Descartes Underwriting

Founded Year

2019Stage

Series B - II | AliveTotal Raised

$141.78MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+33 points in the past 30 days

About Descartes Underwriting

Descartes Underwriting provides parametric insurance for climate, cyber, and emerging risks within the insurance industry. The company develops event-driven coverage that pays out based on predefined parameters and utilizes a method to model and assess risks. It serves corporate and public sector clients across industries, including agriculture, construction, and financial institutions. The company was founded in 2019 and is based in Paris, France.

Loading...

Descartes Underwriting's Product Videos

ESPs containing Descartes Underwriting

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The parametric insurance platforms market consists of insurtechs that offer platforms to insurers and intermediaries to build parametric insurance products. Policyholders of parametric coverage are paid a set amount based on the occurrence of a specific event — characterized by index-backed objective parameters, such as levels of rainfall or wildfire impact. Parametric products often focus on risk…

Descartes Underwriting named as Leader among 8 other companies, including Arbol, Floodbase, and CelsiusPro.

Descartes Underwriting's Products & Differentiators

Natural Catastrophes

Parametric insurance against a full range Nat Cat and climate risks, including cyclone, earthquake, flood, wildfire, and more.

Loading...

Research containing Descartes Underwriting

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Descartes Underwriting in 3 CB Insights research briefs, most recently on Oct 23, 2025.

Oct 23, 2025 report

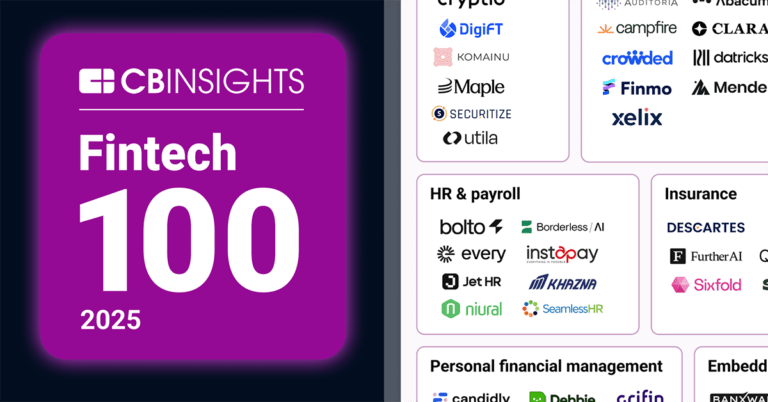

Fintech 100: The most promising fintech startups of 2025

Oct 23, 2025 report

Book of Scouting Reports: 2025’s Fintech 100

Oct 16, 2025 report

Insurtech 50: The most promising insurtech startups of 2025Expert Collections containing Descartes Underwriting

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Descartes Underwriting is included in 6 Expert Collections, including Real Estate Tech.

Real Estate Tech

2,494 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Insurtech

4,636 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

14,203 items

Excludes US-based companies

Insurtech 50

100 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Insurtech 50 2025

50 items

Do not share

Fintech 100

100 items

Descartes Underwriting Patents

Descartes Underwriting has filed 1 patent.

The 3 most popular patent topics include:

- network protocols

- operations research

- sensors

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/22/2021 | 8/15/2023 | Sensors, Wireless sensor network, Virtual private networks, Operations research, Network protocols | Grant |

Application Date | 3/22/2021 |

|---|---|

Grant Date | 8/15/2023 |

Title | |

Related Topics | Sensors, Wireless sensor network, Virtual private networks, Operations research, Network protocols |

Status | Grant |

Latest Descartes Underwriting News

Nov 6, 2025

Reinsurance News Descartes Underwriting, the specialist in corporate parametric solutions, sees a growing opportunity to bring fresh, sustainable parametric capacity to Asia, particularly within frequency layers where insurers are facing higher retentions, according to Ben Qin, Head of Asia Pacific. In an interview with Reinsurance News around the Singapore International Reinsurance Conference (SIRC), Qin noted that Asia has traditionally lagged behind regions such as the US and Australia in adopting new insurance solutions. He said that in parts of Asia, adoption of both life and general insurance has only risen in recent decades but, generationally, “it’s starting from almost zero.” Qin continued, “As a proportion of climate-related risks globally, Asia takes up a lot of it. It’s got the population for it; half the world’s population is sitting in North and Central Asia. So, we’ve got the population density factor, we’ve got the actual settlements, we’ve got the economic dollars on the line. So, if you think about the risk exposure, it’s huge. “We’re only at the tip of the iceberg in regard to adoption. If people never adopted traditional insurance products, it’s always good to start afresh and say parametric is a new type of product, a new type of cover. So, we see pretty good adoption and understanding of it and maturity over the past few years since Descartes opened offices in that region. We see nice potential in the region to do something meaningful.” He identified a particularly strong opportunity in the frequency layer, where parametric solutions can help fill a protection gap left by the retreat of traditional reinsurers as they looked to mitigate volatility amid rising losses from so-called secondary perils. Qin explained, “The retentions that local insurers and cedants have historically enjoyed aren’t coming down. These insurers are now having to bear more of the volatility in that frequency bit, and that’s where we are seeing opportunity come up. “Because we are representing fresh and new capacity in the market that’s not taken up by the large reinsurers of the world, it’s a very refreshing look. Our local partners, brokers, and cedants are saying that it’s a fresh new appetite. It’s sustainable capacity in the frequency layer, where historically they have enjoyed the volatility smoothing by reinsurers in a traditional manner, but now we are bringing that back in that reinsurance space.” He added that the greatest growth potential in Asia lies in solutions built on reliable, measurable indices, which can support sustainable, long-term adoption. “The trick is coming up with the right index so that both the buyer and the seller are comfortable with the index to be used and it’s sustainable, and not just a band aid solution to address some kind of a surface level retention solution. It’s here to stay. So hopefully some of the modelling companies, some of the third parties, some of the brokers can rise up to the challenge and come up with good, reliable and accurate indices for the likes of us, for capacity providers, to really provide clients with appropriate solutions,” said Qin. Qin noted that parametric solutions were once primarily used for non-damage business interruption in sectors such as agriculture and energy, but as capacity tightens across traditional insurance markets, new opportunities have emerged. “With us, because we’re a capacity filler, we’ve seen a lot in construction, infrastructure, the public sector, the PPPs, plus all the government stuff—those are probably the bigger ones and the ones that have the requirements and the demand. We still see all the esoteric, non-damage business interruptions, except they’re not so esoteric anymore. “The one that’s evolved a lot in the thinking over the years is actually hospitality—hotels and leisure groups—where the business interruption element of a traditional property damage product never really served its purpose. If you think about revenue earning or income or interruption from a normal bricks-and-mortar point of view, like a factory, then the factory is down from a damage perspective, therefore you face interruption of revenue. Whereas hotels and hospitality, even the surrounding airport, if people can’t get in or there’s depopulation from an event, there’s a non-damage element to it. And after COVID, everyone tightened up on wording and really matured in their understanding of it. So, we’ve started to see a lot from that sector as well, which is always good.” Qin also highlighted that Descartes’ strength lies in its deep technological foundation, which has been central to the company’s approach since its inception in 2019. “The backbone of Descartes has always been built on technology, AI adoption, the whole idea of using device and hardware to enable some kind of an onsite measurement. We’ve always had that element from day one. From the pre-selection of risks, building up risk models to pricing and underwriting. So, from all of that we’ve got physics based models to enable a better and accurate pricing of risk, and that’s from a global scale, scraping satellite imagery, IoT, and other forms of external data to come up with, effectively, the ground truth,” he said. He added that this technology-driven approach gives Descartes the infrastructure and resources to view risk differently from other insurers and reinsurers. Qin revealed, “Last year, we were awarded by the French state-owned entity GENCI—the controllership for three of the larger computing centres in France—three million computing hours to enable a piece of work on wildfire modelling, and hail as well. “So, we’re definitely leveraging both the development ops side, which is the AI side, and also the hardware side, which is infrastructure. Just the sheer amount of computing power needed to get something done. From a technology angle, that’s all very common, but from an insurance point of view, no one’s really done that before. “So, that’s all the pre-processing, pricing, and underwriting part. On the post-processing side, we’re starting to use IoT sensors and devices to accurately depict the client’s exposure to a particular event or loss. And we’re scraping satellite imagery post-loss, too. For example, you’ve got a vast amount of bushland, and you’re really looking for a pattern in that imagery after a loss. That, again, requires a huge amount of computing power. So, it’s all evolving over the years.” Share this:

Descartes Underwriting Frequently Asked Questions (FAQ)

When was Descartes Underwriting founded?

Descartes Underwriting was founded in 2019.

Where is Descartes Underwriting's headquarters?

Descartes Underwriting's headquarters is located at 148 rue de Courcelles, Paris.

What is Descartes Underwriting's latest funding round?

Descartes Underwriting's latest funding round is Series B - II.

How much did Descartes Underwriting raise?

Descartes Underwriting raised a total of $141.78M.

Who are the investors of Descartes Underwriting?

Investors of Descartes Underwriting include Battery Ventures, Leading European Tech Scaleups, BlackFin Capital Partners, Serena Capital, Cathay Innovation and 10 more.

Who are Descartes Underwriting's competitors?

Competitors of Descartes Underwriting include Demex and 2 more.

What products does Descartes Underwriting offer?

Descartes Underwriting's products include Natural Catastrophes and 2 more.

Loading...

Compare Descartes Underwriting to Competitors

Arbol is a FinTech company that focuses on climate risk management through parametric insurance solutions. The company offers a platform that provides insurance coverage based on data triggers, using artificial intelligence for underwriting and blockchain technology for operational efficiency. Arbol serves sectors such as agriculture, energy, and travel, providing insurance and derivatives solutions to address climate-related risks. It was founded in 2018 and is based in New York, New York.

Skyline Partners specializes in providing custom-crafted, data-driven insurance products for various sectors. The company offers services such as data sourcing, policy design, calculation services, underwriting management, and claims notification and management, focusing on transforming data streams into transparent, reactive protection. Skyline Partners primarily serves re/insurers, brokers, underwriting and distribution agents, affinity partners, and government agencies. It was founded in 2017 and is based in London, United Kingdom.

Demex focuses on non-catastrophic weather risk management within the insurance sector. The company offers solutions such as retained climate risk reinsurance and operational climate risk coverage, which use customer data to quantify and transfer unique financial risks for insurers and corporations. Demex primarily serves the insurance industry by providing supplementary reinsurance programs and budget stability for businesses affected by volatile weather. It was founded in 2020 and is based in Washington, District of Columbia.

Extraordinary RE specializes in the trading of insurance liabilities within the insurance and reinsurance industry. The company offers a platform that allows the transfer of different risk classes to capital markets investors, using technology to create tradeable contracts for insurance liabilities. This service provides capital market participants with returns and helps reinsurers manage risk. It was founded in 2012 and is based in San Clemente, California. Extraordinary RE ceased operations.

Delos provides property insurance focusing on climate-affected regions, using technology and knowledge of wildfire behavior and climate risk. The company offers homeowner policies based on AI-driven risk models and climate risk assessments, allowing them to provide coverage in areas with high wildfire exposure where traditional insurers withdraw. Delos serves the insurance industry while addressing the challenges posed by climate change. It was founded in 2017 and is based in San Francisco, California.

AIR Worldwide specializes in catastrophe modeling and risk assessment within the insurance and risk management sectors. The company offers a suite of software solutions and consulting services designed to help clients understand and manage the risks associated with natural disasters, climate change, and other extreme events. AIR Worldwide primarily serves insurers, reinsurers, financial institutions, and government entities seeking to mitigate and manage risks. It was founded in 1987 and is based in Boston, Massachusetts.

Loading...