FINNY AI

Founded Year

2023Stage

Angel | AliveTotal Raised

$4.8MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+322 points in the past 30 days

About FINNY AI

FINNY AI provides tools for financial advisors to assist in their prospecting efforts within the financial services industry. The company offers services that include identifying potential prospects, prioritizing them based on a compatibility score, and automating outreach processes to support advisor-client connections. Its platform aims to improve the prospecting process, allowing financial advisors to focus on building relationships and developing their businesses. The company was founded in 2023 and is based in New York, New York.

Loading...

ESPs containing FINNY AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The wealth management prospecting and lead generation platforms market provides technology solutions that enable financial advisors to segment, prioritize, and engage with potential clients. These platforms leverage AI, data analytics, and client profiling to identify high-potential leads, offer insights into client behavior, and optimize engagement strategies. Key features include relationship ma…

FINNY AI named as Leader among 15 other companies, including Salesforce, HubSpot, and Seismic.

Loading...

Research containing FINNY AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned FINNY AI in 2 CB Insights research briefs, most recently on Mar 6, 2025.

Mar 6, 2025

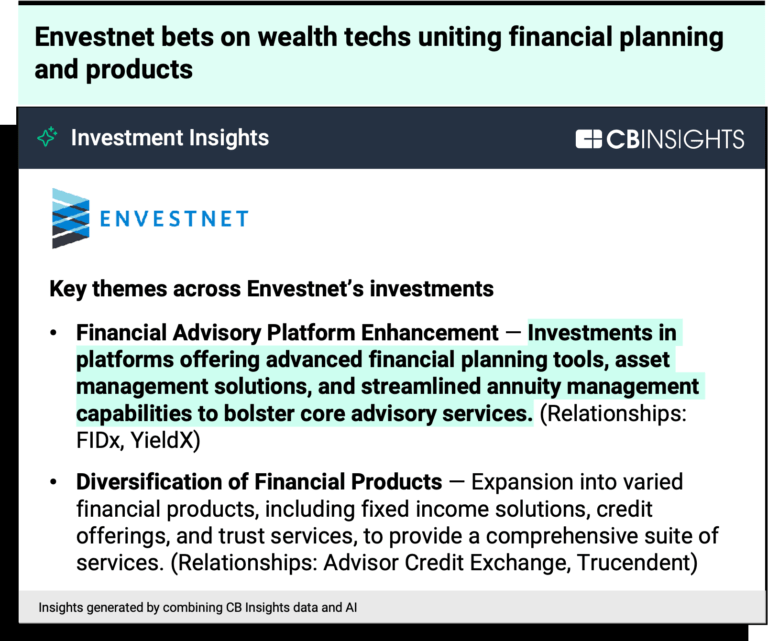

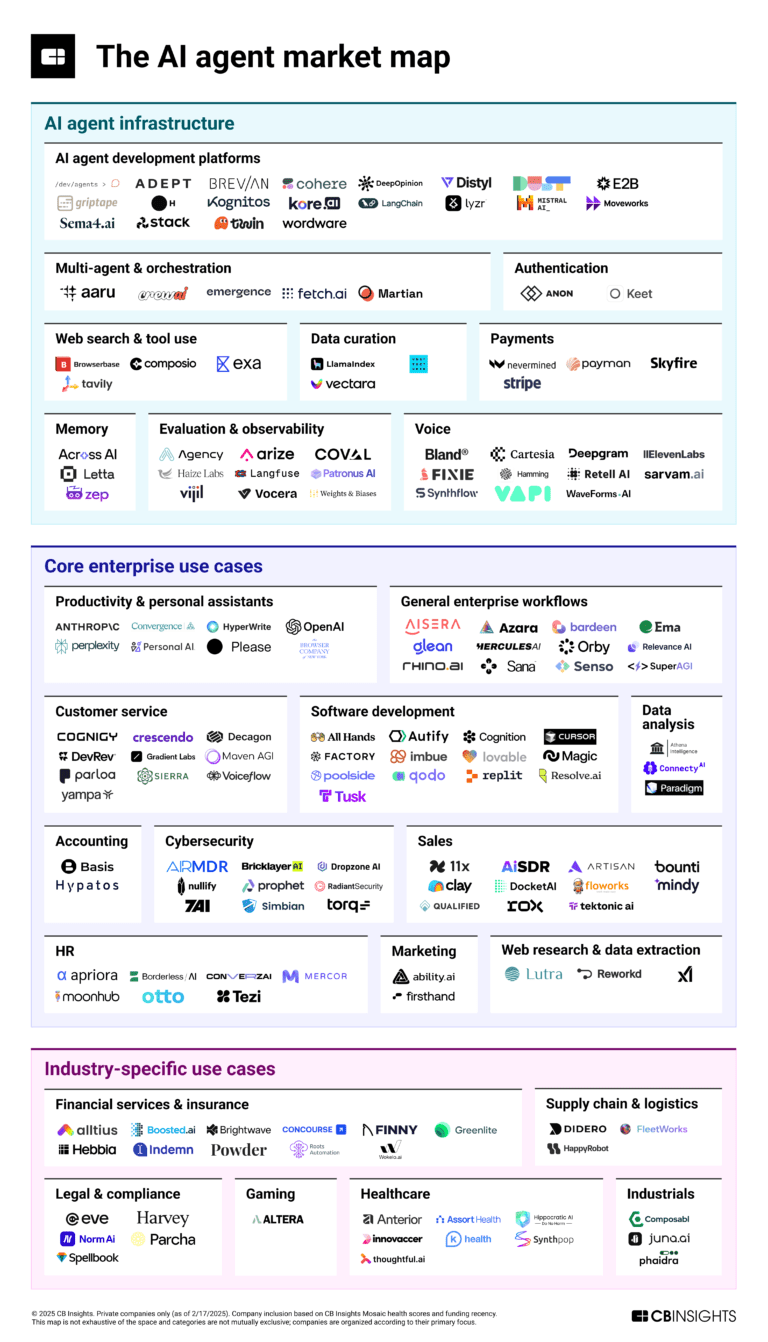

The AI agent market map: March 2025 editionExpert Collections containing FINNY AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

FINNY AI is included in 6 Expert Collections, including Artificial Intelligence (AI).

Artificial Intelligence (AI)

20,894 items

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Wealth Tech

2,489 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

AI agents (March 2025)

376 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

Generative AI

2,951 items

Companies working on generative AI applications and infrastructure.

AI agents & copilots

1,772 items

Companies developing AI agents, assistants/copilots, and agentic infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy.

Latest FINNY AI News

Oct 29, 2025

FINNY AI Inc. (“FINNY”), the AI-powered prospecting and marketing platform built specifically for financial advisors, today announced a strategic partnership with Integrated Partners (“Integrated”), a national financial planning and registered investment advisory (RIA) firm serving more than $22 billion in assets under advisement (AUA). As part of its commitment to equip advisors with cutting-edge tools that enhance growth and client acquisition, Integrated has selected FINNY as a partner to bring AI-driven prospecting capabilities to its network of over 220 advisors, 250+ CPAs and 116 regional offices. FINNY's advanced data intelligence and automation will enable Integrated's advisors to identify and engage high-intent prospects, personalize outreach and scale growth more efficiently. The partnership reflects Integrated's strategy to align with leading technology firms that strengthen its advisor ecosystem, while underscoring FINNY's expanding role as the go-to prospecting platform for the RIA community. “At Integrated, we're committed to offering our network of independent advisors with the resources to effectively build, grow and lead their practices,” said Andree Mohr president of Integrated . “Our advisors are entrepreneurs first, and collaborating with innovative technology firms like FINNY allows us to provide them with tools and data necessary to scale their businesses. FINNY's AI-driven platform combines intelligence, automation and personalization in a way that strengthens client relationships and creates new growth opportunities across our advisor community.” FINNY has also added two leading marketing executives to its advisory board, both bringing decades of experience in wealth management marketing and advisor growth. John Wernz , partner and strategic advisor at Mission Wealth , is a seasoned growth and marketing executive with more than 20 years of experience, including 13 years as chief marketing and growth officer at Wealth Enhancement Group. Justin Barish chief marketing and digital officer at Lido Advisors , joins with over 15 years of experience, including leading digital marketing at Cerity Partners. Together, they will guide FINNY in refining product-market fit, aligning platform features with advisors' growth needs and ensuring scalability for both individual advisors and multi-billion-dollar RIAs – all while shaping strategies for brand positioning and adoption. “Integrated exemplifies the kind of innovative, advisor-first firm that FINNY was built to serve, and our partnership reflects a shared vision for how data intelligence and automation can transform advisor growth,” said Eden Ovadia , co-founder and CEO of FINNY. “Together with the addition of two of the industry's most forward looking CMOs to our advisory board, this represents a major milestone in FINNY's efforts to redefine and accelerate the way RIAs connect with prospective clients.” The Integrated partnership and advisory board additions build on FINNY's recent momentum, following its $4.3 million seed round and the appointment of Josh Brown – CEO of Ritholtz Wealth Management and a prominent financial commentator – to its advisory board. Since April, FINNY's advisor base has grown tenfold, and those running multi-channel campaigns are closing on average one new client per month and seeing 30% higher engagement. Together, these developments reflect FINNY's broader focus on building technology solutions that empowers advisors to prospect more effectively and drive organic growth. “FINNY's growth this year has been fueled by significant partnerships, platform expansion and the incredible enthusiasm of the wealth management industry,” said Victoria Toli , co-founder and president of FINNY. “As we scale, we're building an advisory board and rapidly expanding advisor community that embodies that same spirit of innovation. Adding Integrated and two powerhouse CMOs expands that expertise in exactly the areas driving the next era of advisor growth—data, brand and digital engagement.” For more information about FINNY and its AI-powered prospecting and marketing platform built exclusively for financial advisors, visit www.finny.com . Advisory firms wishing to learn more about Integrated's suite of back-office and sustainable, organic growth solutions are encouraged to visit integrated-partners.com About FINNY FINNY is the AI-powered prospecting and marketing platform built exclusively for financial advisors. By leveraging advanced data intelligence and automation, FINNY helps advisors identify, prioritize and engage high-intent prospects effortlessly—removing the guesswork from client acquisition. With a proprietary database of millions of records, a predictive F-Score matching engine and automated outreach tools, FINNY helps ensure that prospecting is targeted, scalable and seamlessly integrated into an advisor's workflow. Backed by top fintech investors and recognized as Best of Show at the 2024 Morningstar Annual Fintech Showcase, FINNY is redefining organic growth for financial advisors. Visit www.finny.com to learn more. About Integrated Since 1996, Integrated Partners has been helping financial advisors to achieve their entrepreneurial vision. We offer comprehensive business building services, designed with the truly independent advisor in mind. With over 220 advisors, 250+ CPAs and 116 regional offices across the United States. Integrated has built our reputation advisor by advisor, client by client. Constructed and grown upon a foundation of empowerment, integrity, and trust, we believe in the incredible power that financial advisors have to make a positive impact on people's lives. Integrated supports advisors by offering a completely customizable open architecture business environment: technology, investment management, advanced planning, CPA partner program, custody, marketing, public relations, M&A, succession planning and comprehensive business counsel. We believe in advisors. Let us prove it to you. Investment advice offered through Integrated Partners, a registered investment advisor. *$22 billion in assets under advisement inclusive of $16.5 billion in advisory assets as of 6/30/2025. View source version on businesswire.com: https://www.businesswire.com/news/home/20251029428235/en/ Contacts Media Contacts: StreetCred PR For FINNY: finny@streetcredpr.com Lexie Brazil lexie@streetcredpr.com For Integrated: Integrated@streetcredpr.com Tom Warburton Tommy@streetcredpr.com

FINNY AI Frequently Asked Questions (FAQ)

When was FINNY AI founded?

FINNY AI was founded in 2023.

Where is FINNY AI's headquarters?

FINNY AI's headquarters is located at 153 Mercer Street, New York.

What is FINNY AI's latest funding round?

FINNY AI's latest funding round is Angel.

How much did FINNY AI raise?

FINNY AI raised a total of $4.8M.

Who are the investors of FINNY AI?

Investors of FINNY AI include Josh Brown, Y Combinator, Tomer London, Crossbeam Venture Partners, Kunal Kapoor and 8 more.

Who are FINNY AI's competitors?

Competitors of FINNY AI include d1g1t, Conquest Planning, Addepar, Envestnet, Canoe Intelligence and 7 more.

Loading...

Compare FINNY AI to Competitors

Addepar focuses on investment portfolio management within the financial services industry. The company provides a system that consolidates and evaluates data related to the market and clients, aiding investment professionals in decision-making. Addepar's services are relevant to wealth managers, family offices, private banks, and institutions, offering functionalities for trading, rebalancing, scenario modeling, and billing. It was founded in 2009 and is based in New York, New York.

d1g1t provides an enterprise wealth management platform in the financial technology sector. The company offers a comprehensive suite of analytics and risk management tools designed to enhance the quality of financial advice and streamline wealth management operations. Its services cater to financial advisory firms, multi-family offices, registered investment advisors (RIAs), broker-dealers, and bank advisor networks, aiming to integrate various aspects of wealth management into a cohesive system. It was founded in 2017 and is based in Toronto, Canada.

Metaframe Technology Solutions provides financial technology solutions that focus on asset management and investment firms. The company offers services that include intelligent agents through its DashHub AI platform, which automates financial operations and reporting. Metaframe also provides ITSM solutions, technology leadership, and compliance automation to support IT infrastructure and regulatory adherence for financial services. It was founded in 2010 and is based in New York, New York.

Powder provides artificial intelligence (AI) solutions for the wealth management sector, focusing on document analysis. The company offers AI agents that automate the parsing and analysis of financial documents, which reduces the time required for these tasks and allows wealth management professionals to engage with clients and perform other activities. Powder's AI technology aims to improve client service by increasing productivity, ensuring compliance, and providing data security. It was founded in 2023 and is based in Los Altos, California.

Nitrogen operates as an inclusive client engagement platform. It focuses on wealth management firms and financial advisors. The company offers a suite of tools designed to facilitate risk tolerance assessment, investment research, portfolio analytics, and client acquisition and retention. Nitrogen primarily serves financial advisors, wealth management firms, banks, and insurance companies. Nitrogen was formerly known as Riskalyze. It was founded in 2011 and is based in Auburn, California.

InvestCloud focuses on transforming the financial industry's approach to digital and operates within the financial technology sector. The company offers a no-code software platform for digital and commerce enablement, providing cloud-native, multi-tenanted solutions that help banks, wealth managers, and asset managers overcome technology debt and meet the needs of their clients. The company primarily serves the financial industry. It was founded in 2010 and is based in West Hollywood, California.

Loading...