Fireblocks

Founded Year

2018Stage

Unattributed VC | AliveTotal Raised

$1.039BRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-7 points in the past 30 days

About Fireblocks

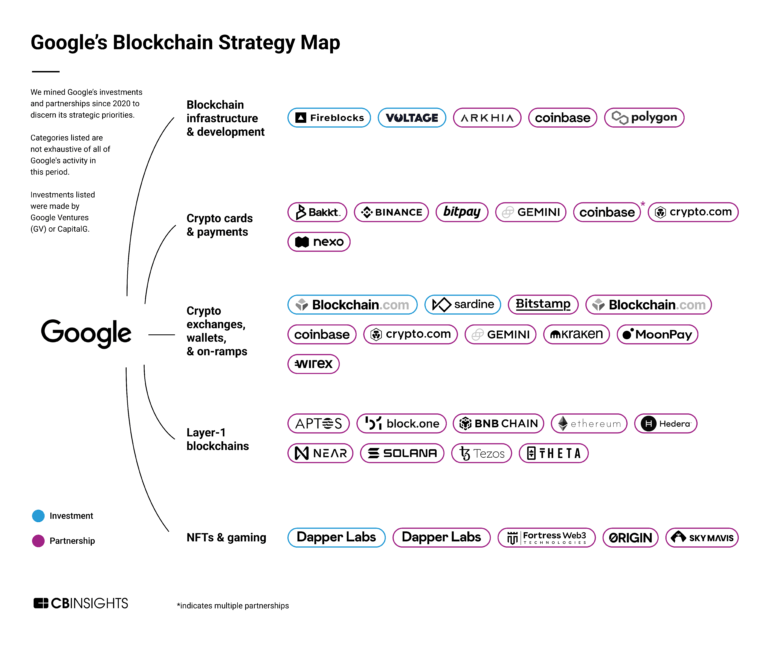

Fireblocks provides infrastructure for digital asset operations in the financial technology sector. It offers services including custody and management of cryptocurrency operations, wallet solutions, token creation and distribution, and facilitation of blockchain payments. It serves trading firms, financial technologies, financial institutions, and web3 companies. It was founded in 2018 and is based in New York, New York.

Loading...

ESPs containing Fireblocks

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The tokenized deposit issuance platforms market provides software and infrastructure that enables regulated banks and credit unions to issue, manage, and redeem tokenized deposits on distributed ledgers. These platforms integrate with core and digital banking systems so that on-chain tokens remain direct claims on insured or otherwise regulated bank deposits, preserving existing regulatory treatme…

Fireblocks named as Leader among 7 other companies, including Stablecore, R3, and Tokinvest.

Loading...

Research containing Fireblocks

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Fireblocks in 5 CB Insights research briefs, most recently on Sep 23, 2025.

Sep 23, 2025 report

The Money Awards Finalist Spotlight

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025Expert Collections containing Fireblocks

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Fireblocks is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,309 items

Blockchain

13,632 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,809 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Fireblocks Patents

Fireblocks has filed 5 patents.

The 3 most popular patent topics include:

- alternative currencies

- cryptocurrencies

- cryptography

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/29/2021 | 8/20/2024 | Data security, Cryptography, Computer security, Key management, Cryptographic protocols | Grant |

Application Date | 11/29/2021 |

|---|---|

Grant Date | 8/20/2024 |

Title | |

Related Topics | Data security, Cryptography, Computer security, Key management, Cryptographic protocols |

Status | Grant |

Latest Fireblocks News

Nov 14, 2025

Business Telegraph November 7, 2025 Contents Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure A new industry group called the Blockchain Payments Consortium has formed with the aim of setting common rules for how blockchains move money. According to statements from participants and industry summaries, the consortium brings together seven major firms and foundations that support different blockchains and infrastructure. The group says it wants a shared framework that covers both the technical steps of a transfer and the compliance data that banks and regulators expect. Blockchain: Standardizing Cross-Chain Stablecoin Transfers The founding members listed include Fireblocks, Solana Foundation, TON Foundation, Polygon Labs, Stellar Development Foundation, Mysten Labs and Monad Foundation. Based on reports, the initial focus will be on stablecoin payments that move between different blockchains. That area has grown large: on-chain payments last year were reported at roughly $20 trillion in total volume, a figure that market watchers point to when arguing for clearer, shared rules. Trending Why The Group Formed Industry sources say the consortium’s backers want to reduce friction that arises when one chain speaks one way and another chain speaks a different way. Reports note that firms and banks often need consistent data attached to payments — things like origin, purpose and compliance flags — before they will accept a payment. The consortium aims to define how that data should travel along with a token when it crosses networks, and how settlement and reconciliation should be handled so companies can rely on the result. According to BPC, blockchain rails are “reshaping the global payments landscape.” But for blockchain payments to reach full potential, the group said they must “address the inconsistent and fragmented experiences individuals and institutions face when moving between traditional payments and blockchain.” As of today, the market cap of cryptocurrencies stood at $3.34 trillion. Chart: TradingView Cross-Industry And Regulatory Reach The group plans to act as a bridge between blockchain projects and regulators. It expects to propose templates that exchanges, custodians and payment processors can use so that audits and reporting become easier. Some members have warned that getting regulators across several jurisdictions to accept the same approach will be difficult. Reports also point out that different chains use different technical designs, which makes a one-size-fits-all solution hard to implement. The consortium has described its work in general terms so far, focusing on a framework rather than a finished protocol. Based on reports, concrete outputs could include data formats, API patterns and recommended checks that service providers should run during cross-chain transfers. Featured image from Yuichiro Chino/Getty Images, chart from TradingView Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Fireblocks Frequently Asked Questions (FAQ)

When was Fireblocks founded?

Fireblocks was founded in 2018.

Where is Fireblocks's headquarters?

Fireblocks's headquarters is located at 500 Fashion Avenue, New York.

What is Fireblocks's latest funding round?

Fireblocks's latest funding round is Unattributed VC.

How much did Fireblocks raise?

Fireblocks raised a total of $1.039B.

Who are the investors of Fireblocks?

Investors of Fireblocks include Haun Ventures, Tenaya Capital, Coatue, Paradigm, BAM Elevate and 33 more.

Who are Fireblocks's competitors?

Competitors of Fireblocks include Ripple, CheckSig, Utila, Tangany, Zero Hash and 7 more.

Who are Fireblocks's customers?

Customers of Fireblocks include Customer Name: Revolut , Crypto.com and GMO Trust.

Loading...

Compare Fireblocks to Competitors

Copper operates in digital asset infrastructure, focusing on custody, prime services, and collateral management within the financial technology sector. The company provides digital asset custody, off-exchange settlement solutions, and agency lending services, utilizing Multi-Party Computation technology to facilitate crypto transactions. Copper serves institutional investors, including hedge funds, trading firms, foundations, exchanges, exchange-traded product (ETP) providers, venture capital funds, and miners. It was founded in 2018 and is based in Zug, Switzerland.

BitGo is a digital asset infrastructure company that provides wallet services, custody, and financial services including wealth management and trading for digital assets. BitGo serves institutional investors, trading firms, investment advisors, exchanges, and developers. It was founded in 2013 and is based in Palo Alto, California.

Ledger involved in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Ledger's products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. It was founded in 2014 and is based in Paris, France.

Anchorage Digital offers a cryptocurrency platform that provides financial services and infrastructure solutions for institutions. It offers services including custody, staking, trading, and governance for digital assets. Anchorage Digital serves sectors such as wealth management, venture capital firms, governments, exchange-traded fund (ETF) issuers, and asset managers. It was founded in 2017 and is based in San Francisco, California.

Hex Trust offers services including custody, staking, and market services for digital assets. Hex Trust serves protocols, foundations, financial institutions, and the Web3 and Metaverse sectors. It was founded in 2018 and is based in Hong Kong.

Taurus is a company specializing in digital asset infrastructure within the financial technology sector. The company offers a platform for the custody, issuance, and management of cryptocurrencies, tokenized assets, and digital currencies. Taurus provides services including storage solutions, tokenization of various assets, and a trading platform for institutional investors. It was founded in 2018 and is based in Geneva, Switzerland.

Loading...