EBANX

Founded Year

2012Stage

Series C | AliveTotal Raised

$460MLast Raised

$430M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-42 points in the past 30 days

About EBANX

EBANX provides cross-border payment solutions within the financial technology sector, focusing on emerging markets. The company has a payments platform that facilitates transactions in Latin America, Africa, and India, offering various payment methods and currencies. EBANX serves global companies aiming to operate in these economies. It was founded in 2012 and is based in Curitiba, Brazil.

Loading...

Loading...

Research containing EBANX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned EBANX in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Jan 23, 2023 report

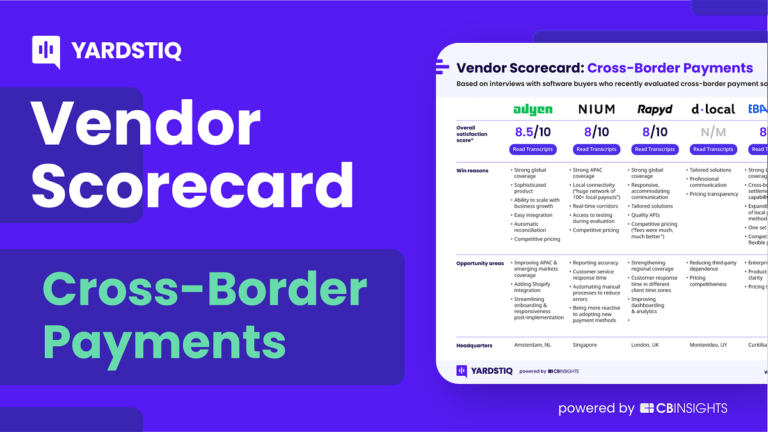

Top cross-border payments companies — and why customers chose them

Nov 28, 2022

The Transcript from Yardstiq: Feel the churnExpert Collections containing EBANX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

EBANX is included in 5 Expert Collections, including E-Commerce.

E-Commerce

11,641 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,309 items

Payments

3,277 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,203 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest EBANX News

Nov 17, 2025

Following this announcement, the partnership will provide merchants with the possibility to gain instant access to two of Brazil's payment solutions through the use of a single integration. Furthermore, this expansion is set to enable Spreedly's global merchants to grow cross-border and tap into Brazil's USD 378 billion ecommerce market, according to data from Payments and Commerce Market Intelligence (PCMI). Spreedly's support for Brazil's Pix Automático and NuPay through EBANX According to the official press release, as Brazil continues to focus on developing global payments, Pix currently processes USD 5.3 trillion annually (BRL 26.4 trillion in 2024), according to the central bank, and is expected to surpass credit cards for online payments by 2025, per PCMI. Furthermore, the adoption of Pix Automático and NuPay, which were developed to focus on recurring and installment-based payments, has also been complex and costly because each local payment service provider (PSP) introduces features at different times. With this in mind, Spreedly's open payments platform aims to solve this difficulty through the process of giving merchants immediate access to Pix Automático and NuPay without multiple builds or provider lock-in. In addition to these two payment methods, Spreedly, through its partnership with EBANX, is set to enable merchants to sell products and services to Brazilian customers and users by leveraging credit and debit cards, Pix for single transactions, MercadoPago for e-wallets, and Boleto Bancário for cash-based methods. The partnership will also focus on EBANX's strategy to allow global merchants to further develop in emerging markets by respecting and integrating with the local financial culture. At the same time, through the collaboration with Spreedly, the company will also focus on expanding global access to Brazilian innovations like Pix Automático and NuPay, making it easier for merchants to serve several consumers and users in an ever-evolving market.

EBANX Frequently Asked Questions (FAQ)

When was EBANX founded?

EBANX was founded in 2012.

Where is EBANX's headquarters?

EBANX's headquarters is located at Rua Marechal Deodoro, 630, Curitiba.

What is EBANX's latest funding round?

EBANX's latest funding round is Series C.

How much did EBANX raise?

EBANX raised a total of $460M.

Who are the investors of EBANX?

Investors of EBANX include Advent International, FTV Capital, Endeavor, Bossa Invest, Caravela Capital and 4 more.

Who are EBANX's competitors?

Competitors of EBANX include CloudWalk, Payall, Belvo, Bamboo Payment, Pismo and 7 more.

Loading...

Compare EBANX to Competitors

SUNRATE offers a global payment and treasury management platform that operates in the financial services industry. The company offers solutions for international payments, commercial card issuance, and treasury management, designed to facilitate cross-border transactions and manage financial risks. SUNRATE primarily serves businesses engaged in B2B trade, e-commerce, and online travel. It was founded in 2016 and is based in Singapore.

Nium operates within the financial technology sector and provides services including multi-currency accounts, global card issuance, and solutions for sending payouts to countries, facilitated through Application Programming Interface (API) and platform. Nium serves financial institutions, money transfer operators, and enterprises across sectors such as payroll, marketplaces, spend management, the creator economy, and travel. Nium was formerly known as InstaReM. It was founded in 2014 and is based in San Francisco, California.

Rapyd is a financial technology company focused on global payment processing and fintech solutions. The company provides services including payment acceptance, payouts, card issuing, and multi-currency business accounts, to manage financial transactions for businesses. Rapyd serves sectors such as eCommerce, online gaming, marketplaces, and the creator economy, offering tools to integrate various payment methods and streamline operations. Rapyd was formerly known as CashDash. It was founded in 2016 and is based in Essex, United Kingdom.

PayU is a company in global payments and fintech, focusing on enabling local and cross-border payments as well as providing financial services. The company offers a payment platform that facilitates online payment processing and payment gateway services. PayU primarily serves sectors such as e-commerce, hospitality, and marketplace solutions. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Bamboo Payment provides cross-border payment solutions in the financial technology sector. The company has a platform for payments and payouts for global merchants, allowing transactions across multiple markets and currencies with various payment methods. Bamboo's services include e-commerce, ride-hailing, gaming, payroll, delivery, online education, and airlines and travel. Bamboo Payment was formerly known as Perdury. It was founded in 2020 and is based in Montevideo, Uruguay.

Fincra is a payment gateway provider focused on payment processing for businesses across various sectors. The company offers services including virtual accounts, multicurrency accounts, and API integrations for online and offline payments. Fincra serves sectors such as ecommerce, financial institutions, global businesses, and developers. It was founded in 2019 and is based in Toronto, Ontario.

Loading...