Elliptic

Founded Year

2013Stage

Unattributed - II | AliveTotal Raised

$99.13MAbout Elliptic

Elliptic provides blockchain analytics and crypto compliance solutions within the financial technology sector. The company offers services including risk management for regulatory compliance, monitoring and screening for anti-money laundering (AML), and tools for law enforcement and intelligence operations to combat financial crime. Elliptic's platform serves clients such as financial institutions, centralized exchanges, network operators, and regulators, providing data to ensure compliance and manage risks in the evolving crypto landscape. Elliptic was formerly known as Bitxchange. It was founded in 2013 and is based in London, United Kingdom.

Loading...

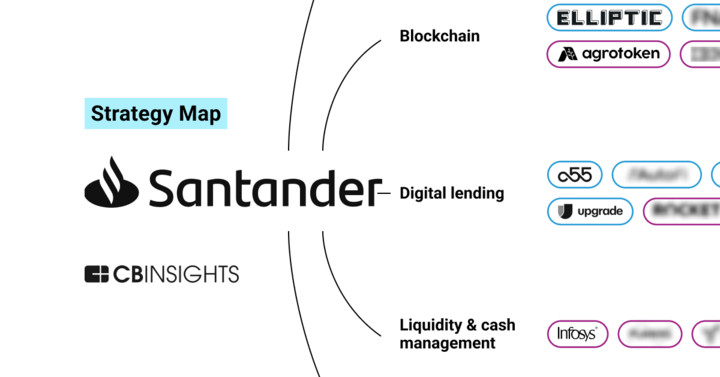

ESPs containing Elliptic

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

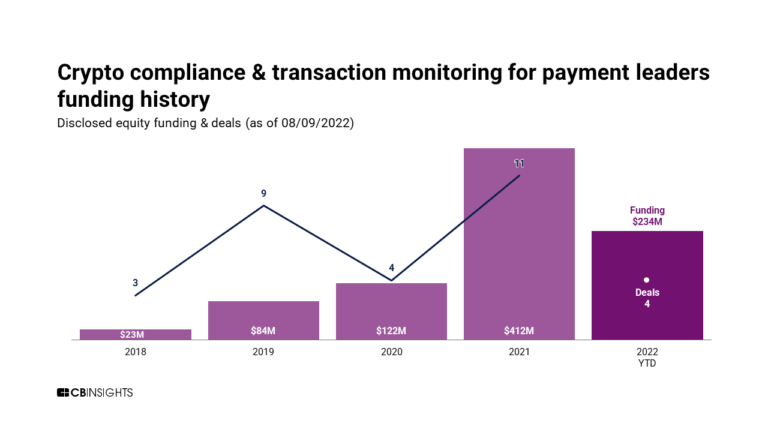

The crypto compliance & transaction monitoring market helps organizations comply with regulatory requirements in the cryptocurrency industry, including anti-money laundering (AML) and counter-terrorism financing (CTF) standards. These solutions leverage blockchain technology and proprietary risk algorithms to monitor transactions for potential illicit activity, such as money laundering, terrorism …

Elliptic named as Leader among 14 other companies, including Chainalysis, ComplyAdvantage, and Sardine.

Loading...

Research containing Elliptic

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Elliptic in 6 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

Mar 14, 2024

The retail banking fraud & compliance market map

Expert Collections containing Elliptic

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Elliptic is included in 9 Expert Collections, including Regtech.

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

9,441 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Game Changers 2018

70 items

Artificial Intelligence (AI)

16,627 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Cybersecurity

11,028 items

These companies protect organizations from digital threats.

Fintech

14,203 items

Excludes US-based companies

Elliptic Patents

Elliptic has filed 69 patents.

The 3 most popular patent topics include:

- audio engineering

- acoustics

- sensors

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/20/2024 | 1/14/2025 | Loudspeakers, Audio engineering, Loudspeaker manufacturers, Audio equipment manufacturers, Sensors | Grant |

Application Date | 3/20/2024 |

|---|---|

Grant Date | 1/14/2025 |

Title | |

Related Topics | Loudspeakers, Audio engineering, Loudspeaker manufacturers, Audio equipment manufacturers, Sensors |

Status | Grant |

Latest Elliptic News

Nov 10, 2025

Elliptic noted that government agencies have more digital asset data than they ever had before. The growth in crypto adoption means that agencies now encounter digital assets across a broader range of their ongoing work, from various fraud investigations that involve blockchain / DLT transactions to large-scale seizures containing large amounts of crypto-focused intelligence. However, Elliptic pointed out that gathering blockchain data and extracting insights from it are quite different challenges. Agencies tend to find themselves really overwhelmed by data they may know contains certain intelligence about criminal networks, money laundering patterns and fraud schemes. But, as Elliptic noted, they often tend to struggle to reliably identify which crypto leads are actually worth going after and which ones will end up wasting valuable investigative resources. According to a blog post from Elliptic, the result is a familiar paradox: They are “data rich, but insight poor.” Elliptic claims that there’s great potential in this data, however, unlocking its value is not merely a matter of throwing more money or human resources at the problem. According to the blockchain analytics and security firm, What’s required is a systematic approach that aims to turn raw blockchain data into more prioritized, actionable intelligence. Elliptic further noted that systematic data processing unlocks capabilities that individual case investigation cannot achieve. When agencies start to apply “consistent filtering criteria” across large datasets, they gain intelligence that transforms how they may be approaching financial crime. Pattern recognition across cases. When multiple victims report similar fraud schemes, systematic analysis can reveal whether they’re targeting the same criminal operation or whether they represent separate incidents requiring different responses. This pattern recognition transforms reactive fraud reporting into proactive criminal enterprise investigation. Proactive victim identification. Agencies can identify additional victims following identical criminal patterns, then notify relevant exchanges or financial institutions to prevent further losses. For example, if analysis reveals an organized group conducting romance scams through a particular method, agencies can proactively identify other individuals likely to be targeted by the same operation. Trend analysis over time. Financial intelligence units can track whether specific criminal methods are happening more or less, measure the effectiveness of public awareness campaigns and identify emerging threats before they cause significant damage. This makes evidence-based resource allocation and policy decisions possible. Cross-border intelligence. Systematic processing helps agencies understand how criminal organizations adapt their methods across different jurisdictions. An agency might discover that criminals are favoring particular countries for specific crime types, enabling international coordination to close regulatory gaps or strengthen enforcement cooperation. Strategic performance measurement. Instead of tracking only seizures and arrests, agencies can measure victim loss prevention, criminal infrastructure disruption and deterrent effects on organized crime operations. This provides clearer evidence of investigative effectiveness for leadership reporting and budget justification. Continuous improvement through feedback loops. Systematic data processing creates feedback loops that improve investigative approaches over time. Agencies can identify which types of cases produce successful outcomes, which analytical approaches prove most effective and where additional resources would generate the highest impact. Elliptic’s blockchain intelligence allows government agencies to transform data overload into key insights for digital assets. Sponsored Links by DQ Promote

Elliptic Frequently Asked Questions (FAQ)

When was Elliptic founded?

Elliptic was founded in 2013.

Where is Elliptic's headquarters?

Elliptic's headquarters is located at 35-37 Ludgate Hill, London.

What is Elliptic's latest funding round?

Elliptic's latest funding round is Unattributed - II.

How much did Elliptic raise?

Elliptic raised a total of $99.13M.

Who are the investors of Elliptic?

Investors of Elliptic include HSBC, Tech Nation Future Fifty, J.P. Morgan, Octopus Ventures, Digital Currency Group and 18 more.

Who are Elliptic's competitors?

Competitors of Elliptic include Chainalysis, Predicate, Merkle Science, Coinfirm, Gray Wolf and 7 more.

Loading...

Compare Elliptic to Competitors

Chainalysis operates within the cryptocurrency industry and provides services that include monitoring blockchain transactions, tracing activities, ensuring compliance with regulations, and offering security for web3 platforms. The company serves law enforcement agencies, regulators, financial institutions, centralized and decentralized exchanges, tax agencies, consumer brands, and cybersecurity entities. It was founded in 2014 and is based in New York, New York.

TRM Labs detects and investigates crypto-related financial crime and fraud within the financial sector. The company provides services such as forensics, tactical investigations, compliance solutions like transaction monitoring and wallet screening, and incident response. TRM Labs serves government agencies, financial institutions, and crypto businesses, equipping them with tools to address crypto-facilitated crime and ensure regulatory compliance. It was founded in 2018 and is based in San Francisco, California.

Merkle Science is a predictive cryptocurrency risk and intelligence platform that operates in the financial technology sector. The company provides tools for detecting, investigating, and preventing illegal activities involving cryptocurrencies, with services that include transaction monitoring, compliance training, and forensic analysis. Its offerings cater to crypto businesses, decentralized finance (DeFi) participants, financial institutions, government agencies, and insurers. It was founded in 2018 and is based in Brooklyn, New York.

Crystal Intelligence provides blockchain analytics and compliance solutions within the cryptocurrency and financial sectors. The company offers tools for investigations and research, enabling users to monitor and analyze data to ensure adherence to anti-money laundering regulations in the crypto space. Crystal Intelligence serves financial institutions, law enforcement agencies, and regulatory bodies with its blockchain intelligence products and services. It was founded in 2018 and is based in Amsterdam, Netherlands.

Scorechain operates in blockchain compliance and digital asset risk management within the fintech industry. The company provides services including wallet transaction screening, compliance monitoring, and risk assessment for virtual asset service providers (VASPs). Scorechain serves the cryptocurrency sector, financial institutions, law enforcement agencies, and regulatory bodies. It was founded in 2015 and is based in Esch-sur-Alzette, Luxembourg.

Predicate provides blockchain compliance solutions within the financial services sector. The company offers services that define transaction rules, design ecosystems, and embed compliance rules into blockchain-related infrastructures. Predicate serves sectors that require regulated financial transactions, including asset issuers, decentralized finance (DeFi) platforms, and privacy-focused blockchain applications. It was founded in 2023 and is based in Wilmington, Delaware.

Loading...