Figure

Founded Year

2018Stage

IPO | IPOTotal Raised

$1.718BDate of IPO

9/11/2025About Figure

Figure operates as a non-bank financial services company that provides home equity lines of credit and other lending solutions. The company offers products including HELOCs, debt consolidation loans, solar panel financing, business funding, and education financing, all through a technology platform that supports loan processing. Figure serves homeowners looking to utilize their home equity. It was founded in 2018 and is based in Charlotte, North Carolina.

Loading...

ESPs containing Figure

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The real estate asset tokenization market converts physical real estate properties into digital tokens on blockchain networks, enabling fractional ownership and trading of property rights. These platforms allow investors to purchase token-based shares in residential, commercial, and mixed-use properties, receiving proportional rental income and capital appreciation. Key features include smart cont…

Figure named as Highflier among 15 other companies, including Securitize, Fireblocks, and GreatX.

Loading...

Research containing Figure

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Figure in 1 CB Insights research brief, most recently on Apr 10, 2025.

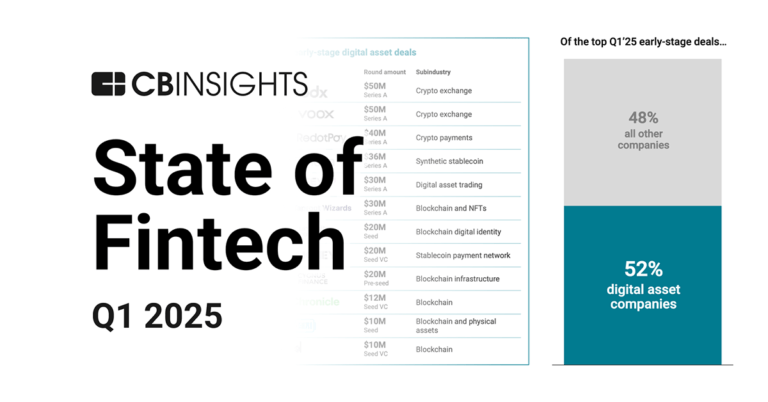

Apr 10, 2025 report

State of Fintech Q1’25 ReportExpert Collections containing Figure

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Figure is included in 7 Expert Collections, including Mortgage Tech.

Mortgage Tech

218 items

Companies here streamline and digitize the mortgage lending process. Collection includes direct lenders, mortgage brokers, process optimization technologies for lenders, as well as tools that support borrowers throughout the search and application phases.

Real Estate Tech

2,798 items

Startups in the space cover the residential and commercial real estate space. Categories include buying, selling and investing in real estate (iBuyers, marketplaces, investment/crowdfunding platforms), and property management, insurance, mortgage, construction, and more.

Blockchain

9,872 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Digital Lending

2,538 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Figure Patents

Figure has filed 17 patents.

The 3 most popular patent topics include:

- artificial intelligence

- bipedal humanoid robots

- humanoid robots

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/1/2013 | 1/31/2023 | Job scheduling, Commerce websites, Social networking services, Information technology management, Software architecture | Grant |

Application Date | 3/1/2013 |

|---|---|

Grant Date | 1/31/2023 |

Title | |

Related Topics | Job scheduling, Commerce websites, Social networking services, Information technology management, Software architecture |

Status | Grant |

Latest Figure News

Nov 7, 2025

By Catherine Leffert November 07, 2025, 6:00 a.m. EST 4 Min Read Key insight: Consumers' use of home equity lines of credit is rapidly growing, as homeowners look to tap into the value of their houses, but banks are losing market share. Supporting data: Banks hold just under two-thirds of total HELOC debt, compared with the more than 80% they held some 15 years ago. Forward look: The demand for home equity debt is likely to stay elevated for some time, as borrowers avoid refinancing their mortgages at less favorable rates. As consumers continue to take on more and more debt, banks are losing business in one of the fastest-growing household loan products. The volume of home equity lines of credit has been rising since 2022, as Americans have sought ways to access affordable debt without refinancing their mortgages at unfavorable rates. The acceleration in the usage of home equity lines follows a period of contraction that started about 15 years ago, when banks cut back on the business, or pulled out entirely. At the peak of the Great Recession, banks held more than 80% of HELOC debt. Now, they hold just under two-thirds, as fintechs and other nonbanks have jumped into the rapidly expanding business. Meredith Whitney, a Wall Street veteran who now runs an investment research firm, said that after banks were scarred by the mortgage crisis of the late aughts, they may be missing out on the resurgence of HELOC opportunities. While banks do still hold the majority of HELOC volume, at roughly $276 billion, per data from the Federal Reserve Bank of St. Louis, nonbanks' market share is quickly increasing. Several banks exited the HELOC business in 2020, due to economic uncertainty from the pandemic. Wells Fargo stopped offering the product at the time, and hasn't picked it up again. Capital One Financial, which completed its blockbuster acquisition of Discover Financial Services this spring, announced in July that it would wind down Discover's home equity loan business. Whitney said she thinks banks have time to get in the HELOC action. At this point, though, they'll have to build digital products that are fast and easy to use, she said, in order to compete with the fintechs. "That sounds really simple, but people want to go online and get their home equity approved and funded," Whitney said, explaining that banks will need to make investments in the HELOC business. "It's not as easy as just turning on the switch. They've been out of the market for long enough that they have to re enter the market in a competitive, modern way." Figure Technology Solutions, which both originates HELOCs on its own and partners with other lenders to offer them, facilitated $5 billion in HELOCs in 2024. That volume accounted for about 13% of total HELOC growth last year. The company's HELOC customers have an average FICO score of 755, Figure said in a public filing. "There is a lot of demand that the banks aren't meeting," Anthony Stratis, vice president of lending partnerships at Figure, told American Banker. "I do think there is an opportunity for depositories to rethink their home equity strategy and partner with companies, like Figure, in order to meet that demand without having the consumers go entirely outside their ecosystem." To be sure, the largest originators of HELOCs are still banks, including Citizens Financial Group, Bank of America and PNC Financial Services Group. And there are signs that banks are responding to the rise in HELOC demand. Earlier this year, JPMorganChase relaunched its home equity line of credit offering, after a five-year break from the product. Fifth Third Bancorp said this summer that it would expand parts of its home equity business, which has helped drive consumer growth, to make up for lost solar panel financing activity following new tax legislation. The jump in demand is in line with an increase in consumer debt overall, according to the Federal Reserve Bank of New York's quarterly report on household debt and credit. Total household debt grew by $197 billion, or 1%, in the third quarter, to $18.59 trillion, continuing an upward march that began in 2014. But rising indebtedness isn't necessarily a sign that there's more strain on Americans to scrape together funds, said a New York Fed researcher on a background call with reporters Wednesday. The increasing popularity of HELOCs is likely a reflection of low-risk borrowers moving away from more expensive types of debt, like credit cards or student loans, according to the researcher. "I really see it as just a product switch where a borrower might opt for a different product than they would have a few years ago," the researcher said. "One note, I think, is that they are more available now. There were many years after the global financial crisis where the home equity product just wasn't quite as available." U.S consumers are still showing resilience this year, with delinquency rates among Americans stabilizing in the third quarter, per Fed data. The New York Fed researcher said that the median credit score on a newly opened HELOC is "much higher" than the median score of a newly originated 30-year mortgage, though Wednesday's report didn't include that data. At Bank of America, fewer than 4% of its revolving home equity loans were held by borrowers with FICO scores under 660 on Sept. 30. As of the same date, the average FICO score among HELOC borrowers at PNC was 777. Figure's Stratis said that he thinks the demand for home equity borrowing is still on the rise, due to the pressure interest rates are continuing to put on mortgage refinancing activity. "There's going to be a need for cash on the consumer side," Stratis said. "And as far as rates go, which asks the question of what products are a good option for consumers, I think home equity still has a place." Whitney said that consumers are still far less leveraged than they have been historically, because equity in U.S. homes has nearly tripled since 2009, to $36 trillion. "I think we're still at the very beginning," Whitney said of HELOC growth.

Figure Frequently Asked Questions (FAQ)

When was Figure founded?

Figure was founded in 2018.

Where is Figure's headquarters?

Figure's headquarters is located at 650 South Tryon Street, Charlotte.

What is Figure's latest funding round?

Figure's latest funding round is IPO.

How much did Figure raise?

Figure raised a total of $1.718B.

Who are the investors of Figure?

Investors of Figure include Victory Park Capital, Sixth Street, Jefferies, J.P. Morgan, Goldman Sachs and 39 more.

Who are Figure's competitors?

Competitors of Figure include Amount, 1X, aaim, Percent, Point and 7 more.

Loading...

Compare Figure to Competitors

Hometap is a financial services company that specializes in home equity investments as an alternative to traditional loans. The company offers homeowners the ability to access the equity in their homes without the burden of monthly payments or debt, providing funds that can be used for a variety of personal and financial goals. Hometap's services are primarily utilized by individuals seeking financial solutions for education, home improvements, debt consolidation, business funding, retirement, and investment opportunities. It was founded in 2017 and is based in Boston, Massachusetts.

Kiavi provides lending solutions for real estate investors. The company offers various financing products including bridge loans, fix-and-flip loans, rental property financing, and new construction loans, aimed at assisting investors in acquiring and rehabilitating investment properties. Kiavi serves the residential real estate investment sector, offering financial solutions to individual and professional investors. Kiavi was formerly known as LendingHome. It was founded in 2013 and is based in Pittsburgh, Pennsylvania.

Domochi provides shared home equity lending within the financial services sector. The company offers products that enable homeowners to use their home equity without traditional mortgage solutions. Domochi's services focus on individuals seeking financing options for their real estate needs. It was founded in 2020 and is based in New York, New York.

Unlock is a financial services company that provides home equity agreements to American homeowners. Its main offering is a home equity agreement (HEA) designed to help families with financial challenges. The company serves homeowners seeking solutions to traditional home equity tapping methods. It was founded in 2019 and is based in Scottsdale, Arizona.

Point specializes in home equity investments and offers financial solutions within the fintech sector. The company's flagship product, the home equity investment (HEI), allows homeowners to access funds by sharing a portion of their home's future appreciation without the need for monthly payments. It primarily serves homeowners looking to leverage their home equity for debt elimination, home improvements, and personal growth without the financial burden of traditional loans. It was founded in 2015 and is based in Palo Alto, California.

Unison specializes in home co-investing in financial services. The company offers a financing alternative that allows homeowners to access their equity without incurring additional debt. It works with lenders, regulators, and institutional investors to integrate homeownership investing into the housing finance system. Its HomeBuyer enables purchasers to buy the home they want with controlled debt and risk. Its service is primarily targeted towards homeowners and investors. It was founded in 2004 and is based in San Francisco, California.

Loading...