EvolutionIQ

Founded Year

2019Stage

Acquired | AcquiredTotal Raised

$60.35MValuation

$0000About EvolutionIQ

EvolutionIQ focuses on claims guidance for the insurance sector. The platform offers insights and guidance to aid in insurance claims processing. The company serves the insurance industry, providing solutions that support the operational tasks of claims professionals across various lines of business. EvolutionIQ was formerly known as DeepFraud AI. It was founded in 2019 and is based in New York, New York. In December 2024, EvolutionIQ was acquired by CCC Intelligent Solutions.

Loading...

ESPs containing EvolutionIQ

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The claims triage software market facilitates the triage process in insurance claims management. Claims triage involves the initial assessment and categorization of insurance claims upon first notice of loss. Insurers can use these solutions to optimize resource allocation, expedite the claims handling process, and improve the customer experience. The solutions in this space typically leverage tec…

EvolutionIQ named as Challenger among 15 other companies, including UiPath, Guidewire, and Sapiens.

EvolutionIQ's Products & Differentiators

IQInvestigate

Focused on monitoring Disability Claims in real time to identify which claims no longer meet the definition of disabled so examiners can focus on claims that can be resolved and reduce investment on low priority claims

Loading...

Research containing EvolutionIQ

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned EvolutionIQ in 6 CB Insights research briefs, most recently on Oct 16, 2025.

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Feb 13, 2025 report

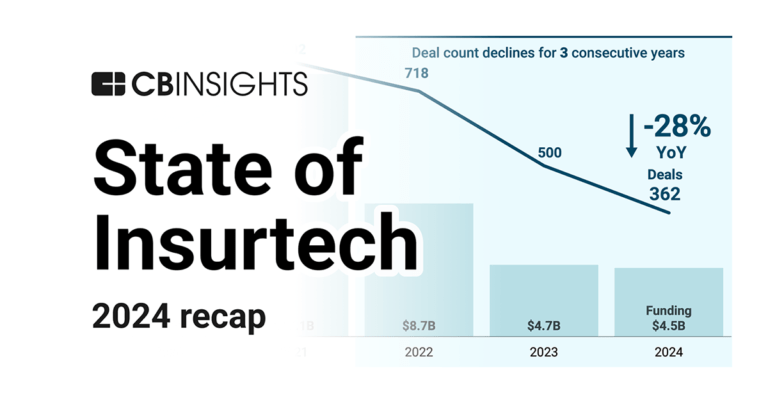

State of Insurtech 2024 Report

Oct 11, 2024

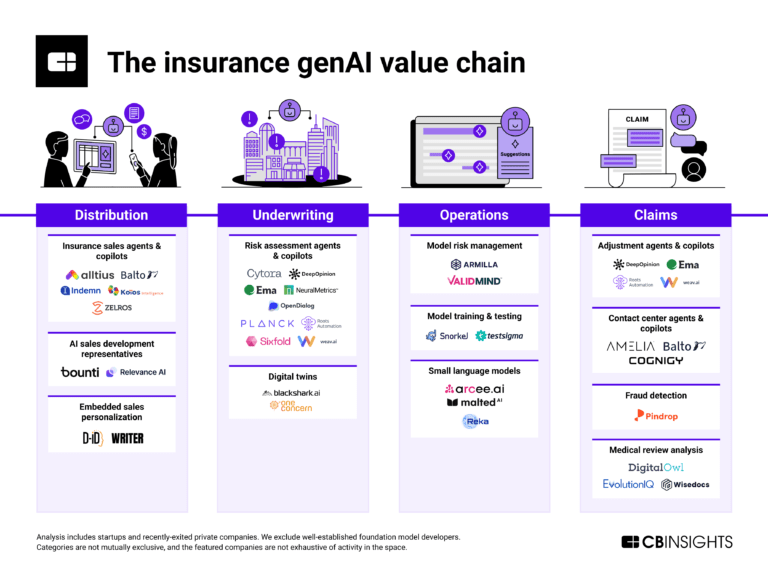

How genAI is reshaping the insurance value chain

Dec 18, 2023

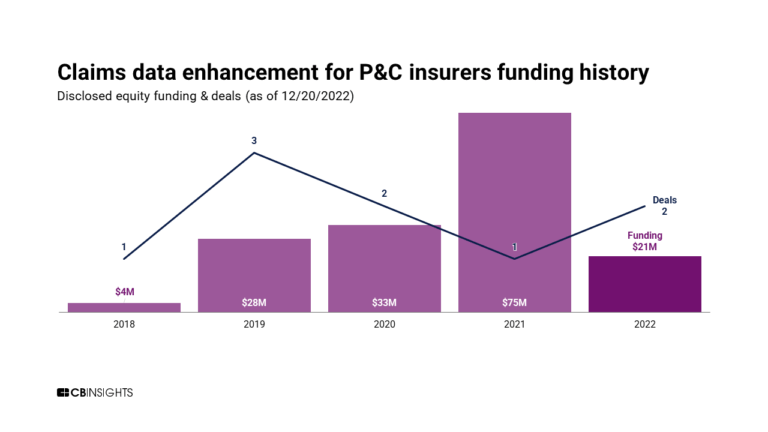

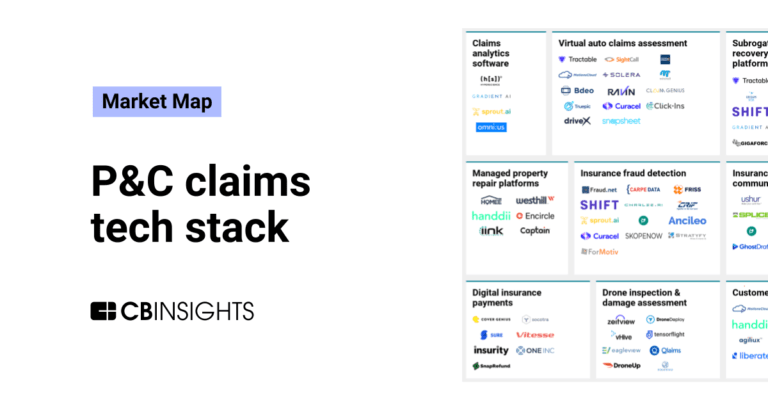

The P&C claims tech stack market mapExpert Collections containing EvolutionIQ

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

EvolutionIQ is included in 9 Expert Collections, including Insurtech.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

100 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

AI 100 (All Winners 2018-2025)

200 items

AI 100 (2024)

100 items

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Latest EvolutionIQ News

Jun 11, 2025

The move is aimed at expediting the transition to a product and service-based IT operating model. June 11, 2025 HCLTech will provide The Standard with its genAI-led service transformation platform, AI Force, as well as digital engineering and cloud services. The Standard Insurance Company has expanded its alliance with technology company HCLTech to incorporate AI into its infrastructure and application services. This move is aimed at expediting the transition to a product and service-based IT operating model, aligning with the insurer’s digital transformation agenda. Go deeper with GlobalData HCLTech will provide The Standard with its generative AI (genAI)-led service transformation platform, AI Force, as well as digital engineering and cloud services. These technologies are expected to refine The Standard’s delivery of workplace benefits, with a focus on customer service. The transformation will be supported by the formation of a Joint Innovation Council and a Digital Experience Office. The Standard chief information security officer and IT infrastructure and security management organisation head Laxman Prakash said: “The Standard’s growth journey has accelerated in recent years through digital transformation and acquisitions, and HCLTech has proven to be the best partner to help us scale efficiently and seamlessly with its digital-first and customer-focused approach. We look forward to the positive impact that this ongoing partnership will provide for our customers.” GlobalData Strategic Intelligence US Tariffs are shifting - will you react or anticipate? Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis. By GlobalData HCLTech senior vice-president and North America insurance head Anubhav Mehrotra stated: “We are excited about this extended partnership with The Standard, showcasing our deep commitment to the insurance sector. This collaboration underscores HCLTech’s investment in AI-led capabilities and innovative talent, which have been pivotal in guiding The Standard through its digital transformation journey.” Last month, The Standard expanded its partnership with EvolutionIQ , integrating an AI-powered claims guidance platform into its disability insurance processes. This technology empowers The Standard’s claims team to leverage data insights to reduce administrative workloads, enhance decision-making and streamline payments. Sign up for our daily news round-up! Give your business an edge with our leading industry insights.

EvolutionIQ Frequently Asked Questions (FAQ)

When was EvolutionIQ founded?

EvolutionIQ was founded in 2019.

Where is EvolutionIQ's headquarters?

EvolutionIQ's headquarters is located at 250 Hudson Street, New York.

What is EvolutionIQ's latest funding round?

EvolutionIQ's latest funding round is Acquired.

How much did EvolutionIQ raise?

EvolutionIQ raised a total of $60.35M.

Who are the investors of EvolutionIQ?

Investors of EvolutionIQ include CCC Intelligent Solutions, First Round Capital, Amasia, Guidewire, Foundation Capital and 16 more.

Who are EvolutionIQ's competitors?

Competitors of EvolutionIQ include omni:us and 6 more.

What products does EvolutionIQ offer?

EvolutionIQ's products include IQInvestigate and 1 more.

Who are EvolutionIQ's customers?

Customers of EvolutionIQ include Reliance Standard and Argo Group.

Loading...

Compare EvolutionIQ to Competitors

Charlee.ai focuses on artificial intelligence and predictive analytics in the insurance sector. The company provides solutions for insurance providers to manage claims litigation and reserve management processes. Charlee.ai was formerly known as Infinilytics. It was founded in 2016 and is based in Pleasanton, California.

Shift Technology focuses on artificial intelligence for the insurance sector, particularly in fraud detection, risk assessment, and claims processing. The company provides solutions that assist in decision-making across underwriting and claims. Shift Technology serves the insurance industry, including property & casualty, healthcare, and life & disability sectors. It was founded in 2014 and is based in Paris, France.

Gradient AI specializes in artificial intelligence solutions for the insurance sector. The company offers a software-as-a-service platform that utilizes AI to enhance underwriting results, minimize claim costs, and boost operational efficiency. Gradient AI primarily serves the insurance industry, including carriers, MGAs, TPAs, and other related entities. It was formerly known as Milliman - Gradient A.I. It was founded in 2012 and is based in Boston, Massachusetts.

Skopenow is a company specializing in open-source intelligence and threat intelligence within the security and investigative sectors. Its offerings include tools for entity search, link analysis, situational awareness, and automated fraud and risk signaling, aimed at helping organizations detect and analyze threats and fraud. Skopenow serves sectors such as insurance, legal, government, law enforcement, and media. It was founded in 2016 and is based in New York, New York.

Pilotbird focuses on insurance analytics within the insurance industry. The company offers products that analyze social data points to enhance risk scoring, customer engagement, and fraud detection for the life and health and property and casualty insurance sectors. Its solutions are designed to improve the accuracy and relevance of underwriting, distribution, and claims processes. It was founded in 2020 and is based in New York, New York.

FRISS focuses on risk assessment automation for property and casualty (P&C) insurance carriers. The company offers a platform that provides real-time analytics to understand and evaluate the inherent risks in customer interactions, aiming to enhance trust and efficiency in insurance processes. FRISS's solutions enable insurers to automate underwriting, accelerate claims processing, and conduct structured investigations into suspicious activities. It was founded in 2006 and is based in Mason, Ohio.

Loading...