service is an artificial intelligence (AI)-powered underwriting workbench, which helps underwriters focus on high return on investment opportunities, quickly evaluate submissions, and understand the hidden risks associated with each case. It primarily serves the commercial insurance industry. It was founded in 2018 and is based in New York, New York.

Convr is a company focused on AI-driven underwriting solutions for the commercial property and casualty insurance industry. Their offerings include a modularized underwriting workbench that improves the underwriting process through data enrichment, risk scoring, and document processing. Convr serves commercial P&C carriers, reinsurers, managing general agents, and underwriters. It was founded in 2015 and is based in Schaumburg, Illinois.

Carpe Data provides predictive data analytics and artificial intelligence solutions for the insurance industry. The company offers services for fraud detection, claims processing, and small commercial underwriting using data science techniques and AI. Carpe Data serves the insurance sector with products aimed at improving the efficiency and accuracy of claims and underwriting operations. It was founded in 2016 and is based in Santa Barbara, California.

Unqork is an enterprise application development platform that creates applications across various sectors. The company provides solutions for building, testing, and running applications. Unqork serves industries such as financial services, insurance, healthcare, and government. It was founded in 2017 and is based in New York, New York.

Sixfold provides generative AI tools for the insurance underwriting sector. Its platform ingests underwriting guidelines, extracts relevant risk data, and offers risk insights and suggestions. The company serves insurers, managing general agents (MGAs), and reinsurers across various lines of insurance including life, disability, and property & casualty. It was founded in 2023 and is based in New York, New York.

Send Technology provides underwriting software for the commercial insurance sector. Its offerings include an underwriting workbench that automates the underwriting process, as well as tools for data integration and compliance management. The platform serves insurers and managing general agents (MGAs), facilitating operational efficiency and data-driven decision-making. It was founded in 2017 and is based in London, United Kingdom.

Loading...