Zip

Founded Year

2020Stage

Series D | AliveTotal Raised

$358.13MValuation

$0000Last Raised

$190M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+46 points in the past 30 days

About Zip

Zip is a procurement orchestration platform that focuses on the procurement process across various business functions. The company provides services including intake management, procure-to-pay automation, and sourcing process optimization, aimed at improving visibility, control, and efficiency in organizational spending. Zip serves sectors such as life sciences, financial services, and technology, offering solutions for startups, mid-market, and enterprise-level businesses. Zip was formerly known as Evergreen. It was founded in 2020 and is based in San Francisco, California.

Loading...

Zip's Product Videos

ESPs containing Zip

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The procure-to-pay market addresses all aspects of purchasing goods and services, from procurement to payment. This market includes technology solutions to automate and streamline this process, improving efficiency, reducing costs, and minimizing the risk of errors and fraud. These platforms feature spend management capabilities, supplier onboarding and management tools, purchase order processing,…

Zip named as Challenger among 15 other companies, including Esker, AvidXchange, and Tata Consultancy Services.

Zip's Products & Differentiators

Zip Intake-to-Procure

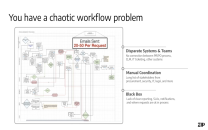

Drive enterprise-wide purchasing policy adoption to unlock spend control and visibility. Zip Intake-to-Procure centralizes intake for any procurement request and automatically orchestrates cross-functional approvals. Make process compliance intuitive while eliminating manual collaboration from requests, approvals, and vendor onboarding with an enterprise-grade, no-code workflow platform.

Loading...

Research containing Zip

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zip in 2 CB Insights research briefs, most recently on Dec 8, 2023.

Dec 8, 2023 report

The top 25 most successful startup accelerators

Oct 12, 2023

The procurement tech market mapExpert Collections containing Zip

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zip is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

100 items

Artificial Intelligence (AI)

20,894 items

AI agents & copilots

1,772 items

Companies developing AI agents, assistants/copilots, and agentic infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy.

Latest Zip News

Oct 24, 2025

Abacor AI assistant launches from stealth Jertam2567 - stock.adobe.com emerged from stealth with the launch of its new AI assistant made specifically to help accounting firms manage their administrative load. Co-founder and CEO David Lam noted that more than half of an accountant's time is devoted to administration, which takes attention away from more valuable activities. The plan is for the assistant to eventually handle many tasks but to start they are focusing on meeting admin. The AI solution can send timely, clear, and polished recaps after every client meeting; automatically share meeting insights across teams with context and permissions intact; turn every meeting into searchable, reusable knowledge so teams instantly access context from prior conversations; automates meeting preparation, notes, and follow-ups; and accurately captures, timestamps and stores every discussion, creating a reliable record of client interactions that protects both the firm and its clients. Abacor, though, said this is only the first step. More features and integrations are planned for the future. Suralink unveils AI enhancements in Workpaper Suite Digital Vision Lab - stock.adobe.com announced new AI enhancements in its Workpaper Suite. The workpaper suite now has advanced data matching which enables engagement teams to perform vouching and tracing procedures with human-like flexibility through the ability to set tolerance ranges, required fields, and close-match thresholds, replicating real-world professional judgment. The software now also automates the verification of footing and cross-footing in financial statements, automatically extracts or links tables or other similarly formatted information from any PDF or client document in just one click, and supports simpler, more intuitive, and comprehensive data extraction functionality. In the future Surealink plans to add an Ask Anything in Excel feature which lets users query multiple client documents at once and instantly surface key information with cited sources without leaving Excel; as well as an Extract Anything feature which allows users to instantly pull structured data from various file types (e.g., W-2s, invoices, data tables, or financial statements) directly into workpapers, removing the need for templates or manual entry. Zip touts price negotiation agent, other AI agents Yeti Studio - stock.adobe.com announced the release of a suite of new AI agents, including a price negotiation agent. The Price Negotiation Agent works by analyzing both internal purchase history and external market benchmarks to provide data-backed negotiation guidance. When a procurement team needs to renew their marketing automation software, for example, the agent analyzes what the company paid historically, benchmarks against third party market intelligence and provides specific negotiation tactics on each contract. Beyond price negotiation, Zip unveiled additional agents spanning the procurement journey, including a Preferred Vendor Agent that surfaces approved suppliers during intake and a suite of finance agents that automate accounts payable tasks like invoice-to-contract compliance checking. The company also introduced conversational AI capabilities across its platform from intake to final payment. Instead of navigating lengthy forms, employees can now handle every step in the procurement process through plain language. Zip's AI asks intelligent questions, reads uploaded documents, and automatically completes requests while providing instant policy answers. FlexTecs launches AP automation module robu_s - stock.adobe.com . The software ingests all AP inbox messages directly into the FlexTrap platform, where AI classifies, routes, and drafts responses using live ERP data. Specifically, it detects invoices and assigns them to the correct payment workflow; identifies supplier statements and routes them into reconciliation processes; drafts ERP-researched replies to payment status requests for AP review; flags suspicious requests (e.g., bank account changes) with supplier context for added protection; and provides audit-ready visibility into inbox activity, compliance, and workload. The solution will debut at the Shared Services & Outsourcing Week (SSON) in Amsterdam. Paystand announces accounts payable support, among other enhancements , a blockchain-enabled b2b receivables solutions provider, announced new enhancements to its platform that include accounts payable support, enabling users to automate the entire purchase process from start to finish. This is done by syncing pre-approved transactions with details like receipt images and service dates for efficient amortization. With this, Paystand is also able to provide built-in Bitcoin rewards on every OPEX and AP card transaction, with no extra steps. In addition, Paystand also announced Canadian dollar ETF support which gives Canadian businesses using Microsoft Dynamics 365 Business Central the same experience as U.S. users;.SmartCheck, Paystand's fully digital replacement for paper checks, which allows payers to scan or upload check images and complete payments instantly via ACH; Credit Memo Application at Checkout, which allows payers to view and apply posted credit memos directly during checkout—whether for a single invoice or multiple transactions., with the system automatically recalculating the remaining balance, processing the payment, and syncing updates to Business Central in real time; and a Dispute Automation Workflow which automatically unapplies the affected payment, reopens the invoice, and creates a dispute entry in the ledger, an end-to-end automation that keeps ERP data consistent, accelerates dispute resolution, and allows customers to easily repay reopened invoices through Paystand; and Secure Payment Links, which let merchants embed Paystand checkout links directly within third-party systems—powered by encrypted identifiers such as GUIDs and Paystand IDs. Partnerships and integrations announced a strategic partnership, combining their complementary strengths to deliver innovative integrated solutions across tax operations and compliance. Label and TaxTec look forward to unlocking new opportunities together, helping clients embrace innovative solutions and meet evolving tax operations and compliance challenges with confidence. … Close management software provider announced it has partnered with Trovata, a specialist in corporate banking connectivity. With FloQast's Trovata-powered Bank Connector, users no longer need to manually download bank statements or rely on spreadsheets. Trovata's platform automates the aggregation of bank data into FloQast. And because the Trovata integration is set up directly within the FloQast platform, there is no need for additional logins or switching between systems. … Top 100 firm , a machine learning-powered payments recovery platform, announced that it has strengthened its leadership team with two key additions: Sofya Pogreb as Chief Executive Officer and Charles Rosenblatt as Chief Commercial Officer. Pogreb has previously served as Chief Operating Officer at BILL, and previously held the same role at NEXT Insurance, and also served on the boards of Indigo and Next Insurance, bringing her deep expertise to the operational side. Rosenblatt has held senior roles at Payoneer and Hyperwallet, where he helped lead the company to its IPO, and at Hyperwallet, as well as serving as president of PayQuicker. … Bookkeeping and accounting platform Keeper

Zip Frequently Asked Questions (FAQ)

When was Zip founded?

Zip was founded in 2020.

Where is Zip's headquarters?

Zip's headquarters is located at 1 Sansome Street, San Francisco.

What is Zip's latest funding round?

Zip's latest funding round is Series D.

How much did Zip raise?

Zip raised a total of $358.13M.

Who are the investors of Zip?

Investors of Zip include Y Combinator, Charles River Ventures, Adams Street, DST Global, Bond and 9 more.

Who are Zip's competitors?

Competitors of Zip include Tipalti and 6 more.

What products does Zip offer?

Zip's products include Zip Intake-to-Procure and 1 more.

Who are Zip's customers?

Customers of Zip include Databricks, Lattice and Canva.

Loading...

Compare Zip to Competitors

Iq Software Services specializes in IT development services within the technology sector. The company offers data analytics solutions, API development and integration, and cloud-native application development. Iq Software Services primarily caters to sectors such as healthcare, retail, finance, automotive, and independent software vendors. It was founded in 2003 and is based in Bangalore, India.

E42 is a cognitive process automation platform that builds AI co-workers for enterprise process automation across functions. The company provides a platform that enables the creation and deployment of AI solutions to automate tasks in HR, marketing, finance, IT operations, and customer service. E42's AI co-workers are designed to enhance efficiency and accuracy in enterprise operations. It was founded in 2012 and is based in Pune, India.

Stampli focuses on accounts payable automation and invoice management. It offers a range of products to provide efficiency, visibility, and control for payments, employee expenses, corporate credit card spending, and vendor management. Stampli's services are primarily utilized by sectors such as healthcare, hospitality, professional services, construction, retail, and manufacturing. The company was founded in 2014 and is based in Mountain View, California.

Glean AI focuses on accounts payable automation and spend intelligence in the financial technology sector. The company provides software that automates data extraction, general ledger coding, bill approvals, and payments, and offers insights into spending trends and vendor management. Glean AI's solutions aim to support collaboration among accounting and financial planning teams, assisting in budget planning and decision-making. It was founded in 2019 and is based in New York, New York. In April 2025, Glean AI was acquired by Pipe.

Procurify offers a procure-to-pay platform that supports purchasing and accounts payable automation. It enables organizations to manage their business spending. Procurify's solutions serve various sectors, including technology, healthcare, biotech, manufacturing, consumer packaged goods, education, charter schools, and nonprofit organizations. It was founded in 2012 and is based in Vancouver, Canada.

Kyriba is a company that specializes in liquidity performance within the financial technology sector. The company offers services including cash and treasury management, risk management, payment processing, and connectivity solutions for banks and enterprise resource planning systems. Kyriba's platform is used by CFOs, Treasurers, and IT leaders to manage liquidity. It was founded in 2000 and is based in San Diego, California.

Loading...