Delos

Founded Year

2017Stage

Series A | AliveTotal Raised

$22.3MValuation

$0000Last Raised

$9M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-66 points in the past 30 days

About Delos

Delos provides property insurance focusing on climate-affected regions, using technology and knowledge of wildfire behavior and climate risk. The company offers homeowner policies based on AI-driven risk models and climate risk assessments, allowing them to provide coverage in areas with high wildfire exposure where traditional insurers withdraw. Delos serves the insurance industry while addressing the challenges posed by climate change. It was founded in 2017 and is based in San Francisco, California.

Loading...

Delos's Product Videos

ESPs containing Delos

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech managing general agents — personal lines property & casualty market comprises insurtech managing general agents (MGAs) that provide personal lines property & casualty (P&C) insurance. These lines of business may include (but are not limited to) automotive, homeowners, renters, and travel. Also included in this market are insurtech managing general underwriters (MGUs) and other insurt…

Delos named as Challenger among 15 other companies, including Hippo, SageSure, and Rhino.

Loading...

Research containing Delos

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Delos in 5 CB Insights research briefs, most recently on Oct 23, 2025.

Oct 23, 2025 report

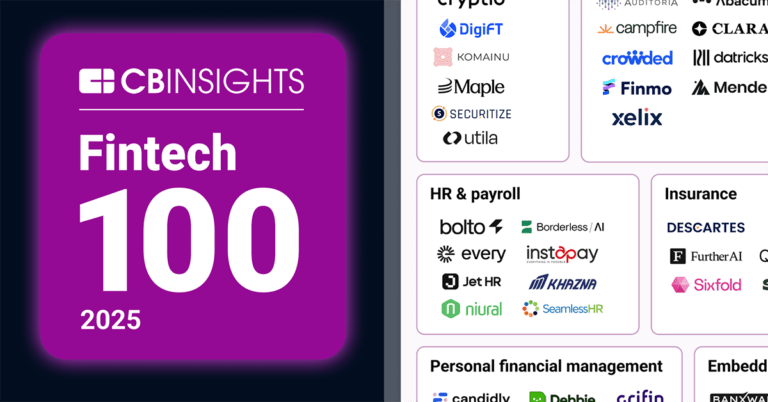

Fintech 100: The most promising fintech startups of 2025

Oct 23, 2025 report

Book of Scouting Reports: 2025’s Fintech 100

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025

Oct 24, 2024 report

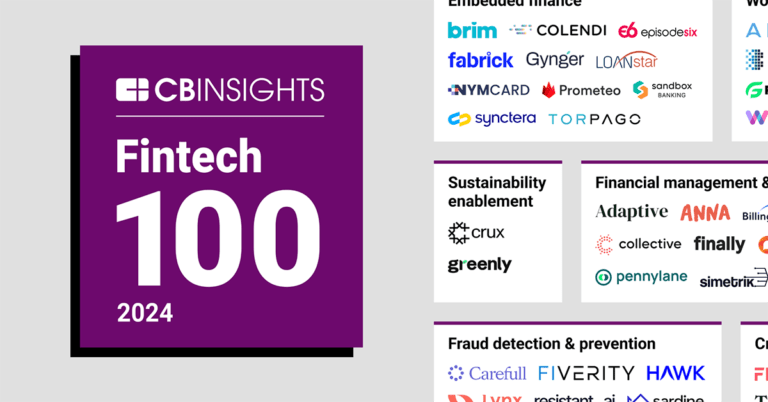

Fintech 100: The most promising fintech startups of 2024

Feb 23, 2024

The B2C US insurtech market mapExpert Collections containing Delos

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Delos is included in 8 Expert Collections, including Insurtech.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50 (2024)

50 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Insurtech 50

100 items

Report: https://www.cbinsights.com/research/report/top-insurtech-startups-2024/

Artificial Intelligence (AI)

20,894 items

Fintech 100 (2024)

100 items

Delos Patents

Delos has filed 1 patent.

The 3 most popular patent topics include:

- computer storage media

- geographic information systems

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/5/2023 | 12/10/2024 | Rotating disc computer storage media, Wireless networking, Geographic information systems, Machine learning, Computer storage media | Grant |

Application Date | 10/5/2023 |

|---|---|

Grant Date | 12/10/2024 |

Title | |

Related Topics | Rotating disc computer storage media, Wireless networking, Geographic information systems, Machine learning, Computer storage media |

Status | Grant |

Latest Delos News

Jul 4, 2025

Delos Insurance is using climate data and AI to differentiate good risks in wildfire-prone zones Share As insurers pull back from California’s fire-prone regions, one MGA writing excess and surplus (E&S) business is taking a different approach. Delos Insurance is underwriting property coverage using a wildfire risk model developed in partnership with the Spatial Informatics Group, a research think tank known for its work with Cal Fire and the California Public Utilities Commission. “Spatial Informatics Group has been doing some of the most important wildfire modeling for civil governments for decades,” said Shanna McIntyre (pictured), chief data officer at Delos. “Through our partnership, we have exclusive access to all of that data for anything insurance related.” Delos’s model blends this environmental science with machine learning. According to McIntyre, it has been rigorously tested and has successfully predicted the scope of major wildfires over the past seven years. “We innovated using machine learning on geospatial datasets,” she said. “It’s not just about historical loss. We include climate projections and focus on worst-case scenarios.” Rethinking fire risk to stabilize pricing The model is also aimed at addressing volatility in the market. Sharp pricing swings have contributed to carrier exits and non-renewals in high-risk ZIP codes. “We like to make sure that we don't have to have large swings between one year to the next in our view of risk,” McIntyre said. That stability, she added, is partly what makes the E&S space viable for Delos. As a non-admitted carrier, the company is not bound by the same rate approval processes as insurers in the admitted market. Still, McIntyre emphasized Delos’s ongoing engagement with regulators. “We always want to make sure that we are communicating really well with the Department of Insurance,” she said. Delos also uses its model to distinguish insurable properties in areas often redlined by traditional markets. McIntyre said their analysis finds that 65% of homes flagged as high-risk by legacy carriers are acceptable risks under the Delos model. Testing against real losses, not just assumptions Rather than relying solely on theoretical modeling, Delos validates its approach against actual insurance losses. “The most important role that we use for testing our model are people who have access to loss data at insurers and reinsurers,” said McIntyre. The company also consults with wildfire experts and has a former Cal Fire chief of staff among its advisors. This commitment to empirical testing, she said, is what makes the model viable for underwriting in today’s environment. “We undergo back-testing against historical fires, and the model has accurately captured the full extent of the risk in advance of the most significant fires in recent years, including those in Los Angeles.” Engineering mindset in a regulatory world Before joining Delos, McIntyre worked in aerospace engineering, where she focused on predictive modeling. She sees strong parallels between the two fields. “Both are highly regulated and involve complex systems with many interdependent parts,” she said. As wildfire behavior evolves – driven by climate change and events like dry lightning storms and urban conflagrations – Delos believes it can carve out a role in covering underserved markets. The company has already insured more than 25,000 policyholders in California and continues to grow its capacity partnerships. Whether this model-driven approach will hold up under ongoing climate and regulatory pressure remains an open question. But in a retreating market, it offers one potential roadmap forward. Fetching comments...

Delos Frequently Asked Questions (FAQ)

When was Delos founded?

Delos was founded in 2017.

Where is Delos's headquarters?

Delos's headquarters is located at 548 Market Street, San Francisco.

What is Delos's latest funding round?

Delos's latest funding round is Series A.

How much did Delos raise?

Delos raised a total of $22.3M.

Who are the investors of Delos?

Investors of Delos include IA Capital Group, Seraphim Space, Generation Space, Blue Bear Capital, HSBC Asset Management and 12 more.

Who are Delos's competitors?

Competitors of Delos include None and 5 more.

Loading...

Compare Delos to Competitors

ZestyAI provides AI-powered risk assessment solutions for the property and casualty insurance industry. The company offers peril-specific risk models for natural disasters and environmental hazards, along with property insights to assist in underwriting and pricing decisions. ZestyAI's services are used by the insurance sector for risk management and decision-making. ZestyAI was formerly known as PowerScout. It was founded in 2015 and is based in San Francisco, California.

United Services Automobile Association operates as a financial services company serving the military community and families. The company offers a variety of products, including insurance, banking, retirement, and investment services. United Services Automobile Association serves active duty military and veterans. United Services Automobile Association was formerly known as United States Army Automobile Association. It was founded in 1922 and is based in San Antonio, Texas.

Amica serves as a mutual insurance company, provides auto, home, and life insurance, as well as marine, motorcycle, and umbrella options. The company primarily serves individual policyholders and small businesses. It was founded in 1907 and is based in Lincoln, Rhode Island.

Auto-Owners Insurance provides insurance products for individuals and businesses. The company offers services including homeowners, auto, life, and business insurance, as well as policies such as term life, universal life, and whole life. Auto-Owners Insurance serves various clients with its coverage options. It was founded in 1916 and is based in Lansing, Michigan.

Nationwide Mutual Insurance Company operates as an insurance and financial services organization. The company offers products including auto, business, homeowners, farm, and life insurance, as well as retirement plans, annuities, and mutual funds. Nationwide serves individual consumers and businesses with its insurance and financial products. Nationwide Mutual Insurance Company was formerly known as Farm Bureau Mutual Automobile Insurance Company. It was founded in 1925 and is based in Columbus, Ohio.

Northwestern Mutual provides financial planning and insurance within the financial services industry. The company offers life insurance, disability insurance, long-term care, and investment advisory services. Northwestern Mutual serves individuals and businesses seeking to address their financial needs. It was founded in 1857 and is based in Milwaukee, Wisconsin.

Loading...