Dune

Founded Year

2018Stage

Series B | AliveTotal Raised

$79.42MValuation

$0000Last Raised

$69.42M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-52 points in the past 30 days

About Dune

Dune provides a data platform for the cryptocurrency sector. It specializes in organizing, decoding, and presenting blockchain data in a human-readable format, making crypto data more accessible to users. It primarily serves the cryptocurrency analytics community. It was founded in 2018 and is based in Oslo, Norway.

Loading...

ESPs containing Dune

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital assets market data & insights market provides comprehensive data and analytics on blockchain networks, cryptocurrency and stablecoin markets, and decentralized finance. It includes solutions that offer historical and real-time on-chain and market data for research, trading, risk management, reporting, and compliance. Companies in this market aggregate fragmented data from multiple sour…

Dune named as Outperformer among 15 other companies, including Chainalysis, Kaiko, and Elliptic.

Loading...

Research containing Dune

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Dune in 2 CB Insights research briefs, most recently on Feb 23, 2023.

Dec 14, 2022

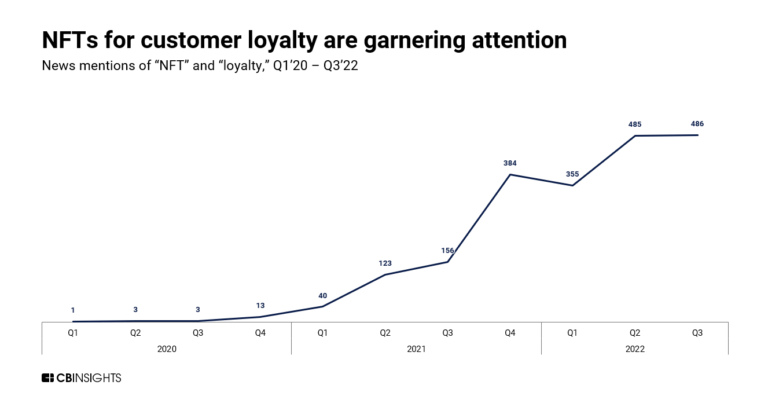

What L’Oréal, Nike, and LVMH are doing in Web3Expert Collections containing Dune

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Dune is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,297 items

Blockchain

13,333 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

14,203 items

Excludes US-based companies

Blockchain 50

50 items

Stablecoin

471 items

Latest Dune News

Nov 3, 2025

Copied Overview DeFi traders in 2025 rely on advanced DeFi tools for analytics, automation, and MEV protection in decentralized finance. Lower transaction fees and AI-powered platforms are making DeFi faster, smarter, and more efficient for DeFi traders. Tools like DeFiLlama, Nansen, 1inch, CoW Swap, and DeFi Saver create a complete ecosystem for research, trading, and risk management in DeFi. Decentralized Finance (DeFi) has grown fast thanks to cheaper transaction fees and better trading tools. After Ethereum’s Dencun upgrade in 2024, fees on Layer-2 networks became much lower. This encouraged more people to trade on-chain. DeFi’s total value locked (TVL) has also increased again, reaching around $150 to $170 billion across different blockchains. In this fast-moving market, certain tools help traders make better decisions, manage risk, and improve profits. Let’s take a look at the most useful DeFi tools for traders. Also Read: DeFiLlama DeFiLlama is a popular website that shows how much money is locked in different DeFi platforms. It tracks TVL, trading volumes, and how money moves between blockchains and protocols. It shows total DeFi TVL in the mid-100 billion dollar range. This tool helps traders understand where their finances are going and which platforms are gaining or losing users. Dune Dune allows anyone to create and use custom dashboards based on blockchain data. It is built by the community, and new dashboards appear quickly when a new token or protocol becomes popular. Dune updated its system to handle higher traffic and improved its credit model for users. It is useful for checking real on-chain data, like token trades, pool volumes, and stablecoin supply, in a visual and easy way. Nansen Nansen specializes in tracking wallet activity on many blockchains. It uses labels like “smart money,” “funds,” or “exchanges” to show who is buying or selling. The platform also launched Nansen AI, an assistant that uses (DEX) aggregator. It searches many platforms to find the best swap price for a trade. In June 2025, 1inch updated its Pathfinder algorithm. This upgrade improved trading rates by up to 6.5 percent and reduced gas fees. This helps traders save money, especially when making large or frequent trades. CoW Swap uses a unique method for trading. Instead of sending direct exchanges to DEXs, it uses 'solvers' that compete to find the best result. Trades are grouped in batch auctions, which reduces MEV risk. CoW Swap provides cross-chain exchanges by blending trading and bridging in a single step. It also expanded to the BNB Chain and started offering gasless trades. This makes it a strong option for safe and efficient transactions. DeFi Saver DeFi Saver helps automate finance strategies. It is popular for managing loans in platforms like Maker, Aave, and Compound. The platform has features such as automatic debt repayment, stop-loss, and take-profit tools. DeFi Saver gave support for EIP-7702 in August 2025, which allows normal wallets to perform advanced smart contract actions in one trade. It also made automation easier and faster on Layer-2 networks. MetaMask Portfolio is one of the most popular crypto wallets. Its Portfolio feature makes it more powerful. This tool allows users to track all tokens, NFTs, and DeFi positions across different networks in one place. It also offers staking services and built-in bridges. In early 2025, new updates were added to make self-custody safer and improve the platform. This tool helps traders quickly move funds and access DeFi exchanges without leaving their wallet. Zapper is a dashboard that shows all DeFi assets, NFTs, and wallet activity in real time. It supports multiple blockchains and wallets. The mobile apps were improved for better speed and accuracy. Zapper also helps traders discover new protocols by showing what active wallets are doing on-chain. This makes it helpful for monitoring overall portfolio health and exploring new opportunities. Market Trends in 2025 Two major changes are affecting how DeFi tools are used in modern times. First, transaction fees on Layer-2 networks are much lower after Ethereum’s upgrades. This makes activities like frequent trading, automated strategies, and arbitrage cheaper and more profitable. Second, AI is becoming a key part of DeFi tools. Platforms like Nansen and Arkham now use AI assistants to deliver insights faster and more clearly. Final Thoughts Successful DeFi trading depends on using the right tools. DeFiLlama gives a big-picture view of the market. Dune provides custom data analysis. Nansen and Arkham offer insight into what smart wallets and large traders are doing. For trading, 1inch and CoW Swap help find the best prices while protecting against MEV. Flashbots adds another layer of safety. DeFi Saver automates complex positions, while MetaMask Portfolio and Zapper make it easy to track and manage assets. Together, these tools form a complete system for research, execution, protection, and portfolio management. As DeFi continues to grow and change, staying updated and using reliable platforms will remain the key to success. You May Also Like 1. What are DeFi tools, and why are they important for DeFi traders? DeFi tools are platforms or applications that help traders analyze markets, execute trades, automate strategies, and manage portfolios in the decentralized finance ecosystem. 2. Which are the best DeFi tools for DeFi traders in 2025? Some of the most popular tools in 2025 include DeFiLlama, Dune, Nansen, Arkham, 1inch, CoW Swap, Flashbots Protect, DeFi Saver, MetaMask Portfolio, and Zapper. 3. How do DeFi tools help reduce risk in decentralized finance? DeFi tools offer features like real-time wallet tracking, MEV protection, price alerts, liquidation prevention, and automated risk management to help traders avoid losses. 4. Are DeFi tools safe to use? Most popular DeFi tools are considered safe, but it is important to verify official platforms, avoid fake links, and use secure wallets to protect funds and data. 5. Do DeFi tools work on multiple blockchains? Yes, many modern DeFi tools support multiple blockchains and Layer-2 networks, allowing traders to track assets, trade, and manage portfolios across Ethereum, Arbitrum, Polygon, BNB Chain, and others.

Dune Frequently Asked Questions (FAQ)

When was Dune founded?

Dune was founded in 2018.

Where is Dune's headquarters?

Dune's headquarters is located at C/o Epicenter Edvard Storms gate 2, Oslo.

What is Dune's latest funding round?

Dune's latest funding round is Series B.

How much did Dune raise?

Dune raised a total of $79.42M.

Who are the investors of Dune?

Investors of Dune include Multicoin Capital, Dragonfly, Coatue, Redpoint Ventures, Union Square Ventures and 13 more.

Who are Dune's competitors?

Competitors of Dune include Kaiko and 8 more.

Loading...

Compare Dune to Competitors

Whalemap provides on-chain data for Bitcoin trading within the cryptocurrency market. The company offers tools to track whale activity, identify support and resistance levels, and analyze market trends for trading decisions. Whalemap's services cater to individuals and institutions looking to gain insights into Bitcoin's market movements based on whale transactions. It was founded in 2020 and is based in London, England.

Sun Zu Lab focuses on providing data solutions for the cryptocurrency ecosystem. The company offers services such as crypto market research, analytics, and in-depth articles, as well as a customizable dashboard for monitoring crypto markets. Sun Zu Lab primarily serves institutional investors, token foundations, and trading venues within the cryptocurrency industry. It was founded in 2020 and is based in Metz, France.

Riskbloq is a company focused on providing professional risk analysis and scoring for digital assets within the cryptocurrency sector. Their main services include generating comprehensive risk profiles for over 3000 crypto assets by combining on-chain and off-chain data, aimed at aiding investors in making informed crypto investment decisions. The company primarily caters to individual and institutional investors looking for data-driven insights into the cryptocurrency market. It was founded in 2022 and is based in Johannesburg, South Africa.

DeepDAO lists, ranks, and analyzes top DAOs across multiple metrics, such as membership and assets under management (AUM). Its mission is to provide comprehensive discoverability for decentralized governance systems, analytics, and information gathering.

Chainalysis operates within the cryptocurrency industry and provides services that include monitoring blockchain transactions, tracing activities, ensuring compliance with regulations, and offering security for web3 platforms. The company serves law enforcement agencies, regulators, financial institutions, centralized and decentralized exchanges, tax agencies, consumer brands, and cybersecurity entities. It was founded in 2014 and is based in New York, New York.

Artemis is a company that provides an institutional data platform for digital assets within the financial technology sector. Its offerings include tools for analyzing on-chain activity, such as a terminal for analytics, a spreadsheet plugin for data integration, and services for data sharing and API access. Artemis serves the financial and investment sectors, providing resources for crypto analysts and institutional investors. It is based in New York, New York.

Loading...